Upcoming Demand Volatility in U.S. Gas Markets?

The natural gas market is as busy as ever and being both the leading producer and consumer, actions or developments that take place in the North American market can have rippling effects that could in turn shake up the global market and vice versa. What developments can we expect in North America? What is the demand outlook? How will producers respond to any changes?

This month we present diverse commentary primarily covering the markets within North America. We have a quick brief highlighting our recent natural gas and LNG seminar in in Houston; New trends in actions gas producers are taking to respond to changes in price; and coverage of potential future market drivers that could greatly impact future demand within the United States.

We hope you enjoy these articles and interviews created to give you greater insight into energy markets and the industry, all with the goal to increase your knowledge and help you make better energy decisions.

Join our mailing list today and receive updates directly from RBAC. Not only will you receive this newsletter in your inbox, but also those who sign up on our website will also receive articles a week in advance and other important communications from the team here at RBAC.

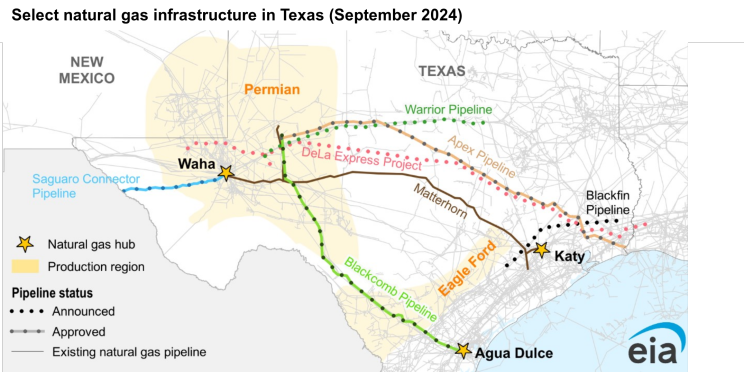

Quick Brief - Natural Gas Pipeline Capacity Increases in the Permian Basin

The Matterhorn Express Pipeline is set to begin service soon and would bring 2.5 bcf/d worth of additional capacity to the Permian Basin.

Natural gas production within the Permian Basin is at an all-time high, with production in the doubling since 2018 and is expected to continue growing which necessitates increases in pipeline infrastructure.

In addition to Matterhorn, several other projects such as the Apex, Blackcomb, and Saguaro Connector pipelines which have a combined capacity of 7.3 bcf/d are also approved and which will by transport Permian gas to other regions. Two of these pipelines are expected to enter service in 2026 and the Saguaro Connector entering in 2027-2028.

With currently approved projects underway and more on the horizon, the Permian Basin is as lively as ever and will be a cornerstone of the U.S. natural gas market in the years to come.

Articles and Media

Gain insight into natural gas and LNG markets across the globe with analysis and commentary from our energy industry experts.

RBAC 2024 September Seminar Recap

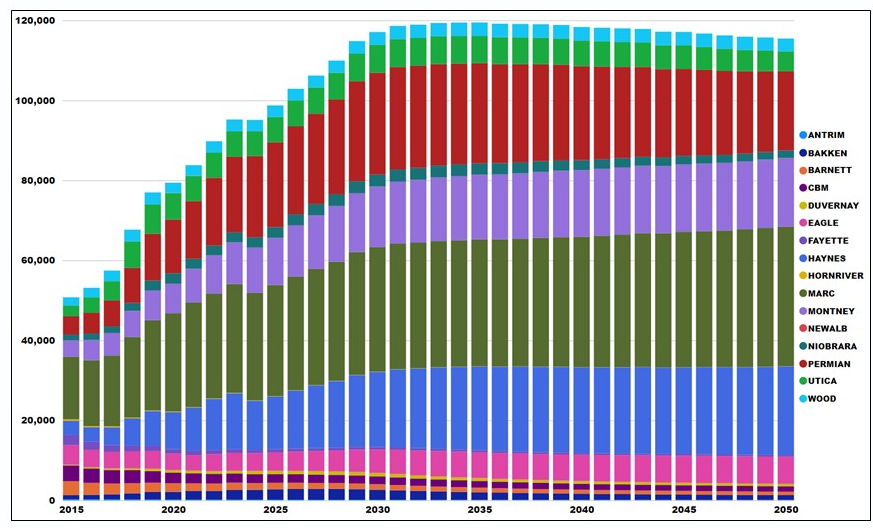

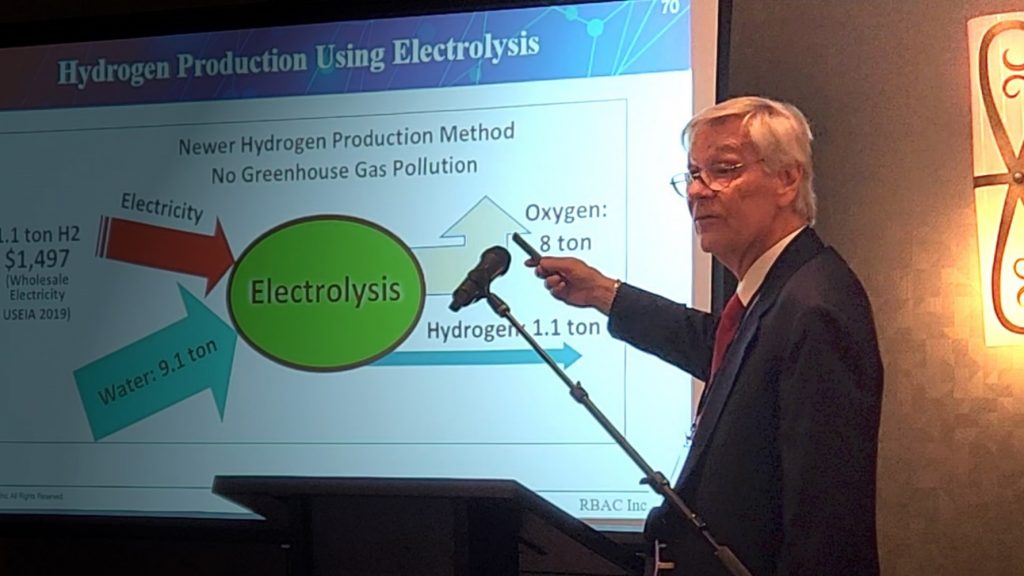

RBAC hosted a fantastic natural gas and LNG seminar in which Dr. Robert Brooks Ph.D, Dr. Ning Lin , and Bethel King (pictured above) presented their outlooks for gas markets across the globe and how developments in hydrogen could also affect. RBAC, Inc.’s GPCM® Market Simulator for North American Gas and LNG™ and G2M2® Market Simulator for Global Gas and LNG™ were utilized to provide a nuanced view of long-term demand growth and insights into the expected evolution of the market.

Read here for highlights from the seminar: https://rbac.com/rbac-2024-september-seminar-recap/

New Trader on the Block

With price volatility in the domestic U.S. natural gas market, gas producers are reacting quickly to adjust production rates as prices rise and fall. In today’s fast paced market, producers are behaving somewhat like traders in terms of the speed of which the curtailments and ramping back production take place. Will this fast reaction time trend continue? How long will these production cuts last? How do LNG exports factor in?

Read Scott McKenna’s new article to find out: https://rbac.com/new-trader-on-the-block/

Demand Projection Dizziness

What are the uncertainties that are impacting natural gas and LNG markets within the United States? How does this relate to imminent demand from data centers and the upcoming election? How does GPCM® Market Simulator for North American Gas and LNG™ show what regions could see gas demand increase, and by how much?

Robert Kachmar dove into market drivers within the United States in this exclusive article published in the International Gas Union’s latest edition of Global Voice of Gas.

Click here to read: https://www.igu.org/news/global-voice-of-gas-3-vol-4/

Essential Reading

Taken from the treasure trove of the writings from our energy experts. Here read technical insights and far-sighted analysis relevant through the lens of today’s energy.

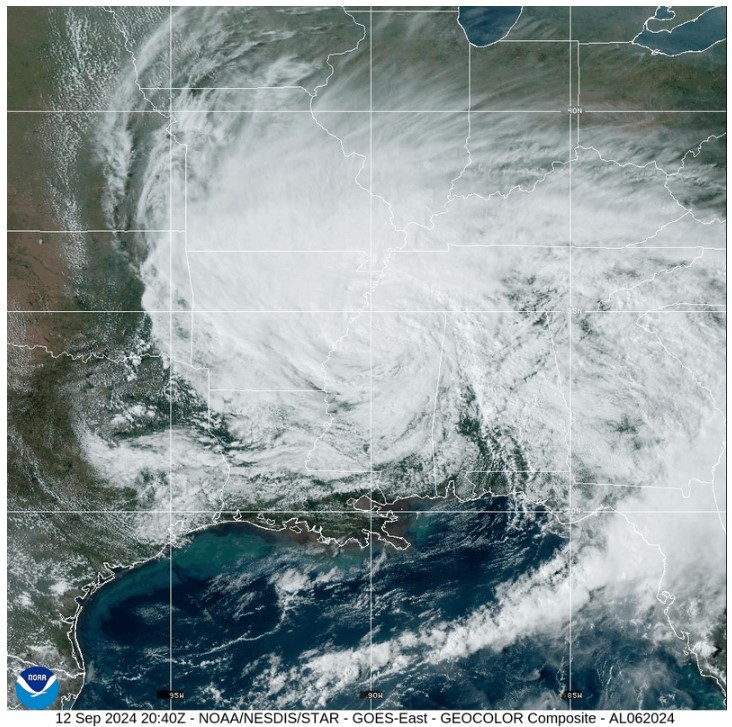

Potential Impacts of a Hurricane on Gulf LNG Exports

Hurricane Francine recently passed through Louisiana earlier this month and luckily the state neither the state nor the LNG exporters on the coast suffered any severe damages. However, Louisiana is no stranger to powerful storms causing chaos, and with a large portion of LNG export activity being located within the state, such storms could have a profound effect on the global market.

Click here to see how a hurricane could impact LNG facilities in the region if it resulted in extended outages: https://rbac.com/potential-impacts-of-a-hurricane-on-gulf-lng-exports/

Food For Thought

Read some of our engaging commentary on social media and join us in the conversation.

Having affordable and reliable sources of energy are crucial to every country and is a fundamental driver of economic growth. How can development of oil and gas assist in increasing the supply of electricity within Africa?

Click here to find out.

RBAC, Inc. is the market leading supplier of global and regional gas and LNG market simulation systems. The GPCM® Market Simulator for North American Gas and LNG™ is the most widely used gas market simulation system in North America. RBAC’s G2M2® Market Simulator for Global Gas and LNG™ is designed for forecasting gas and LNG production, transportation, storage, and deliveries across the global gas markets. These systems provide industry analysts powerful tools for supporting corporate investment and M&A strategy, achieving environmental and sustainability goals, risk analysis and trading.

© 2024 RBAC, Inc. All rights reserved. GPCM and G2M2 are registered trademarks owned by RT7K, LLC and are used with its permission.