Gas Market Analysists Descend upon Orlando

Amidst an AI boom, an energy transition and geopolitical events, the natural gas market has experienced increased volatility creating many challenges to market analysts, the best of whom came together at this year’s incredible RBAC Annual Gas and User Conference in Orlando, Florida.

From the surging growth of data centers needing increased power demand and their impact on natural gas markets to the latest updates in Hydrogen, energy transition scenarios, and our 24Q3 market outlook for North America and the Global Market, Orlando was definitely the place to be.

RBAC industry veterans and guest speakers like Charles Merrick (Charles River Associates) and Hua Fang (Black & Veatch), gave insightful presentations, enabling attendees to dive deep into currently trending topics, like AI-fueled power demand, as well as LNG export impact on both global and regional markets, gaining valuable market insights as well as honing skills on RBAC’s natural gas market simulation tools, GPCM and G2M2.

GPCM 24Q3 Forecast

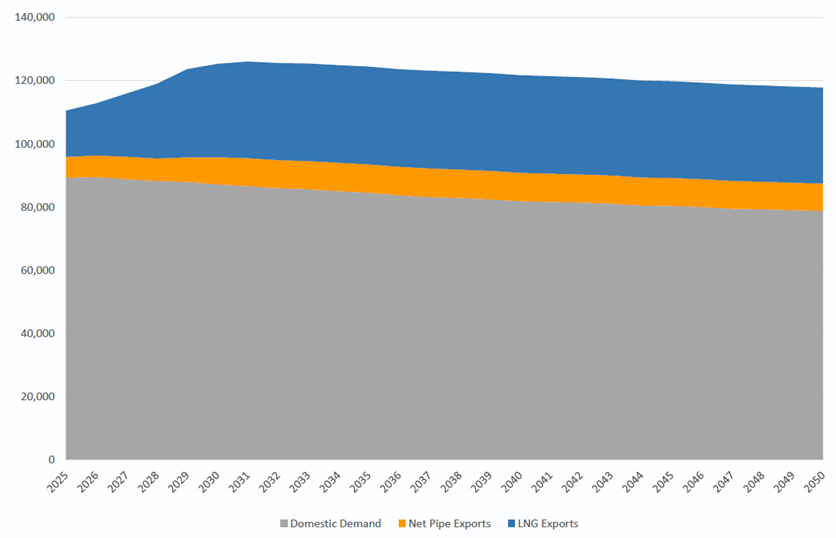

To kick-off the conference, we began with highlights from our recent 24Q3 base case update to GPCM® Market Simulator for North American Gas and LNG™. Bethel King and her team ran countless scenarios and came to a variety of conclusions on where the North American market may be headed. With new LNG export facilities alone, production growth is expected across a variety of basins such as Permian, Haynesville and WCSB’s Montney Shale. Demand for U.S. LNG continues to grow at an incredible rate with demand reaching 120 bcf/d beginning in 2028 and holding steady around that level.

G2M2 24Q3 Forecast

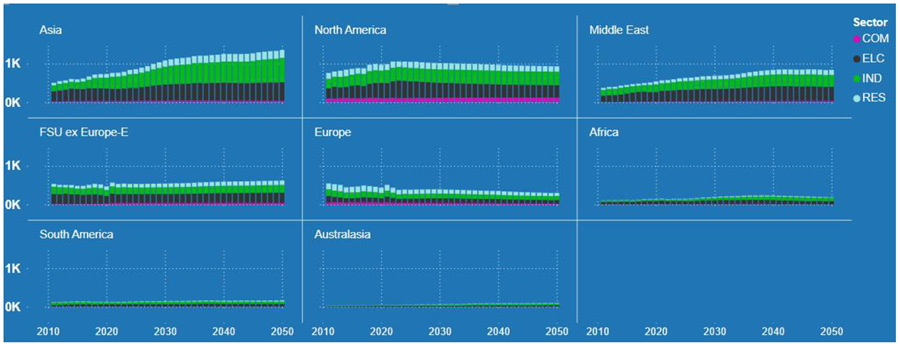

In the 24Q3 global forecast session, Dr. Ning Lin presented what will drive supply and demand in the market in the short, medium and long term. The short term is largely driven by weather and geopolitical factors such as ongoing sanctions against Russia. The medium and long term is primarily driven by changing trends in demand within Europe and Asia because of policy changes to meet decarbonization goals. Europe’s gas demand is on the decline and Asia is seeing tremendous growth in LNG demand. Europe’s gas demand is on the decline and Asia is seeing tremendous growth in LNG demand.

Trendsetters on the Natural Gas Market

Dr. Hua Fang of Black & Veatch presented how decarbonization goals, data centers, LNG, and even Hydrogen are all playing a role in shaping the future of natural gas. Dr. Fang covered in great detail the regulatory environment across the United States and how different regions are approaching decarbonization differently. One of the interesting topics was covered was the power usage of data centers. It can range from 20 KW all the way up to 1 or more GW depending on the size of the facility and the fuel (natural gas, nuclear, wind, etc.) used to power these facilities which largely depends on where the facility is located.

Data Center Trends

Continuing the hot topic of demand from Data Centers, Charles Merrick of Charles River Associates covered overall growth trends and new EPA regulations beginning in 2032 that would affect the maximum dispatch of new gas plants. As a result of projected demand growth, utility companies across the United States have greatly altered their 5-year load forecast to account for data centers. AEP’s is up to 15 GW, Exelon’s is to 11 GW and Xcel Energy’s is to 6.7 GW just to name a few. This will be a hot market to watch develop and natural gas is sure to play an important role in powering these facilities.

Global Gas Demand, Regas & FSRUs

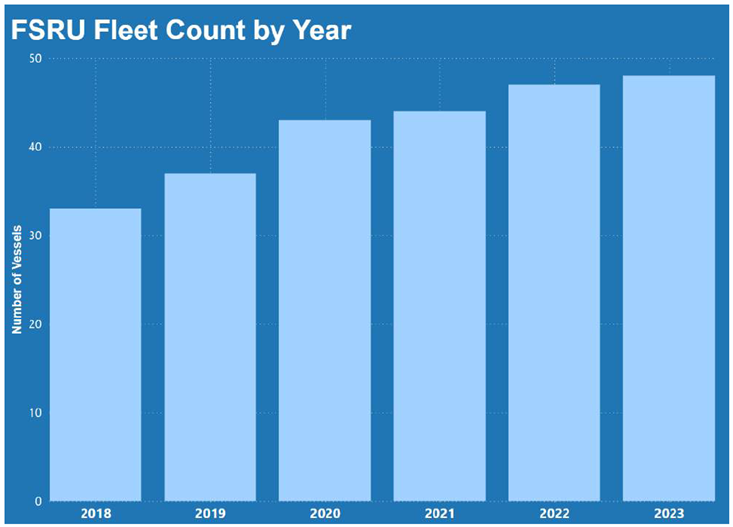

Ed O’Toole gave a fantastic presentation on global gas demand and how Floating Storage Regasification Units (FSRU) are seeing expanded use around the world. He explained the versatility of FSRUs which are an enticing option to countries looking to get into the global market without investing in land-based terminals. Because FSRUs are by design in the water, it allows for them to move across different markets and serve a variety of different contracts from seasonal usage all the way to long-term decade spanning contracts.

Future of RBAC Product Development

A mainstay of our annual user conference, Founder and CEO of RBAC, Dr. Robert Brooks, covered what is in store for the future of our market simulation tools. There are several exciting new features and improvements to current ones on the horizon such as advances on building demand cases, expanded use of Power BI, and a very exciting potential implementation of an English-language like command language within GPCM to open the door for even more market analysis possibilities.

Feedback

And attendees gave rave feedback:

Conclusion

But, in the end, the conference was not just about presentations; it was also a fantastic opportunity to connect with new and familiar faces, discuss the natural gas and LNG market intricacies, and enhance market analysis skills. With great weather in Orlando, the event was a delightful follow-up to last year’s conference in Galveston.

Whether you were there for market insights, learning more about RBAC’s market simulation tools, or picking the brains of RBAC’s staff, there was something valuable for everyone. We look forward to seeing you again at our next user conference!

Would you like to watch a presentation mentioned in this post or get a demonstration of RBAC’s market simulation tools? Contact us today!

RBAC, Inc. has been the leading provider of market fundamental analysis tools used by the energy industry and related government agencies for over two decades. The GPCM® Market Simulator for North American Gas and LNG™ is the most widely used natural gas market modeling system in North America. RBAC’s G2M2® Market Simulator for Global Gas and LNG™ has been instrumental in understanding evolving global gas and LNG dynamics and is vital in fully understanding the interrelationship between the North American and global gas markets.