China’s lockdown finally eased at the end of 2022 enabling economic activity to return and become more frequent in 2023. China’s natural gas consumption grew by nearly 8% in 2023, close to the pre-pandemic level of 9% growth in 2019.

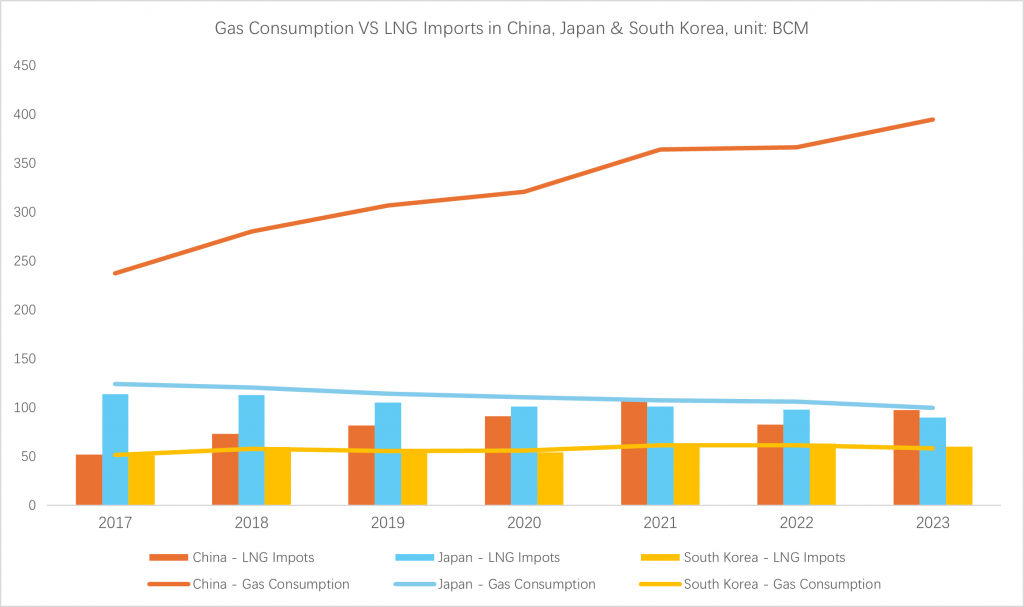

With the recovery of domestic gas demand, China’s LNG imports in 2023 increased by 18% over the previous year, whereas LNG imports in 2022 experienced a drop of 24% compared with 2021. China imported a total of 72 million tons of LNG in 2023, surpassing Japan which imported 66 million tons, once again becoming the world’s largest LNG importer.

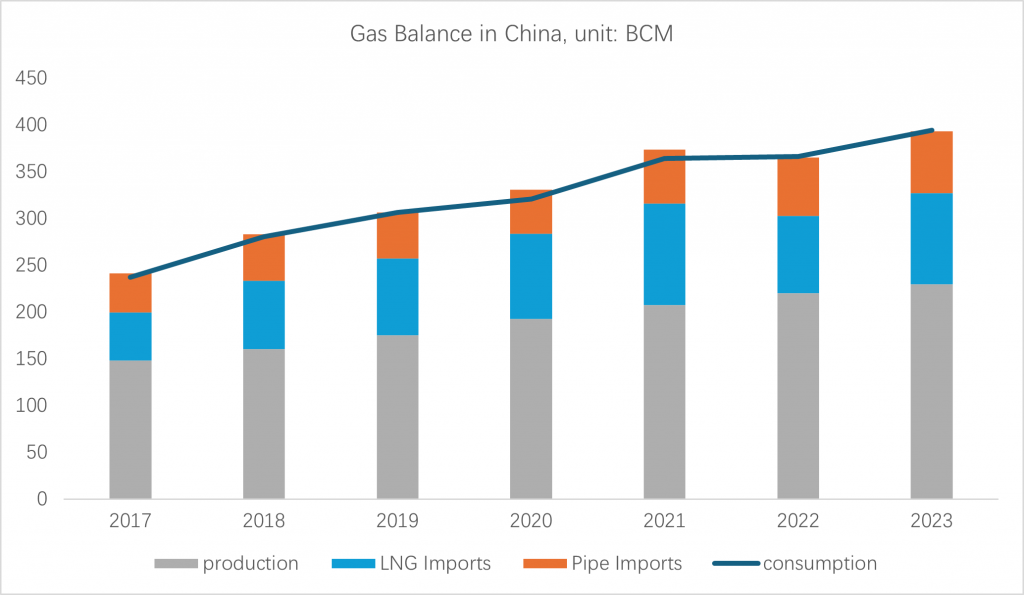

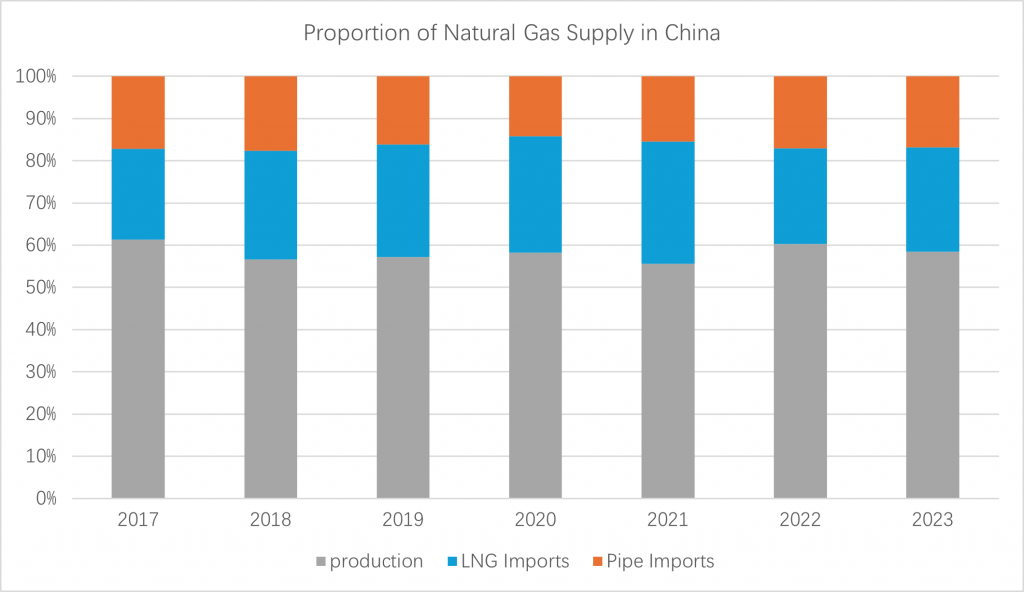

Compared with Japan and South Korea, thanks to its geographical advantages, China has its own domestic natural gas production and pipeline gas imports. The sharp increase in LNG imports has not significantly squeezed the growth of other gas supplies. The proportion of pipeline gas has remained basically unchanged, and though the proportion of domestic production has decreased slightly, the volume of pipeline gas imports and production have maintained a steady growth over the past three years. Due to the relatively low absolute cost of pipeline gas, it is possible that with geopolitical changes, if Power of Siberia 2 pipeline is successfully put into operation in the 2030s, there will be a large increase in pipeline gas imports in the future.

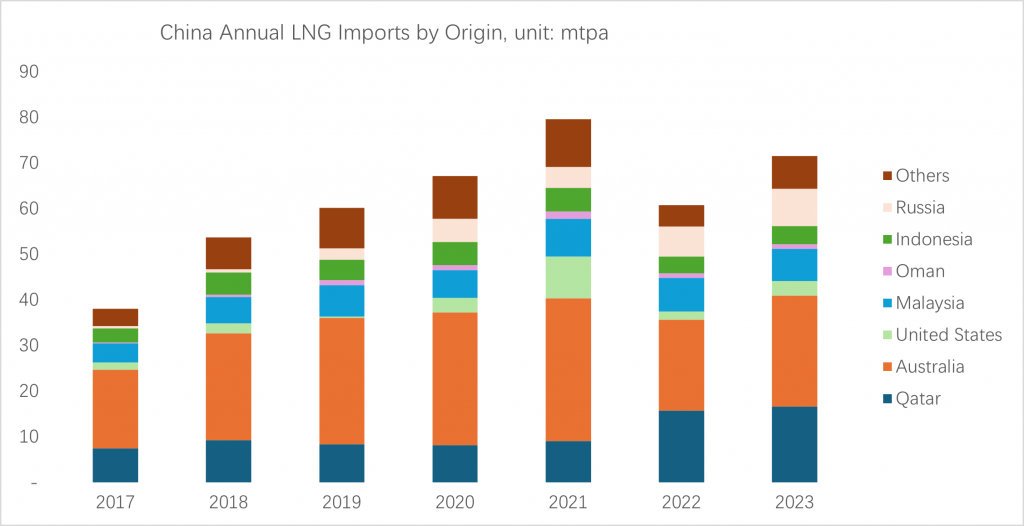

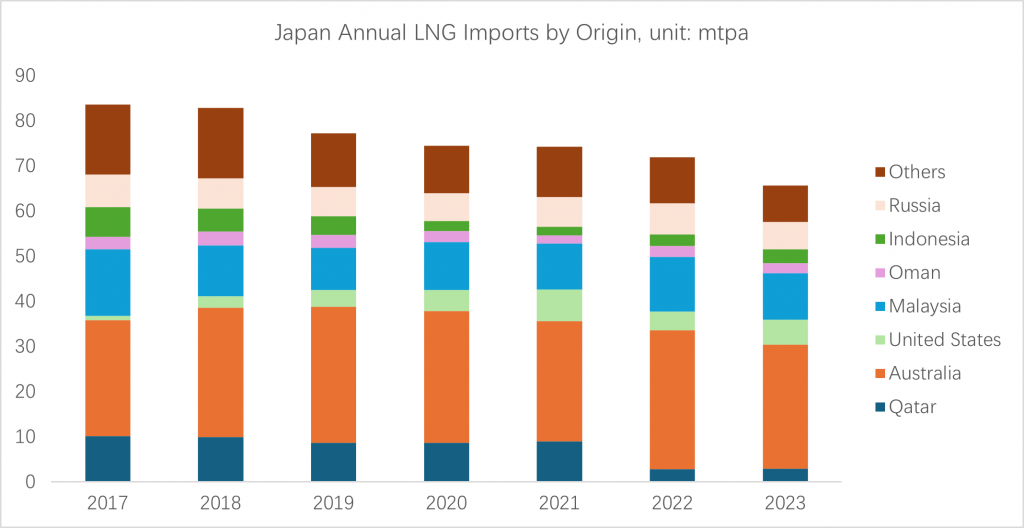

From the perspective of LNG import sources, the LNG import structures of China and Japan are also very different, and their respective trends are also changing. Japan is relatively more dependent on the Asia-Pacific market, with 66% of Japan’s LNG imports from Australia and Southeast Asia, especially from Malaysia, compared to China having about 50% from this market region.

Meanwhile China is increasing LNG imports from Qatar and Russia. Since the start of the Russia-Ukraine conflict, LNG exports from the United States to Europe have increased, resulting in a decrease in U.S. LNG flow to Asia. And in particular, China and Japan have significantly reduced LNG imports from the United States over the past two years.

As more and more LNG export projects are completed, China’s LNG imports are likely to be more diversified in the future, and as Japan has expressed their intention to reduce its domestic gas consumption as part of energy transition policies, Japan may end up participating more in the global trade of LNG than simply being an LNG importer and consumer.

With the sluggish growth of natural gas in Japan and South Korea, China will remain an important pillar of growth over the next five years. Whether it is pipeline gas imports or LNG imports, China has relatively optimistic growth potential.

RBAC, Inc. is a leader in building market fundamental analysis tools used by the energy industry and related government agencies for over two decades. The G2M2® Global Gas Marketing Modeling System™ is designed for developing scenarios for the converging global gas market. It is a complete system of interrelated models for forecasting natural gas and LNG production, transportation, storage, and deliveries across the global gas markets. For more information visit our website at http://www.rbac.com.