In RBAC’s 2019 Quarter 4 gas market outlook (19Q4base), using the GPCM® Natural Gas Market Forecasting System™, a key focus in the near-term forecast is the impact of lower natural gas prices on supply and demand balances and related implications for LNG exports.

Undoubtedly, low natural gas prices have led to a rough winter for producers, and weather forecasts continue to show orange and red color temperature anomalies. The lower gas price environment is leading to a significant throttling back of financing, capital expenditures, and an increased focus on maximizing efficiency throughout the value chain.

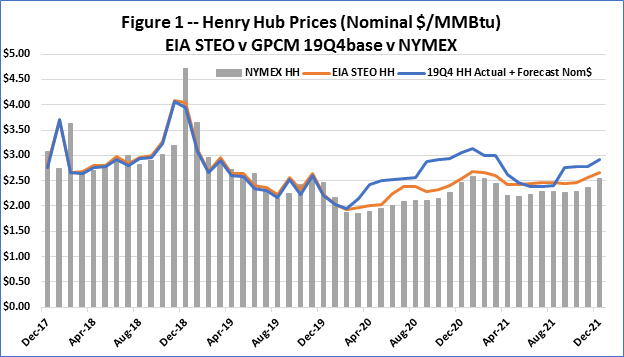

Sources: GPCM 19Q4base, EIA STEO updated on 11Feb20, and Nymex prices are settlement prices for 7 Feb20.

There is potential for price increases as the 19Q4base outlook shows in Figure 1 above, but the key to realizing these price gains is highly dependent upon demand. Specifically, global gas demand will need to steadily increase to drive U.S. LNG exports higher as the U.S. gas market is becoming increasingly integrated with the global market. Currently, there are some short-term concerns related to slowing Asia gas demand growth and the recent coronavirus outbreak, officially now known as the “COVID-19” virus, which will be addressed below.

Likewise, U.S. domestic electric power generation demand will need to realize modest year-on-year gains which can be reasonably expected assuming normal summer weather and the lower year-on-year gas prices forecast by RBAC and EIA and expected by market participants via the NYMEX forward curve. This is further supported by most U.S. economic data that suggests growth will remain at or above trend, though should conditions change quickly on this front, electric demand will likely be negatively impacted. RBAC’s current outlook assumes continued economic growth.

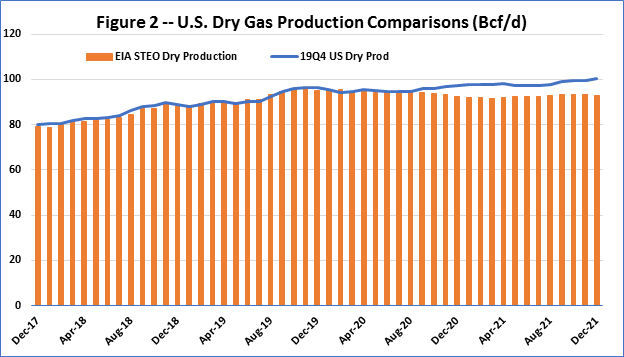

The 19Q4base outlook reflects this more difficult operating environment with its production forecast remaining relatively flat through 2020. Even though there is increasing evidence that U.S. gas supply growth is slowing, at least in the gassier basins, the primary workhorse for growth will be the Permian basin. In the Permian gas is primarily a by-product of crude oil production and flaring is still quite prevalent due to limited dry gas pipeline takeaway capacity. As Figure 2 shows, 19Q4base’s expect production is comparable to EIA’s just released Short-Term Energy Outlook until late 2020. After this point 19Q4base diverges due to higher LNG and electric power generation gas demand which support slightly higher production levels heading into 2021.

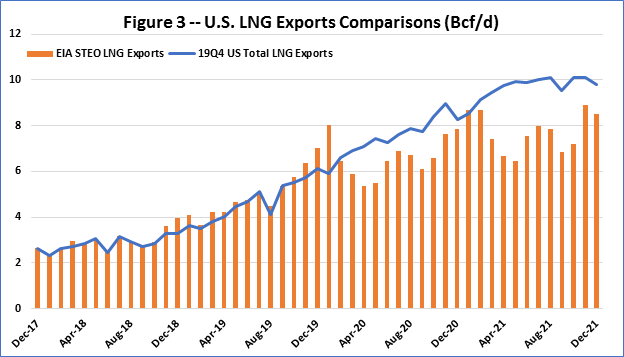

It is becoming more apparent that LNG exports will play a critical role in balancing U.S. supply and demand, especially in the short-term. Recent concerns related to attempted force majeure contract cancellations stemming from the “COVID-19” virus have further pressured already low global gas prices responding to a warmer than normal winter across the globe. This has contributed to the low U.S. price environment — Mar20 futures prices have traded as low as $1.75/MMBtu. The 19Q4base case was developed and released prior to these events, so for now, as Figure 3 shows, it expects increased LNG exports, primarily from the U.S. Gulf Coast, throughout 2020 and 2021.

It is quite possible that the COVID-19 virus will prove 19Q4base’s LNG export forecast to be too aggressive, but therein lies one of GPCM’s unique attributes. It is extremely easy to implement such an assumption and run a series of new scenarios to quickly analyze the impact of “black swan events” or other changes in the market. In a follow up article the RBAC team will be examining the potential impact of COVID-19 on the global supply and demand balance using both the GPCM North American modeling system and the G2M2® Global Gas Market Modeling System™ in an integrated modeling approach.

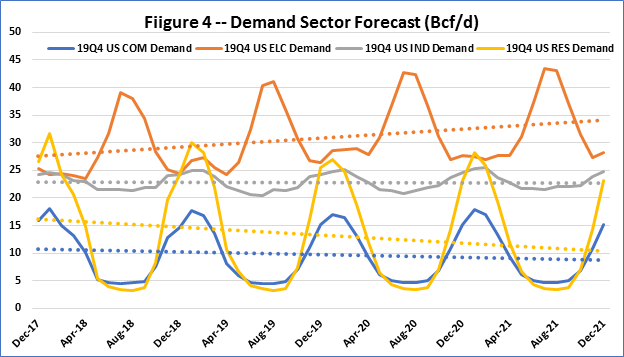

As noted above, the 19Q4base forecast also expects higher electric power generation demand as a direct result of a lower natural gas price environment and continued gas-fired power capacity additions. Electric sector gas demand is forecast to be about 2.5 Bcf/d higher in 2020 than 2019, while the 2021 vs 2020 growth is flat. Of the four primary demand sectors, electric power generation is the only sector to see growth during the short-term forecast.

In our upcoming 20Q1base outlook, we will be incorporating EIA’s 2020 AEO electric power generation gas demand forecast which is even lower than their 2019 AEO – the basis for our 19Q4base. This lower gas demand is attributed to greater renewables market share resulting from lower production cost estimates and increased green policy initiatives. Clearly, this summer will further test the competitiveness of gas-fired power generation in a progressively dynamic environment. This presents another scenario that can quickly and easily be evaluated using GPCM and one that the RBAC team will analyze prior to our 20Q1base outlook – stay tuned for a future article on this scenario.

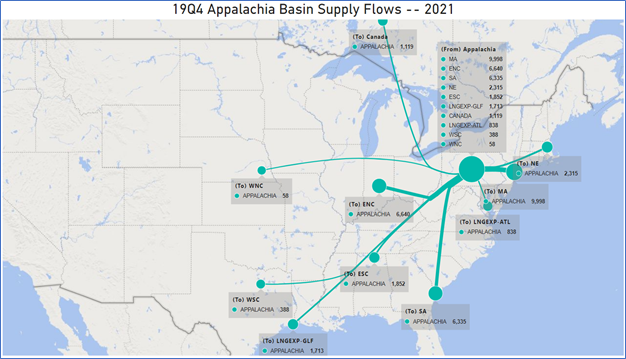

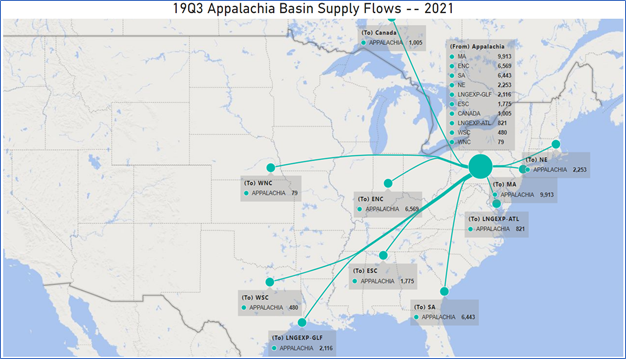

Another important factor to consider are changes in pipeline flow patterns. The outlook from 19Q4base predicts gassier plays experiencing slower production growth in the future. The Appalachia region will likely have less potential to serve growing U.S. Gulf Coast LNG export terminals. Due to their proximity and cost advantages, competition from Permian and Arkla–East Texas basins will result in more Marcellus and Utica gas serving demand markets much closer to home. The following flow maps compare the 19Q4base vs the earlier 19Q3base outlooks for the Appalachia basin in 2021.

Although no one can predict black swan events such as the COVID-19 virus, one can reduce the complexity and uncertainty in the global gas market through good scenario analysis. RBAC’s GPCM modeling system empowers users to quickly perform sensitivity analyses on a wide range of diverse assumptions. Creating scenarios for a variety of potential market environments allows analysts to effectively generate likely impacts on supply, demand, and market prices. The result is better informed trading, risk management, and business decision-making.

RBAC, Inc. is a leader in building market fundamental analysis tools used by the energy industry and related government agencies for over two decades. The GPCM® Natural Gas Market Forecasting System™ is the most widely used natural gas market modeling system in North America. RBAC’s other products include the G2M2® Global Gas Marketing Modeling System™ designed for developing scenarios for the converging global gas markets, Gas4Power®, GPCM Viewpoints® on Natural Gas and the GPCM Power Model Interface (GPCM-PMI™) that integrates RBAC’s natural gas market forecasts with power market models for a more realistic gas and power forecast.