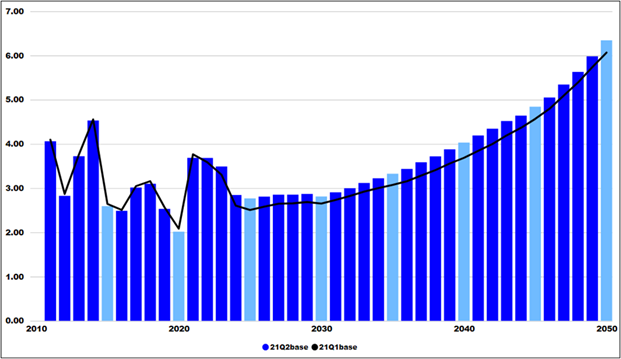

Global natural gas markets are currently ‘tight’ and expected to remain so in the near term, even with rebounds in tight gas supply basins. The rapid return of gas demand domestically and globally has outpaced the supply recovery since the spring of 2020. As a result, North American gas prices have increased to levels not experienced in some time. Henry Hub during the month of July has not exceeded $4.00/MMBtu since 2014.

Figure 1: Annual Average Henry Hub Price ($/MMBtu)

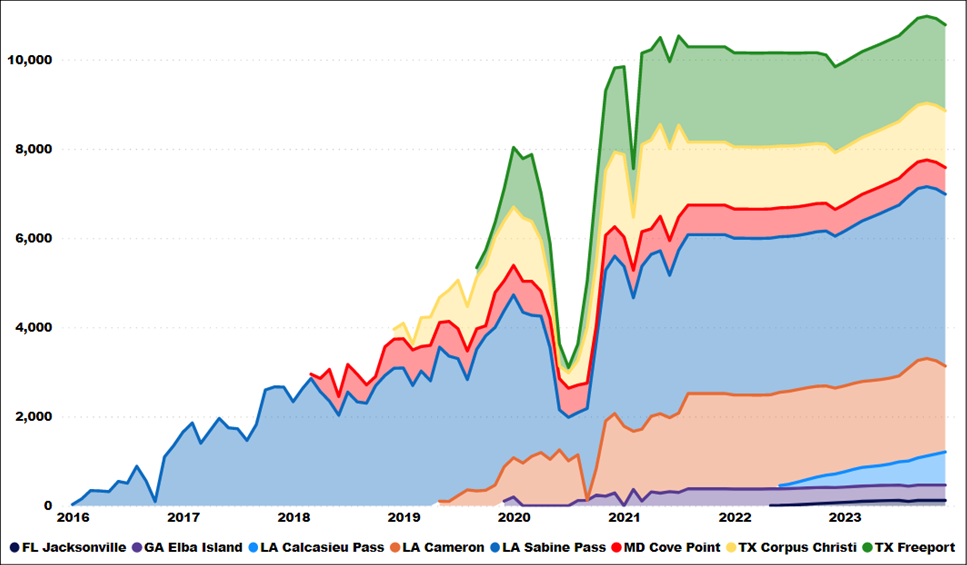

Natural gas demand has significantly recovered since the onset of the pandemic. North American primary consumption is forecast to average 92.3 Bcf/d during 2021, an increase of 750 MMcf/d relative to 2020 but still 1.9 Bcf/d less consumption than during 2019. Demand for all sectors has returned to normal, with the exception of the lagging industrial demand recovery, which drives most of the 1.9 Bcf/d decline relative to 2019. Finally, LNG export terminals in the US gulf coast are currently operating at very high utilization rates, which is expected to continue.

The pandemic ushered in major reductions in global transportation, greatly reducing the demand for transportation fuels. Gasoline and jet fuel were impacted more than other refined petroleum products. Jet fuel volumes dropped by over 50% and gasoline by 25% between March and April 2020. Demand for most refined products has returned to nearly normal levels, but jet fuel still remains well below pre-pandemic levels. As a result, industrial demand for natural gas experienced the largest declines of any sector, particularly those operations involved in petrochemical production. In addition, the declines in transportation fuels led to a crash in the price of oil, a subsequent drop in production in oil focused producing regions, and a significant decline in associated natural gas production.

Reductions in residential and commercial sector natural gas demand were far more modest in contrast. At the onset of the pandemic, some of the declines in commercial demand were offset by increased residential demand. ISOs/RTOs initially reported moderate reductions of 5-10% in weather-adjusted energy consumption driven by pandemic related impacts that have primarily reduced commercial and industrial demand for electricity. Initially, natural gas-fired power generation actually increased overall, as low prices made natural gas an economically attractive fuel for power generation. However, recent high gas prices have led to gas-to-coal switching in some instances (though total coal consumption in the power sector continues its years long decline, just at a lower rate).

Figure 2: LNG Export Summary by Facility (MMcf/d)

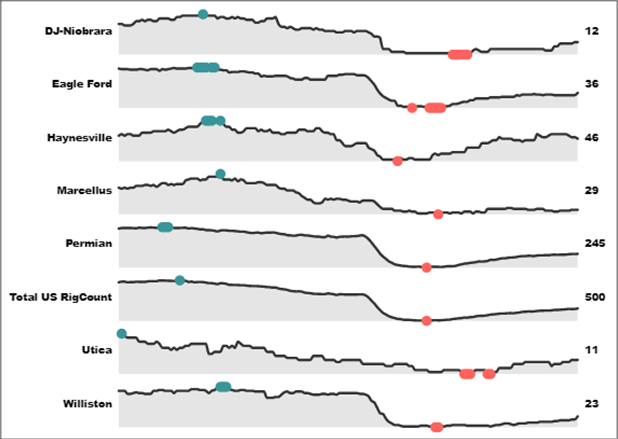

With Henry Hub prices near $4.00/MMBtu and WTI prices in excess of $70/bbl., oil and gas prices are high enough for economic production in many plays throughout North America. The 21Q2 supply outlook forecasts a strong rebound from the pandemic and continued growth throughout the coming decade. However, drilling levels have not yet recovered to their pre-pandemic levels. Production growth is expected to largely be driven by the Permian, Marcellus, Haynesville, and Western Canadian Sedimentary Basin. The plot below shows how rig counts have changed by US basin from 2018 – present, with the teal dots denoting the maximum rig count during that time period and the red dots denoting the minimum. The black numbers to the right represent present day rig counts in each of the basins.

Figure 3: Baker Hughes Rig Count by Basin

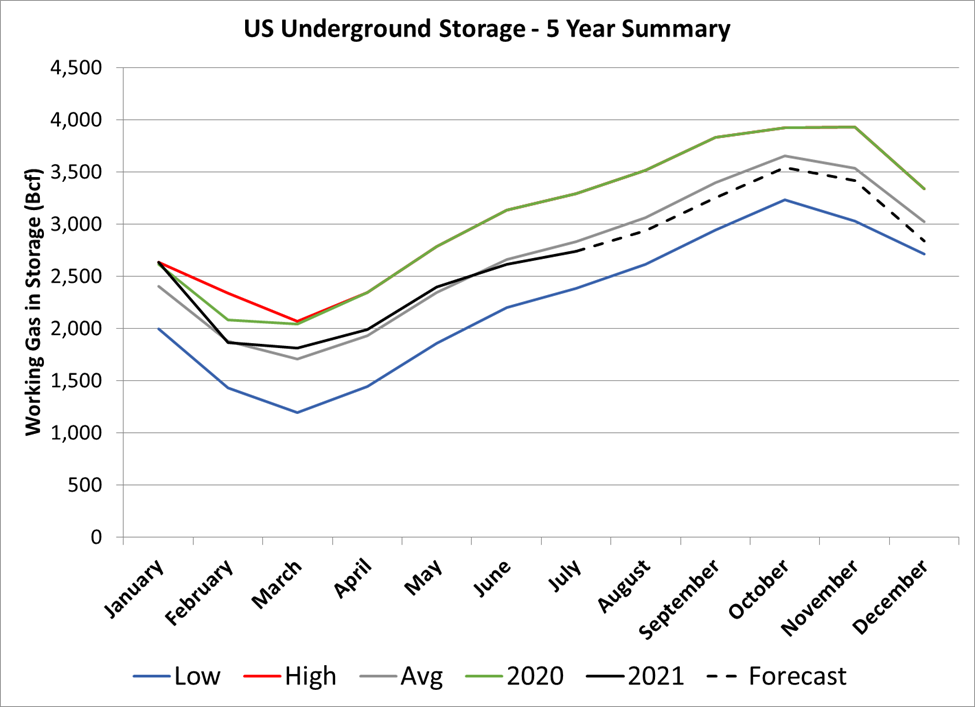

While natural gas consumption rapidly returned, the supply recovery has been more sluggish because of wary investors and the logistics involved with bringing drilling operations back to prior levels. As a result, the market has become tight and storage levels reflect that. Storage levels during 2020 were at their highest levels in five years, meanwhile in 2021 storage levels have been slightly below the 5-year average.

Figure 4: US Working Gas in Storage (Bcf)

RBAC’s 21Q2 outlook expects natural gas markets to remain tight for the next two to three years. High oil and gas prices will induce a supply response that should balance in the market, but increases in supply will likely lag surging global gas demand and fully rebounded North American natural gas consumption.

As the world moves forward with the energy transition, gas and LNG will play an important role in achieving environmental and sustainability goals. Utilizing the GPCM® Market Simulator for North American Gas and LNG™, analysts will get a complete view of the North American wholesale gas markets and be able to assess the market impacts of scenarios such as a faster than expected supply recovery or weaker global gas demand. This will lead to better analysis and decision making when looking towards the future of energy.