How are countries, governments and industry demanding, supplying (and marketing/trading) Natural Gas on the global market? Let’s do three examples:

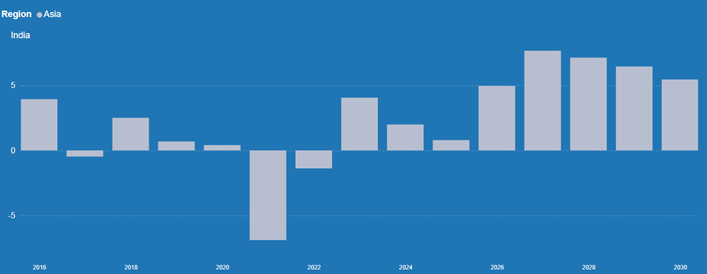

India – The Rising Tiger:

The IEA’s latest report projects that India’s natural gas demand will rise by nearly 60% by 2030, reaching 103 billion cubic meters (bcm) annually. This growth is driven by rapid infrastructure expansion, recovering domestic production, and an expected easing of global gas market conditions. Since 2019, India has 4X’d its compressed natural gas (CNG) stations and 2X’d residential gas connections, with further expansions expected. Domestic gas production is set to grow to just under 38 bcm by 2030, while LNG imports will need to more than 2X to ~65 bcm annually to meet demand with city gas distribution and heavy industry expected to lead this growth.

The Trump Effect:

Meanwhile, amid U.S. President Donald Trump’s drive for “fair and reciprocal trade,” India has agreed to increase its LNG imports from the U.S. as part of a broader energy trade strategy. India’s objectives include boosting natural gas consumption from 6% to 15% of its energy mix and hopes to achieve Net Zero by 2070. At the India Energy Week 2025, a deal was signed between India’s IOCL and UAE’s ADNOC for up to 1.2 mtpa (million tonnes per annum) of LNG from 2026 [1 million metric tons LNG = 1.36 billion cubic meters NG], valued at over $7 billion. Additionally, India is focusing on green hydrogen, with a target of producing 5 million tonnes by 2030.

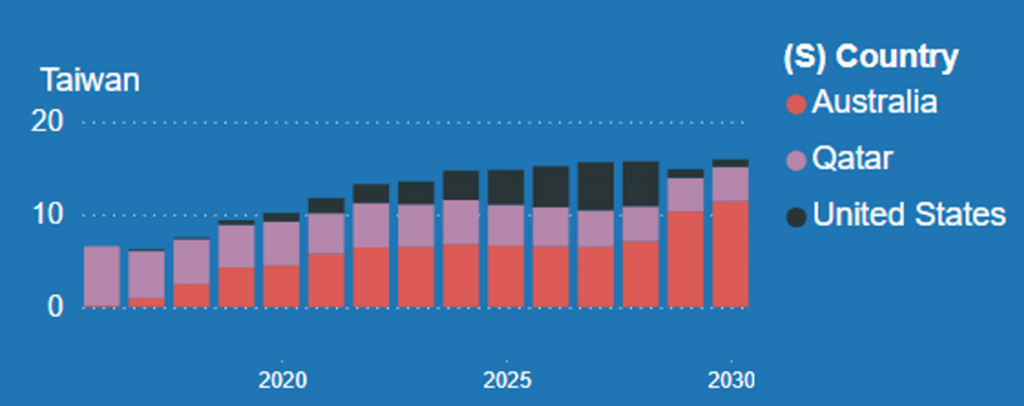

Taiwan – The Tech Giant:

Taiwan is exploring the purchase of natural gas from Alaska to reduce its trade surplus with the United States and avoid potential tariffs. In 2024, Taiwan’s trade surplus with the U.S. surged by 83%, reaching a record $111.4 billion, driven by high-tech exports like semiconductors. Currently, about 10% of Taiwan’s LNG imports come from the U.S., with the majority sourced from Australia and Qatar. The state-run energy company CPC is assessing the feasibility of additional purchases from Alaska, citing the short shipping distance as a key advantage.

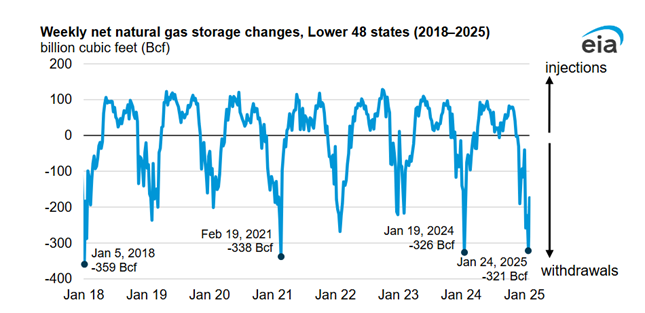

LNG Exports US Market Impact:

In the short term, U.S. natural gas futures surged by 6% to a two-week high, reaching $3.777 per million British thermal units (MMBtu), driven by a larger-than-expected storage draw of 100 billion cubic feet (Bcf) and increased LNG export flows. The U.S. Energy Information Administration (EIA) reported this draw for the week ending February 7, surpassing the forecasted 95 Bcf. Daily gas output dropped to a two-week low of 103 Bcf/d due to extreme cold, while LNG feedgas flows hit a record 15.9 Bcf/d. The 12-month futures strip [average price of natural gas futures contracts] also rose to $4.15 per MMBtu, the highest since December 2022.

Speaking of Forecasts, how would one go about it?

The G2M2 (Global Gas Market Model) can be a powerful tool for predicting and capitalizing on opportunities in the evolving global natural gas market. By leveraging G2M2, stakeholders can gain insights into supply and demand dynamics, price fluctuations, and trade patterns, enabling them to make informed decisions and strategic investments.

For instance, the IEA’s projection of a 60% increase in India’s natural gas demand by 2030 highlights significant opportunities for LNG exporters. By analyzing infrastructure expansion, domestic production and changes in demand, G2M2 analysis can help identify available supply sources as well as potential competitors for gas in 2030, in addition to markets and time periods that could potentially be the most profitable for LNG exports to India

In Taiwan’s case, analysts can use G2M2 to assess the feasibility and economic benefits of proposed LNG export projects. For example, Taiwan’s state-run energy company, CPC, could use G2M2 to evaluate scenarios which include the long talked about Alaskan LNG export project as part of their supply portfolio. With increasing global LNG demand, and uncertainty around proposed LNG export projects, CPC could evaluate the benefits of future supply procurement from this project as part of a strategy to lower their trade deficit and avoid US trade tariffs. Such analyses could help CPC ensure a stable and cost-effective supply of natural gas by utilizing data-driven analytics to make better decisions on LNG procurement.

Furthermore, G2M2 can help analyze the broader implications of India’s increased LNG imports from the U.S. and its focus on green hydrogen. By modeling the impact of these developments on global LNG trade flows and prices, G2M2 can help stakeholders identify new market opportunities and investment areas. For example, through iterations between G2M2 and GPCM Market Simulator for North American Gas and LNG, visualizations and reports from this

Overall, RBAC’s market simulation tools provide a robust framework for getting ahead of the volatility and complexity of the global natural gas market. By taking advantage of its predictive capabilities, stakeholders can identify and capitalize on emerging opportunities, ensuring a competitive edge in a rapidly changing energy landscape.

Contact us today for a free demonstration.

RBAC, Inc. has been the leading provider of market fundamental analysis tools used by the energy industry and related government agencies for over two decades. The GPCM® Market Simulator for North American Gas and LNG™ is the most widely used natural gas market modeling system in North America. RBAC’s G2M2® Market Simulator for Global Gas and LNG™ has been instrumental in understanding evolving global gas and LNG dynamics and is vital in fully understanding the interrelationship between the North American and global gas markets.

Products Referenced in this Post: