A Contrast in Energy: The Land of the Rising Sun and Ilha Formosa

Japan and Taiwan show some similarity in their energy mix and policies, particularly in their high demand for LNG imports and their efforts toward decarbonization; however, the approach of each toward nuclear power is quite different and this fundamental difference affects their future domestic LNG demand, especially for their electricity sector. Japan is restarting nuclear powerplants to enhance energy security and reduce the dependency on coal-fired energy; on the other hand, Taiwan is using LNG to replace coal while carrying forward in their plans toward a “nuclear-free homeland.”

From G2M2 Visuals, it exhibits that Japan is expected to significantly decrease their LNG demand for electricity sector throughout 2025. Taiwan, on the other hand, will increase their reliance to meet electricity demands.

The difference will significantly influence these two countries’ market position in the coming years.

Taiwan’s LNG Market and Policy

Key Policy Goal: Promote green energy, increase natural gas, reduce coal-fired, achieve nuclear-free

Taiwan’s Anti-Nuke History

Taiwan’s energy mix has traditionally been dominated by coal-fired and nuclear energy. However, anti-nuclear campaigns have been active since the 1980s. The Democratic Progressive Party (DPP), the current ruling party, has been a major advocate of the anti-nuclear movement since 1999 and has set a “nuclear-free homeland” as their energy policy guideline. They came to power after the 2016 election and shut down several nuclear power plants between 2018 and 2023. Opposition parties do not share this vision and the public has been mixed on the issue; 59% of voters rejected a nuclear phase out in a referendum in November 2018; however, voters also rejected in another referendum in 2021, finishing the construction of the No. 4 nuclear power plant.

Taiwan’s Energy Transition

New Government’s attitude and the Potential Obstacle

The new president took office on May 20, 2024. As the ruling party remains the same, they have committed to continuing the energy transition and achieving the planned energy goals. The last nuclear power plant has one unit scheduled to shut down in July 2024, and the entire plant set to close in May 2025. However, the nuclear-free vision may encounter significant obstacles. The opposition parties, KMT and TPP, hold a majority in parliament, and recent multiple power outages have intensified debates over the current energy strategy.

Future LNG Expansion Plan

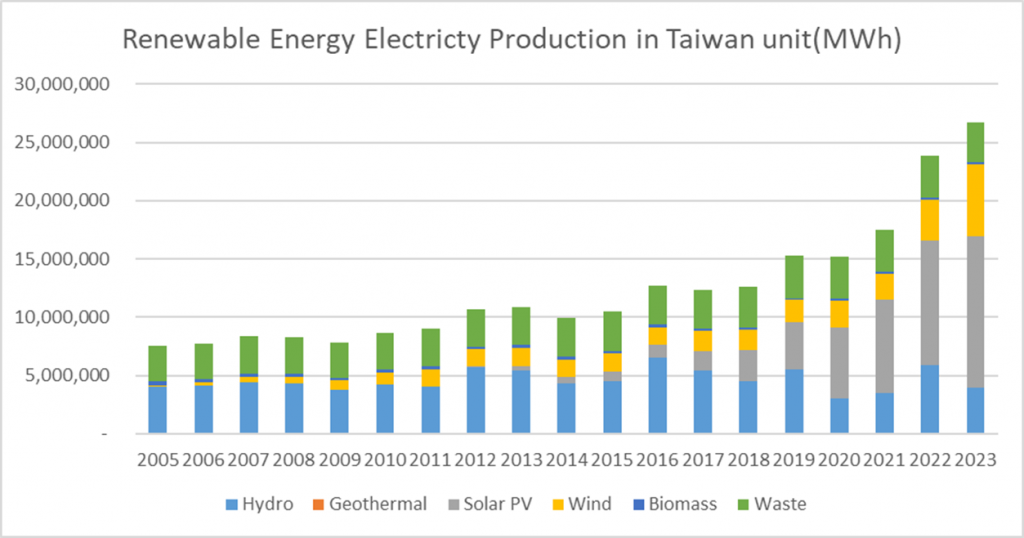

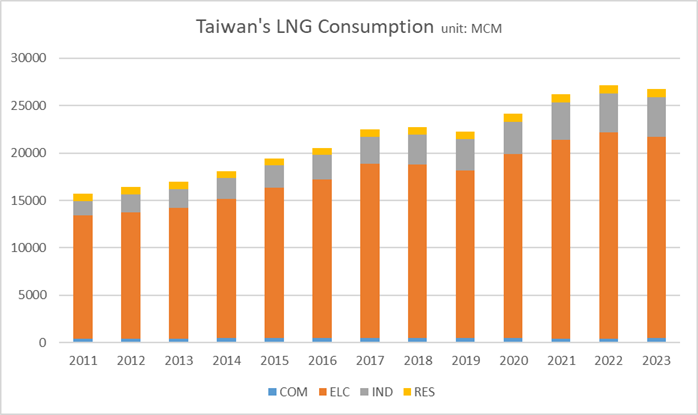

While there might be some impediments to achieving a nuclear-free goal, reducing coal-fired energy and increasing natural gas consumption remain clear policy directions for the Taiwan government. Taiwan imports about 98% of its energy and that includes LNG, making the expansion of regasification terminals crucial as LNG consumption rises. (Figure 2)

The Taiwanese government has initiated the expansion of the Taichung and Yong-An terminal, which are expected to be completed by 2026 and 2027 respectively. In addition, Taoyuan terminal has begun construction and is expected to be completed by the end of 2025. Additionally, four more regasification terminals are currently under discussion or in the environmental impact assessment stage, with the potential to be completed by 2032.

Tai-power also announced the plan to decommission two coal-fired power plant units in 2026 and replace them with gas-fired units. And they further set a future goal to decommission 11 coal-fired power plants in total by the end of 2032.

Summary

Taiwan’s energy policy—”promote green energy, increase natural gas, reduce coal-fired, achieve nuclear-free”—remains unchanged as the new president takes office this May. While achieving a nuclear-free homeland remains uncertain, Taiwan’s LNG demand is expected to grow.

In RBAC’s G2M2 gas outlook, Taiwan’s LNG demand is expected to grow over the next 10 years, particularly in the electricity sector. With G2M2’s new Power BI plugin, users can easily visualize their input data and make comparisons within their selected sectors.

Japan’s Recent Shifts in the LNG market

Japan’s Energy Policy Creates a Declining Domestic Demand for LNG:

In recent years, Japan has witnessed a notable decline in domestic utility demand for LNG. This shift has been primarily driven by significant policy changes in Japan’s energy landscape.

Policy-related Reasons for the decrease in domestic demand:

1. Nuclear Restart:

In 2015, Japan embarked on a journey to restart its nuclear power plants following the March 2011 Fukushima accident. After lifting the restrictions on Kashiwazaki-Kariwa, Japan’s largest nuclear power plant, in Dec 2023, Japan started the fuel process for Unit 6 and 7 (Net power of 1,315 MW each) on 15 April 2024. It is set to start operation this summer. This resurgence in nuclear energy has directly impacted the demand for LNG in the energy mix.

2. Green Transformation:

Japan’s energy policy, as stated in the 2023 Energy White Paper published by Japan’s Ministry of Economy, Trade and Industry, emphasized the commitment to a green transformation. This comprehensive strategy entails restarting additional nuclear power plant units, prioritizing energy efficiency measures, and elevating renewable energy sources as primary contributors to the energy mix. Japan aims to curb the share of natural gas-fired power generation, decreasing use from 34% in 2022 to 20% by 2030. These actions aim to reduce reliance on natural gas and to further their ambitions toward net-zero emissions by 2050.

Japan’s new LNG market position

Reselling LNG Overseas:

Japan’s declining domestic demand for liquefied natural gas (LNG) has prompted a strategic shift by Japan’s large LNG consuming utility companies (JERA, Tokyo Gas, Osaka Gas, and Kansai electric) from consumers to resellers. With long-term LNG procurement contracts (with USA, Australia, Russia, etc.) set to expire in 2030 and an anticipated surplus in inventory for at least the next five years, Japan is exploring opportunities to redistribute excess LNG to Southeast Asian countries, including Indonesia, Vietnam, Singapore, etc.

One can see the beginnings of this with Tokyo Gas partnering with First Gen in Indonesia to operate an LNG terminal, the collaboration between Tokyo Gas and Thai Binh LNG Power (TBLP) to run a floating LNG import terminal for TBLP. This transition carries significant implications for the global LNG market, reshaping supply dynamics and fostering new trade relationships.

Increasing Flexibility in LNG Contracts

The chart represents findings from a survey conducted by the Japan Organization for Metals and Energy Security (JOMEC), illustrating contract quantities with and without destination restrictions. The blue area signifies contracts with destination clauses, while the grey area represents those without such restrictions. As the proportion of contracts with destination clauses declines, Japanese companies will have more flexibility to redistribute surplus inventory in the upcoming years.

Conclusion:

Japan’s strategic shift from being a consumer to a reseller of liquefied natural gas (LNG) reflects its proactive response to declining domestic demand and surplus inventory projections. As major utility companies transition toward reselling surplus LNG, there’s a growing focus on exploring opportunities in global marketing, especially in Southeast Asian markets.

In RBAC’s G2M2 Visuals, it is clear that Japan’s LNG consumption is expected to steadily decline through 2030. Conversely, demand for LNG in Asian countries is projected to increase. This outlook not only indicates an opportunity for Japan to sell its surplus inventory to Southeast Asian nations but also suggests the potential for future partnerships with Northeast Asian countries.

The transition in Japan’s LNG market position will reshape supply dynamics in Japan and foster new trade relationships, with significant implications for the global LNG market.

Report Authored by Chi Wu

RBAC, Inc. is a leader in building market fundamental analysis tools used by the energy industry and related government agencies for over two decades. The G2M2® Global Gas Marketing Modeling System™ is designed for developing scenarios for the converging global gas market. It is a complete system of interrelated models for forecasting natural gas and LNG production, transportation, storage, and deliveries across the global gas markets. For more information visit our website at http://www.rbac.com.

Sources:

Energy Transition in Taiwan – energypedia) (台灣能源轉型事記)

Taiwan: Will Lai Ching-te Phase Out Nuclear Energy? It’s Complicated. (foreignpolicy.com)

Taiwan’s Election Has Big Ramifications for Energy Security – The Diplomat

On the Path to Net-Zero: Will Taiwan Reach Its Goal?

Taiwan’s Pathway to Net-Zero Emissions in 2050

Energy Transition Promotion Scheme

國民黨、民眾黨喊核電占比至少10%~25%,經濟部:需建核五、核六甚至更多

Bechtel starts construction on Taiwan’s largest LNG storage tanks

CPC begins Taichung Phase III LNG terminal expansion

International – U.S. Energy Information Administration (EIA)