Highlights in Market

The first half of 2024 saw a pronounced growth in global natural gas demand, particularly in Asia. China alone has seen a 10% increase in gas consumption compared to 2023 and this rise is expected to continue. Other countries such as South Korea and India are also expected to be expanding the role of gas. Additionally, the expansion of the LNG fleet and improvements in European gas infrastructure are set to play pivotal roles in shaping the market. However, there is much uncertainty due to intermittent geopolitical tensions and supply chain disruptions.

RBAC’s global analysis team has recently updated demand forecasts for the G2M2® Market Simulator for Global Gas and LNG™ which provides a nuanced view of long-term demand growth and insights into the expected evolution of the market.

Global Gas Demand and Supply Trends

Short-term (within 3 years)

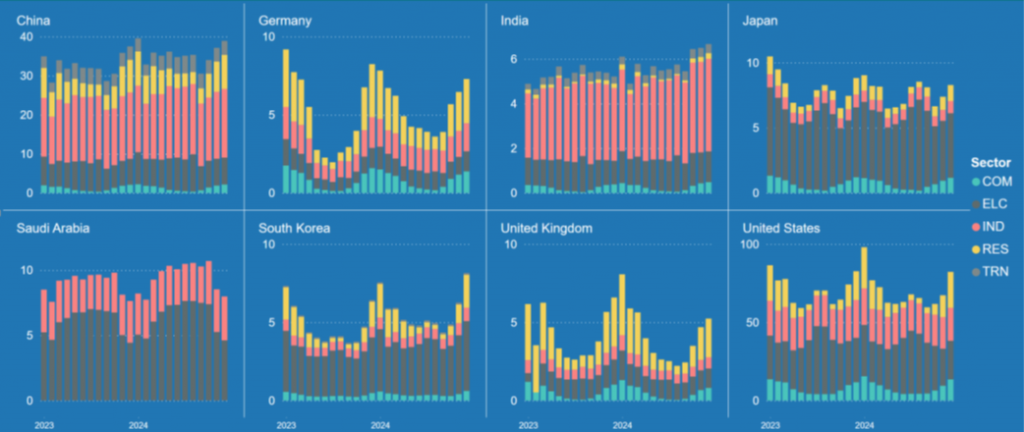

Figure 1 shows that in the short term, global natural gas demand has shown significant growth, largely driven by rapid industrial expansion in Asia and the Middle East. The increase in global demand is expected to be around 2.8% in 2024 and 1.3% in 2025, with the economic outlook being cautiously optimistic. Asia leads this growth due to strong industrial activity and an uptick in LNG imports, with a Compound Average Growth Rate (CAGR) of total demand of 4.0% from 2024 to 2027. European markets are still recovering from previous supply shocks, with a mild rebound likely of 1.8% CAGR of total demand through 2027, led by the ELC and IND sectors, while RES and COM are expected to continue to stagnate and decline slightly.

Medium-term (3-7 years)

In the medium term, the natural gas market is expected to experience a series of shifts as global demand and supply dynamics evolve.

Markets such as China and India are anticipated to drive growth, with industrial expansion and urbanization being key. Meanwhile, North America is expected to maintain a robust supply, bolstered by ongoing shale gas production and infrastructure developments. Europe’s natural gas landscape is experiencing notable changes as the region works a balancing act of energy security, energy independence from Russia and an energy transition towards renewable energy sources. Despite these shifts, the industrial sector may see a modest recovery, supported by lower gas prices and the need for reliable energy. In power generation, European gas demand is shaped by opposing forces: the transition to renewables, which calls for a reduction in fossil fuels, and the phasing out of coal and increased electrification, which could potentially increase demand for natural gas.

Long-term (after 2030)

In the long term, the global natural gas market retains a crucial role in the energy transition, while low-emissions gases, particularly hydrogen, are expected to become increasingly important as nations work towards decarbonization. We expect long term positive CAGR in the period 2030-2050 in emerging markets in Africa, Central Asia, the Middle East and Southwest and Southeast Asia, while negative CAGR in long term for most of Europe and North America as countries continue to move forward with plans for decarbonization.

Regional Market Developments

Figures 2 and 3 show that even with an expected decline in demand from Europe the market would remain strong overall with losses being offset by Asia. Emerging markets in Africa and the Middle East are also seeing marked growth from both a supply and demand perspective.

Asia

Asia remains one of the most important energy markets in the world, with substantial growth in China and India. In the first half of 2024, Asia accounted for approximately 60% of the global increase in gas demand. This surge is attributed to strong industrial activity and a marked increase in LNG imports. China’s economic recovery and expansion in industrial sectors have been particularly influential, while India’s initiatives to boost natural gas usage in transportation have also contributed to demand growth. Looking ahead, the region’s demand dynamics are expected to continue evolving, with a growing focus on enhancing infrastructure and securing supply sources, as illustrated by the steady rise in sectoral gas demand through 2030.

Europe

The changes in the European natural gas market have been consequential, influenced by both external and internal factors. The first half of 2024 saw a 3.5% decline in gas demand, primarily due to reduced gas-fired power generation and mild winter weather, as in the United Kingdom.

However, the medium-term gas outlook towards 2030 shows a stable level of consumption, especially in the industrial (IND) and electricity (ELC) sectors. This recovery is driven by Europe’s ongoing transition towards lower-carbon energy sources, which is gradually replacing coal with natural gas in power generation while maintaining a stable level of industrial demand.

The improvements in European gas infrastructure, including expanding regasification capacities and pipeline interconnections, have bolstered the region’s ability to manage supply disruptions and improve energy security. The region continues to focus on reducing its dependency on imported pipeline gas from Russia and navigating the complexities of geopolitical influences on supply.

North America

In North America, natural gas demand is driven by increased gas-fired power generation and LNG exports. The United States continues to play a vital role as a major LNG exporter, shaping global supply dynamics. The expansion of LNG infrastructure, including new liquefaction projects and the growing fleet of LNG carriers, underscores the region’s commitment to maintaining its position as a key player in the global energy market. North America’s natural gas market is poised for further growth, supported by favorable domestic production trends and strong demand for LNG exports.

The market is always shifting, and disruptions to supply could occur at any moment, it is with the G2M2® Market Simulator for Global Gas and LNG™ that this volatility can be better tamed and accounted for in your analyses and forecasts. With this market simulation tool, countries and companies alike can find the best ways to achieve energy security, both in supply and production, through robust market analysis and better strategic decisions.

© 2024 RBAC, Inc. All rights reserved. G2M2, G2M2 Market Simulator for Global Gas & LNG, GPCM, and GPCM Market Simulator for North American Gas & LNG are trademarks of RT7K, LLC and are used with its permission.