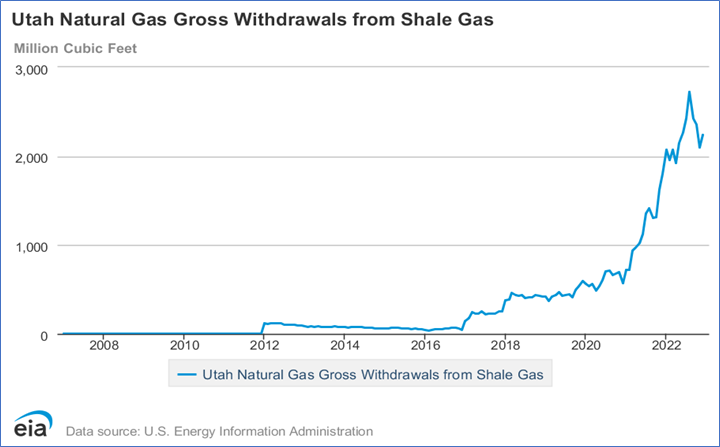

Move over basketball, there is something else to be jazzed about in Utah, the gas markets. Like the champion Denver Nuggets, Colorado has long overshadowed its neighbor Utah as an energy producer, with its massive shale reserves and production in the billions of cubic feet a day – over 5 Bcf/d for Colorado vs Utah’s < 0.8 – 0.9 Bcf/d. However, we have noticed a trend in Utah which may surprise you as much as it did us… an almost 5000% growth in Gross Withdrawals from Shale Gas per the EIA. While still a small volume, this trend is not insignificant.

There are three separate shale formations in Utah: the Manning Canyon, the Paradox, and the Mancos Formations. The Mancos Shale is an emerging play on the Utah side of the Uinta Basin, where recent drilling rigs have been operating. The RBAC Team continues to monitor both the drilling activity and production from this region, and if necessary, will create a new supply area within the GPCM® Market Simulator for North American Gas and LNG™.

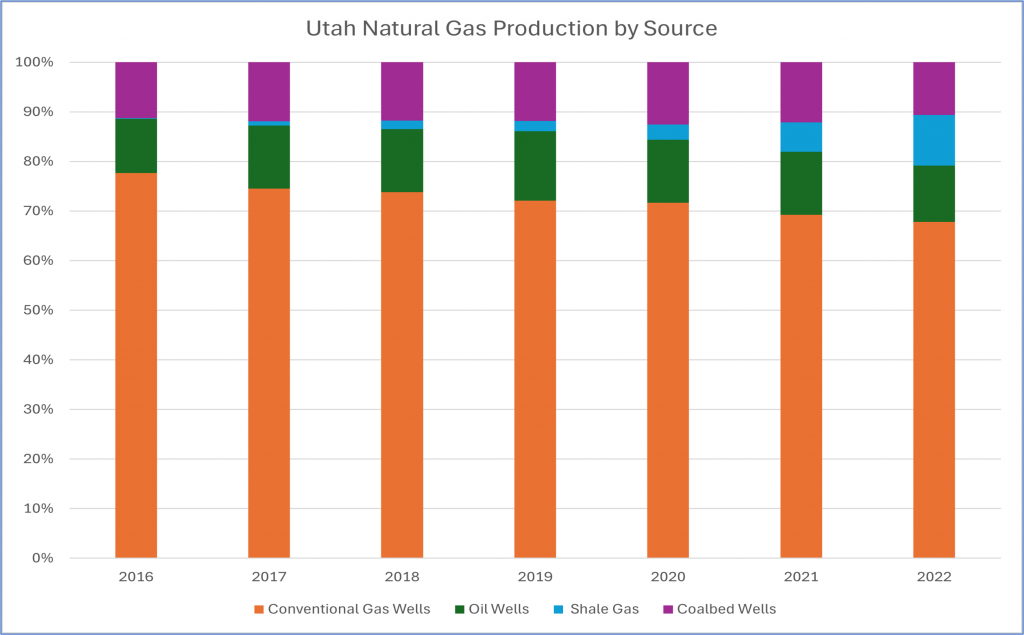

Offsetting declines in Coal Bed Methane production, this shale gas has been a boon to Utah. This shale production is , per the EIA. In 2022, gas-fired electric generation became the greatest consumer of natural gas, surpassing even the residential sector. The growth in shale gas has been a factor in keeping energy costs low and providing energy security for the state’s residents.

While Utah has less than 1% of the United States’ proven gas reserves, one shouldn’t be so quick to dismiss it. The state does have 3 large natural gas fields and boasts impressive infrastructure, evidenced by multiple interstate pipelines which can transport gas to serve local markets in-state as well as the entire Rocky Mountain Region. Utah is also home to the Clay River Natural Gas Storage Facility, the largest facility in the Rocky Mountain Region and the 14th largest natural gas storage field in the country. Located in Daggett County near the Colorado border, Clay River is owned and operated by Questar. This depleted natural gas field ensures reliable natural gas service to the residents and businesses of Utah and surrounding states.

While Utah’s current production is relatively small compared to its larger gas producing neighbors (CO and WY), it produces nearly the same volume as its indigenous consumption and plays an important role in the Mountain Region and to a lesser degree into the California or PNW regions. With production increasing, Utah’s natural gas potential is worth watching. Perhaps more so than the Utah Jazz, who finished the 2024 season 31-51.

The GPCM team is constantly monitoring developing trends in supply, demand, and infrastructure. Keeping a holistic perspective of the North American gas markets is crucial as market dynamics seem to be evolving at an ever-increasing pace. How these dynamics impact flows, domestically and globally, is exactly why RBAC builds its simulation systems – to help participants make better informed decisions and more appropriately manage risk.

RBAC, Inc. has been the leading provider of market fundamental analysis tools used by the energy industry and related government agencies for over two decades. The GPCM® Market Simulator for North American Gas and LNG™ is the most widely used natural gas market modeling system in North America. RBAC’s G2M2® Market Simulator for Global Gas and LNG™ has been instrumental in understanding evolving global gas and LNG dynamics and is vital in fully understanding the interrelationship between the North American and global gas markets.