Overview

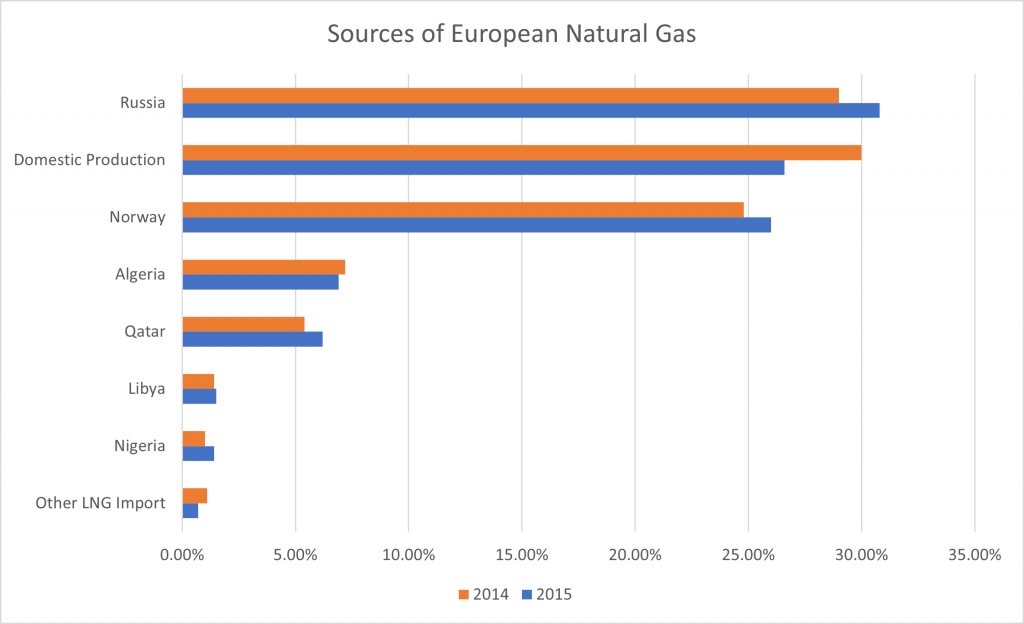

The European Union has five main sources for natural gas: indigenous production (mostly the Netherlands), Norway, North Africa (Algeria and Libya), Russia and LNG. According to Navigant Consulting’s Global Market Intelligence Database, the total amount of gas consumed in the European Union amounted to about 433 billion cubic meters (BCM) in 2015, an increase of 3.9% over 2014. Of this amount 26.6% was produced in Europe and 73.4% imported. As can be seen in Figure 1, the single largest supplier of natural gas to Europe in 2015 was Russia. Of the remaining non-domestic supply, 26% came from Norway, 6.3% came from Algeria and Libya, and 10.4% as LNG from Qatar, Algeria, Nigeria and other countries.

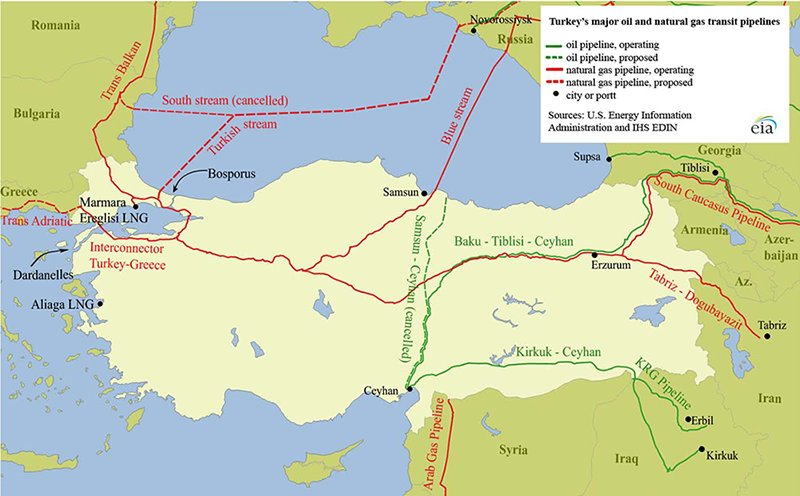

Gas from Russia entered Europe via pipelines through Belarus, Ukraine, and the Baltic Sea.

The amount transiting Ukraine and entering the European Union in 2015 was 15% of total imports or a bit over 47 BCM. The delivery of this gas to Europe is based on a transit contract with Ukraine which expires December 31, 2019. As reported in Oxford Institute for Energy Study’s recent report “Russian Gas Transit across Ukraine Post-2019: pipeline scenarios, gas flow consequences, and regulatory constraints”, Gazprom’s earlier threats to refuse to renew or negotiate a new transit agreement have more recently been replaced with a more conciliatory attitude.

Yet Gazprom is moving forward with strategies aimed at the eventual total bypass of Ukraine.

The strategy includes two alternate routes: one north and one south of Ukraine. The north route follows the existing Nord Stream 2-string pipeline system and involves simply doubling its capacity under a new name: Nord Stream 2. The southern route was dubbed South Stream and involved a pipeline from Russia to Bulgaria across the Black Sea. Fierce opposition to this Ukraine bypass resulted in its cancellation. It was subsequently revived as the Turkish Stream Pipeline (also known as TurkStream). In this variant, the Black Sea route skirts Bulgarian waters and lands in far Northwest Turkey where it connects with the Turkish national system (Botaş) and perhaps in the future to other pipelines moving gas into Southeast Europe.

This project is called the Southern Gas Corridor. It consists of the giant Shah Deniz gas field in the Caspian, the South Caucasus Pipeline Expansion, the Trans-Anatolian Pipeline, and the Trans-Adriatic Pipeline. Principal owners of the project are Azerbaijan’s SOCAR, Turkey’s Botaş, and BP. Gas produced in Shah Deniz is contracted to supply Turkey, Greece, and Italy. Additional pipes such as the Greece-Bulgaria Interconnector (IGB) and the Ionian Adriatic Pipeline (IAP) will expand the reach of Caspian gas to growing markets in the Eastern and Western Balkans.

Not only is there a lot of gas in Shah Deniz (1,000 BCM), but there is substantial gas in other fields in the Caspian as well as gas across the Caspian in Turkmenistan which could potentially become part of the solution to Europe’s goal of gas supply diversification. This could be accomplished by building the Trans-Caspian Pipeline from Turkmenistan on the east side of the Caspian to the Trans-Caucasus Pipeline on the west. Significant further expansion of the Southern Gas Corridor project would be required to move this gas to Turkey and on to Europe. Given this situation, the question presents itself: if Gazprom carries through with its threat to stop gas transit into Europe via Ukraine, can the proposed new pipelines moving new gas supplies from the Caspian fill the void? If so, at what cost? And, if not, what would be the likely impact in terms of supply shortfall and price impact? In order to answer these questions, the author undertook a study involving a set of market evolution scenarios using the G2M2™ Global Gas Market Modeling System developed by RBAC, Inc. (www.rbac.com).

G2M2 is a monthly model which can be used to run scenarios out to 2050 or beyond. It contains information allowing backcasting and calibration from 2006 through 2015. Over 100 countries are represented in the model, included all natural gas and LNG producers as well as all countries which receive gas by pipeline or LNG tanker. Large countries such as the United States, Canada, Russia, and China are divided into sub-country regions. Pipelines connect the regions together in integrated national networks. Over 400 pipelines and seven LNG tanker classes are included in the base model. Users can add their own representations of proposed or hypothetical new transportation infrastructure. Base case supply and demand curves are included with G2M2. Users can replace these with their own assumptions to create their own base cases as well as alternative scenarios.

Scenario Design

For this study we designed a Base Case and several alternative scenarios. The base case might be called the “Business-As-Usual” scenario. In it we assume that Gazprom and Ukraine work out their differences and the transit agreement is extended on the same terms as currently exist from 2020 through the end of the forecast period (2040).

Base Case

- Gas supply and demand forecasts

- By Navigant Consulting based on IEA outlooks, World Bank population growth trends, and BP reserves and production data.

- LNG liquefaction and re-gas capacity growth

- Based on approved projects and those projected by Navigant Consulting to be built.

- Gazprom and Ukraine Agree to extend transit by 2040.

- Opal continues to be constrained to 50% capacity.

- Southern Gas Corridor (SGC)

- 16 BCM line in-service 2019 (Turkey), and 2020 (Greece, Italy

- SGC Expansions

- 24 BCM in 2023 and 32 in 2026

- Trans-Caspian Pipeline does not get built/

- Turkish Stream and Nord Stream 2 do NOT get built/

- G2M2 is a trademark owned by RT7K, LLC, and is used with its permission.

Alternative Scenarios

A set of alternative scenarios were generated to forecast the effect of a cessation of Russian pipeline transit through Ukraine. In the most severe scenario, no additional new pipelines or LNG terminals are built and in service during the forecast horizon, beyond the Southern Gas Corridor and the Ionian Adriatic Pipeline. This is the “No UKT” – No Ukraine Transit or “Do Nothing” scenario.

The other alternative scenarios comprise various combinations of additional pipelines including Turkish Stream (TS), Nord Stream 2 (NS2), Trans-Caspian (TC), and a hypothesized Southern Gas Corridor Expansion (SGCX). The alternative scenario details are shown below:

No UKT

- No Ukraine transit + SGC (16 – 32 BCM, 2019-2020) + Ionian Adriatic Pipeline (5 BCM, 2029)

No UKT + TS

- No UKT + Turkish Stream (2020)

No UKT + TS + NS2

- No UKT + Turkish Stream (2020) + Nord Stream 2 (2020)

No UKT + TC + SGCX

- No UKT + Trans-Caspian Pipeline (2029) + SGC Expansion (to 64 BCM, 2029)

No UKT + TS + TC + SGCX

- No UKT + Turkish Stream (2020) + Trans-Caspian Pipeline + SGC Expansion (2029)

Scenario Results

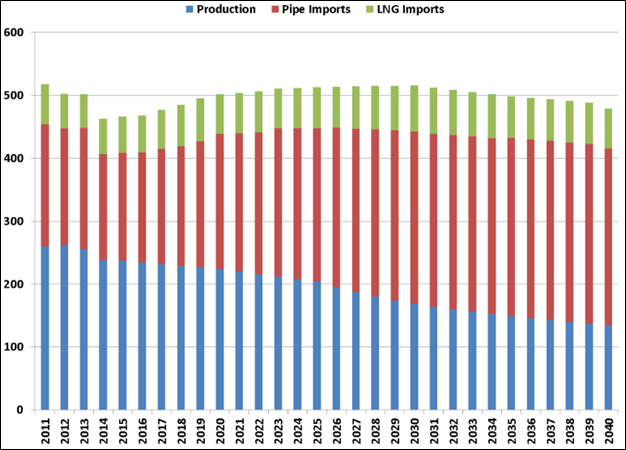

Figures 6 and 7 show the Base Case results for total European gas supply by source and wholesale market prices to Europe and other regions of the world from 2011 to 2040. A significant reduction in European gas production is offset by increases in pipeline and LNG imports. Total supply grows to its 2011 level by 2025 and holds there until slowly declining after 2030.

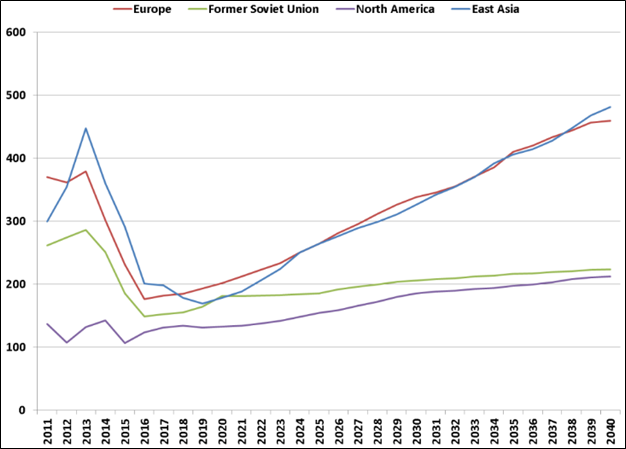

The convergence of global prices is forecasted to be a temporary phenomenon with divergence occurring in the 2020’s due to a continuing growth of demand in Asia, expiration of existing LNG contracts, and a tightening of the LNG market due to cancellation of long lead projects in the period to 2020.

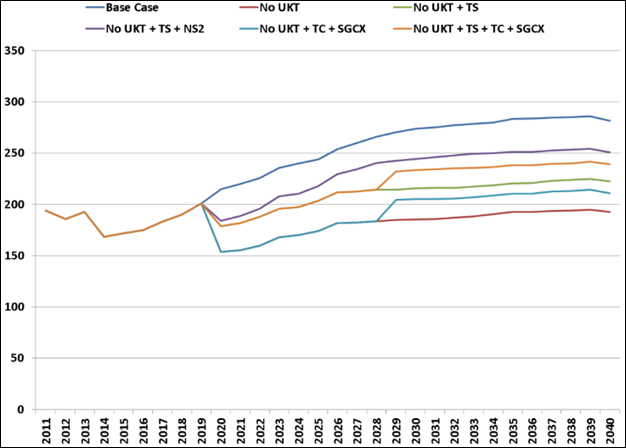

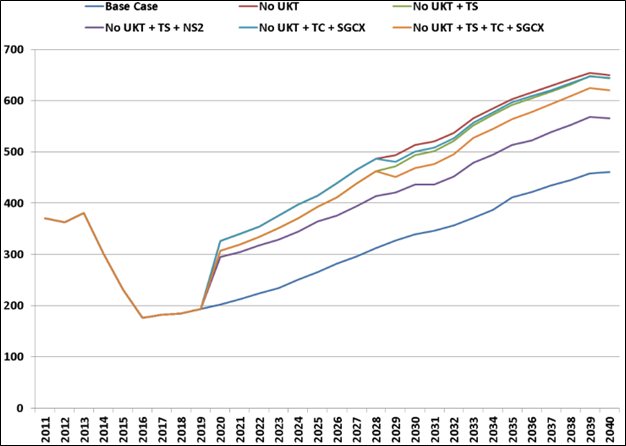

The effect of the cessation of gas transit through Ukraine is to reduce availability of Russian pipeline gas into Europe. One would predict that this reduction would tend to increase demand for higher priced LNG and thus to increase the average wholesale market price, which it does. See Figures 8 and 9.

As expected, the biggest jump occurs in the “No UKT – Do Nothing” scenario. The initial increase is about 125 USD/MCM (approx. $3.50/mmbtu), rising to almost 200 USD/MCM ($5.50/mmbtu) by the mid 2030’s. The least impact scenario, which includes both Turkish Stream (at 32 BCM) and Nord Stream 2 (at 64 BCM), results in a much lower price impact of 95-105 USD/MCM or about $2.50- 3.00/mmbtu.

Higher gas prices in Europe have one positive effect: they attract more LNG imports. Additional supplies from North America increase total European LNG imports by 25 – 50% for the various “No UKT” scenarios in comparison with the Base Case. But LNG imports cannot make up for the loss of pipeline imports through Ukraine.

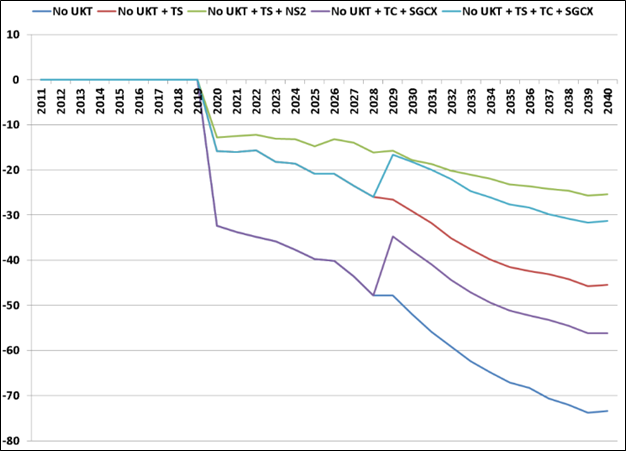

Figure 10 shows the change in total imports into Europe for the “No Ukraine Transit” scenarios when compared with the “Business-As-Usual” base case. The scenario which includes both the Turkish Stream and the Nord Stream 2 pipeline does best, but it still delivers between 13 and 25 BCM/Y less than the base case in the years Figure 7: Average Annual Gas Price (USD/MCM) Figure 6: European Gas Supply 2011-2040 (BCM/Y) Figure 8: Pipeline deliveries to Europe (BCM/Y) p.26 First Quarter 2017 International Association for Energy Economics from 2020 to 2040. These projects cannot replace the lost gas due to the end of Ukraine transit.

Conclusions

From the scenarios we have run, the effect of a shutdown in gas transit across Ukraine leads to the following conclusions:

- Europe needs Caspian Gas from Azerbaijan

- Supplies intended for Europe are needed in all scenarios, including the Business-As-Usual scenario.

- SGC and its expansions will be highly utilized.

- Faster ramp-up of SGC would be helpful.

- Gas from Turkmenistan will also be Needed.

- Reduced supplies from Russia mean Europe will need Turkmen gas transported by the Trans-Cas- pian Pipeline and an additional expansion of the Southern Gas Corridor.

- Turkish Stream will Help.

- But it needs a new downstream pipe to take gas further to Central and Western Europe

- More LNG will be Needed.

- LNG imports increase in all scenarios, but not enough to make up for lost Russian gas.

- Much Higher Prices will be Required.

- To attract additional pipeline gas and LNG to Europe.

- But all Proposed Pipeline Solutions will not be Sufficient.

- They cannot make up for all the gas lost to Europe if the Ukraine transit issue is not resolved.

The scenario results show that even with the expected low growth of the European market, where much of this growth is centered in Turkey, the cessation of gas transit across Ukraine into central and southeast Europe would have a substantial negative effect on both gas supply and price.

The building and expansion of planned pipelines such as South Caucasus Expansion, Trans-Anatolian Pipeline, and Trans-Adriatic Pipeline is insufficient to make up the loss. Completion of new pipelines such as Turkish Stream, Trans-Caspian Pipeline, and Nord Stream 2 would help, but not be sufficient.

Something else is needed. If a new transit agreement between Gazprom and Ukraine is not achieved, a doubling of Turkish Stream to 64 BCM/Y coupled with the completion of the proposed Nabucco West Pipeline between Turkish Stream and Austria or the ITGI Poseidon Pipeline between Turkish Stream and Italy might compensate for the loss in European gas supply. (In a follow-up study, we intend to run this scenario to see if it could make up for this loss and, if so, at what cost.)

There are many political obstacles to making such a hypothetical solution happen. From our study we conclude that the best outcome for Europe and Russia is the “Business-As-Usual” scenario where Russia/Gazprom and Ukraine/Naftogaz design a new transit agreement which both can live with. This solution would best promote the energy security which both Europe and Russia long have sought.

Acknowledgements

This study was made possible by the generous support of Navigant Consulting’s Oil and Gas Practice with whom RBAC has had a long and mutually beneficial relationship.

Navigant team members Gordon Pickering, Ed O’Toole, Angelo Lan, and Jeff Van Horne are particularly thanked for their assistance in model and results evaluation, data research, data compilation, demand modeling, and LNG and pipeline transportation insights.

RBAC researcher David Brooks is also thanked for his assistance with a variety of data requirements. Their contributions made this study possible.

IAEE Conference

This study was originally presented at the International Association for Energy Economics Conference in Baku, Azerbaijan in August 2016.

RBAC, Inc. has been the leading provider of market fundamental analysis tools used by the energy industry and related government agencies for over two decades. The GPCM® Market Simulator for North American Gas and LNG™ is the most widely used natural gas market modeling system in North America. RBAC’s G2M2® Market Simulator for Global Gas and LNG™ has been instrumental in understanding evolving global gas and LNG dynamics and is vital in fully understanding the interrelationship between the North American and global gas markets.