The Demand for Adaptation

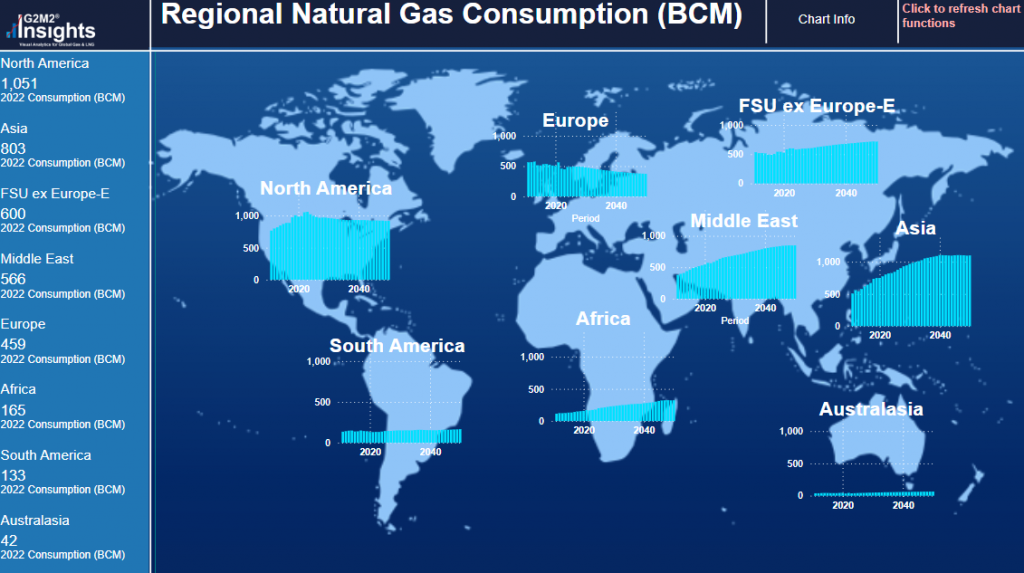

The global gas and LNG markets continue to adapt to the shifting winds of economic, environmental, and technological innovations, programs and policies. Through the hard work of RBAC’s global analysis team in compiling the latest changes in the industry, the latest 24Q1 database for the G2M2® Market Simulator for Global Gas and LNG has just been released.

What trends are we seeing in the global market?

Continue on for an in-depth analysis of prevailing market trends, highlighted by the robust growth in LNG demand, strategic adjustments in the European market, an increasing shift towards renewable energy integration, and widespread infrastructure and capacity expansions.

Surging Asian Demand Showing Resilience

Despite facing a variety of challenges, global LNG demand persists in its growth trajectory, notably propelled by burgeoning demand in the Asia Pacific region. China and India spearheaded a collective demand surge, with a significant uptick in gas consumption, specifically noted with a 10% increase in China year-over-year. The continued expansion in this area has led to a 2% year-on-year increase in global LNG trade in 2023, marking the most subdued growth rate since 2014, apart from the contraction witnessed in 2020.

Returning to a New Normal for Europe

Europe’s shift towards more sustainable energy sources and the high levels of gas storage are influencing LNG prices and trade flows. The EU’s gas storage was exceptionally high at the end of the winter season of 2023/2024, expected to exert downward pressure on prices.

New Infrastructure and New Partnerships

There is a notable upsurge in LNG infrastructure development and capacity expansion across various regions, aimed at securing energy supply and enhancing market positioning. There’s a noticeable shift as new players enter the LNG market, with emerging economies in Asia and Africa beginning to play more significant roles. This diversification is altering demand dynamics and could lead to changes in pricing and contract structuring. These developments are crucial in supporting sustained demand and facilitating the efficient distribution of LNG on a global scale.

Shifting Role of Natural Gas Under Energy Transition

As we approach the 2030 targets for decarbonization, it is increasingly evident that achieving these goals may face significant challenges. The enduring role of natural gas as a transitional fuel is highlighted by its robust demand, particularly as renewable energy integration and decarbonization technologies develop. Natural gas continues to support the global energy mix, providing a reliable and relatively cleaner alternative (compared with coal and fuel oil) during this transformative period. The momentum for natural gas is not just maintained but is gaining traction, as it plays a critical role in balancing energy security with environmental sustainability. This dynamic is crucial in regions and sectors where renewable solutions are not yet viable, reinforcing the importance of natural gas in the medium-term energy landscape. As such, natural gas remains a key component of global energy strategies, ensuring stability and flexibility in meeting the world’s evolving energy needs.

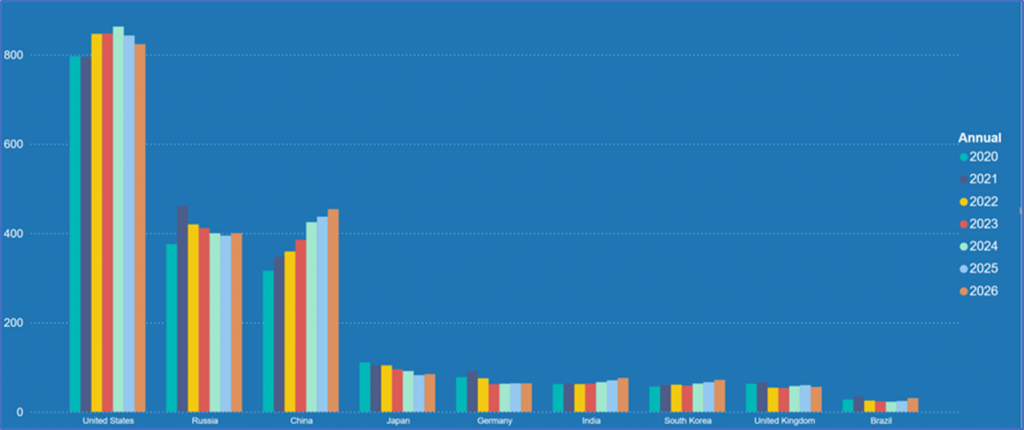

China

China’s gas demand is set to continue its strong growth trajectory, driven by government policies aimed at air quality improvement and energy security. The increased adoption of gas in power generation, industrial sectors, and residential heating is expected to keep demand robust. 2023 had a lull season for lower growth in Q2 and Q3, while the Chinese market rose with solid growth in the 2023 winter season. 24Q1Base highlights a significant year-on-year growth in gas consumption, expecting continued expansion as the country transitions more of its energy mix from coal to gas, reaching over 425 BCM in 2024 and 437 BCM in 2025, with no sign of slowing down.

India

India’s demand for natural gas is expected to surge as the country focuses on diversifying its energy resources and reducing pollution. The expansion of city gas distribution networks and the growth of the industrial sector, including fertilizers and chemicals, are pivotal drivers. 24Q1Base anticipates a substantial increase in another incremental 7 BCM demand in by 2025, compared to the 2023 level, and a rising LNG import to meet the rising demand, especially given India’s limited domestic gas production.

Japan

In Japan, natural gas demand is largely influenced by the country’s energy policy shift following the Fukushima nuclear incident. Japan’s increasing investment in renewable energy and energy efficiency and strong commitment for decarbonization, like at G7 summit, will lead to a continuous decline in gas demand towards 2025, going below 85 BCM.

Germany

Germany’s gas demand in the short term is complex, influenced by the phase-out of nuclear and coal plants and the increasing penetration of renewables. However, natural gas plays a crucial role in ensuring energy security and complementing renewable energy sources, particularly in power generation and heating. The recent geopolitical tensions and energy policy adjustments are likely to keep demand slightly fluctuating but fundamentally strong as Germany seeks reliable energy supplies.

United Kingdom

The UK’s natural gas demand is expected to decrease marginally as the country advances its ambitious decarbonization goals. The increase in renewable energy capacity, energy efficiency measures, and the heat sector’s gradual transition towards electrification are contributing to this decline. Nevertheless, natural gas will continue to be an essential part of the UK’s energy mix in the short term, particularly for providing flexibility and backup for the renewable-heavy power grid.

In summary

The global LNG market is currently undergoing unprecedented change. Asia, with China and India at the lead, continues to exhibit steady growth and resilience, bolstering the worldwide demand for natural gas. Conversely, Europe’s energy transition focus and elevated gas storage have started to influence the global market. Elsewhere, the introduction of new infrastructural projects and alliances, especially in Asia and Africa, is also set to alter trade patterns and possibly even market structures. In the midst of this uncertainty and an ongoing energy transition, the importance of natural gas as a key transitional energy source is becoming increasingly apparent, ensuring energy reliability while addressing environmental concerns. The work is indeed cutout for countries striving to meet decarbonization benchmarks set for 2030.

Looking at short-term trends, Asia’s demand remains robust, with China and India driving this persistence, whereas Japan, Germany, and the UK are each attempting to meet real challenges in their distinct energy strategies and transition commitments.

In both cases, the strategic importance of natural gas within this global energy dynamic has been resoundingly affirmed. With RBAC’s G2M2 market simulator, ensuring a solid and sound strategy of your own will be too.

RBAC, Inc. is a leader in building market fundamental analysis tools used by the energy industry and related government agencies for over two decades. The G2M2® Global Gas Marketing Modeling System™ is designed for developing scenarios for the converging global gas market. It is a complete system of interrelated models for forecasting natural gas and LNG production, transportation, storage, and deliveries across the global gas markets. For more information visit our website at http://www.rbac.com.