The Challenge of Investing in Natural Gas Infrastructure

“If you think about what a bad mix …particularly short-term politics and long-term infrastructure are, and it really is the infrastructure that people have to make decisions on for the long term.” – Alan Armstrong, CEO of Williams

Long-term Infrastructure versus Short-term Politics

Large infrastructure projects such as natural gas pipelines and LNG terminals require long-term investments and years before any return is manifested. The initial capex can be huge achieving FID inherently fraught with challenges, particularly risk management and especially when juxtaposed with the short-term nature of political cycles.

As Alan Armstrong, CEO of Williams, aptly points out in a recent talk, “If you think about what a bad mix … particularly short-term politics and long-term infrastructure are, and it really is the infrastructure that people have to make decisions on for the long term.”

This dichotomy between short-term political agendas and the long-term investment nature of infrastructure projects creates a significant hurdle for stakeholders.

“If you think about the forecasting process and how incredibly important that is … from a boardroom perspective all of those things have to look at what we think the future demand is in the business.”– Alan Armstrong

The Role of Natural Gas Market Forecasting

Critical to bringing long-term infrastructure projects from concept to FID to production is the forecasting process. Robust and reliable forecasting is essential for raising capital, determining the cost of capital, and making long-term commitments.

Williams’ Armstrong emphasizes the importance of forecasting, stating, “If you think about the forecasting process and how incredibly important that is to raising Capital, to the cost of capital for infrastructure, for people being able to commit to long-term infrastructure, producers committing to long-term infrastructure, markets committing to long-term infrastructure, all of those things I can tell you–you know right from a boardroom perspective all of those things have to look at what we think the future demand is in the business.”

Advanced Forecasting Tools Are Available

RBAC’s advanced forecasting tools are designed to address these challenges. But not just with a single forecast, but rather, leveraging decades of industry and modeling experience, RBAC’s leads the industry in energy market simulation technology provides businesses with insights into future supply, demand, flows, prices and more. This enables informed decision-making that drives viable growth and investments.

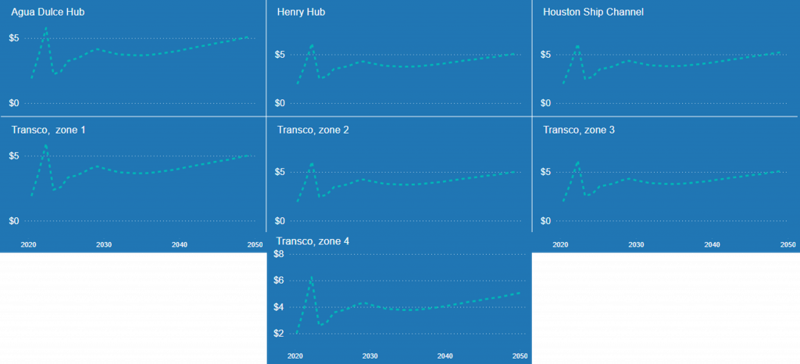

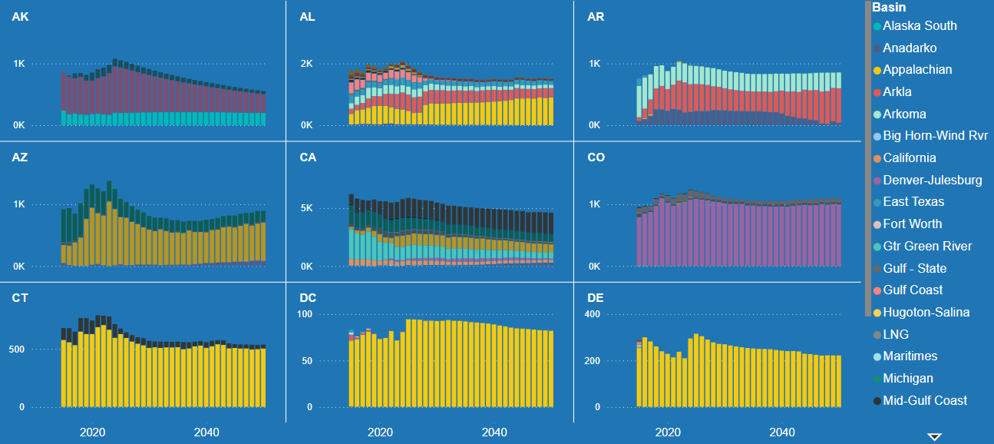

RBAC’s flagship product, the GPCM® Gas Market Simulation System™, is a powerful tool for designing scenarios to evaluate the potential of new pipeline or storage projects to efficiently address future gas demand. GPCM enables industry players such as Williams to forecast these projects’ effects on natural gas production, pipeline and storage utilization, deliveries to local markets and sectors, and prices throughout the North American gas market, thus enabling better analyses and better decisions for organizations that use it.

To illustrate this, see the charts below taken from GPCM’s PowerBI integration which provide key data enabling fast insights into the North American gas market.

But the key question is, if you were to design a system which modelled the market and helped you with your detailed forecasts for such infrastructure investments, what would be the indispensable features you require?

What would be your optimal modeling system?

- Comprehensive: You would want to be able to simulate historical (backcasting) and future natural gas industry activity, providing forecasts of production, prices, pipeline flows, and more. This comprehensive approach ensures that all aspects of the market are considered in the analysis.

- Flexibility and Customization: You would need to allow users to incorporate their own assumptions and analyze short-term and long-term trends at whatever level of detail desired. This customization is crucial for tailoring forecasts to specific project needs.

- Robust Data Integration: Constructing a database from scratch can be time-consuming. To ensure users have access to the most current and accurate data, it would be essential to have someone build and keep up-to-date a standardized database model for the North American natural gas market.

- Scenario Analysis: You would need to enable users to simulate a variety of scenarios, including severe weather demand cases, new pipeline projects, and changes in production capacity. This capability is essential for understanding the potential impacts of different variables on long-term infrastructure projects.

- User-Friendly Output: You would want flexible output reports that can be tailored and exported to Excel and integrates with powerful visualization tools like Microsoft’s PowerBI, making it easy to interpret and present data.

The Look Ahead

The future of infrastructure and energy systems is data-driven forecasting. Energy Market Simulation can bridge the divide between short political cycles and long-term investment, getting everyone on the same page—a boon for energy policy makers, regulators and energy industry professionals alike.

RBAC’s tools empower businesses to thrive in an ever-changing landscape by providing the clarity and precision needed to navigate market uncertainties. Whether working on infrastructure projects or strategic planning, RBAC’s advanced forecasting tools are indispensable for your market analysis and making informed decisions for prosperity and growth.

As Williams’ CEO notes, “It also winds up right here in DC in the process of doing work like with the NPC [National Petroleum Council] doing work that looks at forecasts.” The importance of accurate forecasting cannot be overstated, and with RBAC’s tools, businesses are well-equipped to meet the challenges of long-term infrastructure projects head-on.

Contact RBAC today for a free demonstration of our energy market simulation tools and how they can help you.

RBAC, Inc. has been the leading provider of market fundamental analysis tools used by the energy industry and related government agencies for over two decades. The GPCM® Market Simulator for North American Gas and LNG™ is the most widely used natural gas market modeling system in North America. RBAC’s G2M2® Market Simulator for Global Gas and LNG™ has been instrumental in understanding evolving global gas and LNG dynamics and is vital in fully understanding the interrelationship between the North American and global gas markets.