Football is a multi-billion dollar global industry. It is a game of technical skills, IQ and athleticism. These are the reasons it has such a global appeal. In order for players to score, they need to have the rights tools at their disposal.

The natural gas industry has been on the global playing field for a long time. However, because of the shale gas revolution, the global market is now emerging as one of the most competitive games in the industry. In this game, risks and opportunities are abundant and players will need the right tools to play at the highest level and win.

At the 40th International IAEE Conference in Singapore this past June, Dr. Robert Brooks, Founder of RBAC, Inc. presented a study on the impact on Asia of the developing global natural gas markets. Conducted by RBAC and Navigant Consultants using RBAC’s G2M2® Global Gas Market Modeling System™, the study examined the effect of lower LNG prices on gas demand growth, gas sourcing and infrastructure requirements in Asia.

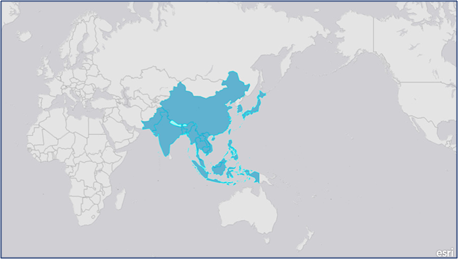

Regional Study Area: (Eastern, Southern, and Southeastern Asia):

The study compared two distinct scenarios; a base case scenario and a high-demand-growth scenario going out to 2050. The high growth scenario focused on gas demand in electricity generation.

The base case scenario was based on a review of all available demand/supply outlooks from various agencies for each individual country and a selection of one supply and one demand outlook for each country that aligned with Navigant’s view of the local market as the benchmark outlooks. Adjustments were then made to the benchmark outlooks to incorporate ongoing changes to reflect local market dynamics.

The high-demand-growth scenario was created using economic, demographic and resource estimates to forecast natural gas supply and demand outlooks. Building the demand scenario consisted of extrapolating natural gas consumption per capita and combining this with World Bank population projections to derive the demand outlook for each country. The supply outlook was created by extrapolating natural gas production from historical production trends and adjusting the extrapolation to align with the country’s economic and resource conditions.

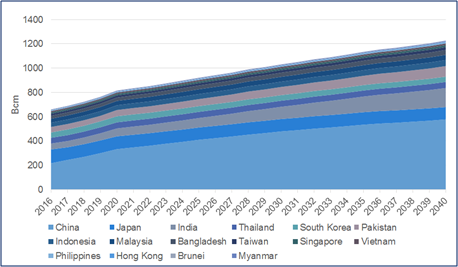

It was found that natural gas demand throughout the three sub-regions (Eastern, Southern, and Southeastern Asia) will nearly double as population and per capita consumption continues to increase. This growth is expected primarily in the industrial and electric sectors.

Reference Case: Regional Demand Outlook by Country (Bcm/yr)

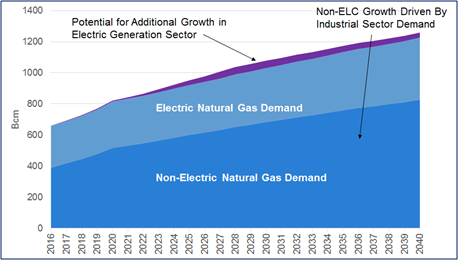

Reference Case: Regional Demand Outlook by Sector (Electricity generation vs Other)

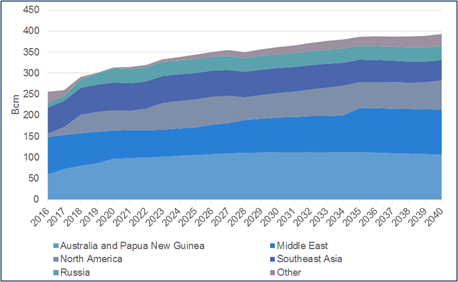

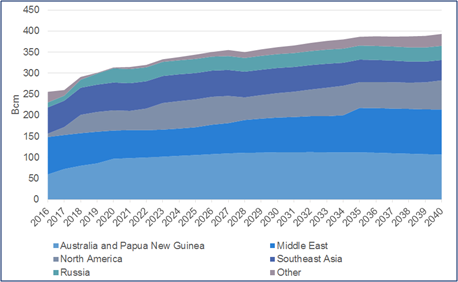

For players looking to reduce their risks and win the game, the results were quite insightful. Throughout the study area, natural gas production growth will not be sufficient to meet expected demand growth between now and 2040. Significant increases in LNG supply from both legacy sources such as the Middle East, Southeast Asia, and Australia and newer players in North America and Russia will be needed to meet this growing demand.

Reference Case: Regional LNG Supply Sources for Study Area

India and Pakistan in Southern Asia and China in Eastern Asia have greater optionality of supply: pipeline gas from major producers such as Iran, Turkmenistan, and Russia. In addition, existing LNG import terminals are underutilized so imports can grow.

Southeastern Asia does not have this optionality. It is limited to its own production (which is declining) and to LNG imports from the west (Middle East, Africa), south (Australia, PNG) and east (North America). The ability to grow its gas demand for electricity generation will depend on substantial investment in new LNG import capacity.

In his presentation Dr. Brooks made an interesting observation. “It is fascinating that LNG supply to Asia is very nearly the same as natural gas demand in the electric power sector. The growth rate of electric power demand in Asia – and other electrically underserved markets – will be an important factor in the future success of the global LNG market.”

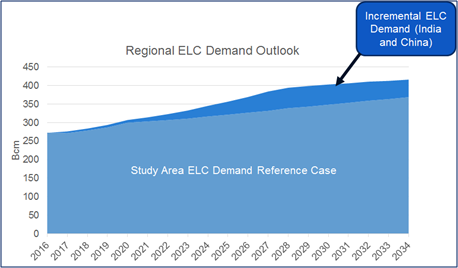

High-Growth Scenario: Incremental Regional Demand

LNG Supply almost equal to ELC Demand

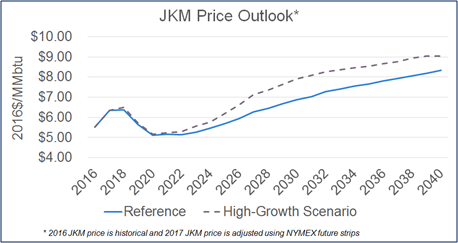

Continuing growth in supply from Australia and North America will cause LNG prices in Asia to decline to about $5.00 / mmbtu by 2020. But … increasing demand will cause them to rise again to $8.00 – $9.00 by 2040.

JKM Price: Reference Case vs High-Growth Scenario

As the famous Brazilian playwright Nelson Falcᾶo Rodrigues once said, “In football, the worst blindness is only seeing the ball.”

When investing in any potential opportunity one must have the tools to see beyond the current goal and to visualize the entire playing field. RBAC’s G2M2® Global Gas Market Modeling System™ is designed to enable you to see the whole field and give you the best opportunity to not only score a goal, but to win the game.

RBAC has been the leader in building the fundamental analysis tools used by the energy industry and related government agencies for over two decades. The GPCM® Natural Gas Market Forecasting System™ is the most widely used tool of its kind in its markets. RBAC other products include the G2M2® Global Gas Market Modeling System™, Gas4Power®, GPCM Peak Daily Demand Analyzer™, GPCM Viewpoints® on Natural Gas and NGL-NA® Model.