Hat tip to Tsvetana Paraskova for Wall Street Re-Discovers Oil, and gave me a thought, “What about gas?”

Well, despite streams of rhetoric against use of natural gas, and streams of disinformation about this simple molecule of one carbon and four hydrogen atoms, the industry and investors are showing impressive resilience.

Let’s look at the big picture first, as seen from various sources (it’s not just me saying it!):

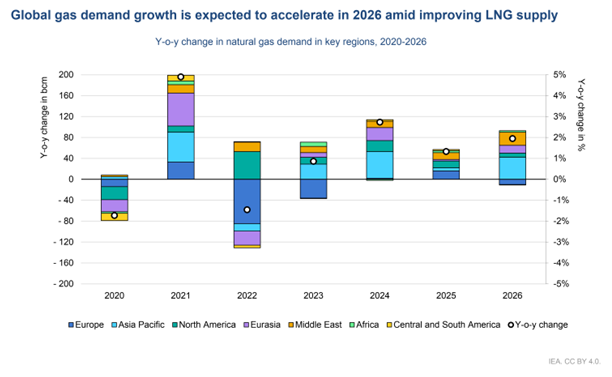

- The IEA projects “In 2026, LNG supply is set to rise by 7%, or 40 bcm – its largest increase since 2019” (International Energy Agency)

- J.P. Morgan “estimates global LNG supply capacity to increase by ~350 Bcm by 2030, up ~54% from 2024 levels, driven primarily by an increase in liquefaction capacity from North America and Qatar.” (JPMorgan Chase)

- Shell forecasts the global LNG market “to rise by around 60% by 2040, largely driven by economic growth in Asia, emissions reductions in heavy industry and transport as well as the impact of artificial intelligence.” (Shell)

- In the U.S., the S&P Global LNG Impact study notes that “in less than a decade, this sector has become a major export industry, contributing more than $400 billion to U.S. GDP and supporting hundreds of thousands of American jobs.” (S&P Global)

A Golden Era for LNG?

According to researchers at Rystad, “the next four years could prime the liquefied natural gas (LNG) markets for a golden era. Based on his campaign pledge, the returning president’s expected policies are likely to accelerate U.S. LNG infrastructure expansion through deregulation and faster permitting, bolstering global supply” (World Oil)

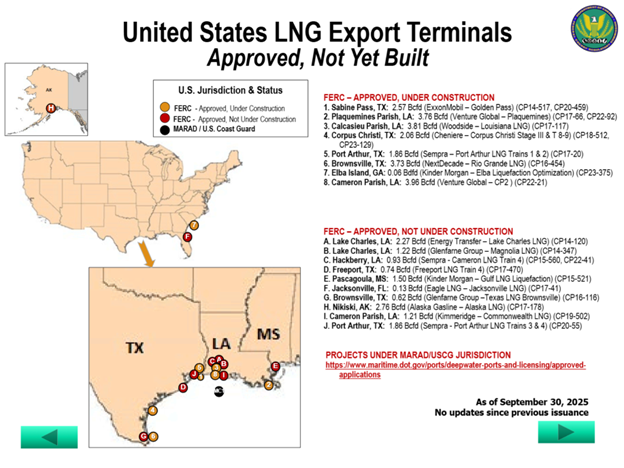

- Eight U.S. LNG export projects are under construction, and another ten are approved but not broken ground and five more proposed. (FERC)

- EIG Global Energy Partners has doubled down on LNG infrastructure via its MidOcean arm, backing a $13 billion LNG export terminal in Lake Charles, La (16.5 Mtpa) among others. (The Wall Street Journal)

- Meanwhile, BP and TotalEnergies are deepening their U.S. gas investments: Total acquired a 49 % stake in Continental Resources’ gas assets, targeting ~150 Mcf/d by 2030. (Reuters)

- But caution also from Shell’s CEO who recently warned that the U.S. LNG construction boom may lead to oversupply and depressed margins. (Barron’s)

I don’t think we’re at a place where recent “fiscal discipline” has been replaced with “fiscal freewheeling”, but safe to say that we are in a far different place than we seemed to be headed just a few years ago, and its vastly different world if Russia had never invaded Ukraine.

Natural Gas Media Narratives and Stark Reality

Have you noticed that anti-gas narratives have died down? But I think WoodMac has an interesting take in a recent Natural Gas report which “warns that gas is still a ‘dirty’ word in climate discussions due to methane emissions and its fossil fuel status.” (OilPrice.com)

These narratives are still kicking around, but let’s look at some facts:

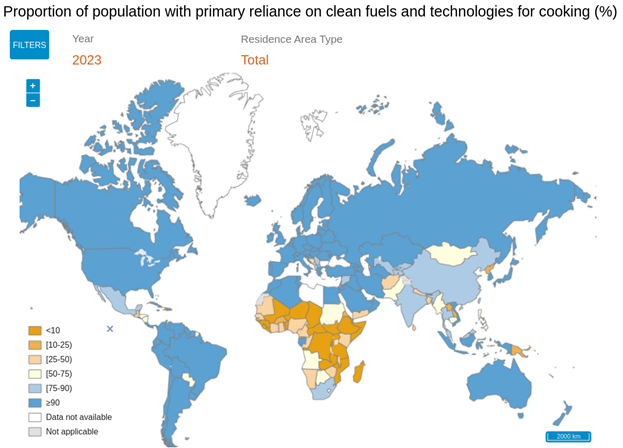

- For much of the developing world, the stark reality is that 3.2 million deaths per year still stem from household air pollution caused by cooking with wood, charcoal, coal, or kerosene. (World Health Organization)

- A 2024 Lancet meta-analysis of 116 studies across 34 countries found that switching from such polluting fuels to gaseous fuels like natural gas or LPG reduces risks for acute lower respiratory infection by 46 %, chronic lung disease by ~64 %, and adverse birth outcomes including low birth weight and preterm births—literally lifesaving. (ResearchGate)

- In wealthier nations, where energy reliability and cost matter, gas stoves are less expensive, and gas is often cheaper than electricity. But for all cooking we must place a single caveat: ventilation is essential. All cooking (gas, induction, or electric) releases volatile organic compounds and particulates from the food itself (including PM2.5) and without an exhaust hood or proper airflow, indoor concentrations can exceed health guidelines, but with such ventilation PM2.5 can be reduced by up to 90%. (The Conversation)

If cities were going to mandate or put a label on anything, it would be for effective ventilation, else the most impactful factor to human health is ignored.

Narratives be Damned: The Growth That “Shouldn’t Happen”

So far, the market has “refused” these negative narratives, and even some European ambitions on their energy mix are changing (see earlier from RBAC):

- U.S. LNG exports hit a record ~9.3 million tons in August 2025. (US News & World Report)

- The U.S. Energy Information Administration expects the U.S. “will increase total LNG exports to 14.7 Bcf/d in 2025 and to 16.3 Bcf/d in 2026, up from 11.9 Bcf/d in 2024,” driven by new liquefaction plants (e.g., Plaquemines, Corpus Christi Stage 3). (EIA)

- EU importers still heavily rely on LNG, “the US supplied 45 percent of EU LNG imports in 2024 (114 bcm), while the EU purchased 43 percent of US LNG exports (119 bcm).” (CGEP)

- Despite Europe’s broader push toward renewables and curtailed gas demand, its LNG import infrastructure continues to expand with a renewed emphasis on energy security. (EU: largest planned LNG import terminals 2025| Statista)

Natural Gas Drivers:

We know why, but let’s spell it out:

- Ukraine War = No Russian Gas

Post-Ukraine war, Europe has rushed to decouple from Russian pipeline gas. Turkstream still flows, and LNG increased, but days may be limited. (RBAC) - Asia Economic Expansion Hungry Asian markets (India, China, Southeast Asia) are scaling gas imports to shift from coal. (Shell)

- Cost and infrastructure tailwinds

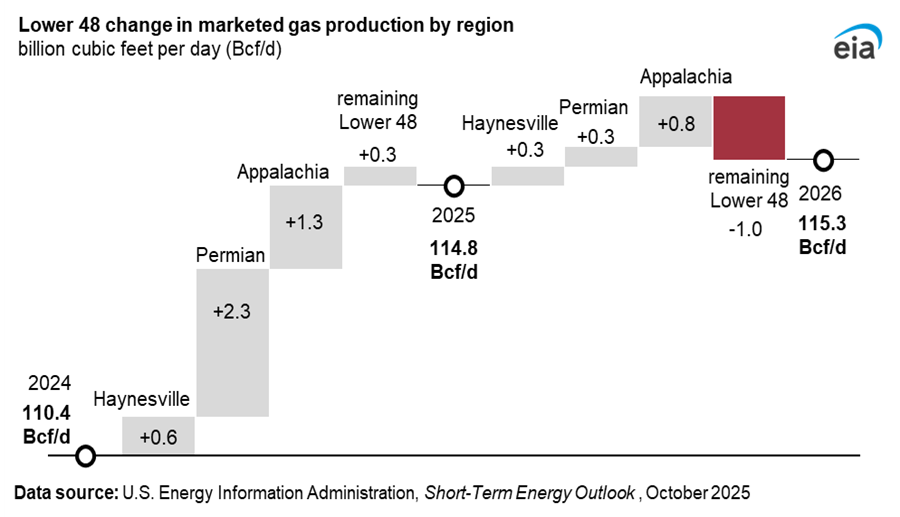

U.S. shale gas production has grown ~50 % in the past decade, cutting domestic gas prices in half. (Deloitte)

Liquefaction plants offer scale economies, and more supply is coming online globally. (International Energy Agency) - Fuel switching potential

In many high-emitting economies, gas is still far cleaner at the burner than coal or heavy oil, thus LNG displacing coal yields climate and local air benefits in many real cases. (First Nations Natural Gas Alliance) - Capital allocation dynamics

With pressure on pure renewable returns, many energy firms are rebalancing to hybrid portfolios. Shell now says LNG will be its “top contribution” in the coming decade. (Reuters)

Shifting Sands: Tools to Tame Volatility?

Given the continuous change and volatile supply & demand, as well as vagaries of politicians and geopolitical strife, how can get sure footing in such uncertain times?

For example, whether you are in the upstream, midstream or downstream, strictly in energy, or even in venture capital, private equity or infrastructure fund, what if you want to know:

- How can one know the true value of a pipeline or storage asset before it’s even acquired?

- How would one use market simulation to know how today’s business decisions will shape future gas revenues?

- Could under-used natural gas pipelines become tomorrow’s CO₂ or hydrogen corridors? [VC interest right there]

- How can modeling identify unviable projects early, before millions are sunk into development?

- Can simulations show how gas will move from production toward premium markets?

- How do you know whether your pipeline tariffs will truly recover costs?

Market simulation and scenario modeling tools may actually be like a lighthouse, enlightening analysts on a sure way forward. This is where industry leading software like GPCM (North American markets) and G2M2 (Global markets) come into play:

- Supply-Demand Scenario Forecasting

You can model how global and regional LNG supply, demand and price trajectories evolve under alternative assumptions (e.g. policy, weather, LNG plant buildouts). This helps test whether “golden era” growth is plausible or if oversupply will bite margins. - Project Viability & Investment Stress Testing

For individual LNG export or pipeline projects, modeling can run through cases (high vs low gas price, permitting delays, carbon pricing) to see under what conditions projects survive or get stranded. - Policy & Regulatory Impact Modeling

You can simulate how different government policies (e.g. methane fees, carbon pricing, faster/easier permitting) will affect gas/LNG market growth, supply flows, and thus the competitiveness relative to renewables or coal. - Gas / Energy Portfolio Optimization & Risk Management

For firms and funds, modeling lets you optimize capital allocation across gas, LNG, renewables, storage, hydrogen, etc., subject to constraints like carbon targets, volatility, regulatory risk, and scenario shifts.

Just some ideas for you but talk to us if you are in the field.

Let’s make better energy decisions together.

RBAC, Inc. has been the leading provider of market fundamental analysis tools used by the energy industry and related government agencies for over two decades. The GPCM® Market Simulator for North American Gas and LNG™ is the most widely used natural gas market modeling system in North America. RBAC’s G2M2® Market Simulator for Global Gas and LNG™ has been instrumental in understanding evolving global gas and LNG dynamics and is vital in fully understanding the interrelationship between the North American and global gas markets.