Amidst a global energy crisis, geopolitical events like Russia’s invasion of Ukraine highlight more than ever the need for energy security. Security from undersupply and from price disruption at the fuel pump and in consumer utility bills. Is such security possible while at the same time achieving global climate goals? Producing cheap, environmentally friendly energy should be a goal every American can get on board with and one that would benefit everyone. But how can we do it?

In EQT’s report, “Unleashing U.S. LNG,” Toby Rice stated “Our goal has been to present a climate-centric argument for leveraging U.S. natural gas to replace international coal, as we believe this to be one of most important initiatives available to the world in addressing climate change.”

To bring that about, it will require both the private and public sectors working together to achieve energy security and address climate change in one fell swoop. Sending more US-produced natural gas abroad to developing countries, lowering fuel costs, and reducing the use of coal, kerosene, and wood and other carbon intensive sources.

Last month, FERC issued an updated policy statement on the certification of new interstate natural gas facilities. While politically driven, it was a long time coming, the previous policy statement having been issued in 1999. The update emphasized the need for more than precedent agreements when applying for certification, and FERC may consider other evidence of need such as demand projections, estimated capacity utilization rates, and potential cost savings to customers. Effectively saying that developers will need robust, well-defended reasons for additional infrastructure.

This new policy highlights the need for flexible, transparent data-driven research and analysis, the type of which, dynamic market simulation software can provide. Performing this analysis in the pre-approval stage of the project can answer such questions as:

- How is demand projected to change as a result of this project?

- How much of this pipeline is expected to be utilized?

- What cost savings could this project bring to customers?

Exactly the evidence needed that FERC may consider. Having market simulation software allows you to do your due diligence and not rely solely on precedent agreements. Which, in turn, streamlines the approval process, minimizes the risk of construction delays, and gets your project in service sooner.

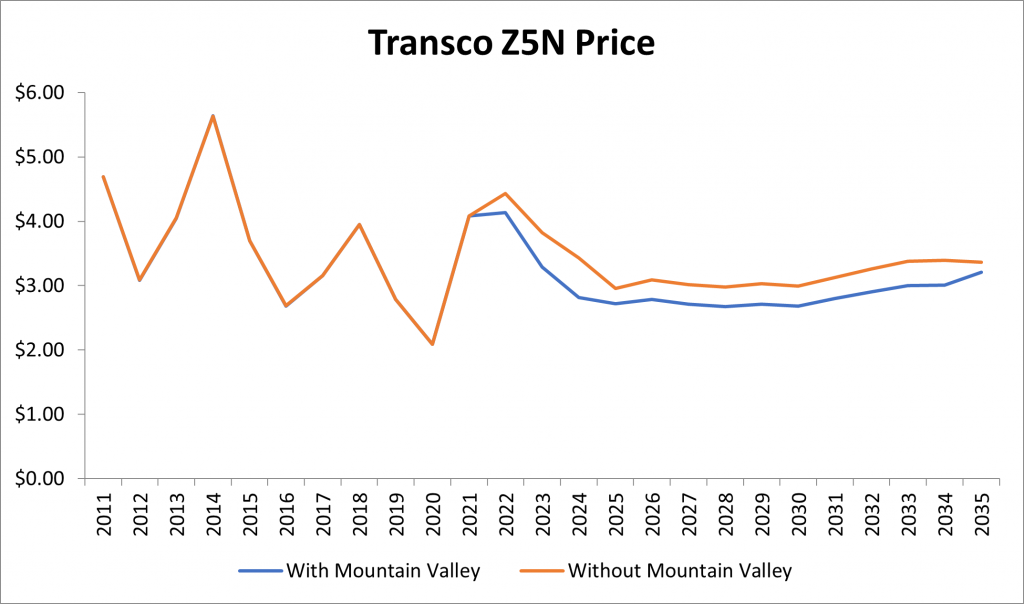

Using RBAC’s GPCM Market Simulator for North American Gas and LNG, we were able to run a base scenario with and without the Mountain Valley Pipeline. The results showed a noticeable drop in the price outlook in Transco zone 5, directly benefitting customers in that market. See chart below.

Transco Zone 5 Price

But what does greater visibility in FERC policy have to do with global energy security and climate change?

Timely approval of domestic pipeline and LNG projects means cost savings to consumers in non-producing regions, whether in the United States or around the globe.

However, it will require a significant investment in additional infrastructure and a supportive regulatory environment to meet those requirements.

By providing the proper and thorough analysis in the pre-approval stages, one could streamline the FERC approval process for new gas and LNG infrastructure. This will ultimately help bring about the necessary energy source changes (coal to gas) that will achieve the environmental goals and future cost reductions. The U.S. has been a stellar example of this greener shift, the unique and significant emissions reductions that result and lower consumer costs. All while reducing dependence on foreign energy supplies.

Stay tuned for a more detailed look at the RBAC’s analysis of EQT’s “Unleashing U.S. LNG” report.