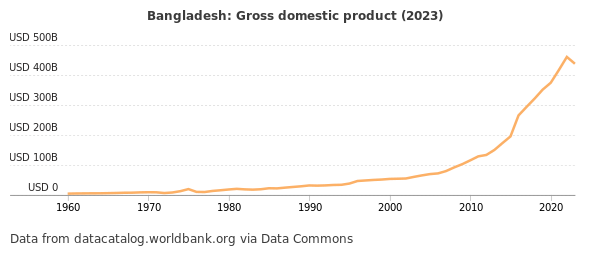

Bangladesh, with the world’s 8th largest population and a consistent GDP growth rate of above 5% over the last three decades, was experiencing a severe energy crisis in 2023 that brought a large portion of the nation’s power capacity offline and forced power cuts for over 100 days. The government made several moves to bring things back online which included expanding LNG imports and revitalizing domestic gas production. Have things taken a turn for the better in the two years since?

Bangladesh’s LNG Imports and Infrastructure

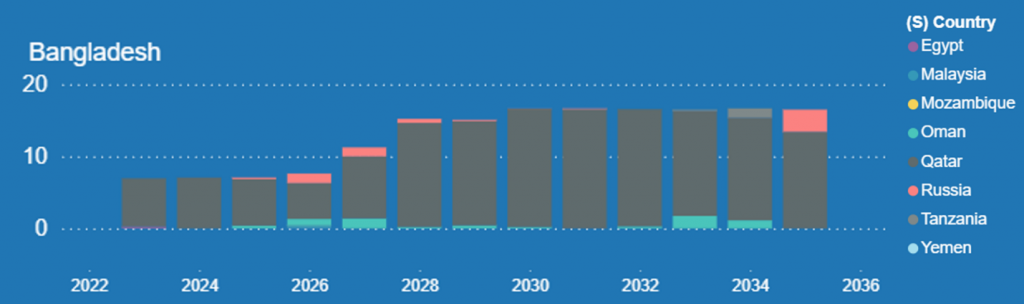

Amidst declining production from domestic fields, Bangladesh turned to signing new long-term LNG contracts to meet demand.

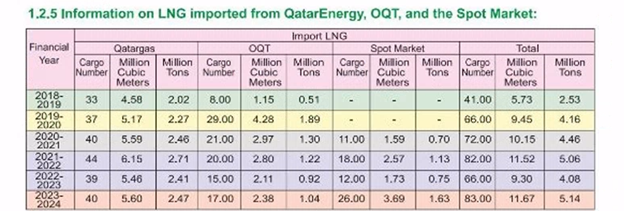

In mid-2023, a 10-year deal with Oman Trading International and a 15-year deal with QatarEnergy and Excelerate Energy were signed. The new 15-year deal with Qatar is in addition to the already existing 15-year LNG Sale and Purchase Agreement (SPA) which was signed in 2015.

Qatar and Bangladesh also are going to renew a Memorandum of Understanding (MoU) that recently expired in January of 2025. Qatar’s Minister of State for Energy Affairs, Saad bin Sherida Al Kaabi stated, “We want to support Bangladesh as much as possible, and we will continue doing that.” Bangladesh has long been an importer of LNG from Qatar receiving 40 LNG cargoes annually.

Bangladesh’s adviser for the Ministry of Power, Energy, and Mineral Resources has also noted that there are currently, “plans to build a land-based LNG terminal and pipeline in Matarbari [port near the border of Myanmar] to boost energy infrastructure, aiming to handle up to 115 cargoes a year.”

Outside of Qatar and Oman, Bangladesh has also turned to the United States, and in particular to Argent LNG which plans to build an LNG export facility in Louisiana’s Port of Fourchon. This project would have an initial capacity of 12 million metric tonnes per year (mtpa) with a future expansion of four additional trains totaling 25 mtpa. A Heads of Agreement (HoA) has been signed; however, unlike the prior agreements, this LNG supply is contingent on the facility actually being constructed and coming online which is not expected till around 2030. More information about this upcoming project will be revealed at Gastech 2025 in Milan.

In the meantime, Bangladesh will continue to rely on the spot market to make ends meet and has sent out a bid request for three cargoes to be delivered in August to meet surging demand.

Reviving Domestic Production?

Currently, Bangladesh is heavily reliant on gas imports, but it is to the tune of a half billion dollars each year. Government subsidies are also costly and getting them right is a balancing act which may help so long as they’re temporary, well-targeted, linked to performance or innovation and accompanied by structural reforms to improve competitiveness.

Both gas and power are subsidized with the Bangladesh Power Development Board stating, “At present, the bulk tariff at which BPDB sells electricity to distribution companies, and the latter to final consumers, is lower than the supply cost of electricity. The gap between the supply cost and the tariff entails a subsidy that is directly transferred from the government to the BPDB. This transfer to the BPDB was US$800 million in 2012, equivalent to 0.6% of the country’s GDP”.

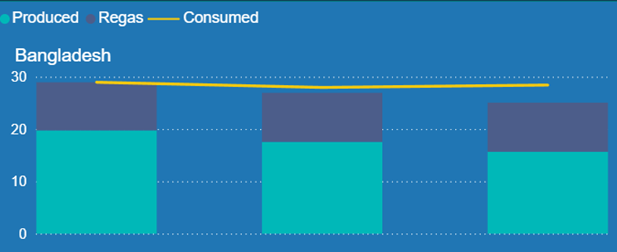

Domestic production and LNG imports are currently combining for 25.05 bcm which is below the demand of 28.42 bcm. Because of this, gas continues to be rationed and flows to power plants, industrial customers, and other consumers are being heavily managed to avoid disruptions to supply which could potentially cripple the country’s power and economy.

At the end of 2024, gas production had fallen to the lowest in 10 years at 19.72 bcm. Bangladesh hopes to revive domestic production and lessen the dependence on imports, and plans to do this have already been set in motion.

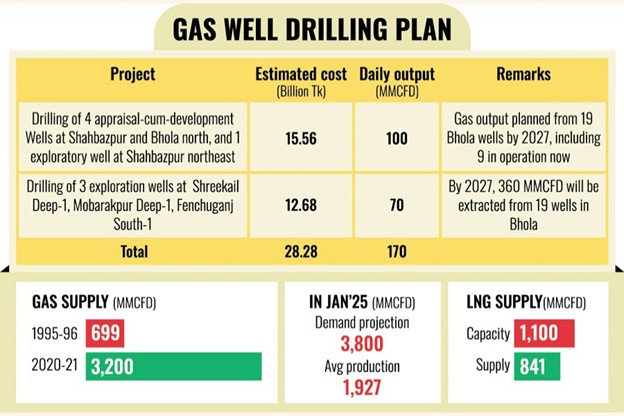

New gas wells are set to be drilled, and these wells are estimated to add a combined 170 mmcfd (an increase of domestic production by ~9% compared to 2024 levels equal to 1.76 bcm per year) of natural gas by 2028.

Bangladesh is also going to be exploring the potential of their offshore reserves as well. “Bangladesh’s interim government, through Petrobangla, has announced plans to invite international tenders for offshore gas exploration on 9 December and for onshore reserves in March of the following year.”

Additionally, 31 wells currently operating are set to receive infrastructure updates to increase the amount of gas produced.

Economic Uncertainty

Bangladesh has high hopes that its domestic natural gas industry can be revived, however what will be the cost of all of these developments? Aside from power related crises, Bangladesh is also in the midst of economic distress. GDP growth is slowing, the currency strength is waning, and debt continues to rise.

Currently, Bangladesh allows private investments in power generation and natural gas exploration but does not permit full foreign ownership in petroleum marketing and gas distribution. Oil and gas supermajor, Chevron, has had a longstanding partnership with Bangladesh and has committed to assist in the exploration and development of future natural gas projects.

Bangladesh has also cleared out most of the debts incurred from previous LNG import contracts and purchases from the spot market. Several companies assisting Bangladesh through providing LNG such as Qatar Energy, Vitol Asia, OQT, Excelerate LP, Gunvor Singapore, and others.

In total, $665 million had been brought down to just $10 million, a major step in solving their energy crisis. The money that was being allocated towards paying off debts can be now put towards improving energy infrastructure.

The next major step will be upgrading the LNG import and domestic production capabilities within the country. This will be a massive multi-year undertaking by Bangladesh, requiring billions of dollars in investments. Companies looking to invest in Bangladesh’s domestic infrastructure would be able to see the return on investment and the risks associated with individual projects. G2M2 can also be used to see where demand-supply gaps exist, assess seasonal and peak-load vulnerabilities, and impact of new LNG terminals, storage, or pipelines.

Interested in learning more about G2M2? Contact us here for more information and to schedule a free demonstration.

RBAC is the market-leading supplier of global and regional gas and LNG market simulation systems used by the energy industry and related government agencies for over two decades. The GPCM® Market Simulator for North American Gas and LNG™ is the most widely used natural gas market simulation system in North America. RBAC’s G2M2® Market Simulator for Global Gas and LNG™ has been instrumental in understanding evolving global gas and LNG market dynamics and is vital to fully grasp and leverage the interrelationship between the North American and global gas markets.

References:

[1] https://rbac.com/bangladeshs-worst-power-crisis-in-a-decade/

[2] https://www.thedailystar.net/business/news/qatar-renew-lng-supply-deal-bangladesh-3878051

[3] https://www.offshore-energy.biz/bangladesh-books-lng-from-future-export-terminal-in-louisiana/

[4] https://argentlng.com/pages/sectors

[5] https://www.lngindustry.com/liquefaction/07072025/argent-lng-to-unveil-lng-project-at-gastech-2025/

[9] https://today.thefinancialexpress.com.bd/last-page/eight-new-gas-wells-to-be-drilled-1752430072

[10]

https://www.offshore-technology.com/news/bangladesh-offshore-gas-tenders/?cf-view

[11]

https://en.prothomalo.com/bangladesh/3v2drhbzeb

[13] https://www.state.gov/reports/2024-investment-climate-statements/bangladesh/