Over the past two years, the oil and gas industry has seen record profit for producers, geopolitical conflicts, supply chain disruptions, inflationary and ESG pressures and a war to boot. A quote from A Tale of Two Cities comes to mind, and sums up quite nicely our recent circumstances:

“It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity…”

Charles Dickens, A Tale of Two Cities

Over 150 years have passed since Dickens penned those lines and yet those words are as fitting now as they were then.

There are strange dichotomies everywhere, it seems like the world is going to heck in a handbasket, just as it seemed to Dickens during the French Revolution.

Last year Henry Hub highs spent the summer months well above $7/MMBtu as Europe raced to refill storage, yet this year Henry Hub has been decimated and is currently flirting with $2/MMBtu. Investment in fossil fuels has dropped off with Net-Zero Transition Policy and investor requirements for heightened capital discipline.

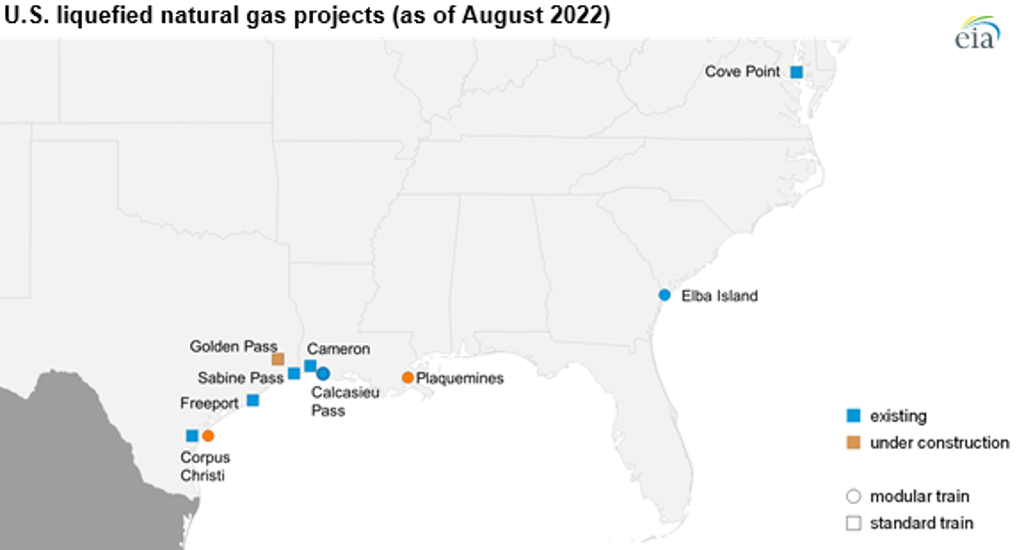

Demand, however, has not fallen, exports have ramped up to record highs as Freeport has come back online. Inflation appears to have been somewhat tamed as the FED has been increasing rates at record pace, but volatility and the potential for higher prices for both oil and gas may create future headaches for the FED. Energy maybe excluded from the “core” rate, but it’s certainly included in daily personal and business life.

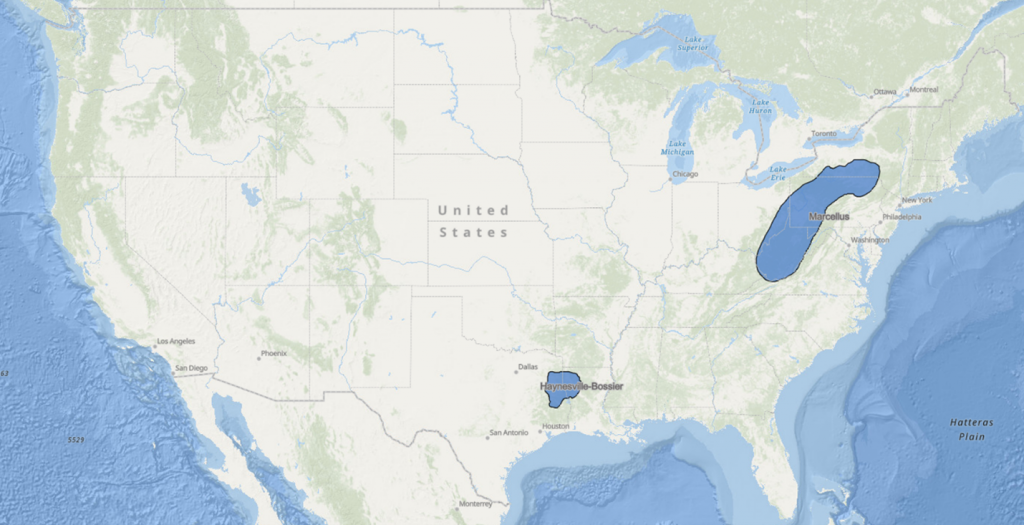

And thus, we come to our tale of two shales: Haynesville-Bossier and Marcellus. And the dichotomy could not be more stark.

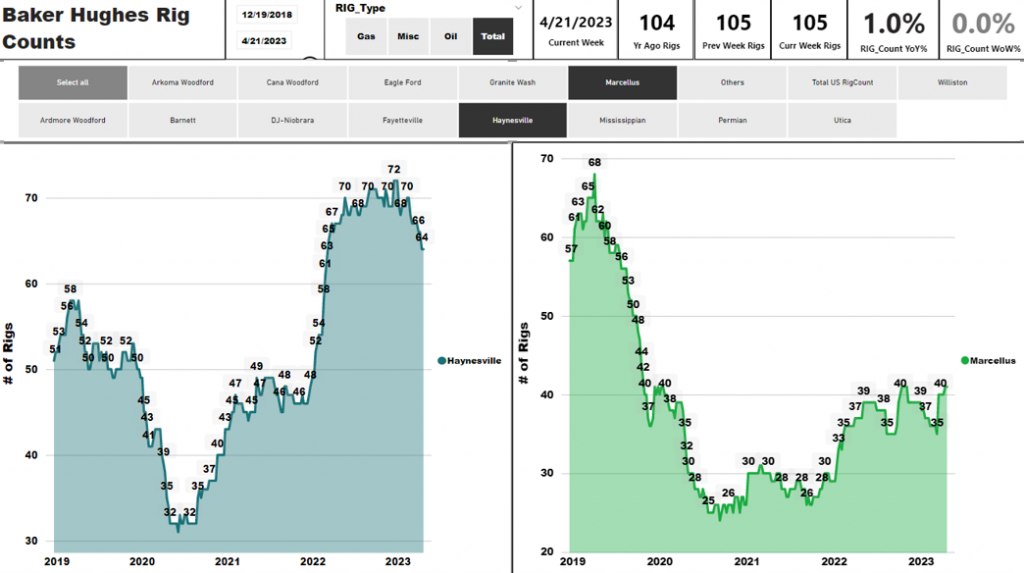

On the one hand, both have been vital to the growth of the North American Natural Gas Industry, but on the other, the outlooks for each couldn’t be more different. Both have seen an uptick in activity post COVID-19; however, Haynesville Shale production is poised to continue growing leaps and bounds as a slew of new LNG Export projects reach completion in 2024 and more planned to be online before 2030. Meanwhile the Marcellus sits, underutilized, in a sort of regulatory constraint purgatory.

At first glance this seems nonsensical, the Marcellus Shale is massive in comparison the Haynesville, and much closer to historical consuming regions in the northeast United States. However, upon closer review this proximity is a blessing and a curse. While it allows Marcellus production to reach consumers with less transportation costs, it is bottlenecked by regulation. Building a pipeline in the region is difficult if not impossible, as Equitrans Midstream is finding much to their chagrin (i.e., their Mountain Valley Pipeline project), and as Dominion previously experienced in their now scuttled Atlantic Coast Pipeline project. By no means is the Marcellus resource base potential being questioned here. The binding constraints are a direct function of the political and regulatory atmosphere. Unless and until there is a regime change, Marcellus’ future looks encumbered.

Haynesville’s regulatory environment is at the complete opposite end of the spectrum, where projects are not only accepted, but encouraged, and Haynesville has its own fast developing consuming region: Gulf LNG Exports.

Uniquely suited to provide natural gas feedstock to Gulf LNG export projects at rock bottom transportation costs, the activity in the Haynesville has been running gang busters. Already well above pre-pandemic levels, this shale has been on the front lines, providing natural gas to our allies around the world.

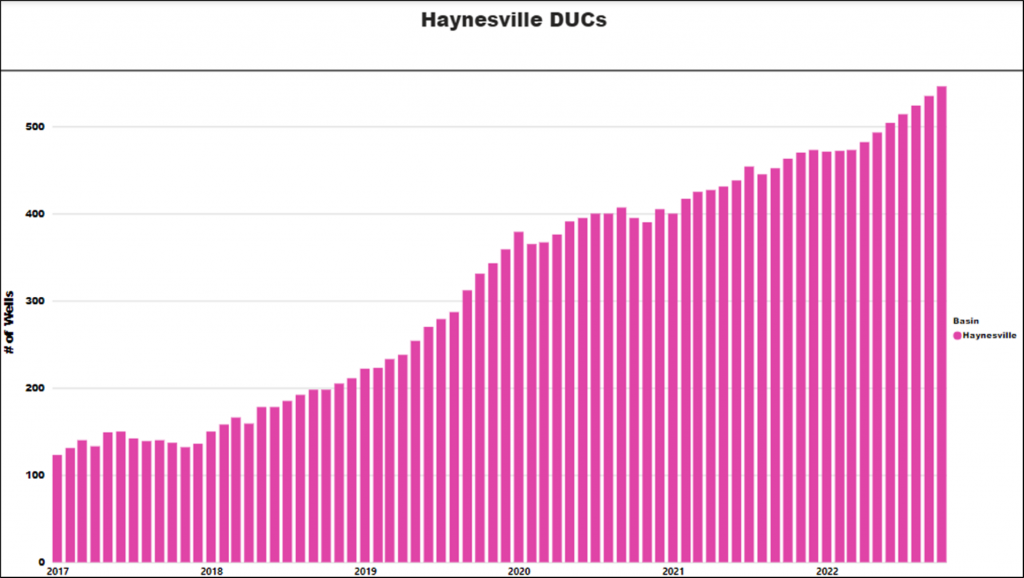

This is only the beginning. Golden Pass LNG and Plaquemines LNG both have an expected in-service date of 2024 and are expected to be filled with Haynesville Gas. Representing an incremental 5 Bcf/d of export capacity, nearly a 30% increase from current levels. Associated with this high rig count in the Haynesville is a steadily increasing DUC count. An acronym for drilled but uncompleted wells, this number is an indicator of the future ability to bring on additional supply quickly. For instance, if several large LNG Exports facilities were to come into service…

It is also worth noting the Haynesville Shale is also very close to Erath Louisiana, the home of Henry Hub, giving its activity an outsized impact on pricing in the United States. And directly influencing the spread global LNG buyers can realize when taking gas abroad.

What remains to be seen is how producers’ sharpened focus on shareholder returns and capital discipline play out in a much lower gas price environment. Should DUC accumulations continue and rig utilization drop, Supply/Demand balances could tighten rapidly. One must not forget that associated gas is also a major contributor to supply and thus liquids prices (crude oil and NGLs) are a key to how this production category responds. The Permian basin is the workhorse on this front and its supply growth over the last year, coupled with Mother Nature’s desire to be warm this past winter, helped perpetuate the last 6 months’ dramatic gas price decline. Maybe this should be more appropriately entitled “A Tale of Three Basins”.

As far as gas centric shales are concerned, the Marcellus Shale will continue to play a vital role in our country’s energy future, but it will be Haynesville who shines brightest in the next few years. An outcome that seemed inconceivable a few years ago.

RBAC, Inc. has been the leading provider of market fundamental analysis tools used by the energy industry and related government agencies for over two decades. The GPCM® Market Simulator for North American Gas and LNG™ is the most widely used natural gas market modeling system in North America. RBAC’s G2M2® Market Simulator for Global Gas and LNG™ has been instrumental in understanding evolving global gas and LNG dynamics and is vital in fully understanding the interrelationship between the North American and global gas markets.