This article is organized into two parts. Part 1 examines the accelerating collision between AI-driven electricity demand and LNG export growth. Part 2 explores the infrastructure constraints and growing local resistance that complicate how and if these competing demands can be met.

Upsetting the Apple Cart

In a recent essay, one experienced industry analyst noted that “the natural gas conversation is shifting,” and “LNG and power growth could upset the apple cart,” (Amber McCullagh in The nat-gas conversation is shifting: These three reports show why) noting that U.S. gas markets are coming into a structural realignment where AI-driven data centers, LNG export growth, and physical infrastructure constraints are interacting in ways that redefine many market watchers understanding of gas market dynamics: supply, prices, and flows, and investments into the infrastructure.

Natural gas is no longer simply a cheap and abundant commodity with nuanced seasonality. It is rapidly becoming a strategic input for the AI revolution as well as the global energy supply. And the competition for it is beginning to look like a 3D chess match.

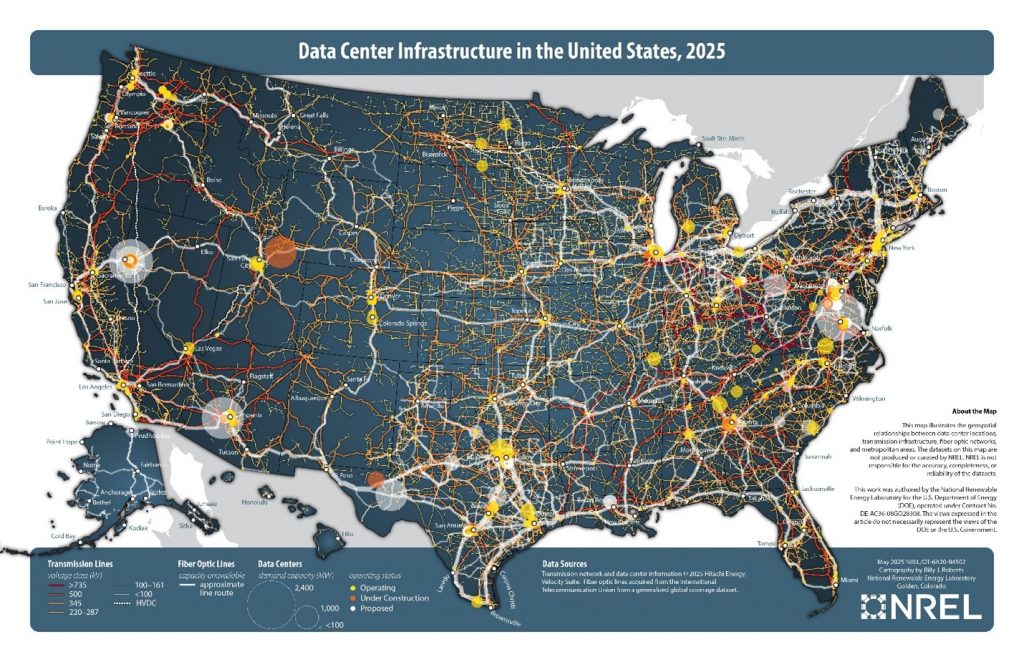

AI Data Centers Are Redefining U.S. Load Growth

The U.S. Department of Energy’s new assessment, led by Lawrence Berkeley National Laboratory (LBNL), highlights how sharply data-center demand has deviated from historical trends.

From the DOE/LBNL report:

“Data centers consumed about 4.4% of total U.S. electricity in 2023 and, depending upon how much the rest of the economy grows, are expected to consume between 6.7 and 12% of total U.S. electricity by 2028.” The report shows U.S. data centers consumed 176 TWh in 2023, (4.4% of all U.S. electricity), and are projected to reach 325–580 TWh by 2028. This means demand could double or triple within five years.

Many AI-oriented facilities now plan for 300-MW to 1-GW loads, the scale of a small city. For the first time in decades, U.S. electricity demand is being driven by new, persistent, and geographically concentrated load growth.

Data Centers Localized: Everything is Big in Texas

Looking at one large growth area, the Bureau of Economic Geology at University of Texas recently released their whitepaper, “Data Center Growth in Texas” and noted:

“In July 2024, ERCOT [Electric Reliability Council of Texas] projected that summer peak electricity demand could reach 153 GW by 2033, nearly double the peak of 85.5 GW in 2023, driven by expected growth in data centers, industrial electrification (particularly in oil and gas), and cryptocurrency mining. ERCOT also projected that the peak electricity demand could surpass available supply by 6.2% in 2026, with the deficit potentially widening to 32.4% by 2029.”

Some uncertainties include:

- Economic volatility hindering investment in oil and gas electrification

- Advancements in data center energy efficiency

- Investments in dedicated power or private microgrids

“[Yet] it remains clear that there is an urgent need to meet growing electric demand in Texas, and data centers will play a central role in shaping ERCOT’s future power landscape.”

For its part, ERCOT voted to approve a $9.4 billion project to build a 765kV superhighway of new high voltage transmission lines as part of its Strategic Transmission Expansion Plan (STEP), and reported that in 2025 they received 225 large load interconnection requests with nearly 73% of them from data centers.

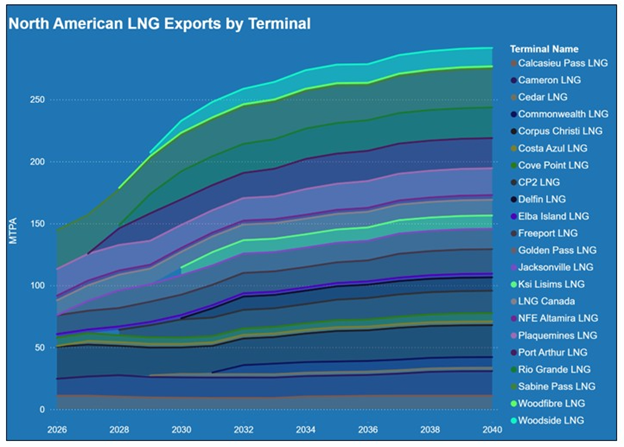

LNG Exports Continue Expanding and Locking in Firm Demand

At the same time, U.S. LNG exports continue to rise. Export terminals require continuous, firm feedgas, and new trains under development will add long-term demand to the system.

“Liquefied natural gas (LNG) exporters in the United States have announced plans to more than double U.S. liquefaction capacity, adding an estimated 13.9 billion cubic feet per day (Bcf/d) between 2025 and 2029”

This is not optional or interruptible load. It is contractual, global-market-driven, and insensitive to short-term domestic price changes.

“Based on figures from financial firm LSEG reported by Reuters, U.S. LNG exports hit a record 10.9 million metric tons in November, while feedgas flows have surged too. Export volumes continue to rise as new capacity ramps up, intensifying competition between export loads and domestic heating demand during peak cold periods. Analysts note that the market is experiencing structural shifts in how supply is allocated, adding to price volatility.”

With both LNG and AI data centers expanding at once, they are beginning to compete for the same molecules, capacity, and infrastructure.

Yet, to put the scale in context, it helps to bracket both sides of the demand equation. On the LNG side, announced capacity additions of roughly 14 Bcf/d make LNG exports the single largest structural driver of incremental U.S. gas production and prices. On the data-center side, Berkeley Lab estimates imply 150–400 TWh of incremental electricity demand by 2028, translating to roughly 2–5 Bcf/d of gas burn in gas-heavy regions. Even if every new data center was served solely by natural gas power generation, LNG would remain the 1000‑lb gorilla in the room nationally, though data centers might be 300‑ to 500‑lb competitors in key hubs where localized constraints drive competition.

But even then, it’s not a question of, for those in the field of dreams, if you build it, will the gas come? The question is:

Can you build it?

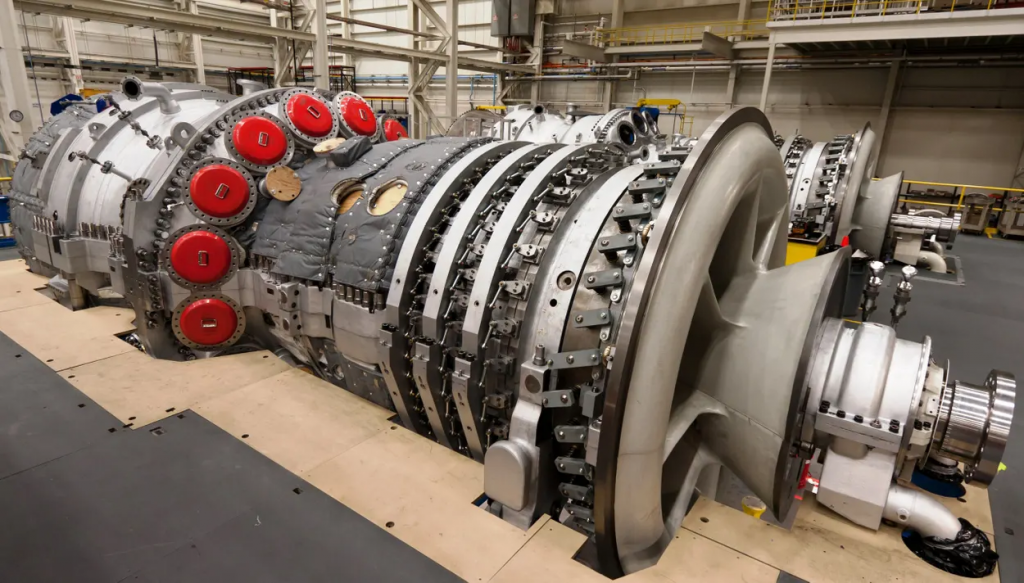

The Critical Data Center Constraint: Power Generation at Scale

None of this AI demand growth matters if the U.S. cannot build reliable power generation fast enough. And currently, it’s severely challenged. The U.S. is depending on natural-gas-fired generation to provide firm capacity at scale, yet turbine manufacturers cannot keep up with soaring orders.

“Lead times have stretched from three to four years to six to seven years, depending on manufacturer and model.”

Why?

The major heavy-duty turbine manufacturers all face skilled-labor shortages and long supply-chain lead times after years of volatility in turbine markets.

“Gas turbines were dead in 2022,” Siemens Energy North America President Rich Voorberg.

This means a developer cannot simply order a new 300-MW combined-cycle plant and expect a delivery in two or three years. In many cases, they are being told five to seven. Even with abundant natural gas in the ground, the ability to convert gas into electricity is constrained.

But, suppliers are responding to the market.

“The turbine supply market for U.S. gas-fired plants is dominated by three large equipment manufacturers: GE Vernova, Siemens Energy and Mitsubishi Power. … Mitsubishi Heavy Industries, for example, is prepared to double its production capacity within the next two years as demand for gas turbines continues to increase. … New orders for GE Vernova’s gas turbines have nearly tripled year-over-year, reaching 55 gigawatts, [and GE] plans to invest more than $160 million in its Greenville plant in South Carolina to meet surging gas turbine demand. As of August, Siemens Energy had 14 gigawatts of gas turbine orders year-to-date, [and] plans include a 61,000-square foot expansion of its Gibsonton, Florida, manufacturing facility.”

So, the plans are there as is the momentum. But what are the competing factors and challenges to threatening this juggernaut known as AI/Date Center growth and how do we model the resulting natural gas growth?

These questions will all be answered in part 2 of this article.

LNG exports and data centers are set to be the key drivers to new demand for the United States. Market simulation tools such as GPCM offer analysts insight into how these factors will shape the market for years to come and having the ability to do scenario analysis with GPCM’s capabilities is an invaluable addition to any analyst’s toolbox. Interested in seeing how RBAC’s market simulation tools can assist you? Learn more about what GPCM has to offer by scheduling a free demonstration through our website.

RBAC, Inc. has been the leading provider of market fundamental analysis tools used by the energy industry and related government agencies for over two decades. The GPCM® Market Simulator for North American Gas and LNG™ is the most widely used natural gas market modeling system in North America. RBAC’s G2M2® Market Simulator for Global Gas and LNG™ has been instrumental in understanding evolving global gas and LNG dynamics and is vital in fully understanding the interrelationship between the North American and global gas markets.