Introduction

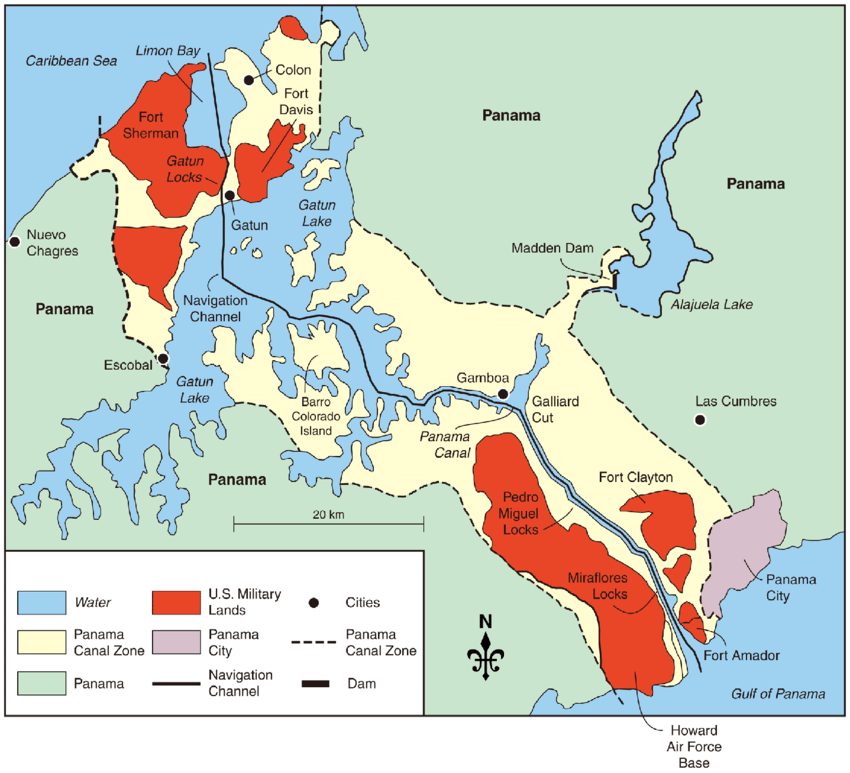

Recently we have seen two instances where LNG tanker traffic was affected due to issues in the Panama Canal and the Red Sea. In the case of the Panama Canal, low water level in Gatun Lake has resulted in a reduction in capacity with associated increase in traversal time, fees, and cost.

In the southern part of the Red Sea, Houthi forces have been launching rockets at tankers. While claiming they are aiming only at those which are doing business with Israel (and in support of Palestine), the rockets are either poorly aimed or just launched indiscriminately.

In any case, a number of LNG shippers have chosen to use the longer, more expensive route around Africa’s Cape of Good Hope rather than take the chance their vessels will get hit by a Houthi rocket.

In addition to these current issues, threats have been made in the past to shut down tanker traffic in the Persian Gulf by blocking the Strait of Hormuz between Iran and UAE and Oman.

How might we assess the effect of such partial or complete shutdowns of major LNG traffic arteries around the world?

At RBAC we have developed and use a market simulation system called G2M2. G2M2 consists of a database which describes and defines the many components of the global gas and LNG market, a software interface to that database which allows analysts to design realistic scenarios concerning the market, a solver which computes forecasts based on the assumptions in those scenarios, and software for viewing the results and exporting them to Excel, PowerPoint, and PowerBI.

In order to answer the question posed at the beginning of this report, we set up four scenarios. In the first, all three of these waterways were allowed to operate normally based on historical levels of capacity and cost. Then three additional scenarios were created wherein one of the three waterways described above was shut down for the entirety of 2024.

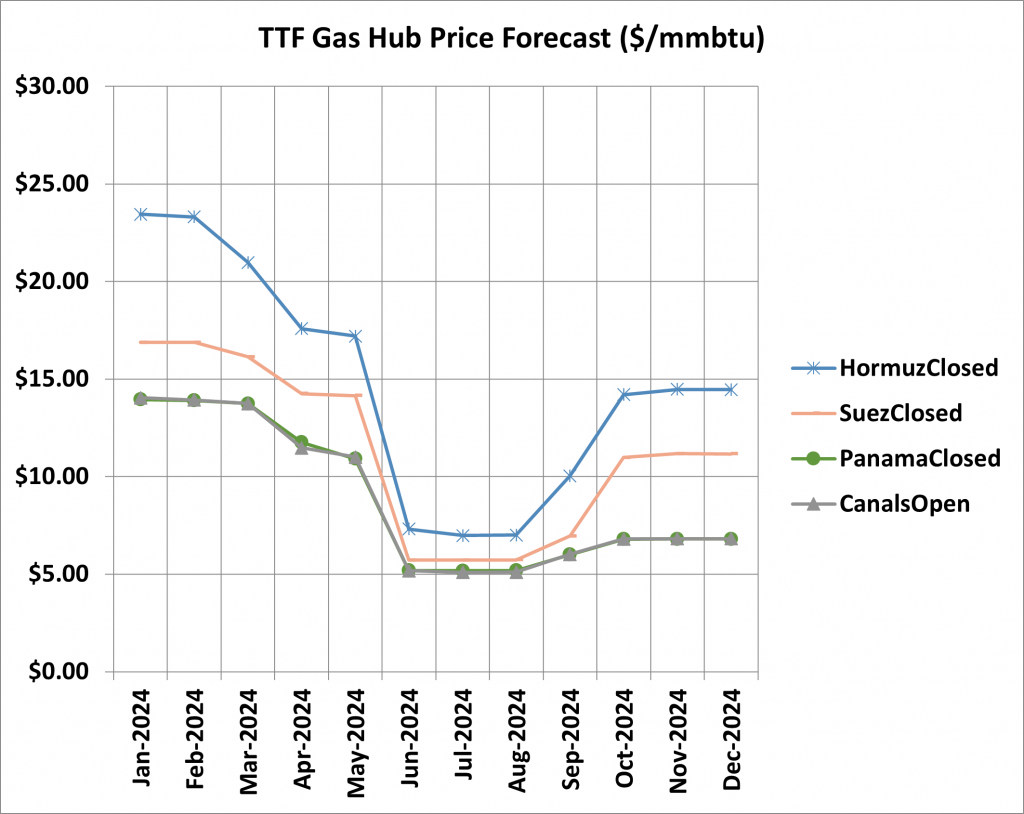

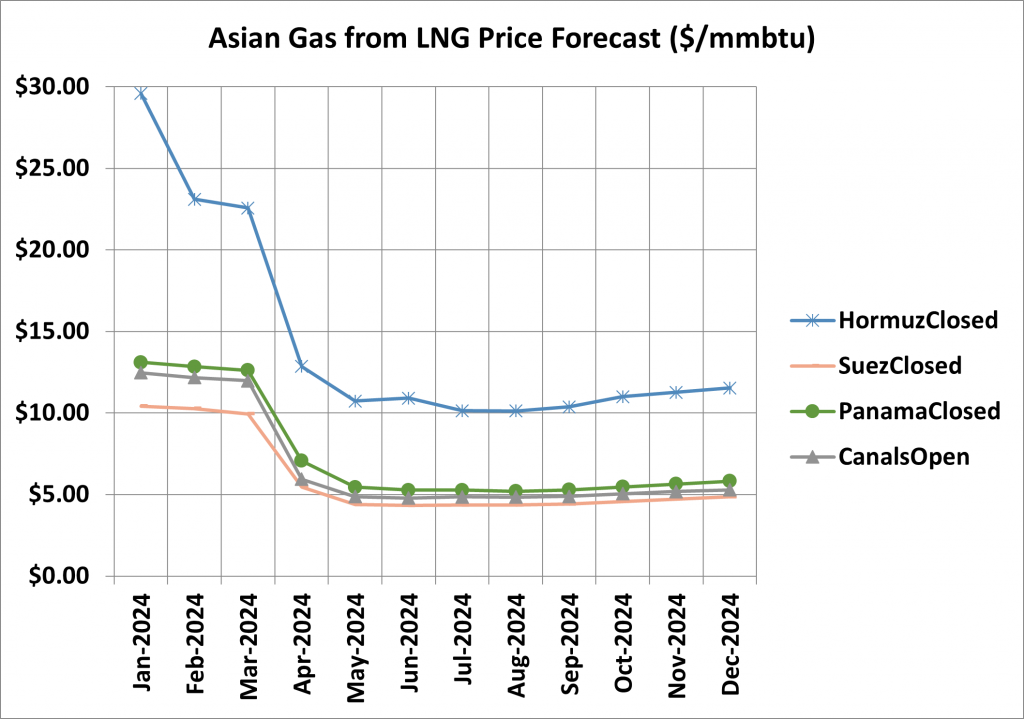

We then ran these four scenarios and compared the resulting prices in Europe (TTF) and Asia (JKM). Here are those results.

In the case of European LNG prices at the TTF trading hub, we can see that the closure of the Strait of Hormuz would have the most profound effect. In January 2024, for example, prices would rise from about $14 USD to about $24 USD. In December, the prices would be twice as high if the Strait of Hormuz were closed compared to the base case.

The next most severe effect would be felt if the Suez Canal had been shut down during all of 2024. Note that closure of the Bab el Mandeb by Houthi forces would effectively shut down most if not all Suez Canal traffic.

Interestingly, the low water level in Panama’s Gatun Lake causing traffic restrictions has little effect on gas and LNG prices in Western Europe, even if all LNG tanker traffic had to be diverted to other routes.

A full shutdown of the Strait of Hormuz, and thus the Persian Gulf, to LNG traffic would cause prices in Asia to double or more throughout the entire year. This is understandable since a large fraction of Qatar’s LNG is destined for Asia. This would be a catastrophe for Asian as well as European gas markets.

Note that prices are much lower at the end of the year due to additional LNG capacity coming online in 2024 as well as lower gas demand in Europe due to demand reduction programs.

Closure of the Panama Canal to LNG traffic would result in a much smaller price effect in Asia. Alternative pathways to get from the US Gulf Coast to Asia via Cape Horn at the tip of South America or traveling eastward using the Suez Canal would result in higher transportation costs, but not a reduction in available LNG. In addition, more US LNG would flow to Europe, freeing up Middle East LNG for delivery to Asia.

The last one is very interesting but possibly counter-intuitive. If the Suez Canal were shut down in 2024, Asian gas and LNG prices would actually decline rather than rise. How could this happen? Actually, it can be made to make sense. LNG could not flow from the Middle East to Europe through the Red Sea and Suez Canal. It would then make more sense to flow any spot or divertible tankers to Asia rather than steaming around the Cape of Good Hope in South Africa to get to Europe. More LNG available for Asia means lower prices there.

Using the G2M2® Market Simulator for Global Gas and LNG™, we are able to project what would likely happen in global gas and LNG markets due to adverse weather effects (such as in Panama) or attacks on civilian ships such as we have seen in the Red Sea. It can also be used to forecast the effect of other factors that affect the market: economic growth, population, weather (heat and cold), trade wars, hypothetical new pipelines or LNG facilities, contracts, etc.

These are conditions and events that are difficult or impossible to forecast with any credibility unless you have a sophisticated market simulator such a G2M2® Market Simulator for Global Gas and LNG™.

RBAC, Inc. has been the leading provider of market fundamental analysis tools used by the energy industry and related government agencies for over two decades. The GPCM® Market Simulator for North American Gas and LNG™ is the most widely used natural gas market modeling system in North America. RBAC’s G2M2® Market Simulator for Global Gas and LNG™ has been instrumental in understanding evolving global gas and LNG dynamics and is vital in fully understanding the interrelationship between the North American and global gas markets.