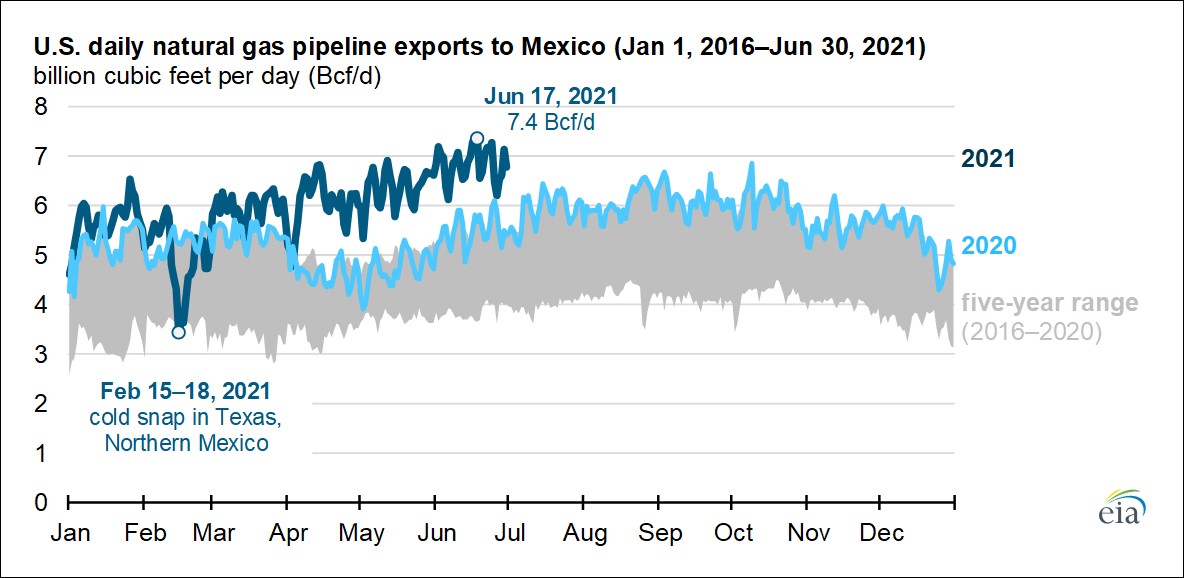

At the recent Mexico Infrastructure Projects Forum in Monterrey, Mexico, both government and private sector attendees came together to voice their concerns over deficiencies of Mexico’s energy supply chain, using Winter Storm Uri as “Exhibit A” to drive the point home. During Uri, pipeline deliveries of natural gas dropped dramatically, as shown in Figure 1 below, and the residents of northern Mexican states experienced electricity interruptions and outages for several days, resulting in at least 14 deaths and over $1.5 billion in damages.

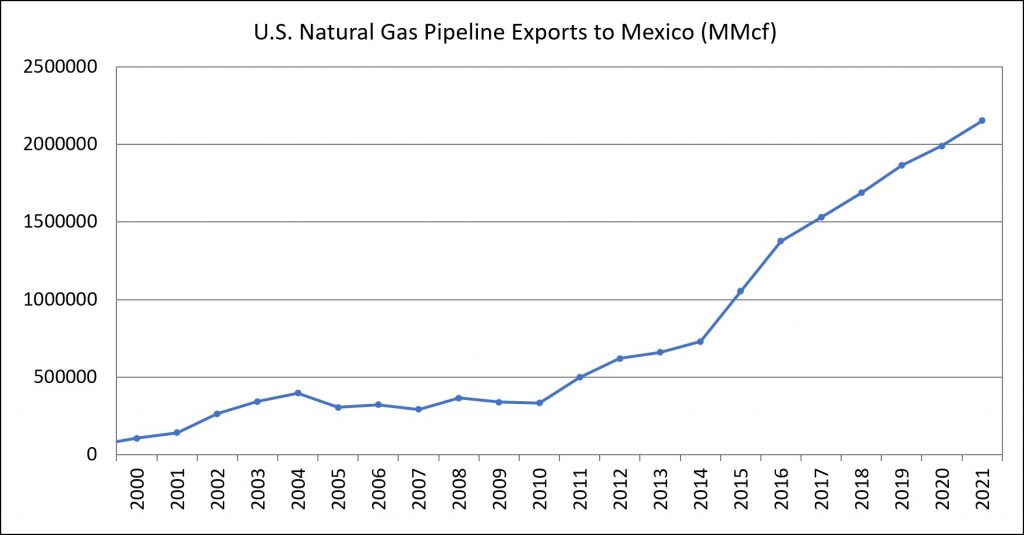

Pipeline exports of natural gas from the United States to Mexico have increased dramatically in recent memory, spurring an industrial and power generation renaissance that would not have been possible otherwise. According to the EIA, in the year 2000, approximately 105Bcf of natural gas was transported via pipe across the US-Mexico Border. Fast forward to 2021, that number surged to 2,154Bcf annually or ~6Bcf per day. A whopping 1950% increase. While natural gas has provided a great benefit to the Mexican people, natural gas storage is extremely limited, barely enough to supply the country for two days in the event of a disruption—a paltry number when compared with the US, which has the storage capacity to supply the country for 30 to 45 days or with Japan with an impressive and whopping 90 days. This dearth of gas storage, a vital link in the energy supply chain, subjects end users to supply disruptions and extreme price volatility—exactly what was experienced during Uri.

But how can additional storage and pipelines help? And to what degree? By using natural gas market simulation software, we can perform scenario analysis against historical results and see the quantitative impact of additional Mexican infrastructure. This is where RBAC’s innovative GPCM® Market Simulator for North American Gas & LNG™ software shines. A partial economic equilibrium model, GPCM is rigorously calibrated quarterly to historic supply, demand, and prices. Effectively modeling the North American natural gas market.

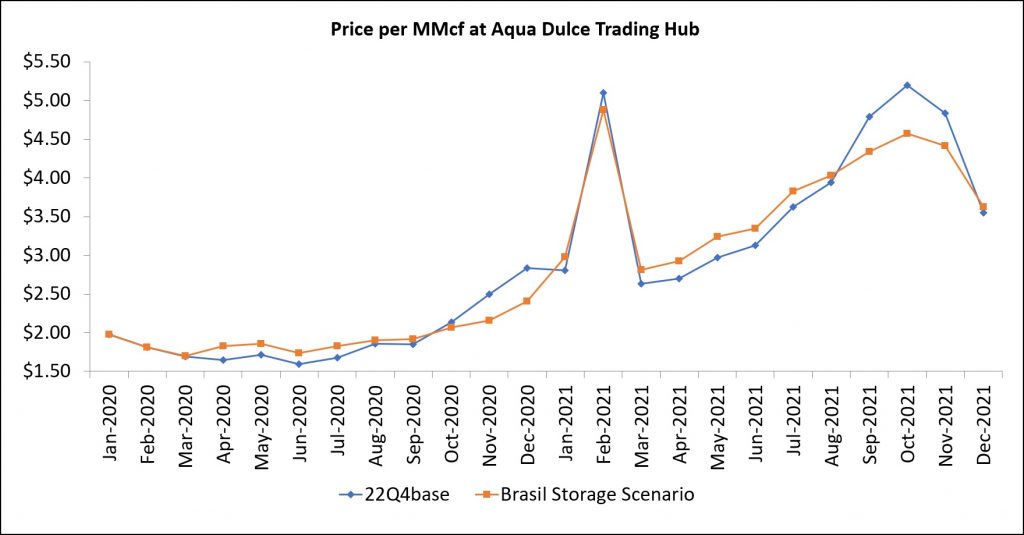

For the Mexican market, there are several projects in the works, however for this analysis we are focusing on Mirage Energy’s Brasil Natural Gas Facility and the associated bi-directional pipelines to model how flows and prices during winter storm Uri would be impacted had it been in service at the time in northeast Mexico. This project was singled out because of the size, location, and ability to flow gas back across US borders if need be. Located in the Burgos Natural Gas Basin, the Mexican extension of the Eagle Ford, the Brasil Field will be the single largest natural gas storage facility in North America at 786Bcf of total natural gas capacity and 418Bcf of working gas. Working gas is natural gas that is available for injection and withdrawal while still ensuring structural integrity of the facility. When compared to the largest facility in the US, Tres Palacios, we extrapolate the Brasil Storage Facility would have a withdrawal capacity of ~1.7Bcf per day. Offsetting much of the loss in pipeline supply resulting from Winter Storm Uri as seen above in Figure 1. Brasil Storage is provided with competitively priced natural gas from the Aqua Dulce Hub for industrial and electric generation purposes in Mexico, and provides a security of supply and an opportunity for pricing arbitrage. On top of that the bi-directional pipelines associated with Brasil storage also allow it to flow gas north back into the United States in certain situations.

When reviewing the results of our Brasil Storage Field scenario analysis, we see that over the entire month of February 2021, US exports to Mexico decrease by an average of ~.6Bcf/day. Demonstrating that even this one storage facility, granted a very large one, can offset and even reduce pipeline deliveries, reducing the Mexican people’s exposure to supply disruptions. Conversely, we see demand increase during the spring and summer season, as expected with the additional requirements for the storage refill, benefitting producers in the Permian, an area long plagued by demand disruptions, by providing them with an outlet for their production.

Furthermore, when analyzing pricing impacts at the Aqua Dulce and Waha Hubs in south Texas, we see corresponding decreases of ~$.21 per MMcf/day across the entire month of February, thus mitigating the pricing impact of Winter Storm Uri and effectively acting as a peak shaving facility, showing how consumers benefit in the United States just as they do in Mexico.

By utilizing the GPCM market simulator this study was able to quantify the impact Brasil Storage Facility and associated pipelines would have had on the local markets. It is important to note that the Brasil Storage Facility is just one, albeit the largest one of many proposed projects south of the United States border. We are confident that additional infrastructure would not only provide producers with a stable outlet for their gas but protect consumers and possibly save lives during extreme weather events.

RBAC, Inc. has been the leading provider of market fundamental analysis tools used by the energy industry and related government agencies for over two decades. The GPCM® Market Simulator for North American Gas and LNG™ is the most widely used natural gas market modeling system in North America. RBAC’s G2M2® Market Simulator for Global Gas and LNG™ has been instrumental in understanding evolving global gas and LNG dynamics and is vital in fully understanding the interrelationship between the North American and global gas markets.