What This Shift Means for Natural Gas, LNG, Power, and Global Growth

“Energy and geopolitics were always interwoven. But I have never ever seen that the energy security risks are so multiplying and the dark and long shadow of geopolitics on energy sector overall. So, therefore energy security in my view should be elevated to the level of national security today.”

Fatih Birol, Executive Director of the International Energy Agency at Davos

Changes in the Energy Conversation

The World Economic Forum at Davos has always been a place where major global narratives compete—from globalism to global conflicts, from health to high-end tech, from equity to economic growth, including many controversial ideas and policies such as central bank digital currencies, the Global Reset (stakeholder capitalism) including policies centered around climate and decarbonization.

In January 2026, however, the conversation showed a notable shift, particularly around energy. What had been framed primarily through climate ambition is increasingly being reframed around energy security—grid reliability, affordability, security of supply, powering industry, and all in the face of rapid growth in electricity demand driven by AI and data centers. These pressures are increasingly part of the conversation at Davos.

That reframing is quite relevant. When energy security moves to the center of the discussion, markets stop responding to policy intentions (and in some cases, wishful thinking) but rather, start responding to constraints of where gas and power can be produced and delivered, how reliably it can be supplied, and at what marginal cost. For natural gas, LNG, and power markets, this is not simply word play, but real-world pressures have caused a shift that will likely show itself in 2026 in both policy and practice.

Davos 2026: Energy Security as the Organizing Principle

“Keeping the lights on” has replaced earlier narratives to the point where the WEF is literally now saying “The energy transition used to be about climate. Now it’s also about energy security, reindustrialization and affordability.” (WEF)

This evolution hopefully reflects a change that energy discussions are now anchored in positive and measurable outcomes which are closer to home, namely, industrial competitiveness and consumer affordability, with lower energy costs and grid resilience—outcomes which would be quite a departure from simple climate targets alone.

That evolution followed a series of real-world events that exposed gaps between ambitions of some countries which sought to become climate leaders through various energy policies and how their strategies played out in practice.

Germany: New Reform Strategy a U-Turn?

One clear illustration of this evolution can be found by looking back at Davos 2022. In WEF’s takeaways from that year, Germany’s then Chancellor, Olaf Scholz, declared:

“We will no longer wait for the slowest and least ambitious. We’ll turn climate from a cost factor to competitive advantage.” (WEF)

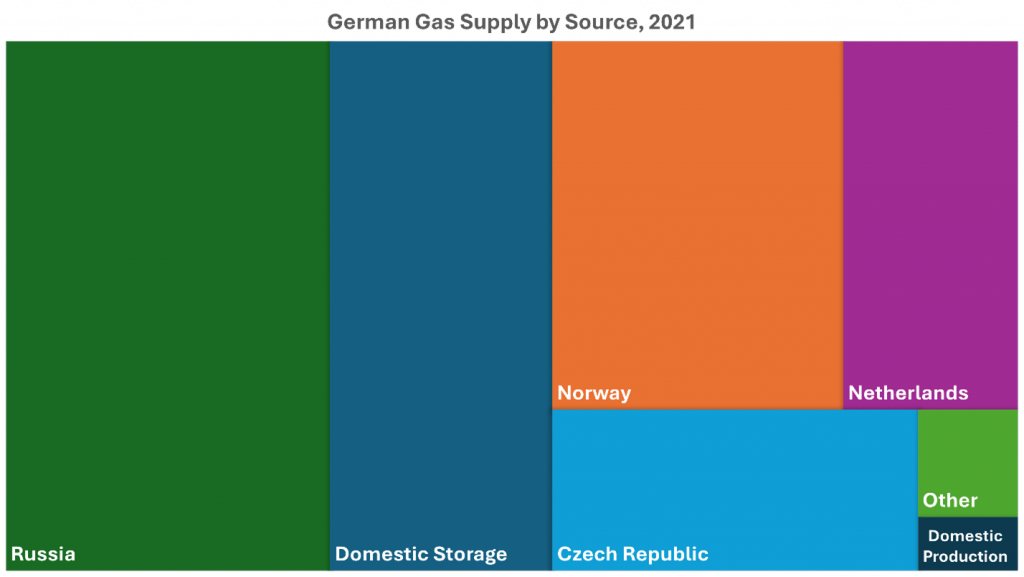

But underpinning this confidence was a deep reliance on continued cheap Russian gas.

This energy security risk did not suddenly appear in 2022. It had been visible years earlier, such as when troubles simmered between Ukraine and Russia in 2014 and the annexation of Crimea—not to mention that in 2018, then-U.S. president Donald Trump warned that Germany’s growing reliance on Russian energy imports created strategic exposure; Reuters quoted him as saying Germany was “captive of Russia.” (Reuters)

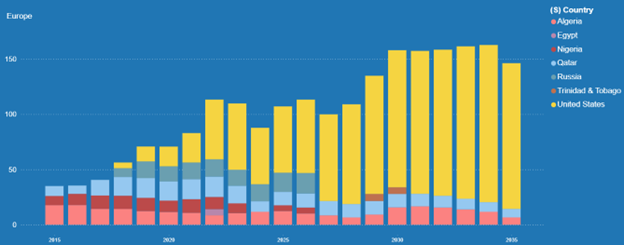

At the time, Trump’s warning was widely dismissed in Europe. After Russia’s invasion of Ukraine in 2022, however, the consequences became unmistakable. Europe’s subsequent scramble for LNG, emergency infrastructure buildout, and price-stabilization measures were a costly reminder of the risk in ignoring energy security as a core national policy.

Yet Germany continued to double down on variable renewable energy sources until increasingly high energy costs leading to a 2-year slump and deindustrialization caused Germany’s political language to shift. But another significant past decision also seems to have come back to haunt Germany in its scramble for power since 2022.

After the accident at Fukushima in 2011, Germany decided to phase out nuclear power. At that time it produced 170 TWh per year. The accident made the world pause on Nuclear power for sure, but it was Germany which led the way by dismantling 17 nuclear power plants, fully ending German nuclear generated power in 2023. Nevertheless, Germany’s current chancellor, Friedrich Merz, has now called Germany’s decision to abandon nuclear energy a “serious strategic mistake.” (Anadolu Agency)

Merz told those at Davos that Germany’s government now “will do its homework and pursue an ambitious reform agenda revolving around security, competitiveness, and European unity. Let us be inspired by what is maybe the most important lesson of enlightenment. Our fate is in our hands. It is in our responsibility and our freedom to shape it.” (Special Address by Friedrich Merz, Federal Chancellor of Germany)

Germany’s experience underscores a core energy-security lesson now resonating at Davos: losing firm, dispatchable capacity without adequate replacement risks energy security, industrial competitiveness and creates economic pressure on everything related to energy.

The UK-Norway: Energy Security as Economic Security

Germany’s U-turn underscores a wider divergence in Europe, where nations made fundamentally different energy choices—and now face very different consequences.

Comparing the UK and Norway experience in the North Sea where they share the basin in terms of oil and gas exploration and production, is very enlightening.

Around 1999–2001, natural gas production in the UK’s sector of the North Sea peaked at nearly 10 TCF (trillion cubic feet) per year which helped the UK meet most of its own gas needs and export surplus volumes into continental Europe. (Wikipedia) At that time the UK was energy self-sufficient and a net exporter of gas by the mid-1990s.(abdn.ac.uk)

Since the early 2000s, the UK’s gas production fell and by the early 2020s, it had declined to around one-third of its peak level. Lower investment in new exploration, rising costs, and fiscal uncertainty are blamed for this descent. According to reports, North Sea investment in 2025, including in natural gas, plunged to near the lowest levels since the 1970s, with operators delaying projects amid unclear tax and regulatory terms. “Activity was terrible in 2025 because there was so much uncertainty,” Martin Copeland, CFO Serica. (Financial Times)

The government itself has contributed to the UK’s North Sea decline (this is in contrast to Norway’s experience mentioned later in this piece), and here are two specific policy examples: 1) The Energy Profits Levy (windfall tax), introduced in 2022 and raised multiple times, has increased the effective tax burden on producers and critics argue it has blunted investment incentives. (Wikipedia) 2) In late 2025, the UK government confirmed it will not issue new oil and gas exploration licenses, a choice framed around climate commitments but challenged by energy sector groups as detrimental to long-term security. (The Guardian)

But this wasn’t a recent development, Tony Blair, then UK Prime Minister said in 2004, “If what the science tells us about climate change is correct, then unabated it will result in catastrophic consequences for our world. … Recent experience teaches us that it is possible to combine reducing emissions with economic growth … To acquire global leadership, on this issue Britain must demonstrate it first at home.” While in 2014, then UK Prime Minister David Cameron vowed to be the Greenest Government ever.

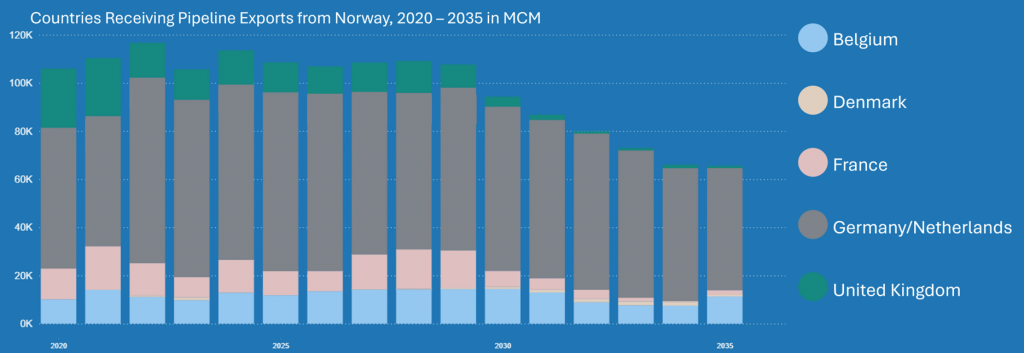

As domestic production waned, the UK shifted from net exporter toward net importer of natural gas, with pipeline imports from Norway outpacing domestic output and making Norway the UK’s largest supplier of imported gas. (Energy Voice) Meanwhile the UK’s total gas import share has risen dramatically as domestic production declined and industry analysts warned that without sustained investment the UK could be importing up to 80% of its gas by 2030.(Offshore Energies UK (OEUK))

Norway’s experience contrasts markedly. Norway had the same global pressure to face environmental and climate concerns. Yet, for decades Norway has threaded the needle “accommodating the world’s energy needs in a responsible manner” (i.e. exporting oil and gas) while still being considered a leader in the energy transition due to being blessed with hydropower adequate for its small population.

And while its North Sea oil and gas fields are also mature, Norway has consistently maintained a policy environment that supports continued exploration and long-term investment, treating natural gas as a strategic national asset rather than a declining legacy industry.

Since the 1970s, Norway has anchored its upstream policy around fiscal and regulatory stability. Its petroleum tax system is explicitly designed to provide “a stable and predictable system for profitable production in a long-term perspective,” enabling companies to commit capital across decades rather than political cycles. Norway even has 10 Commandments for its Oil and Gas industry, orienting it towards energy independence and security.

That long-term orientation has translated into sustained exploration and development well beyond the basin’s early peak years. Recent analysis highlights Norway’s continued use of predictable taxation, regular licensing rounds, and ongoing access to acreage, supporting new discoveries even as the basin matures.

The outcome is now visible. In 2024, Norwegian natural gas production reached record levels (124 BCM or 50 TCF), reinforcing Norway’s role as Europe’s dominant pipeline gas exporter, supplying continental Europe and the UK, with only a modest decline being expected for 2025. (Reuters)

This stands in contrast to the UK’s course it has charted over the last several decades, where similar geological maturity coincided with policies leading to weakened investment, leaving Britain increasingly reliant on imports, and now at a time when energy independence has returned to the forefront.

Return to Reliability: The Iberian Blackout

Geopolitical shocks starting with the invasion of Ukraine and ensuing ramifications re-centered priorities to supply security. Then grid events re-centered it again to reliability.

In April 2025, Spain and Portugal experienced a major power outage that cut electricity to large portions of the Iberian Peninsula. Investigations showed the event began with a voltage disturbance that escalated into cascading disconnections. Reuters reported that Spain’s grid operator underestimated the amount of dispatchable capacity needed at the time and did not bring enough thermal power stations online to stabilize the system once voltage conditions deteriorated.

(Reuters)

But why did the failure propagate so quickly? It turns out that power systems dominated by inverter-based generation (changing DC power to AC, e.g. solar) behave differently from those anchored by large spinning generators (e.g. gas, coal, nuclear, etc.). Traditional generators inherently resist sudden voltage and frequency changes, while inverters rely on software that can rapidly respond, but sometimes by disconnecting rather than stabilizing the grid, which is what happened. Once voltage moved outside acceptable limits, the protective response of disconnecting compounded the disturbance, rather than absorbing it as spinning generators would have, and with insufficient grid-supporting resources online, stability was lost faster than operators could recover.

The Spanish government has since released Royal Decree 997/2025 where Spain’s grid operator is required to install heavy spinning machines like synchronous condensers which act like spinning generators and can absorb disturbances by supplying or removing power, thus providing physical inertia to the national grid, again showing the pivot in emphasis to energy reliability.

Where Do We Go from Here?

Taken together, conversations from Davos 2026 suggest a meaningful shift to energy security, system reliability, affordability, and geopolitical resilience. How might governments and industry assess past decisions and future paths?

In Part 2, we turn from policy signals to market consequences—examining what this shift toward energy realism means for natural gas, LNG, power markets, AI-driven demand growth, and emerging economies. We explore where constraints are forming, where investment signals are changing, and how global flows may evolve as energy security moves to the center of decision-making.

Understanding these dynamics requires deep insights facilitated by advanced modeling and analytics. Contact RBAC to discuss how the most trusted market simulation in the industry can help you with your needs.

RBAC, Inc. has been the leading provider of market fundamental analysis tools used by the energy industry and related government agencies for over two decades. The GPCM® Market Simulator for North American Gas and LNG™ is the most widely used natural gas market modeling system in North America. RBAC’s G2M2® Market Simulator for Global Gas and LNG™ has been instrumental in understanding evolving global gas and LNG dynamics and is vital in fully understanding the interrelationship between the North American and global gas markets.