Japan’s Future Energy

Key Takeaways from the Japan Energy Summit

Discussing the future of energy, Japan Energy Summit & Exhibition was held in Tokyo and concluded on June 5, with the main focus on Asia’s LNG supply flexibility and demand growth, Hydrogen, ammonia, and e-methane’s impact on Japan’s energy mix, and the key technology to achieve carbon neutrality.

LNG Supply Flexibility in Asia

“I believe that LNG could play a vital role For Energy Transition in Asia” — Dr. Takafumi Yanagisawa

Given the complexity of geopolitics and demographics in Asia, it’s not surprising the significant variance in the pace of energy transition across Asian countries, leading to diverse demand growth for LNG. This highlights the importance of flexible LNG supply in Asia to meet the varying levels of demand across different countries.

LNG demand in Asia is predicted to grow continuously, but supply will remain tight until 2026. Qatar and Australia, accounting for nearly 60% of Asia’s LNG supply from 2023 to 2030, are the main LNG suppliers to Asia. Qatar’s North Field expansion won’t begin exports until 2026, limiting supply to Asia. This constraint highlights the importance of flexibility in LNG to support the region’s demand growth.

At the conference, panelists pointed out the potential risks that could threaten the affordability and flexibility of LNG, which includes choke point risk at Hormuz, Panama and Suez canals, the uncertainty in weather conditions, and unpredicted events happened in the supply zones. In the previous article by Dr. Brooks, the shutdown of the Strait of Hormuz would have the most profound effect on Asia LNG prices.

Many Asian countries have sought to enhance their LNG flexibility by increasing their storage capacity and infrastructure, shortening the tenure in long-term contracts, and diversifying their suppliers, including Australia, Qatar, and the United States.

Japan’s Future Energy Mix

Another topic highlighted at the conference was Japan’s future energy mix. Japan’s policy on green transition and nuclear restart remains consistent with the 2023 Energy White Paper. It is expected that Japan’s demand for LNG will decline through 2050, as the government aims to achieve carbon neutrality by that year.

Japan is likely to continue increasing its consumption of new energy sources, such as Hydrogen, ammonia, and e-methane, while decreasing its reliance on gas and LNG. Yuya Hasegawa, Director of METI, stated that “There is no perfect energy source. We need to have as many sources as possible and diversify to ensure a stable supply of energy, even during disasters.” So, what kind of diversity will exist in Japan’s future energy mix?

The short-term target for the energy transition is to achieve 36%–38% renewable generation and an increase in the share of nuclear generation to 20%–22% by 2030 in the electricity sector.

It is expected that Gas and LNG would likely decrease in their future energy mix. However, challenges persist in the storage of hydrogen, and the stability of other renewable energy sources remains relatively low. To maintain Japan’s long-term energy security, in Japan’s energy mix, especially as limitations remain on expanding nuclear power.

Furthermore, Japan’s plans to construct additional semiconductor factories are expected to significantly boost electricity demand. Despite the current target of achieving a 20% share of LNG power generation by 2030, this goal may be revised due to the anticipated rise in electricity demand from the semiconductor industry.

Key Technologies to be Implemented

The summit also discussed key technologies that should be implemented to achieve decarbonization. As LNG remains important for industries with high demand for stable energy, technologies to reduce emissions and produce clean LNG become more important. In July 2023, Japan, Korea, the United States and Australia launched a methane emission reduction initiative called “CLEAN.” Through this program, they will pursue cleaner LNG supply chains by enhancing visibility of methane emissions.

Japan also started testing coal-ammonia co-firing. JERA, the country’s largest power generation company, has begun testing one of its Hekinan Thermal Power Station units using ammonia to replace 20% of coal in energy production. JERA further plans to replace 50% of coal with ammonia at Unit No. 5 around 2028 and eventually have a power plant that runs solely on ammonia.

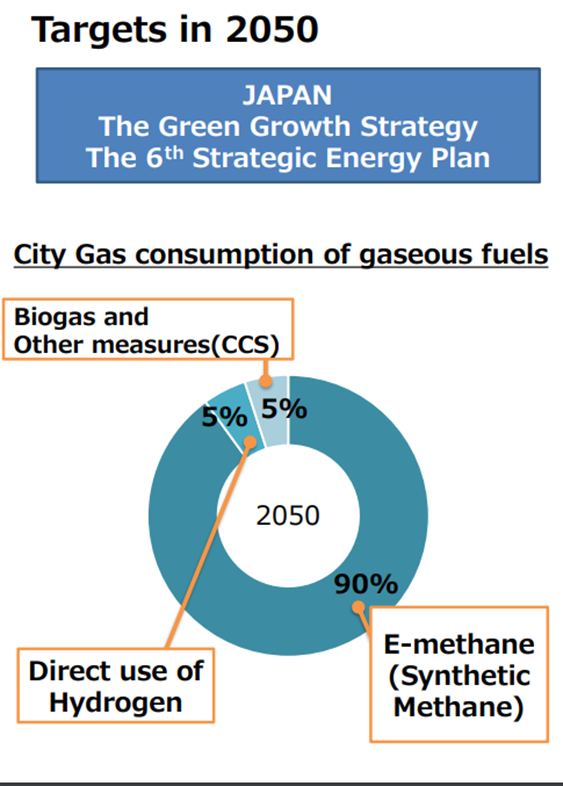

Japan is also promoting synthetic methane, namely, e-methane. Producing methane by hydrogen and carbon dioxide to decrease emissions and further achieve carbon neutrality. The current target for e-methane in Japan is to utilize e-methane for 1% of the gas supply by 2030; 90% of city gas consumption of gaseous fuels by 2050.

The Japanese government is also promoting technologies like CCS (carbon capture and storage) and hydrogen FCEVs (fuel cell electric vehicles) by providing various subsidies. Additionally, Japan aims to introduce advanced technologies, including CCS, ammonia-firing, and hydrogen fuel, to other Asian countries through the Asia Zero Emission Community (AZEC). This initiative seeks to achieve greater scales of decarbonization while ensuring economic growth and energy security.

The Japan Energy Summit & Exhibition covered various topics related to the energy portfolios of Japan and Asia. The conference highlighted energy transition and decarbonization technologies, emphasizing their impact on issues such as energy security and LNG flexibility.

(Special thanks to Dr. Takafumi Yanagisawa for his help and insights, especially regarding LNG flexibility in Asia and new energy technologies. Dr. Yanagisawa’s information can be found here: Researchers – The Institute of Energy Economics, Japan – IEEJ)

Japan’s Decarbonization and LNG

Japan is taking an ambitious path toward decarbonization and its goal of achieving carbon neutrality. In our previous article, we discussed how the decrease in domestic demand has positioned Japan as a reseller of LNG. This new role could be particularly beneficial for other Asian countries with limited flexibility in their energy supply, especially before the expansion of LNG exports from Qatar in 2026.

The decline in demand in Japan primarily results from the country’s energy transition and the restart of its nuclear power plants. Due to regulatory uncertainties surrounding the nuclear restart, hydrogen, e-methane, and ammonia have gained importance in Japan as key methods for its energy transition.

Will the importance of LNG in Japan be undermined? From an economic perspective, LNG remains much cheaper than hydrogen, ammonia, and e-methane. The average hydrogen production cost is around 3-5 times higher than the average LNG price.

Ammonia prices are heavily influenced by natural gas prices, with the variable cost of ammonia ($/tonne) approximated by multiplying the natural gas cost ($/MMBtu) by 30.

According to G2M2 PowerBi data, LNG prices in major Asian gas hubs remain stable and low through 2050. This shows that the alternatives might not gain any economic benefit in recent years. In addition, Japan’s plan to build new semiconductor factories will increase their demand for stable electricity, thereby raising the need for LNG.

Ammonia Supply Chain

As it is unlikely that these alternatives will become significantly cost-efficient in the near future, Japan is introducing and collaborating with coal-dependent countries like Vietnam, Indonesia, and India on ammonia co-firing technology. Through this collaboration, Japan aims to establish a clear and profitable supply chain.

Japan has also planned a further commercial expansion on the supply end of ammonia fuel. It is expected to profit as long as it establishes a stable partnership with other countries. To forecast the profitability and feasibility of this new ammonia supply chain, it is crucial to consider the outlook for LNG prices, as the production cost of grey ammonia is heavily influenced by LNG price levels.

In Summary

It is clear that Japan is attempting a balancing act of significant proportions. Having little to no indigenous resources and reliant on imports, Japan has emphasized the importance of diversifying its energy sources in its energy mix. While new technologies related to hydrogen, ammonia, and e-methane have garnered considerable attention during summits, the importance of LNG in Japan’s energy mix is not diminishing but rather increasing.

LNG not only significantly impacts the price of ammonia within the new supply chain but also plays a crucial role in Japan’s energy security, particularly with the increasing electricity demand from new semiconductor factories.

With the help of the G2M2® Market Simulator, businesses can customize their own scenarios and refine their strategies in emerging fuel markets as well as mature markets to optimize their positions and maximize positive results.

Report Authored by Chi Wu

RBAC, Inc. is a leader in building market fundamental analysis tools used by the energy industry and related government agencies for over two decades. The G2M2® Global Gas Marketing Modeling System™ is designed for developing scenarios for the converging global gas market. It is a complete system of interrelated models for forecasting natural gas and LNG production, transportation, storage, and deliveries across the global gas markets. For more information visit our website at http://www.rbac.com.