25Q3 has been awash with stories, new articles, and reports about the impact of AI and data centers on energy demand, and justifiably so – the billions of dollars already invested in digital and physical infrastructure will only increase in the coming years. We at RBAC continue to evaluate information about data center demand, particularly as it relates to our GPCM base case, and the role natural gas plays in providing stable, reliable electric power. We currently forecast our electric demand based on NERC data, with some appropriate transformations to make it compatible with GPCM’s structure and outlooks.

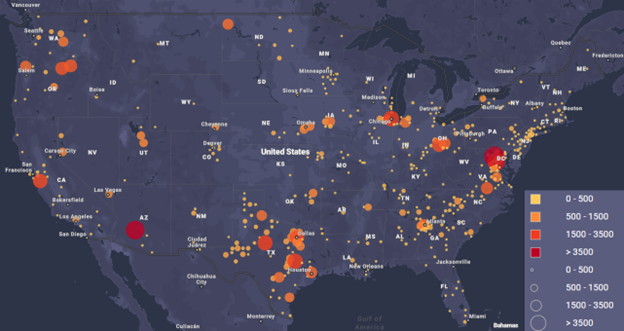

Figure A: Data Center Demand Capacity (MW), Operating and Under Construction (June 2025).

However, as is demonstrated by recent news (and the map above), these data centers and their demand impacts are developing in clusters. To account for the regional development of data centers, we’ve updated our outlooks for two of these clusters in our 25Q3 Base Case: Virginia, which is the existing leader for data center computing, and Texas, which has some attractive characteristics that facilitate data center growth.

Virginia Adjustments

We’ve recently discussed the outlook for data centers in Virginia, and the role natural gas will play in meeting that electric demand, in both a recent article and webinar. Our 25Q3 outlook for Virginia sees it continuing as a data center demand hub. Using some of the state data from our prior article, we modified our Base Case forecast to adjust for state-specific demand increases from data centers. This data, which we cross referenced with other regional outlooks from Dominion Energy and PJM, provided growth in natural gas demand in megawatts (MW) by generation type until 2050. We converted this forecast into MMcf/d by month, using assumptions about heat rate, utilization, and policy outlook.

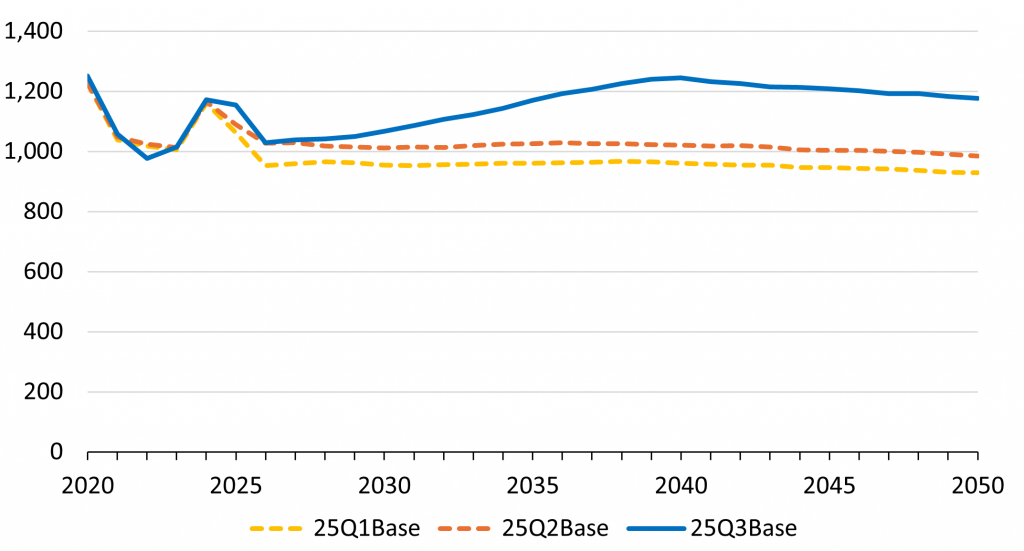

Figure B: Virginia’s Annual Natural Gas Consumption from Electric Power Consumers, 2020 –2050 (MMcf/d)

Compared to our prior forecasts, we see electric demand for natural gas growing from 1,029.0 MMcf/d in 2026 to 1,176.9 MMcf/d in 2050, an increase of 14.0%. Virginia’s electric sector demand for natural gas peaks in 2040 at 1,244.3 MMcf/d, 215.0 MMcf/d higher than in 25Q2 and 278 MMcf/d higher than in 25Q1. This forecast is still moderate compared to the exponential growth projected by some, but we have good reasons for that – Dominion’s rate setting cycle, continuing local backlash against these centers and their byproducts, and an upcoming statewide election, could significantly change the growth trajectory in what is currently home for all things digital.

Texas Growth

Texas is currently the second largest data center hub and one of the fastest growing in the nation with 408 centers. ERCOT said in their Adjusted Large Load Breakdown that they forecast an additional 24.2 GW of data center electric demand by 2031. Furthermore, many of these projects are looking to natural gas to power readily available electricity. For example, there is the Stargate project with a 1.2 GW flagship data center under construction in Abilene; Energy Transfer’s agreement with CloudBurst to provide 450,000 MMBtu to produce 1.2 GW of direct electric power; and Poolside and CoreWeave’s AI project in Odessa.

Given these, and numerous other data sources, RBAC modified its electric outlook for Texas for the 25Q3 Base. Using a process like the one we followed for our adjustments to Virginia, we took ERCOTs outlook for capacity by resource type, and applied similar conversions and assumptions to allow use within GPCM. Given that this forecast only went until 2030, we used linear forecasting with some smoothing to calculate the remainder months.

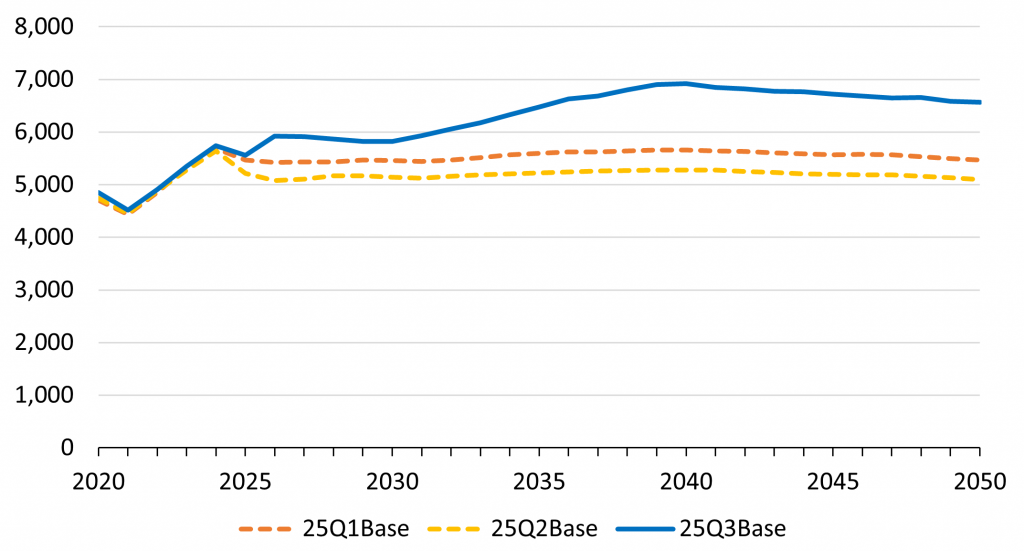

Figure C: Texas’ Annual Natural Gas Consumption from Electric Power Consumers, 2020 – 2050 (MMcf/d)

Compared to our prior forecasts, we see electric demand for natural gas growing from 5,924.3 MMcf/d in 2026 to 6,562.2 MMcf/d in 2050, an increase of 10.7%. Texas’ electric sector demand for natural gas peaks in 2040 (same as Virginia) at 6,916.3 MMcf/d, 1,639.8 MMcf/d higher than in 25Q2 and 1,259.5 MMcf/d higher than in 25Q1. Like Virginia, we are conservative in our outlook (just like ERCOT was in their adjustments of their large load customer needs!). RBAC feels this additional increase more accurately represents the outlook for electric demand for natural gas in Texas going forward.

We will continue to enhance our outlooks for natural gas used for electric generation, and examine more states with hotspots (such as Nevada, Arizona, California). And while we took a close look at Virginia and Texas, users can do the same in their own models. The beauty of GPCM is that a user can provide their own intel/market intelligence about where they think data center fueled natural gas electric demand will go and use it to create unique forecasts to provide valuable information for data-informed decision-making.

The natural gas market is constantly shifting and having the ability to do a scenario analysis with GPCM’s capabilities is an invaluable addition to any analyst’s toolbox. Interested in seeing how RBAC’s market simulation tools can assist you? Learn more about what GPCM has to offer by scheduling a free demonstration through our website.

RBAC, Inc. has been the leading provider of market fundamental analysis tools used by the energy industry and related government agencies for over two decades. The GPCM® Market Simulator for North American Gas and LNG™ is the most widely used natural gas market modeling system in North America. RBAC’s G2M2® Market Simulator for Global Gas and LNG™ has been instrumental in understanding evolving global gas and LNG dynamics and is vital in fully understanding the interrelationship between the North American and global gas markets.