Immediate Executive Action on Energy

In less than a week, the new Trump Administration has drastically changed the trajectory of the energy industry. Although not unexpected, as Trump has been very outspoken about his intentions on the campaign trail, these changes have been met with the full gamut of reactions from praise to complete melt downs.

In a whirlwind of Executive Orders, President Trump has once again taken the U.S. out of the Paris Agreement, reversed President Biden’s pause on LNG export permit reviews, opened up Federal offshore waters for oil and gas exploration permits, paused offshore wind permitting pending environmental reviews, stopped all federal funding under the IRA, and declared a National Energy Emergency, giving his administration additional powers to reducing barriers to expand energy production, including oil and gas.

EIA Reports and Forecasts

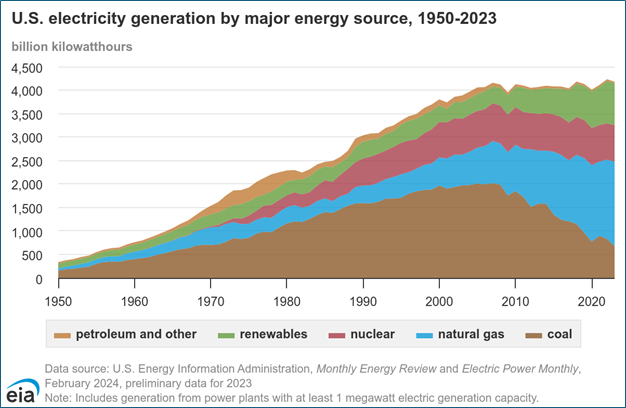

In the chart below, the EIA reported U.S. electricity generation by power source (energy mix) showed growth in renewables and natural gas, but declines in coal and petroleum and others, while nuclear remained relatively steady.

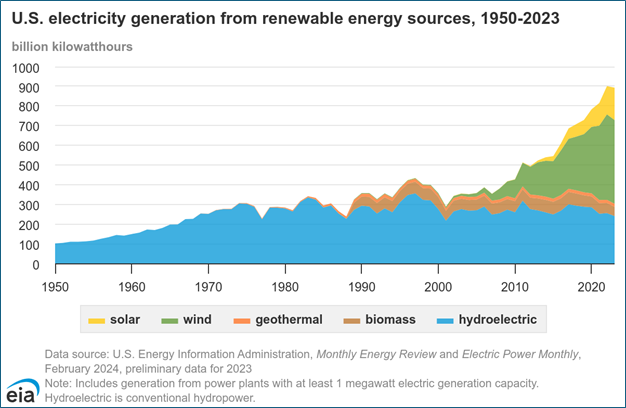

Amongst the renewables, wind has seen the largest growth.

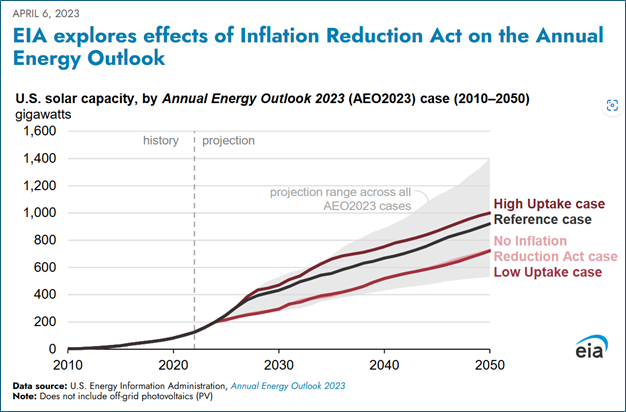

Under the previous administration and with the passing of the IRA, the EIA projected in its Annual Energy Outlook 2023 that “U.S. solar capacity, including rooftop solar, reaches 920 GW in 2050, about 194 GW more than in the No IRA case.”

In January 2024, the EIA released its Short-Term Energy Outlook (STEO) projecting “that wind and solar energy will lead growth in U.S. power generation for the next two years. As a result of new solar projects coming online this year, we forecast that U.S. solar power generation will grow 75% from 163 billion kWh (kilowatt hours) in 2023 to 286 billion kWh in 2025. We expect that wind power generation will grow 11% from 430 billion kWh in 2023 to 476 billion kWh in 2025.”

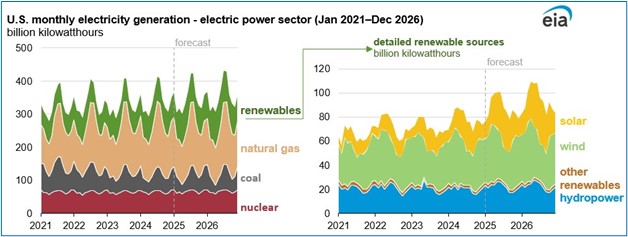

Now on January 25, 2025, the EIA have released their latest STEO, which stated that 2024 U.S. electric power generation grew 3% over 2023 at 4,155 billion kWh and 2025 is expected to increase by 2%, and 1% for 2026.

Looking at generation by source, natural gas grew by 4% in 2024 to 1,767 billion kWh (42% of the electricity mix) but is expected to decline by 3% in 2025 and 1% in 2026.

Renewables grew 9% in 2024 to 945 billion kWh and are expected to continue growth by 12% in 2025 and 8% in 2026.

Nuclear is slightly up in 2024 to 781 billion kWh and is also expected to grow: by 2% in 2025 and 1% in 2026.

Coal generated 647 billion kWh in 2025 and was previously expected to decline to 548 billion kWh in 2025, now the EIA projects in 2025 and 2026, coal-fired generation will remain unchanged at around 640 billion kWh.

What a difference a year makes. With the halting of offshore wind permitting as well as pausing funding from the IRA et al, how will this affect EIA’s short-term and long-term forecasts for U.S. electricity generation?

It was only a few days after President Trump’s National Energy Emergency declaration that the EIA released their STEO and thus it may not include its ramifications.

As to its Annual Energy Outlook (AEO), the EIA have since announced it to be released in Spring 2025. Although, I would not be surprised if they push back the release to consider the impact of the new direction the Trump administration has taken on the U.S. energy strategy.

New Electricity Demand in the US

With the projected increase in electricity demand for data centers and AI in particular, companies are looking for long-term solutions for reliable energy which is dispatchable; and this has been an enduring challenge for VRE (variable renewable energy) sources such as solar and wind.

Big Tech companies like Amazon have tried to reduce their carbon footprint, but without new power sources, you get the “rob Peter to pay Paul” situation, such as in Oregon where media report:

“While Amazon is cleaning up its electricity, though, its rapid shift to renewable energy creates other issues for the region’s power mix. Nearly all of Amazon’s newly acquired renewable power comes from hydroelectricity — a tightly constrained resource that was already maxed out. So more hydro for Amazon means less for everyone else, especially as data centers’ power appetite continues to grow.”

Data Center Power Demand

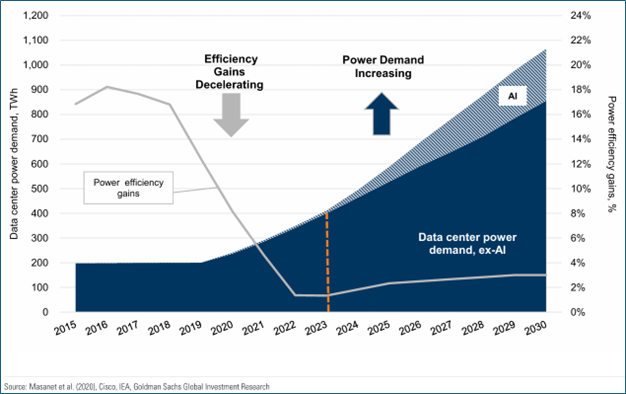

In the chart below, Goldman Sachs reports that after “being flattish for 2015-19, we see power demand from data centers more than tripling in 2030 vs. 2020, with an upside case more than double the base case depending in part on product efficiencies and AI demand.”

On Tuesday, January 21, 2025, President Trump announced a new joint venture called Stargate between OpenAI, Softbank, and Oracle to invest up to $500B to fund artificial intelligence infrastructure.

All this new demand will need to be met by a dispatchable energy source that can be run 24/7. Currently, the two best options to meet this demand and still be environmentally friendly are nuclear power and natural gas-fired generation.

Nuclear power plants are very reliable and produce no emissions, but building them takes an average of six to eight years and is costly. In the US, this is likely due to the fact that they have not been building nuclear power for such a long time, it may take some time, learning through experience, to reduce the length of construction.

On the other hand, due to the fact that a gas-fired power plant can be built significantly faster and at a lower cost, natural gas demand from power hungry data centers is projected to increase.

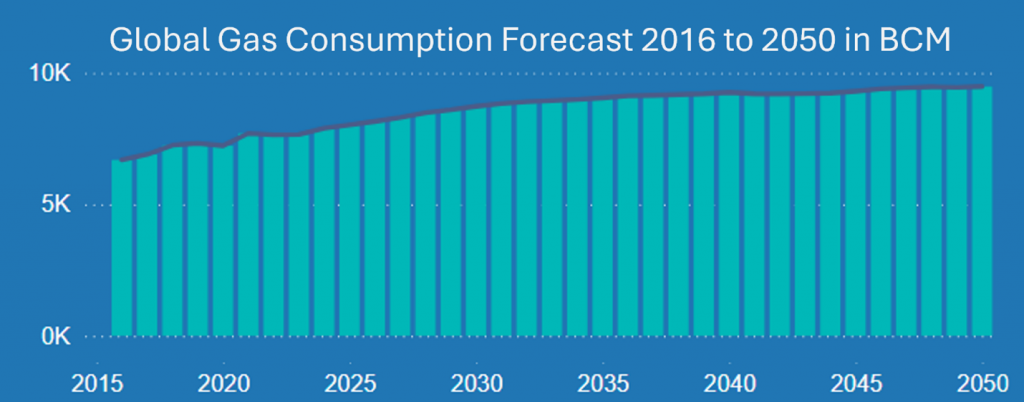

Along with the projected increase in electricity demand, we will also see an increase in demand for natural gas from LNG exports as the demand for natural gas grows globally (see graph below).

In order to meet this greater demand from both sources, there will need to be a significant investment in new energy infrastructure—from natural gas pipeline capacity to gas-fired generation.

Regulatory Action

With President Trump’s declaration of a National Energy Emergency and desire to streamline approval processes by reducing “red tape”, the possibility to develop more energy infrastructure under this Administration may be significantly higher than under the previous Administration.

Even with an Administration supportive of the oil and gas industry and projections for significant growth in energy demand, this does not mean that all proposed infrastructure projects will move forward. However, the potential opportunities will be there, as hurdles from government regulations are set to be reduced, potentially enabling more of these projects to come to fruition.

The new Trump Administration is poised to significantly change the trajectory of the U.S. energy mix over the next decade, having the right market analysis tools to model these changing market dynamics is vital to creating energy strategies to capture these potential opportunities.

Interested in learning more about our robust market simulation tools? Contact us and schedule a free demonstration.

RBAC has been the leading provider of market fundamental analysis tools used by the energy industry and related government agencies for over two decades. The GPCM® Market Simulator for North American Gas and LNG™ is the most widely used natural gas market modeling system in North America. RBAC’s G2M2® Market Simulator for Global Gas and LNG™ has been instrumental in understanding evolving global gas and LNG dynamics and is vital in fully understanding the interrelationship between the North American and global gas markets.