Background:

When caught in a heavy storm there is a natural reaction to go into a mode of coping to the situation. That coping may get you through the storm but could have long term unexpected ramifications. Since the release of last year’s Refinitiv-RBAC 2020/2021 Winter Outlook a lot has changed in energy economics, operations, trade and infrastructure.

We have seen extreme weather drive multiple compound failures in the North American gas and power markets (e.g. Texas), where supply, demand and price balances were shocked and a reduction in exports by pipeline and LNG created ripple effects across the globe. Along with weather events, a shift in global energy policy due to climate change concerns has contributed to the uncertainty swirling around gas and LNG markets around the world.

To deal with these changes, Refinitiv and RBAC have incorporated a whole new set of weather scenarios along with numerous changes in gas and LNG fundamentals, policies, costs and constraints into RBAC’s G2M2® Market Simulator for Global Gas and LNG™, in order to produce an updated outlook for the 2021/2022 winter season. This report gives a detailed look at the changing dynamics of the U.S., European and Asian markets and delivers real insights to help you prepare for and get through any tumultuous weather ahead.

Introduction:

In the Fall of 2020, analysts at RBAC and Refinitiv partnered to develop several scenarios around the upcoming 2020/2021 winter season’s weather and other gas market dynamics. Simulations using G2M2 yielded several impactful insights including:

- Winter demand would likely be one of the primary drivers for Henry Hub price for 2020 Q4 and 2021 Q1. Strong US winter demand would likely keep gas at home rather than being sent overseas as LNG.

- In a post-COVID world, producers would be forced to be more flexible in managing short-cycle production, rather than outspending cash to achieve more aggressive growth.

- Europe and Asia domestic demand would both rely on LNG imports but influence its regional price differently.

This initial joint gas outlook generated a great deal of attention from the industry. But the actual winter of 2020/2021 had a far greater impact. Arctic blasts were more severe and more damaging than the results of all scenarios the team simulated. Gas storage was drawn down to dangerously low levels. As a result global gas markets have heated up to prepare for this coming winter. With the 2021/2022 winter season approaching, the RBAC and Refinitiv team has rededicated its efforts to producing a winter gas outlook for the coming heating season in the northern hemisphere.

Like in the previous study, the Refinitiv-RBAC team developed a series of 36 month forecasts using G2M2, exploring the interconnection between regional markets using both fundamental drivers and weather sensitivities. The team made runs using 19 different weather scenarios to estimate their impact on the global gas balance as well as prices at hubs in North America, Europe, and Asia.

Impact of Henry Hub Price on LNG Exports

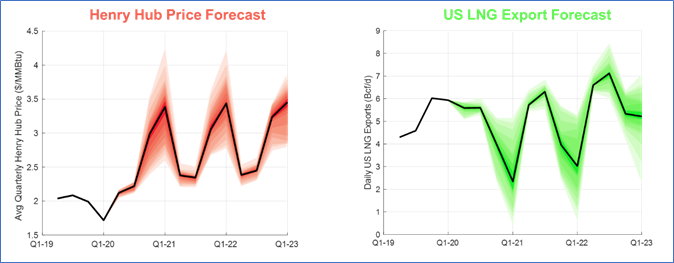

As we look back at the 2020/2021 Refinitiv-RBAC study, the 20 weather scenarios studied (based on the last 20 years of data) predicted a far less tumultuous and volatile winter season than nature delivered. Scenarios were not severe enough to push the simulation to generate spot price spikes, demand shocks and supply reductions approaching those that resulted from winter weather conditions that actually happened.

This was especially true for North America in February 2021 (see lower-left graph below but note the price scale is twice that of the upper left graph). The scenarios, data and simulation conditions could not have included the unknown factors around the unpreparedness of an insufficiently winterized power and gas pipeline network in the key producing region of North America and the resultant impact on LNG exports.

Chart 1 – 2020/2021 Henry Hub Price and US LNG Export Forecast

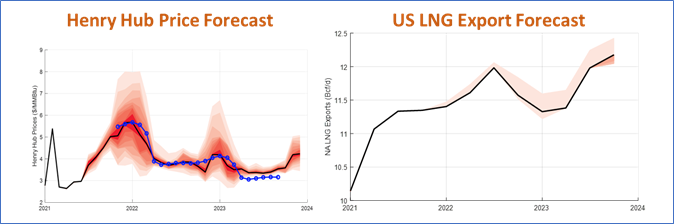

Chart 2 – 2021/2022 Henry Hub Price and US LNG Export Forecast

The study’s 2021/2022 outlook shows a significant increase in the average Henry Hub price to about $5.50/MmBtu in 2022 compared to $3.50MmBtu in last year’s study. In addition, in contradistinction to last year’s forecast, this year’s study projects LNG exports running close to 100% capacity throughout the forecast.

One might think with the increase in domestic prices for gas one would see a reduction in LNG exports as domestic markets would yield a greater potential for profit. However, that is not the case, as global gas and LNG prices have skyrocketed with supply shortages and lower than normal storage levels on the cusp of winter in Europe.

Global Gas and LNG Price

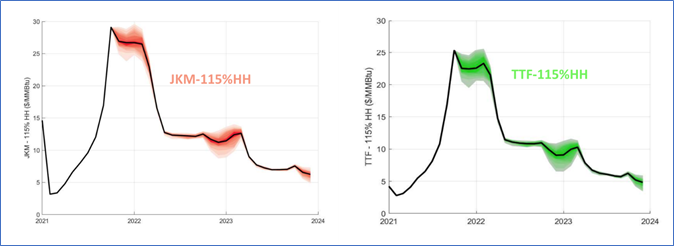

As global supply constraints continue to impact the gas and LNG markets, regardless of the varied weather scenarios studied using G2M2, the study projects price spreads for US LNG exports well above $5/MMBtu for the coming winter.

Chart 3 – 2021/2022 JKM and TTF Prices

European Gas Market – TTF Price Drivers

European Storage:

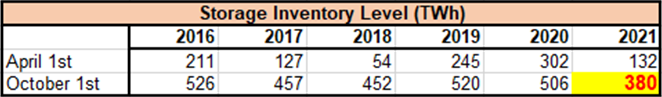

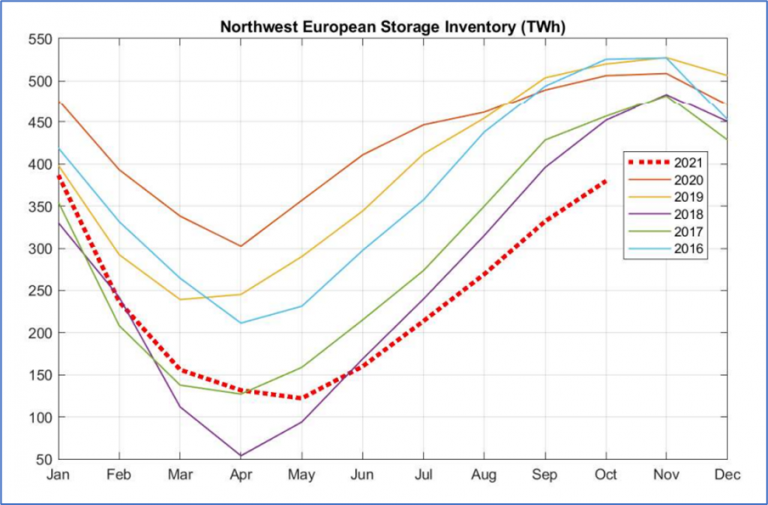

Gas storage has always been the market stabilizing factor during the winter season or unusually hot summers. However, record low Northwest European underground storage inventories have put intense upward pressure on TTF prices. Over the last 5 years, the amount of gas withdrawn during winter from NWE storage has swung wildly from 210 TWh during a mild winter of 2018-19 to 400 TWh in a very cold winter of 2017-18. The 2020/2021 winter was near normal weather conditions, but storage levels were down by 380 TWh.

Chart 4 – European Storage Inventory Levels

Higher than normal storage withdrawals in the 2020/2021 winter were driven by lower supply of LNG imports due to increased Asian demand during an unusually cold winter season. The LNG sendout was 20 Bcm (220 TWh), down from 33 Bcm (360 TWh) the previous year.

At the beginning of June 2021, European storage inventory stood at 160 TWh or 30% of capacity – the lowest level observed over the last 5 years (2016-2020) and significantly lower than the five-year average of 64%. A late winter also resulted in a delay in storage injection this year. Injections did not start until May while historically they have begun in April.

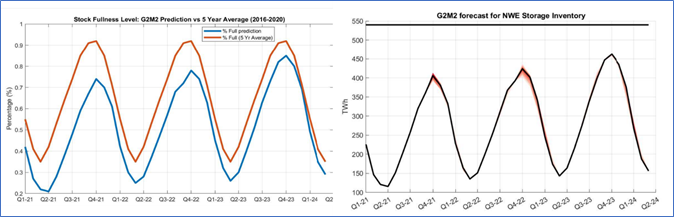

Chart 5 – Northwest European Storage Inventory

The G2M2 model used by the study team consists of a wide range of different demand forecasts based on 19 weather scenarios. The results from these scenarios show that approximately 230 TWh is expected to be withdrawn from NW Europe storage fields over this coming winter (Oct-Mar).

Coming out of winter 21/22, the model forecasts a storage level of about 135 TWh or 25% of storage capacity. This compares to the 5-year average of 35%. The NW European storage inventory level is expected to continue to stay below the 5 year average going into next year, catching up with the 5-year average only by the end of 2023.

Chart 6 – G2M2 European Storage Stock Level Outlook

Imports from Russia:

Although European nations are leading the way in the energy transition, European gas markets still rely heavily on gas and LNG imports to meet domestic demand. Gas imports into the EU are mainly delivered through pipelines from Russia, Norway, and North Africa as well as by LNG tankers from around the world.

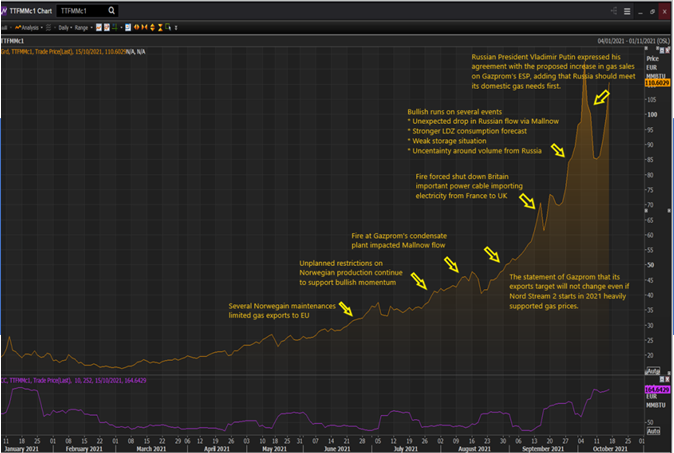

In recent months, uncertainty around Russian gas supply to Europe have had a significant impact on TTF prices. The European market continues to be very reactive to any indication of changes to gas supply. For example, there was a very strong reaction to potential changes around Russian supply from the Nordstream 2 pipeline and capacity auction results as you can see in the chart below.

Chart 7 – Price Impact of Supply Events and Announcements

European Gas Production:

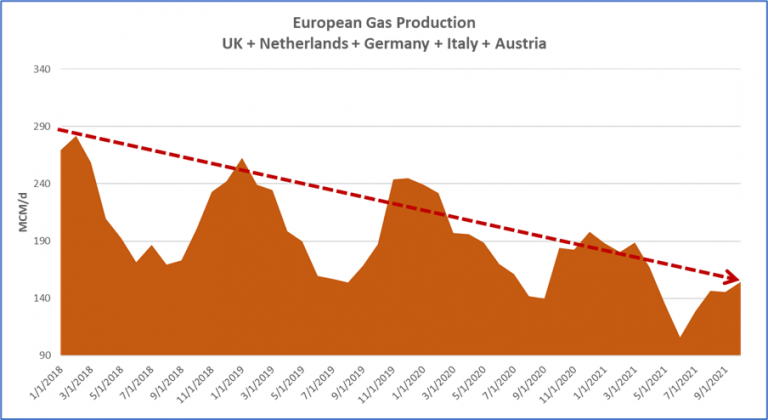

Further exacerbating the upward pressure on TTF prices, European gas production has continued to decline. There has been a drop in production from approximately 280 to 160 MCM/D since January 2018. With the targets for the energy transition well established, there is no indication that the EU will bolster domestic production. In order to stabilize prices, it will need to find a way to secure more gas supply, which will prove to be quite difficult in these uncertain times.

Chart 8 – European Gas Production

Key Take-Aways

Running a variety of weather scenarios using RBAC’s G2M2 Market Simulator for Global Gas and LNG has yielded some very important take-aways that need to be evaluated when considering one’s market fundamentals analysis for the upcoming winter season.

- As always, the weather is one of the biggest unknowns and risks.

- Given the current tightness situation in the gas market globally, colder than normal winter in any of the big markets of the Northern hemisphere (US, Europe or Asia) would send major hub prices even higher and leave markets with the risk of a physical gas shortage over the winter months.

- Some blackouts or demand disruptions may be inevitable if demand is unusually high this winter.

- In addition, this also means that the tightness in global gas market will remain for longer as it will take more time for countries to replenish their underground storage stocks.

- Demand growth in other regions (i.e., China, South America) could exacerbate the current tightness in the market forcing Asian and European customers to compete for the same LNG cargoes.

- Europe could expect continuing limited Russia gas supply. When it will begin flowing and how much gas to be expected from Nord Stream 2 is still quite uncertain.

- Regarding the Nord Stream 2 pipeline, there has already been some delay in the expected start date due to its certification process, which is a mandatory final step before the pipeline can be commissioned and start commercial flows. Among other things, the certification process was hampered by American sanctions and opposition from Poland and did not start soon enough to meet the originally scheduled start date of October 1st, 2021. The certification process is expected to take up to 6-8 months to complete from early September when the pipeline operator submitted its application to the German regulator. For this study, the team has assumed it to start flowing by the end of Q1 2022.

- Another risk is how long it will take Nord Stream 2 to ramp up deliveries once it is commissioned. To date, Russia has not committed to any figure on how much gas will be send to Europe via the new projected route. There is a possibility that it may be at limited capacity.

Conclusion

Winter will always deal unpredictable conditions that impact the market one way or another. Continued growth in demand and tight supply during the energy transition will put upward pressure on prices throughout the Northern Hemisphere. Using market simulation such as has been done in this study allows one to quickly analyze a variety of potential assumptions and scenario outlooks to determine a credible range of results in order to make good decisions to achieve an organization’s goals including those demanded by the energy transition.

Team Leads:

RBAC

Dr. Ning Lin, Ph.D. – ning.lin@rbac.com

Dr. Robert Brooks, Ph.D. – robert.brooks@rbac.com

Refinitiv

Nantanaporn Udomchaiporn – nantanaporn.udomchaiporn@refinitiv.com

Xin Tang – xin.tang@refinitiv.com

RBAC Inc. is the market leading supplier of global and regional gas and LNG market simulation systems. These systems provide industry analysts powerful tools for supporting corporate investment and M&A strategy, improving free cash flow, achieving environmental and sustainability goals, including reduction of CO2 emissions, conducting credible and useful risk analysis and planning, and enhancing profitability in commodity trading. Organizations using RBAC’s products and services include energy industry firms and consultants, ISOs and RTOs, and government agencies involved with energy, transportation, and the environment. The G2M2® Market Simulator for Global Gas and LNG™ is designed for developing scenarios for the converging global gas market. It is a complete system of interrelated models for forecasting natural gas and LNG production, transportation, storage, and deliveries across the global gas markets.

Refinitiv, an LSEG business, is one of the world’s largest providers of financial markets data and infrastructure. Serving more than 40,000 institutions in over 190 countries, we provide information, insights, and technology that drive innovation and performance in global markets. Refinitiv Natural Gas and LNG Research teams provide the most comprehensive insights on market developments, price movements and supply/demand forecasts by leveraging sophisticated proprietary modelling and forecasting techniques. Our reports can help you understand the global gas market and empower you to make informed trading decisions. For more information, please visit: https://www.refinitiv.com/en