History of Venezuela Energy

South America is home to vast resources of oil and gas with Venezuela being particularly notable as it possesses the largest proven oil reserves and is top ten in proven natural gas reserves in the world. However, these reserves have yet to reach their full potential due to a myriad of factors such as infrastructure bottlenecks, sanctions, reliability issues with electrical grid, and a struggling economy.

How did Venezuela’s energy industry reach this point and what could the future hold for one of the most important producers in the world?

Venezuela’s oil industry began in the early 20th century with the first wells being drilled in 1912 and in just 2 decades oil become its largest economic sector. Additionally, it also became the second largest oil producer and largest oil exporter globally. Notably, Venezuela is a key member of OPEC and was one of the founding member nations alongside Iran, Iraq, Kuwait, and Saudi Arabia. These countries as members of OPEC work to, “Ensure the stabilization of oil markets in order to secure an efficient, economic and regular supply of petroleum to consumers, a steady income to producers and a fair return on capital for those investing in the petroleum industry.”

Oil

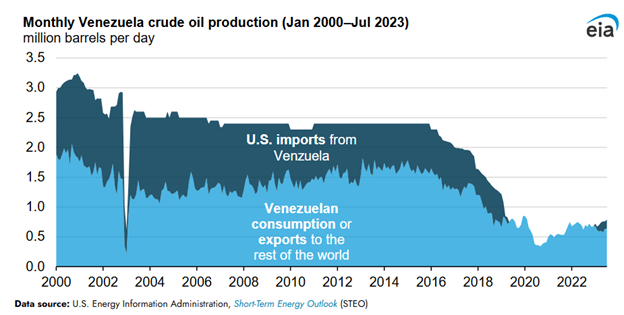

Despite the estimated oil reserves being equivalent to 300 billion barrels, Venezuela’s domestic production is now under 1 million barrels per day which has seen sharp declines over the last decade. This decline has been attributed to a multitude of reasons including nationalization of the industry, lack of key infrastructure, sanctions, and the economic crisis that has been ongoing since 2010.

Another key reason that makes production difficulty is because the oil itself is what is known as heavy crude oil which makes production more difficult. To extract heavy crude oil extra considerations and infrastructure investment needs to be made:

- Specialized drilling equipment

- Upgraders to turn thick crude into exportable oil

- Constant maintenance to keep wells from clogging

- Special chemicals (often imported) to thin the oil so it can flow

Venezuela has the reserves, but not the robust infrastructure to facilitate more production. Gone are the days of Venezuela’s oil peaks with key infrastructure such as pipelines and refineries in such bad conditions that it is estimated that $8 billion USD would be needed just to return to the production levels of the late-1990s. For example, the Paraguaná refinery complex which is the second largest crude oil refinery in the world is only operating at 10% of its capacity.

Natural Gas

Alongside oil, Venezuela also has tremendous reserves of natural gas but is not able to fully utilize it. The natural gas is primarily associated gas with 80% of it being produced as a by-product of oil drilling. It is reinjected into old fields in attempt to increase production, but with the aforementioned decline in oil production gas production has suffered as well.

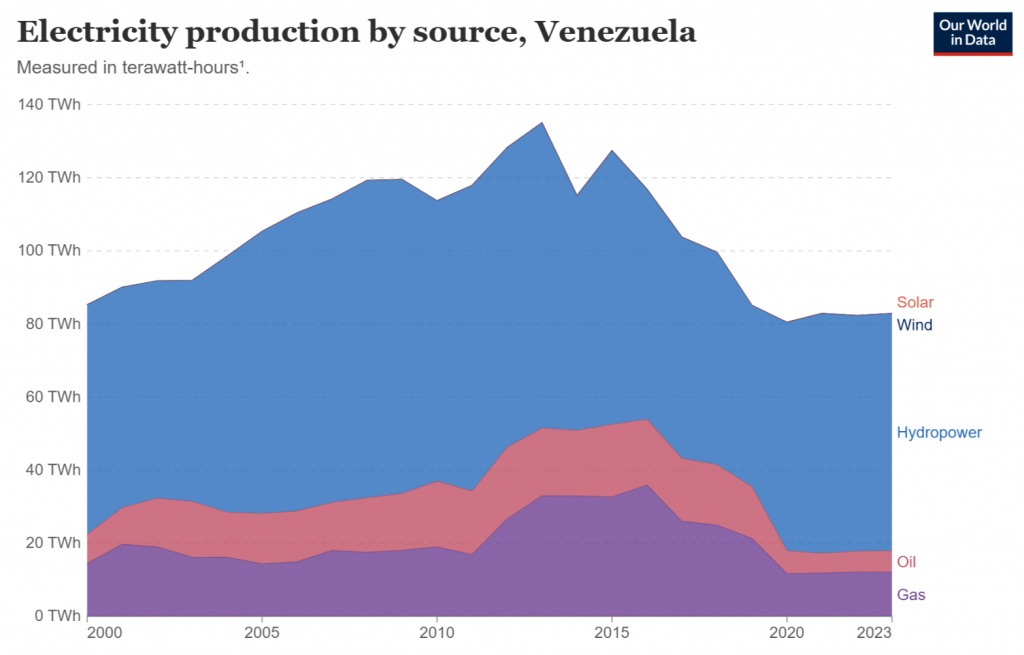

There is an estimated 195 tcf of gas reserves in Venezuela which makes up 73% of total reserves in South America. Similarly to oil, Venezuela lacks natural gas infrastructure, particularly for reinjection into oil fields, for natural gas storage and distribution, and for residential supply. Because there is no way to utilize the gas outside of the oil industry, excess gas is mostly flared as it cannot be used for electricity production.

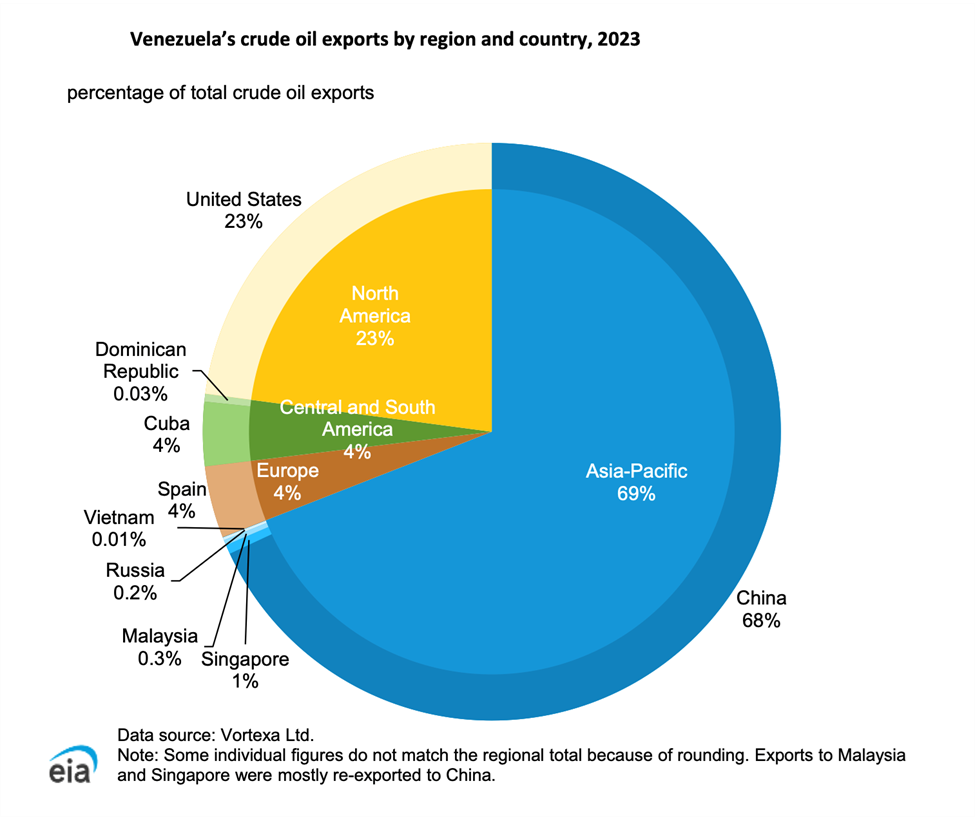

Exports

Venezuela has both the oil and gas reserves to become a major player in the global market, and for oil it has historically been an exporter.

But for natural gas, Venezuela does not import or export, and with the gas being primarily utilized to support the oil industry and some power generation the potential for exports is there. The currently existing Trans-Caribbean pipeline was originally intended for Colombia to export gas to Venezuela until 2011 which then flow would be reversed, however this never came to fruition, and the pipeline has not been in use at all for the past decade.

Venezuela has attempted to build new infrastructure for exports before such as pipelines to deliver gas to neighboring countries as well as LNG export terminals.

The LNG projects include the Cristobal Colon Project that was proposed in 2000 and its capacity would have been 4.0 mtpa and the Sycar FLNG terminal. This terminal was a floating liquefied gas terminal that was proposed in 2022, while it has not been outright cancelled it has been shelved for the foreseeable future due to concerns regarding sanctions by the United States.

Another project that is currently still in-progress unlike the other two is a proposed offshore pipeline connecting Venezuela’s Dragon gas field with Trinidad and Tobago’s offshore Hibiscus platform. This project has been in the works since its initial proposal in 2018 and would be able to move 350 mcf/d of natural gas when completed. Shell, who is one of the stakeholders of the project, anticipates beginning natural gas production at the Dragon field and exporting that gas to Trinidad and Tobago sometime in 2026.

There was another proposed pipeline in the mid 2000’s that would have connected Venezuela, Brazil, and Argentina known as the Gran Gasoducto del Sur. However, this pipeline never made it past the early planning stages and would have taken between $17 to 23 billion dollars and decades before it would be in operation.

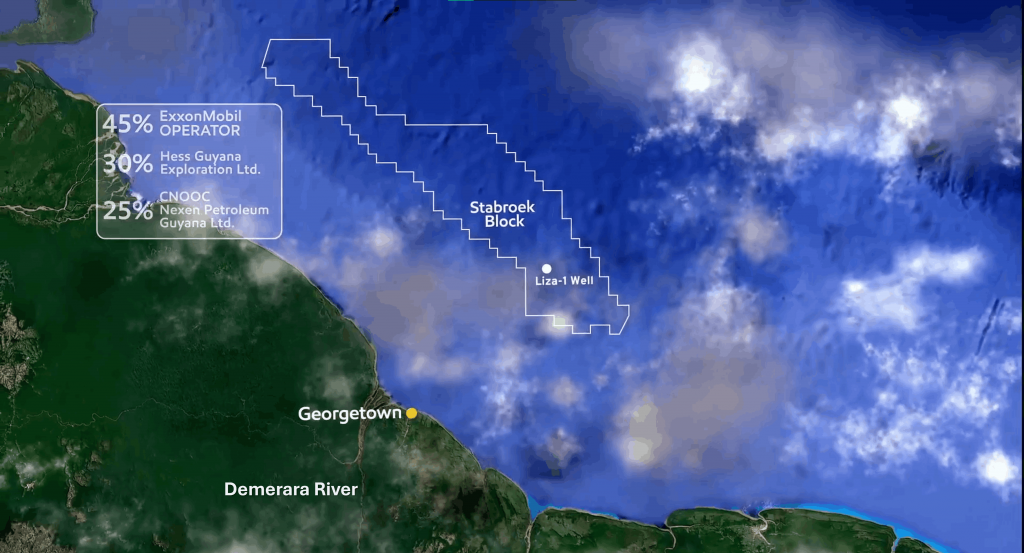

Disputes with Guyana

Venezuela and Guyana have had territorial disputes going back centuries and within the past few years, tensions between the two countries are higher than ever over the Essequibo region. This is due to significant amounts of oil that were discovered off the coast of this region in the 2010s.

While Guyana’s hydrocarbon story has been propelled by world‑class oil finds, the country also holds a sizable ~17 trillion cubic feet (tcf) of natural gas resources, concentrated largely in the eastern portion of the offshore Stabroek Block, near the maritime border with Suriname, which is outside areas disputed by Venezuela in the south east.

By contrast, the discoveries to the west, nearer the Venezuelan‑claimed Essequibo area, are mainly oil discoveries, (some political analysts attribute the heightened territorial tensions to these oil finds beginning in 2015), with subsequent developments across Stabroek; while these oil projects do produce associated gas, Guyana is primarily re‑injecting or using it as fuel.

Foreign investment

After the capture of Nicolás Maduro, uncertainty now surrounds the future of Venezuela. United States President Donald Trump has stated that the U.S. will take over temporary control of its oil industry which includes the sale of between 30 and 50 million barrels to the U.S . The funds generated from this sale will be put towards new infrastructure within Venezuela’s energy industry. “As part of the significant modernization, expansion, and upgrading required, the U.S. will authorize the import of select oil field equipment, parts, and services to immediately offset decades of production decline and drive near-term growth. This will involve technology, expertise, and investment from American and other international energy partners.”

Assuming these lofty goals are actually attained, it could revitalize the economy of Venezuela that has been struggling due to lessened domestic oil production. This would also in turn bring its natural gas more into play, which is almost entirely associated gas. With new oil production would bring new gas into supply, and potential influence from the U.S. could result into new infrastructure such as natural gas pipelines and LNG export terminals. It could also result in new progress on already existing projects such as the pipeline connection to Trinidad and Tobago as well as a potential restart of the Trans-Caribbean pipeline which talks of had already been underway.

Venezuela’s future is in flux and it will be a long road rebuilding the economy. Oil and natural gas are undoubtedly going to be key components towards accomplishing this goal. The next major step will be upgrading the LNG import and domestic production capabilities within the country. This will be a massive multi-year undertaking by Venezuela, requiring billions of dollars in investments. Companies looking to invest in Venezuela’s domestic infrastructure would be able to see the return on investment and the risks associated with individual projects. Market simulation tools such as the G2M2® Market Simulator for Global Gas and LNG™ can be used to see where demand-supply gaps exist, assess seasonal and peak-load vulnerabilities, and impact of new LNG terminals, storage, and pipelines.

Interested in learning more about G2M2? Contact us here for more information and to schedule a free demonstration.

RBAC is the market-leading supplier of global and regional gas and LNG market simulation systems used by the energy industry and related government agencies for over two decades. The GPCM® Market Simulator for North American Gas and LNG™ is the most widely used natural gas market simulation system in North America. RBAC’s G2M2® Market Simulator for Global Gas and LNG™ has been instrumental in understanding evolving global gas and LNG market dynamics and is vital to fully grasp and leverage the interrelationship between the North American and global gas markets.