Bull Market for Natural Gas?

We are now through the first month of 2025 and with a leadership change and fast executive action in one of the most influential countries in natural gas and LNG, the year is already off to a hot start. What’s in this month’s newsletter? We have a quick brief covering upcoming changes in U.S. power generation, high-level analysis of key markets across the globe, how recent tariffs implemented by the U.S. could affect the North American gas market, how to model energy transition scenarios, and how market simulation and forecasting can assist in project’s reaching FID.

We also have recordings of presentations from our recent gas and user conference available now! Click here to fill out the short survey, and you can see an excerpt of the presentations so you can get a taste of the incredible insights in each presentation and have the opportunity to purchase them.

Join our mailing list today and receive updates directly from RBAC. Not only will you receive this newsletter in your inbox, but also those who sign up on our website will also receive articles a week in advance and other important communications from the team here at RBAC.

Quick Brief - U.S. Electricity Generation Capacity

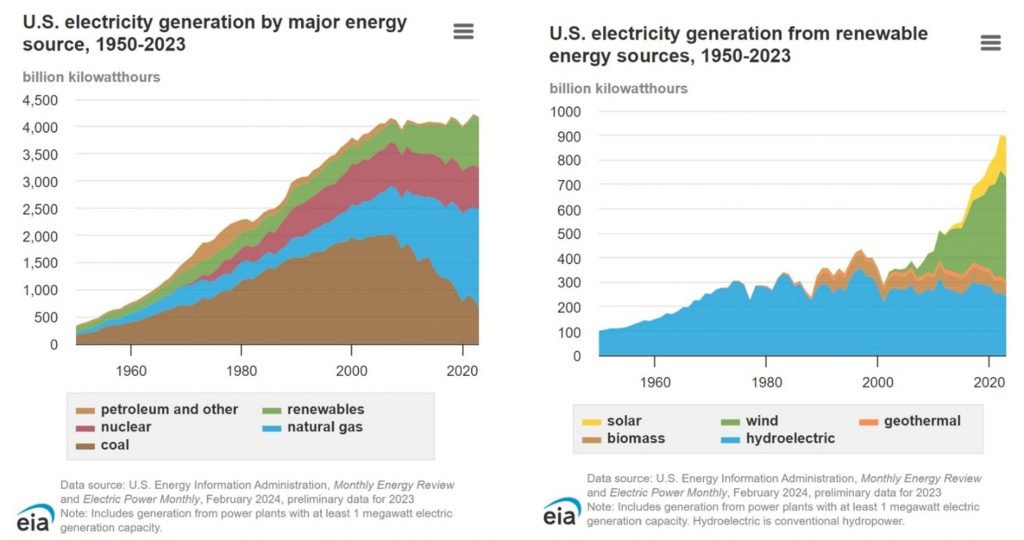

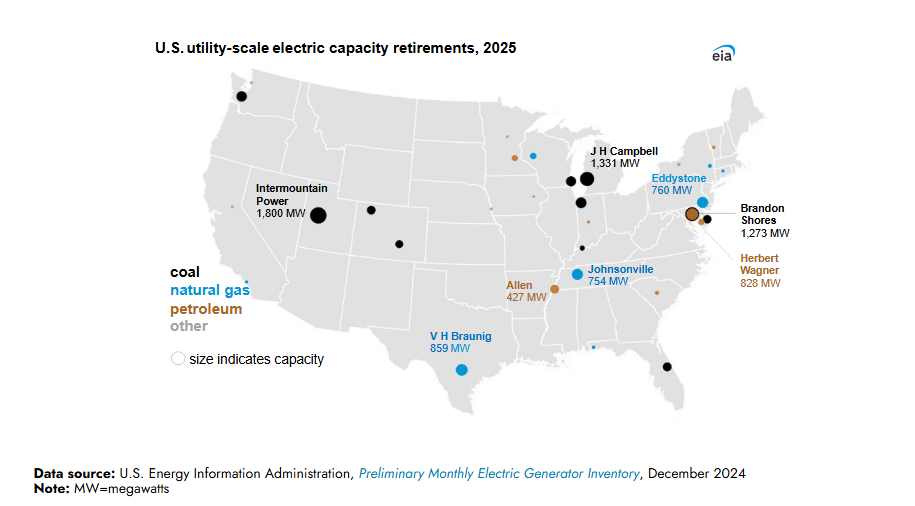

The U.S. is primarily powered by natural gas with coal, nuclear, and renewable sources. Natural gas continues to be the largest fuel source for power generation, despite retirements which are particularly affecting coal-fired power 2025. A total of 12.3 GW of generating capacity is being retired in 2025 which is a 65% increase compared to the previous year.

8.1 GW of coal-fired, 2.6 GW of natural gas-fired, and 1.6 GW of petroleum-fired capacity are all being retired.

On the reverse side of this, natural gas-fired electricity generation is constantly setting new demand records and investments are being made into natural gas to increase the amount of gas in supply for power generation. And with data centers and AI on the rise, natural gas is the current fuel of choice for powering the future.

It can be challenging to fully understand how the natural gas and power markets interact with each other at every level, but RBAC’s Gas4Power makes it easy. Gas4Power enables power market analysts to better understand and simulate gas market dynamics. Even more, users can easily layer in potential changes to those dynamics to simulate how that could affect important business decisions. Watch the short video below to learn more about the incredible capabilities of Gas4Power to enhance your natural gas and power market analysis.

Interested in a free demonstration of Gas4Power? Contact us by clicking here and schedule one today!

Announcements

Hydrocarbon Production Database

Do you need Well or Lease-Level Natural Gas production data, aggregate or drilled down to well level? Would you like aggregated structured reports or granular, detailed data that can be linked to Excel, Tableau, or Power BI?

Take our poll right here on LinkedIn.

Ready for the data right now? Contact us here.

Articles & Media

Catching the Wave of LNG through

Natural Gas Market Predictive Analytics

We visit three key gas markets of India, Taiwan, and the United States to see what is on the horizon for these countries in relation to natural gas and LNG.

Read ‘Catching the Wave of LNG through Natural Gas Market Predictive Analytics’

Tariff Terror

Between severe winter weather events and a flurry of executive orders signed by President Trump, major changes have taken place in the U.S. natural gas and LNG market. But it is the tariffs and how they might affect energy flows and prices at home which are causing a very large stir, particularly in Canada. How would the tariffs on Canada affect gas flows across North America?

Read ‘Tariff Terror’

Modeling Energy Transition Scenarios

As a natural gas market analyst, if you had to model energy transition scenarios then how would you do it? Watch the video below where RBAC’s CEO and Founder, Dr. Robert Brooks, expands on this very question:

Forecasting and Infrastructure

Large infrastructure projects such as natural gas pipelines and LNG terminals require long-term investments and years before any return is manifested. The initial capex can be huge achieving FID inherently fraught with challenges, particularly risk management and especially when juxtaposed with the short-term nature of political cycles. How can market forecasting assist in the process of reaching FID?

Essential Reading

Taken from the treasure trove of the writings from our energy experts. Here read technical insights and far-sighted analysis relevant through the lens of today’s energy.

Renewables, Reality and Evaluating the Global Energy Transition

The energy transition has seen billions of dollars in investment towards the end goal of net-zero emissions. But with all of this investment, is meaningful progress towards that goal being made?

Food For Thought

Read some of our engaging commentary on social media and join us in the conversation.

Rising Natural Gas Prices

Natural gas prices are up by 160% in the past year, what has been going on in the market to result in these high prices? And did RBAC’s analyst predict the current state of the market at the beginning of the year?

RBAC, Inc. is the market leading supplier of global and regional gas and LNG market simulation systems. The GPCM® Market Simulator for North American Gas and LNG™ is the most widely used gas market simulation system in North America. RBAC’s G2M2® Market Simulator for Global Gas and LNG™ is designed for forecasting gas and LNG production, transportation, storage, and deliveries across the global gas markets. These systems provide industry analysts powerful tools for supporting corporate investment and M&A strategy, achieving environmental and sustainability goals, risk analysis and trading.

© 2025 RBAC, Inc. All rights reserved. GPCM and G2M2 are registered trademarks owned by RT7K, LLC and are used with its permission.