The Energy Trichotomy: Data Centers, LNG Growth, and Infrastructure Limits

Just as many expected gas demand to plateau, a new wave of power needs is rewriting the outlook. Rapid growth in AI-driven data centers, semiconductor manufacturing, cryptocurrency operations, and global cloud infrastructure is pushing electricity demand higher in places not traditionally viewed as major load-growth regions. Moreover, the scale, speed, and reliability required by this new demand are all reinforcing the role of natural gas in power systems. Its operational flexibility and ability in providing sustained, around-the-clock output make it a very practical foundation for supporting the digital economy as it scales.

In this edition of RBAC’s newsletter, we look at how these evolving demand patterns intersect with real-world market dynamics. We cover the impact of severe winter weather on North American gas and power markets, explore what may lie ahead for Venezuela’s energy sector, examine key energy themes emerging from the 2026 World Economic Forum, and analyze the evolving natural gas relationship between Europe and Russia.

Want analysis that goes beyond headlines? Join RBAC’s mailing list to receive this newsletter, early access to new articles, and expert perspectives delivered straight to your inbox.

Top Stories in Natural Gas and LNG from Around the World

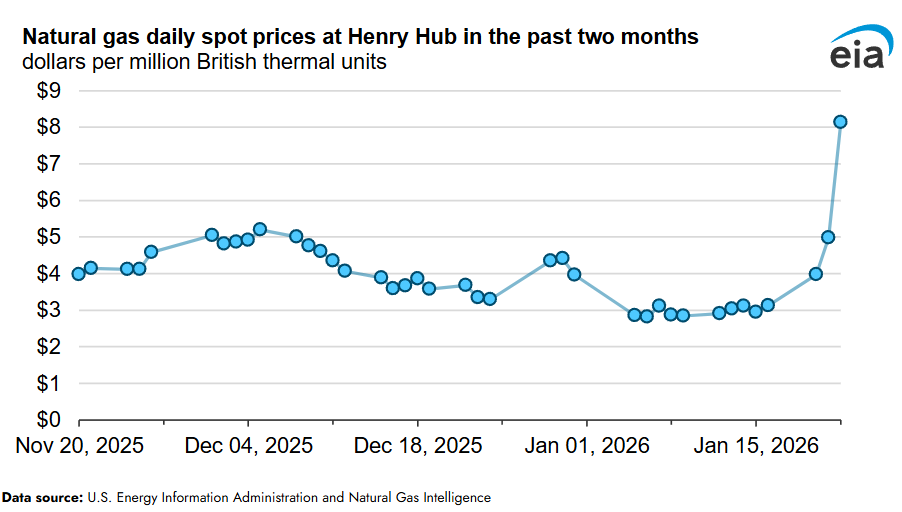

Quick Brief – Winter Weather Effects on Natural Gas Prices

Shifts in natural gas prices often occur to due to changes in the weather and the recent severe winter storm in North America is another example of this trend. How exactly did the freezing temperatures affect prices? Spot prices at Henry Hub doubled, rising up to around $8.15 per million British thermal units.

These increases in price come as a result of increased demand for gas for heating. This rapid increase in demand for both gas and power also puts a massive strain on the power grid itself which can lead to outages. The PJM interconnection reported nearly 21 gigawatts of generation outages on January 25th.

With natural gas making up nearly half of the power generation it is more important than ever to see how both gas and power markets interact with each other. This will be come even more of a need with new demand from data centers coming online over the next few years.

Our market simulation tools can assist you in fully understanding how gas and power markets are related, click here to learn more about Gas4Power, the power market focused tool built upon the GPCM® Market Simulator for North American Gas and LNG™.

Interested in a free demonstration of G4P? Contact us by clicking here and schedule one today!

From Climate-First to Energy Security-First: Davos 2026 at the World Economic Forum

The World Economic Forum at Davos has always been a place where major global narratives compete—from globalism to global conflicts, from health to high-end tech, from equity to economic growth, including many controversial ideas and policies such as central bank digital currencies, the Global Reset (stakeholder capitalism) including policies centered around climate and decarbonization.

In January 2026, however, the conversation showed a notable shift, particularly around energy. Why?

Read: From Climate-First to Energy Security-First: Davos 2026

Beyond Oil: Could Venezuela Be a Natural Gas Powerhouse?

South America is home to vast resources of oil and gas with Venezuela being particularly notable as it possesses the largest proven oil reserves and is top ten in proven natural gas reserves in the world. However, these reserves have yet to reach their full potential due to a myriad of factors such as infrastructure bottlenecks, sanctions, reliability issues with electrical grid, and a struggling economy. How did Venezuela’s energy industry reach this point and what could the future hold for one of the most important producers in the world?

Read: Beyond Oil: Could Venezuela Be a Natural Gas Powerhouse?

How could a Return of Russian Gas Supply to Europe Change Market Dynamics and Investment Narratives?

This new article explores how a restart of Russian gas deliveries to Europe could alter global gas markets at a time when new LNG capacity is already driving prices down. What would happen if it Russian gas did once again flow to Europe? What would happen if it continues to be phased out according to existing plans by the European Union?

Read the full article in World Pipelines magazine here

Essential Reading

Taken from the treasure trove of the writings from our energy experts. Here read technical insights and far-sighted analysis relevant through the lens of today’s energy.

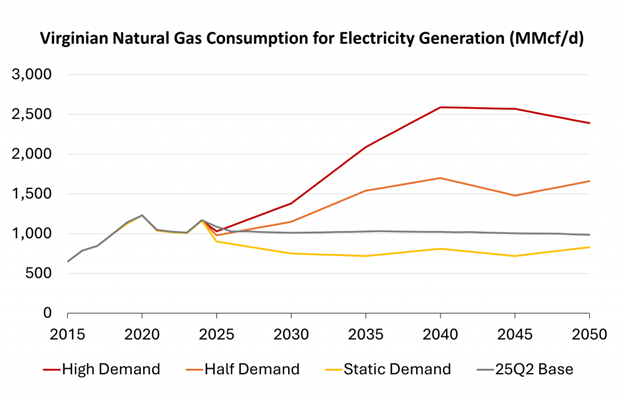

Forecasting the Surge: Virginia Data Centers, Natural Gas, and the Power Demand Puzzle

Virginia is home to many things – the nation’s capital, some of the worst traffic in the country, and 7.6 GW of data center IT load, according to Mordor Intelligence, or about 600 facilities. That’s more computing capacity than anywhere else in the country (or even the world), and that’s only expected to increase in the next 25 years. So, how much energy and specifically natural gas will these data centers need? And how will it impact markets around Virginia and the rest of the country?

Food For Thought

Read some of our engaging commentary on social media and join us in the conversation.

Energy, Economic Development and the Arts

“Charity can bring immediate relief. But it often does not scale and certainly does not sustain and create economic mobility unless it becomes connected to production (jobs, wages, markets, products and services). How can you create real freedom and prosperity for people?”

RBAC is the market-leading supplier of global and regional gas and LNG market simulation systems used by the energy industry and related government agencies for over two decades. The GPCM® Market Simulator for North American Gas and LNG™ is the most widely used natural gas market simulation system in North America. RBAC’s G2M2® Market Simulator for Global Gas and LNG™ has been instrumental in understanding evolving global gas and LNG market dynamics and is vital to fully grasp and leverage the interrelationship between the North American and global gas markets.