2025 Natural Gas and LNG Off to a Hot Start

We are now through the first month of 2025 and with a leadership change in one of the most influential countries in natural gas and LNG, the year is already off to a hot start with changes all around. What’s in this month’s newsletter? We have a quick brief covering price forecasts at Henry Hub, how China become a powerhouse in the global gas market, Iran’s bold plans to dramatically increase oil and gas production, an analysis of findings in the recent U.S DOE report on LNG, and Phillips 66 recent major acquisition in the NGL industry.

We also have recordings of presentations from our recent gas and user conference available for purchase now! All you need to do is click here, fill out the short survey, and then select which videos you are interested in. There is also a short teaser of the presentations so you can get a taste of the incredible insights in each presentation. Were you at the conference and would like to review? Contact us.

Join our mailing list today and receive updates directly from RBAC. Not only will you receive this newsletter in your inbox, but also those who sign up on our website will also receive articles a week in advance and other important communications from the team here at RBAC.

Quick Brief – EIA Expects U.S. Gas Prices to Increase Alongside Demand

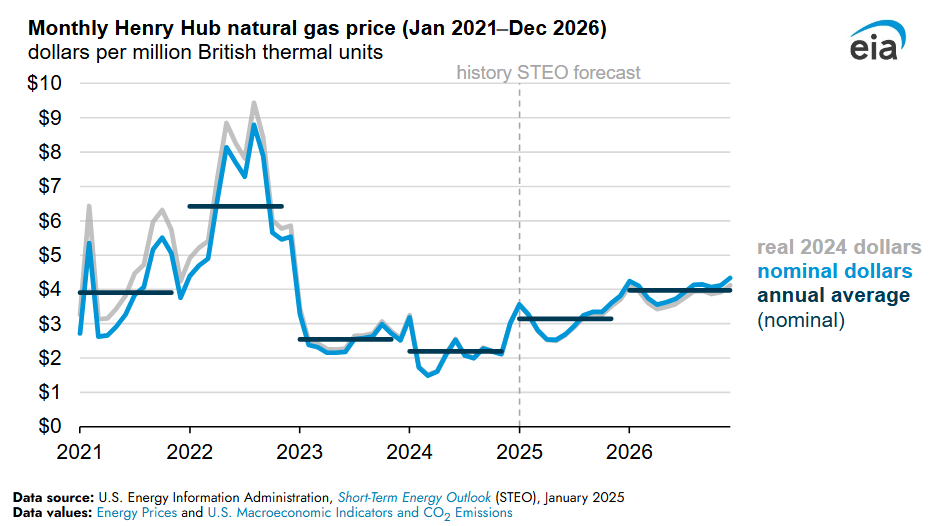

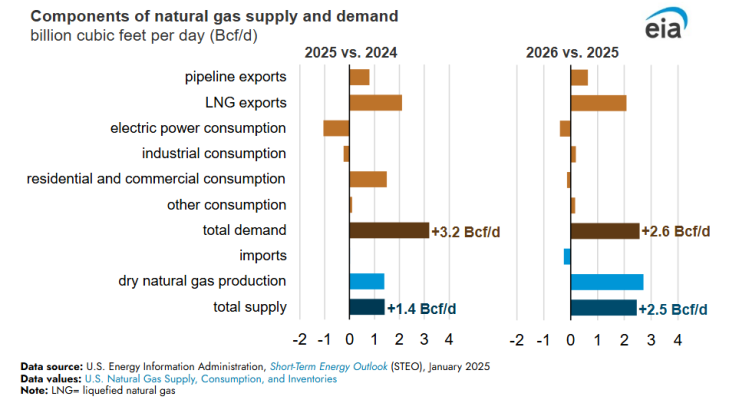

The U.S. Energy Information Administration released a new report a few days ago which forecasts prices at Henry Hub to rise in 2025 and 2026 due to expectations that demand growth will outpace supply growth.

The EIA believes the driving factors behind this will be increased demand from U.S. LNG export facilities which in-turn reduces the amount of gas in storage.

In this forecast, prices in 2025 would increase to an average of $3.12/MMBtu and in 2026 to an average of $4.00/MMBtu. Overall, the EIA is expecting gas supply to grow by 3.9 Bcf/d by 2026 and demand to grow by 5.8 Bcf/d leaving a 1.9 Bcf/d gap between supply and demand.

There has also been forecasts for rising demand as a result of investments into data centers and AI which could also greatly contribute to increased demand for natural gas and thus gas prices.

It’s a challenge to take into account the interplay of all possible variables in the North American gas market, but RBAC’s GPCM® Market Simulator for North American Gas and LNG™ allows analysts to create custom scenarios under a wide range of possible assumptions to tame some of the uncertainty accompanying the market. Watch the short video below to understand more about the incredible capabilities of GPCM to enhance your natural gas and LNG market analysis.

Interested in a free demonstration of GPCM? Contact us by clicking here and schedule one today!

Articles & Media

How Will the U.S. Energy Mix Trajectory Change Under the New Trump Administration?

The Trump administration has drastically changed the trajectory of the U.S. energy industry through a flurry of new directives and executive orders. These include ending the pause on LNG export permit reviews, opening Federal offshore waters for oil and gas exploration, and once again leaving the Paris Agreement. How will all these actions affect the U.S. market? And what about the ripple effects abroad from countries importing LNG from the U.S.?

Read ‘How Will the U.S. Energy Mix Trajectory Change Under the New Trump Administration?‘

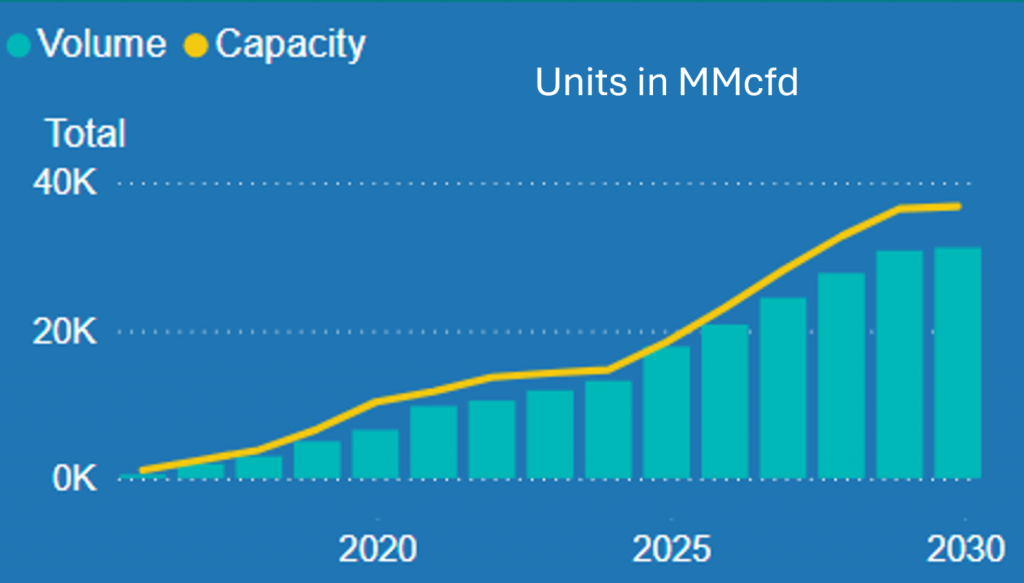

Trump, Tariffs and Trade Wars, Natural Gas and LNG into China

Asia and more specifically China are set to be among the most important markets to watch in the coming decades for natural gas and LNG. With the United States as a major supplier to the region, actions taken by either have great reverberations on each other and the entire market. How do the U.S. and China interact in terms of natural gas and LNG?

Read ‘Trump, Tariffs and Trade Wars, Natural Gas and LNG into China’

Iran’s $120B Bet on Natural Gas

Iran is investing big into expanding its natural gas infrastructure to end recent shortages that have resulted in power outages within the country over the last few years. Iran also has a long-term goal of establishing itself in the global LNG market. Can Iran really become a major player in LNG?

Natural Gas Market Modeling and the DOE LNG Study

The U.S. Department of Energy (DOE) recently released a report analyzing different aspects of the United States’ natural gas and LNG market. However, that study was done during the previous and now that a new one is settling into office, will the new administration come to a different conclusion? And what was in the original report?

Phillips 66 Makes a Move on NGLs

Phillips 66 made a massive move in the NGL market acquiring EPIC for $2.2 billion. Phillips 66 CEO, Mark Lashier, thinks that this move will not only assist in improving their NGL value chain but also better position the company as a downstream energy provider. But what exactly are NGLs and why are they significant?

Essential Reading

Taken from the treasure trove of the writings from our energy experts. Here read technical insights and far-sighted analysis relevant through the lens of today’s energy.

Global Waves: Navigating the Ripple Effects of China’s Economic Tide on LNG Markets

How does the ebb and flow of China’s economy send ripple effects through the global gas and LNG market? This study highlights how interconnected markets are around the world for LNG, especially for major producers such as the United States.

Read ‘Global Waves: Navigating the Ripple Effects of China’s Economic Tide on LNG Markets’

Food For Thought

Read some of our engaging commentary on social media and join us in the conversation.

Data Center and AI Breakthroughs Around the World

The recent DeepSeek AI announcement has turned the world on its head and called into question previous forecasts for massive expansion of data cents and AI in the United States and the required power for it. This is because of the announcement of DeepSeek vastly more efficient computational power requiring far less energy to operate than competitors. What is the latest in AI developments? How are natural gas and LNG affected?

Cyrus Brooks explains here

RBAC, Inc. is the market leading supplier of global and regional gas and LNG market simulation systems. The GPCM® Market Simulator for North American Gas and LNG™ is the most widely used gas market simulation system in North America. RBAC’s G2M2® Market Simulator for Global Gas and LNG™ is designed for forecasting gas and LNG production, transportation, storage, and deliveries across the global gas markets. These systems provide industry analysts powerful tools for supporting corporate investment and M&A strategy, achieving environmental and sustainability goals, risk analysis and trading.

© 2025 RBAC, Inc. All rights reserved. GPCM and G2M2 are registered trademarks owned by RT7K, LLC and are used with its permission.