Warm Weather Fuels Booming LNG Markets

Summer is now underway in North America, bringing with it increased demand for natural gas and LNG. This month we present diverse commentary covering the markets in both Europe and Asia.

We have a quick brief looking into the retirement of the Mystic Generating Station in New England; an analysis of Qatar’s plans to further expand its LNG export capacity; coverage of renewable natural gas developments within Europe; and a breakdown of how Japan is planning to meet the energy demand of the future.

We hope you enjoy these articles and interviews created to give you greater insight into energy markets and the industry, all with the goal to increase your knowledge and help you make better energy decisions.

Join our mailing list today and receive updates directly from RBAC. Not only will you receive this newsletter in your inbox, but also those who sign up on our website will also receive articles a week in advance and other important communications from the team here at RBAC.

Quick Brief – New England’s Mystic Generating Station Retired

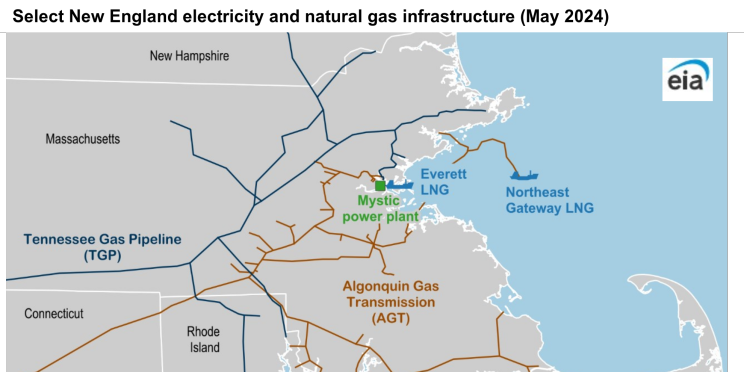

The Mystic Generating Station which has served the New England region for over 80 years was finally retired on May 31st. When the decision was made to retire the facility, questions were raised on the future of the adjacent Everett LNG terminal which supplied all of the gas to Mystic.

Constellation Energy, owners and operators of both the Mystic power plant and Everett LNG terminal, decided to keep the Everett operational through winter 2029-30. Excelerate Energy’s Northeast Gateway LNG terminal is also able to receive LNG imports.

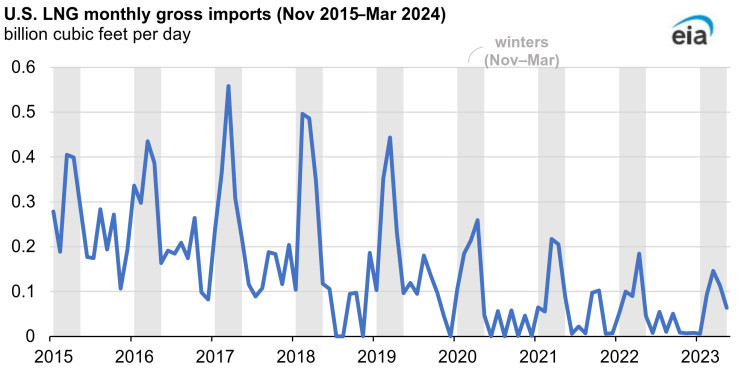

While the United States is often thought of an exporter in terms of LNG, some regions still rely on imports for their energy needs.

Of the regions that import LNG within the United States, New England receives the majority of them as the winter weather can cause pipeline constraints. “In 2023, the Everett LNG regasification terminal near Boston, Massachusetts, received about 87% of total U.S. LNG imports, all by LNG carriers from Trinidad and Tobago and Jamaica. The remaining 13% of LNG imports were delivered by truck from Canada into Alaska, Maine, Montana, New York, Vermont, and Washington.”

Articles and Media

Gain insight into natural gas and LNG markets across the globe with analysis and commentary from our energy industry experts.

Qatar’s Plans for Vast LNG Expansion

Qatar is already a major player in the global natural gas and LNG market and its presence may see even further growth in the coming years. How will Qatar’s LNG capacity growth affect the market?

Europe’s RNG Objectives: Aspirations Run into Hard Realities

Europe has long been a big proponent of accelerating the energy transition and one of the approaches to reach the goal of net zero emissions is through investment into renewable natural gas through 2030 to the tune of €37 billion.

Read: Europe’s RNG Objectives: Aspirations Run into Hard Realities

Japan’s Future Energy

The Japan Energy Summit and Exhibition is behind us now and it revealed how leaders in energy across Asia are tackling obstacles in the way of ensuring energy is available for all when it is needed. This article focuses on how Japan is approaching developing their energy strategy.

Read: Japan’s Future Energy

Essential Reading

Taken from the treasure trove of the writings from our energy experts. Here read technical insights and far-sighted analysis relevant through the lens of today’s energy.

Potential Impacts of a Hurricane on Gulf LNG Exports

We are well into Hurricane season and luckily no major meteorological events have occurred. But if a Hurricane were to strike the gulf coast of the United States, how could LNG exports potential be affected?

Food For Thought

Read some of our engaging commentary on social media and join us in the conversation.

Is 2024 the year of the Data Center?

With the ongoing AI boom, the buildup of data centers across the world are driving demand for natural gas and LNG to power the future. Some experts are predicting that this could result in a 4x increase in electricity demand over the next 15 years.

Read here

RBAC, Inc. is the market leading supplier of global and regional gas and LNG market simulation systems. The GPCM® Market Simulator for North American Gas and LNG™ is the most widely used gas market simulation system in North America. RBAC’s G2M2® Market Simulator for Global Gas and LNG™ is designed for forecasting gas and LNG production, transportation, storage, and deliveries across the global gas markets. These systems provide industry analysts powerful tools for supporting corporate investment and M&A strategy, achieving environmental and sustainability goals, risk analysis and trading.

© 2024 RBAC, Inc. All rights reserved. GPCM and G2M2 are registered trademarks owned by RT7K, LLC and are used with its permission.