Mexico: A Gas Nation

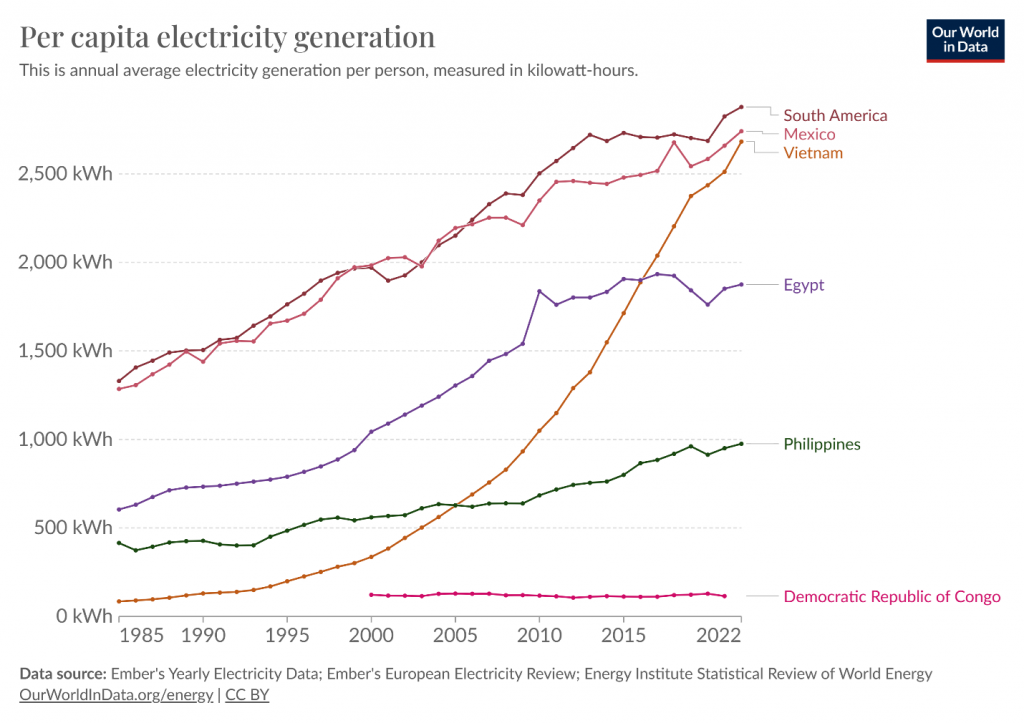

Mexico’s electricity consumption per capita has grown steadily 4.9% per year since 1985, and it is the top consumer of similar sized emerging markets. Much this electricity is powered by natural gas.

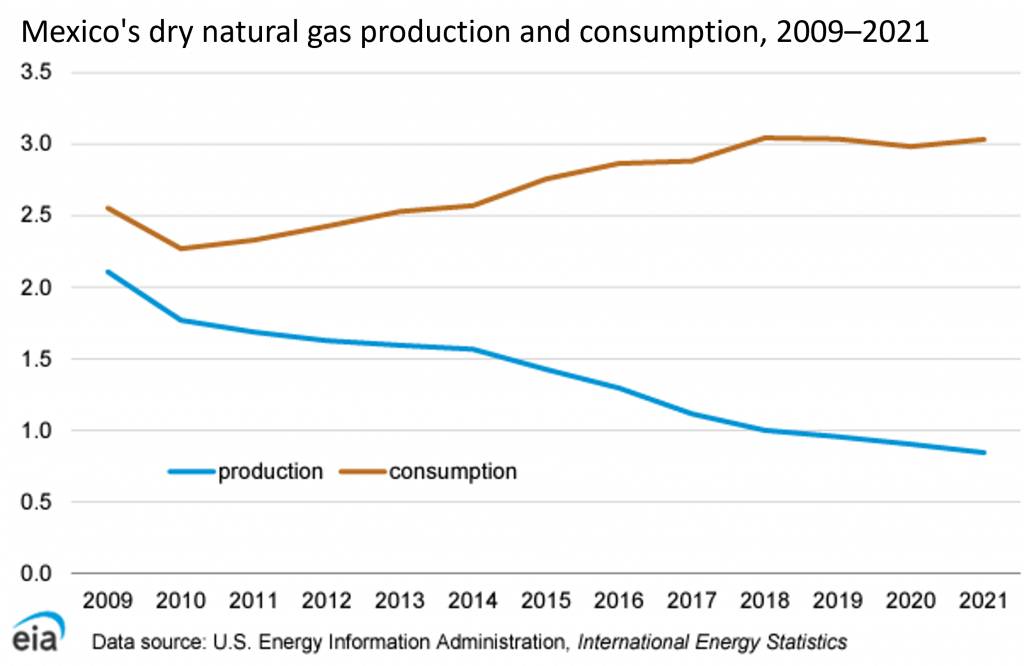

However, this natural gas is not from their own production. And overall, they are one of the top importers of gas in the world but similar to Europe before the war in Ukraine, they have been getting a majority of their natural gas by pipeline from one country. This is despite possessing significant natural gas reserves of their own.

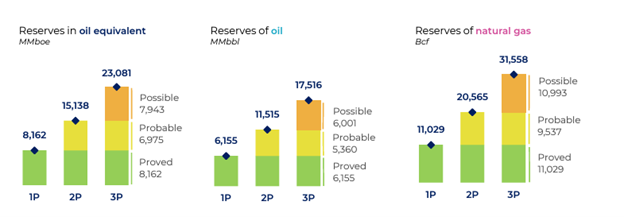

As of January 2023, Mexico has 11 tcf of proven natural gas reserves and 6.2 MMbbl of proven oil reserves.

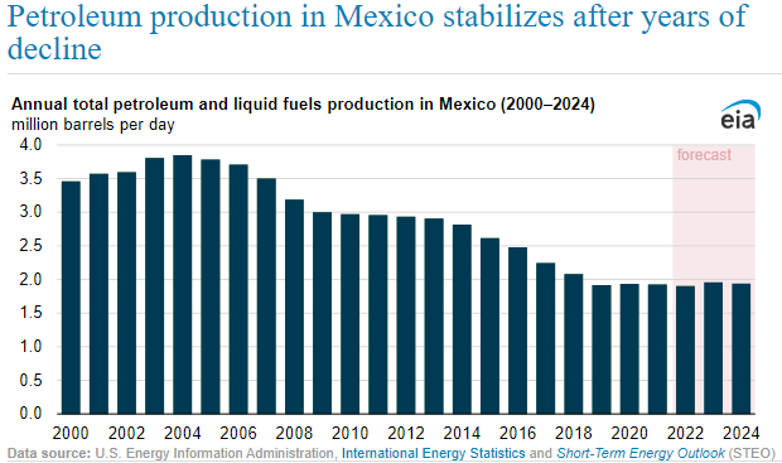

However, even with these reserves in their possession, there has not been much success as of late in reviving their domestic production industry. Both oil and gas production have been steadily declining each year while demand is rising.

Turning to Imports

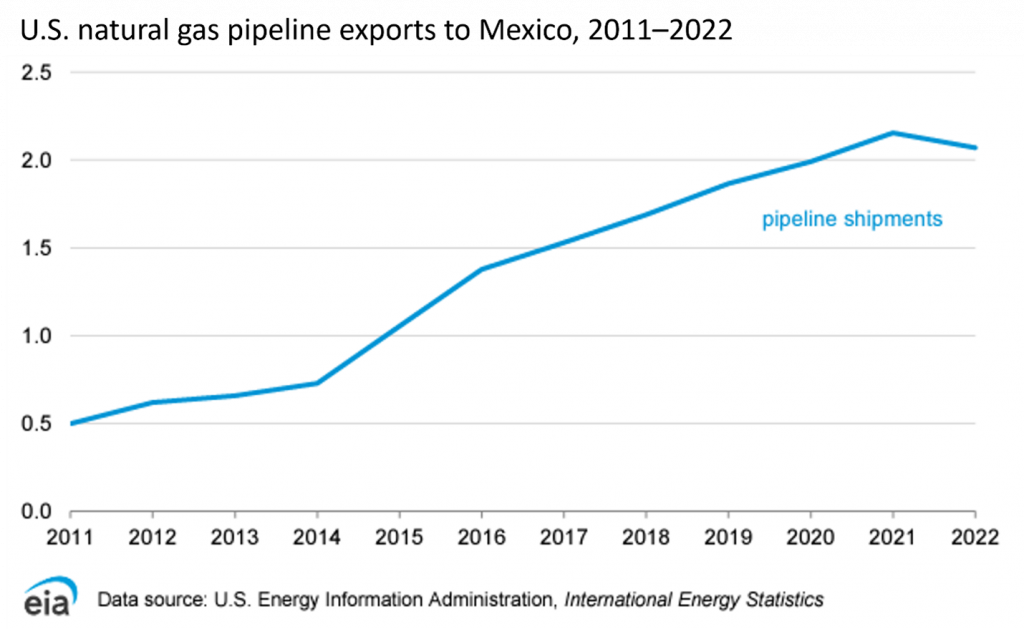

Due to a lack of domestic production, Mexico turned to pipeline gas imports from the United States. As we have seen in other parts of the world where one country becomes almost entirely reliant on another for energy, which can result in disaster if the supply is suddenly cut off. This brings us to the question, has Mexico become over reliant on natural gas imports from the United States?

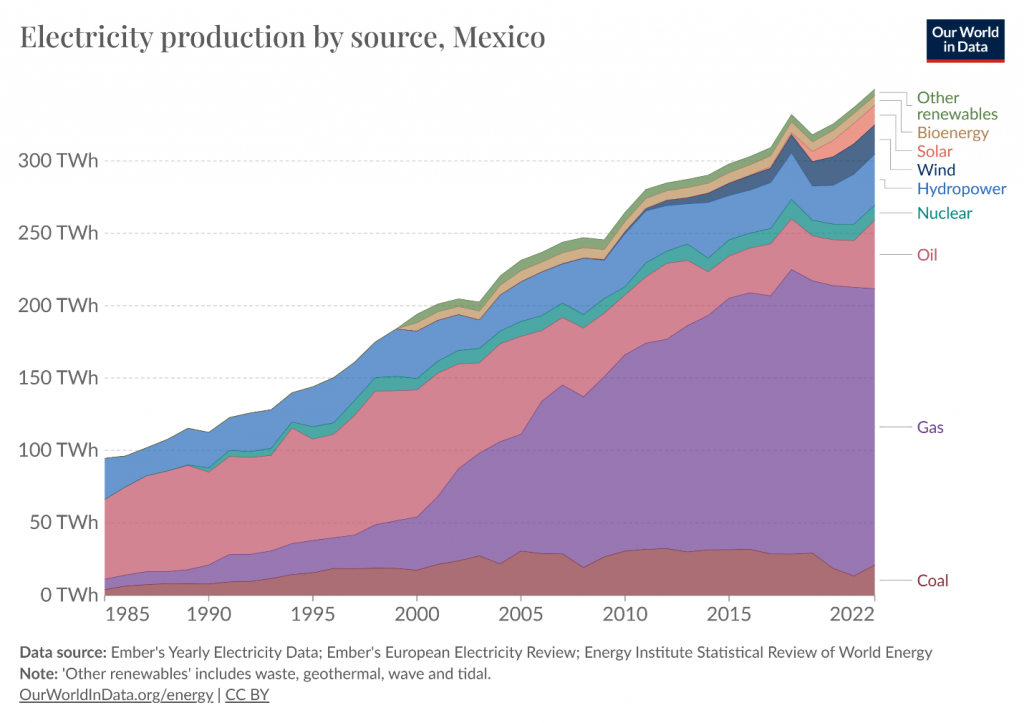

Mexico’s energy mix is primarily made up of oil and natural gas. Because importing natural gas from the United States is both available in large quantities and relatively cheap, Mexico has relied on their northern neighbor to meet their supply needs. “The share of Mexico’s natural gas supply met by pipeline imports from the United States grew from 61% in 2019 to 72% in 2021.”

While it is great for Mexico that they have a supplier they have friendly relations with, it is important from an energy security standpoint to not be reliant on a single source for nearly your entire energy supply. We all saw the turmoil and strife that Europe underwent when gas from Russia was cut off.

Although it is very unlikely that relations between the U.S. and Mexico could sour so much that the U.S. would turn off the taps in a similar manner, what we can look at is extreme weather disrupting supply, such as what happened during 2021’s Winter Storm Uri that affected Texas and northern Mexico.

Millions were left without power because of supply shortages caused by pipelines between the two countries being frozen and unable to transport gas and a lack of local storage (they are currently looking to fix). To avoid potential shortages in the future, all options should be on the table for ensuring energy is available when you need it and the best way for that to happen is to be in control of it.

How about LNG? If Mexico was faced with a potential supply shortage from the U.S. could they recoup the loss with LNG imports from other sources? Unfortunately, Mexico currently has only a minor ability to import LNG which is not expected to increase in the near future.

Mexico’s Energy Mix

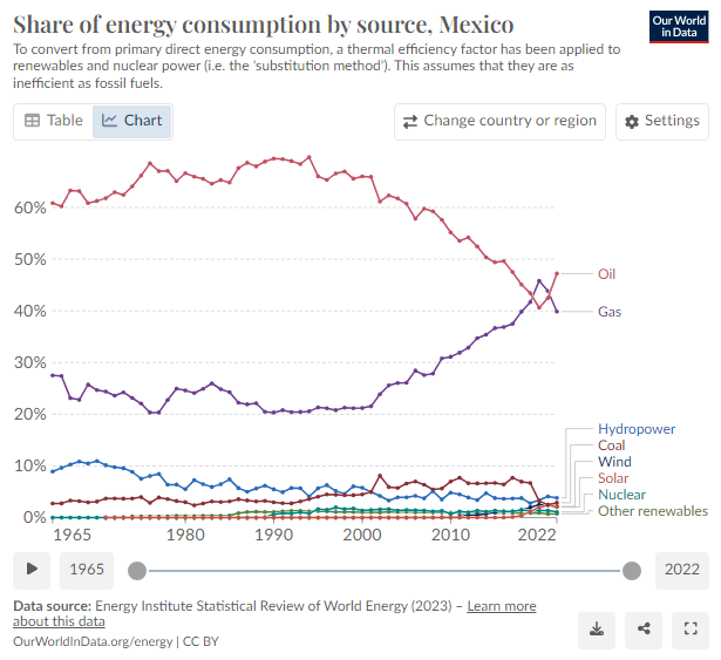

One might say that another great way to be secure in your supply of energy is to have a diverse supply of it. Mexico’s energy industry has historically been dominated by oil, but in recent years, natural gas has become a much larger part of Mexico’s energy mix. Even with global calls for renewable energy, natural gas continues to play a substantial role throughout the world, including in Mexico where oil and gas comprise almost 90% of energy consumption.

Natural Gas is their Future

Héctor Moreira, who is a member of the Comision Nacional de Hidrocarburos (National Hydrocarbons Commission), believes that natural gas is the future of Mexico’s energy industry. “We have more gas resources than oil. We are a gas nation rather than an oil one.” So, is there a leaf turning for the natural gas industry in Mexico?

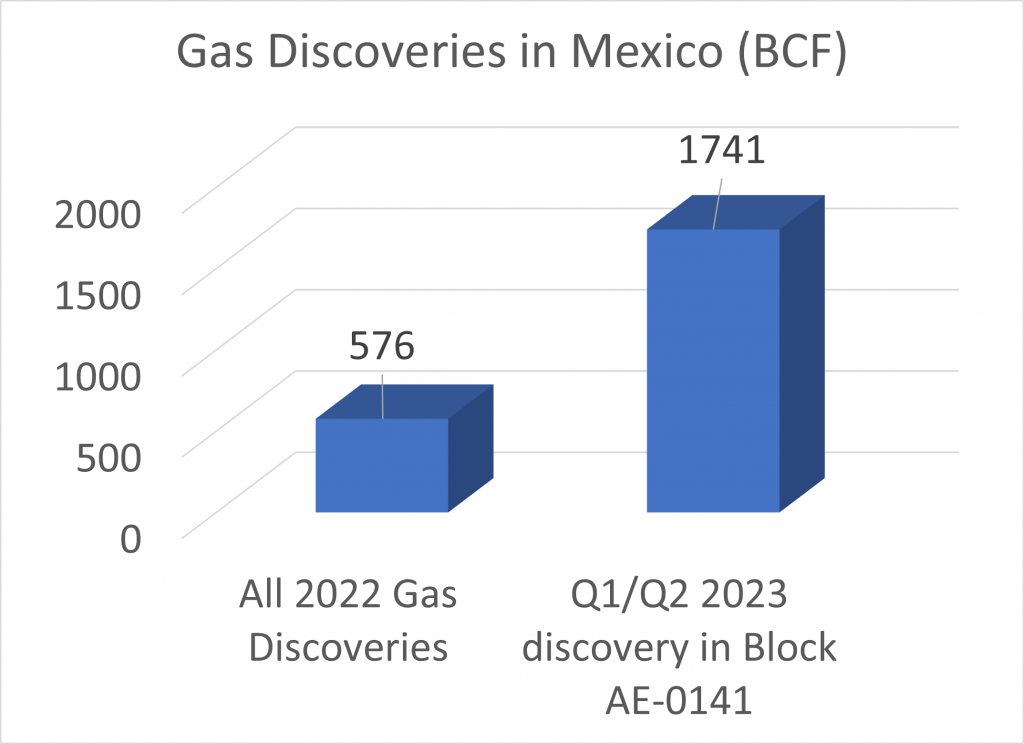

Perhaps. The results of 2022’s exploration activity was about 576 BCF, at a daily consumption of 9.3 BCF, it would last 62 days. But 2023’s activity has shown great promise. In the first half of 2023 there was a major gas discovery in block AE-0141 of 1,741 BCF, over 3 times all discoveries from 2022.

Mexico’s Budding LNG Industry

Even with plans to grow domestic production, they would still rely on imports from the United States to meet domestic demand and for supplying LNG export terminals. Adrian Duhalt from the Baker Institute’s Center for United States and Mexico at Rice University stated, ”Mexico is set to become an exporter of US-produced natural gas and this is mostly driven by market dynamics that are taking place globally — especially those in Asia.” Mexico has several LNG export projects starting with Costa Azul LNG which will be coming along in 2024 with 0.6 mtpa capacity with more additions planned.

The export project to watch out for is the Saguaro Energía LNG terminal which is a 3-phase project with the phase 1 already having reached FID. The first phase will have a capacity of 9.4 mtpa, the second and third will have 4.7 and 14.1 – 15 mtpa of capacity respectively, for a total capacity of 28 to 29 mtpa. This project already has several supply agreements with major companies such as Shell, ExxonMobil LNG Asia Pacific, Zhejiang Energy, and ConocoPhillips.

Costa Azul LNG and Saguaro Energía LNG are the two projects nearest completion, but that doesn’t mean they are the only projects Mexico has plans for. LNG Altamira is another project expected within the next few years.

LNG Altamira is a 3-phase project with the first phase having reached FID; it was supposed to have begun operation in September of 2023 but it has been delayed with the start pushed back to December. The remaining two phases are still in pre-FID, the project as a whole will combine for 4.2 mtpa.

Should Mexico Increase Domestic Production?

Regardless of the trade relationship between Mexico and the United States, it is in the best interest of Mexico to make use of the resources that they have. To this end, the government has approved billions of investment dollars into further developing their domestic resources.

Only time will tell what the future holds for their natural gas industry, as at their current consumption rate of 9.3 bcfd, even their reserves, both proven and possible, would only last at most a decade and only if demand did not increase. Because of this we expect imports to remain a large part of their natural gas portfolio unless there are more discoveries, such as the one made earlier this year in block AE-0141 that has spurred further investment into revitalizing their domestic production.

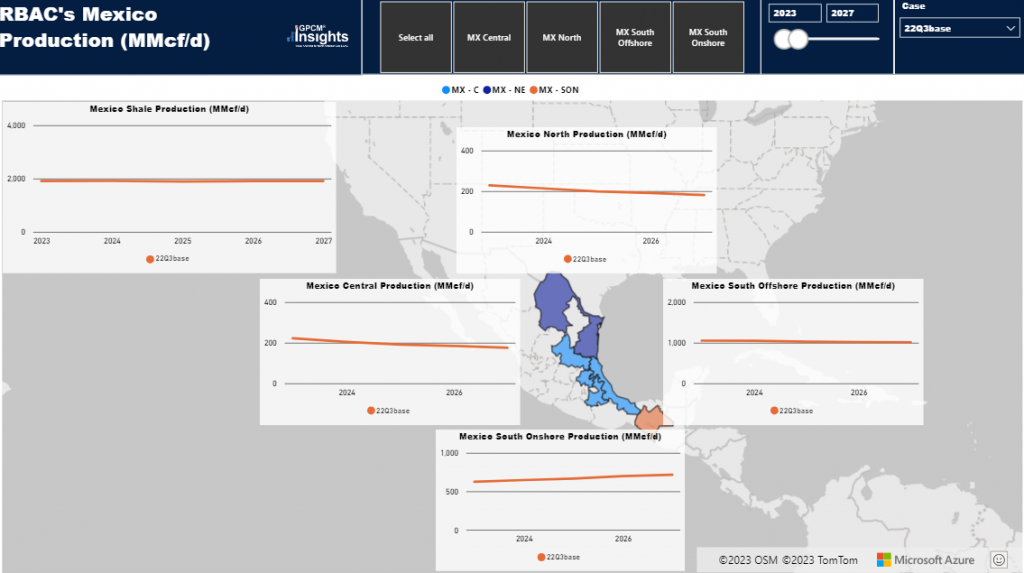

Regardless of how the future unfolds, any potential scenario can be run and analyzed with GPCM® Market Simulator for North American Gas and LNG™ for developments within Mexico for their imports and exports.

Not only can you visualize historical trends in Mexico’s production in addition to forecasts, but you can also see the potential effects on supply, demand, prices, gas flows that investment into their industry or changes in imports would have.

Mexico has a broad array of options on how to proceed with their evolving natural gas industry and how a mix of their domestic production and imports will contribute; no matter which path they end up taking, market simulation is an invaluable tool to see the long-term effects of any changes in their overall energy strategy.

RBAC, Inc. has been the leading provider of market fundamental analysis tools used by the energy industry and related government agencies for over two decades. The GPCM® Market Simulator for North American Gas and LNG™ is the most widely used natural gas market modeling system in North America. RBAC’s G2M2® Market Simulator for Global Gas and LNG™ has been instrumental in understanding evolving global gas and LNG dynamics and is vital in fully understanding the interrelationship between the North American and global gas markets.

[1] Mexico – The World Factbook (cia.gov)

[2] hydrocarbonreserves_202301.pdf (hidrocarburos.gob.mx)

[3] Country Analysis Brief: Mexico (eia.gov)

[4] U.S. Energy Information Administration – EIA – Independent Statistics and Analysis

[5] Mexico: Energy Country Profile – Our World in Data

[6] U.S. Energy Information Administration – EIA – Independent Statistics and Analysis

[8] Mexico Seeks Gas Storage Options (mexicobusiness.news)

[9] G2M2 Insights Visual Analytics for Global Gas & LNG – RBAC Inc.

[10] Mexico Is a Gas Rather Than Oil Country, Says Héctor Moreira (mexicobusiness.news)

[11] Mexico Plans to Become an Export Hub With US-Drilled Natural Gas (yahoo.com)

[12] Costa Azul LNG Terminal – Global Energy Monitor (gem.wiki)

[13] Saguaro Energía LNG Terminal – Global Energy Monitor (gem.wiki)

[14] Shell and Mexico Pacific sign long-term LNG sales and purchase agreement | Shell Global

[15] Mexico Pacific to sell LNG to ExxonMobil | Oil & Gas Journal (ogj.com)

[16] Mexico Pacific signs 20-year LNG supply deal with China’s Zhejiang Energy | Reuters

[18] New Fortress delays start of Mexico’s first LNG plant to December | Reuters

[19] New Fortress Altamira FLNG Terminal – Global Energy Monitor (gem.wiki)

[20] Approved Investment in Contracts (hidrocarburos.gob.mx)