In a recent post, Mark P Mills put it bluntly: “Electricity is the new oil,” pointing out that while oil powered the 20th century’s industrial growth, electricity is now the prime mover of the digital economy — from AI and data centers to EVs and cloud infrastructure. If that is true, then Natural Gas is the prime mover of electricity [double prime as we would say in math class].

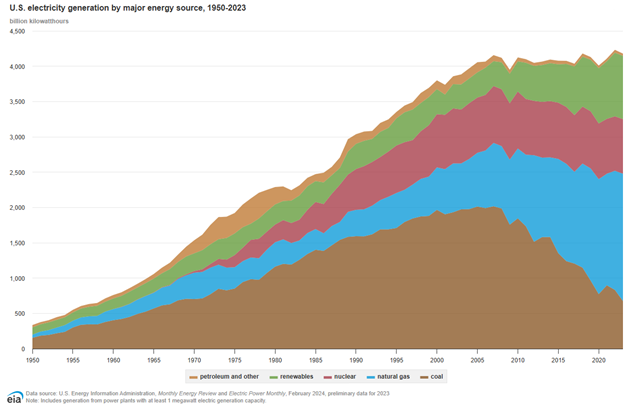

Remember, just 10 years ago, power generation growth was flat, as the IEEE stated in a 2015 article, “The U.S. economy has grown 8 percent since 2007, but the annualized electricity demand growth has been zero over that same period.” And BloombergNEF stated at the time, “There has been an outright decoupling between electricity growth and economic growth.” How times have changed!!

True, digital infrastructure (unlike traditional loads) demand reliable, always-on power. But the difference today is the massive buildup and volumes, not just sparked by AI and data centers, but everything digital and increased electrification.

And utilities are gearing up to meet this demand; for example, Dominion Energy and others are preparing to spend heavily on both renewables and firm capacity to meet this new baseline of power needs.

Indeed, “We’re now moving at speed into the Age of Electricity,” IEA Executive Director Fatih Birol declared in late 2024, and further stated that energy will “increasingly be based on clean sources of electricity.” Although we won’t debate here the word “clean,” it might be noted that the massive mining needed for renewable energy sources’ raw materials and manufacturing them also requires immense energy supplied mostly by fossil fuels. Safe to say that, Mr. Birol is referring to renewable energy sources such as wind and solar.

But here’s the rub: intermittent power sources (such as wind and solar) don’t meet the needs of 24/7 operations like AI training or industrial automation. They require flexible, dispatchable support — which today, comes overwhelmingly from natural gas.

A Real Clear Energy report stated, “Today, solar and wind are relatively low cost, and prices will likely fall further. But they are not like fossil fuels—they are what’s known as variable renewable energy (VRE)—meaning they only produce electricity when the sun shines or the wind blows.

“Electric utilities are currently adding lots of short duration (4-hour) lithium-ion batteries to address [this] … but while these batteries are reliable and can be turned on with the flip of a switch, they only solve VRE deficits for a few hours at a time. Longer duration VRE deficits are another matter. What happens when deficits last for weeks or months?”

The Central Role of Natural Gas in this new the Energy Transition

Natural gas currently fuels more than 40% of all U.S. electricity generation, according to the U.S. Energy Information Administration (EIA). It provides critical ramp-up and backup power to compensate for fluctuations in renewable generation — especially during peak demand or weather disruptions.

- The Interstate Natural Gas Association of America (INGAA) notes that natural gas provides the grid with “reliability, affordability, and dispatchability” — characteristics renewables alone cannot yet offer at scale. (INGAA)

- A McKinsey & Company report emphasizes that natural gas is crucial for decarbonizing power, acting as a flexible buffer to variable renewables. (McKinsey)

Yet while natural gas remains indispensable, the interdependency between gas and power markets is creating new modeling challenges. As demand for electricity grows — and with it, natural gas demand — so too does the complexity of understanding market interactions.

Why Traditional Energy Modeling Isn’t Enough

Here’s the issue: electricity market models and gas market models often operate in silos. Thus, and commonly, when planners assume a static gas price for power generation, the resulting demand from their models may feed back into the gas market — causing price shifts the models didn’t anticipate.

This leads to:

- Misaligned forecasts

- Poor infrastructure investment timing

- Missed opportunities and heightened corporate risk

Moreover, with LNG exports growing, international markets are exerting greater influence over U.S. gas prices, which in turn affect domestic power costs. Analysts and policymakers need tools that can account for this circular, dynamic relationship between gas and power.

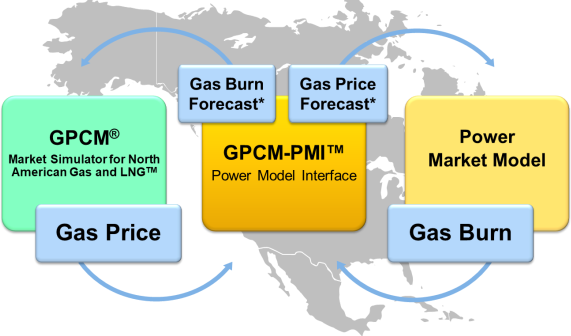

So, for RBAC, the challenge was to bridge the gap or de-SILO the systems. That is how Gas4Power came into being to bring real Integrated Market Insight.

Utilizing RBAC’s PMI (Power Model Interface), RBAC created robust platform for simulating gas and power market interactions in an iterative and transparent way. It gives energy analysts and planners a consistent and credible forecast across both markets, empowering smarter decisions at all levels. And it works with all major power models and both North American and Global Gas models (GPCM and G2M2).

This is how you eliminate mismatches between gas price inputs and power model outputs, do scenario testing for LNG exports, CO₂ pricing, infrastructure changes, and renewables, create detailed modeling by basin, sector, region, and even individual terminals or aggregate by region looking at the global model.

The system incorporates proprietary data alongside RBAC’s quarterly base case and supports both historical calibration and forward-looking analysis.

Of course, why would energy companies, consultants or regulators need such tools?

We are in a constrained grid environment.

Policymakers are starting to acknowledge the risks of underinvestment in firm capacity and transmission infrastructure. According to the Electric Power Supply Association (EPSA), natural gas remains the largest source of dispatchable, cost-effective power across nearly every U.S. region.

We’ve been reading for quite a few years about shortages in transformers, switchgear, and transmission permitting delays. These are known bottlenecks. Thus, the stress to the grid increases as we increase the load.

In this context, the ability to accurately simulate system-wide dynamics isn’t just helpful — it’s vital to prevent blackouts, reduce volatility, and allocate capital efficiently.

In Summary

Thus, if electricity is indeed the new oil — and the global economy’s dependence on data, automation, and electrified mobility is only accelerating, then the reliability and economics of electricity now hinges more than ever on that firm capacity. And all roads right now are leading toward natural gas and how it integrates with the power sector.

Key takeaways:

- Gas demand affects electricity price

- Electricity demand drives gas demand

- Global LNG trends reshape local and regional markets

How can we optimize this complex feedback loop?

When modelling is done that is transparent as to its inputs the gears that turn, and when that model is robust enough to be calibrated against historical data, then you use it.

If you’re an analyst modeling future scenarios, a utility making investment decisions, or a policymaker crafting energy resilience strategy. This is what you need.

This is how you make better energy decisions.

Interested in learning more about Gas4Power and Power Model Interface? Contact us here for more information and to schedule a free demonstration.

RBAC is the market-leading supplier of global and regional gas and LNG market simulation systems used by the energy industry and related government agencies for over two decades. The GPCM® Market Simulator for North American Gas and LNG™ is the most widely used natural gas market simulation system in North America. RBAC’s G2M2® Market Simulator for Global Gas and LNG™ has been instrumental in understanding evolving global gas and LNG market dynamics and is vital to fully grasp and leverage the interrelationship between the North American and global gas markets.