There is no doubt we hear echos and rumblings of a possible return of Russian gas to Europe—not that it ever left, in actual fact. Let’s take a look at Russian LNG.

In early 2024, RBAC’s Dr. Robert Brooks analyzed Russia’s LNG export strategy, highlighting challenges like Arctic logistics, limited market access beyond China, and the potential of the Northern Sea Route. Fourteen months later, current developments validate these insights. So, let’s start by looking at the recent scene.

Despite EU ambitions to phase out Russian fossil fuels by 2027, imports of Russian LNG surged to record levels in 2024, with Europe importing 17.8 million tonnes—a 9% increase from the previous year. Germany’s imports alone soared by over 500%, totaling €7.32 billion. This uptick is partly due to discounted Russian LNG prices and the absence of EU sanctions on LNG, even as pipeline gas imports have declined.

China’s role as a primary market for Russian LNG is expanding. In 2024, China’s imports of Russian LNG increased by 3.3%, with expectations for further growth in 2025. This aligns with Dr. Brooks’ observations about Russia’s pivot towards China amid Western sanctions.

However, logistical challenges persist. The Northern Sea Route remains seasonally limited, and sanctions have hindered the completion of Arctic LNG 2, with key partners like TotalEnergies withdrawing support. These factors constrain Russia’s ability to expand LNG exports beyond current levels.

While Russia has managed to increase LNG exports to Europe and China, technical and geopolitical hurdles continue to limit its long-term expansion.

Thus, Dr. Brooks’ analysis remains very pertinent, offering valuable insights into the fluid and dynamic global LNG market.

The Future of Russian LNG: Geopolitics, Markets, and Modeling

In an episode of the Global Gas and LNG Insights Podcast, produced by Natural Gas World in partnership with RBAC, Inc. In this episode, RBAC’s founder and CEO, Dr. Robert Brooks, explores the evolving landscape of Russian natural gas—particularly LNG—and its broader implications for global markets, energy strategy, and geopolitics.

Russia’s Emergence as an LNG Exporter

Russia has grown steadily as an LNG exporter over the past 15 years. Starting with the Sakhalin facility supplying Japan, Korea, and China, the country expanded its export capacity with the Yamal LNG project located in the Arctic region. The Yamal facility, led by Novatek rather than Gazprom, represented a pivotal shift in Russian gas strategy—low-cost production with high logistical complexity due to the need for ice-class LNG carriers. Although the Eastward Northern Sea Route is only open for about four months per year, LNG can be shipped Westward and redirected globally, albeit with longer transit times and higher costs.

Pipeline Decline and LNG Resilience

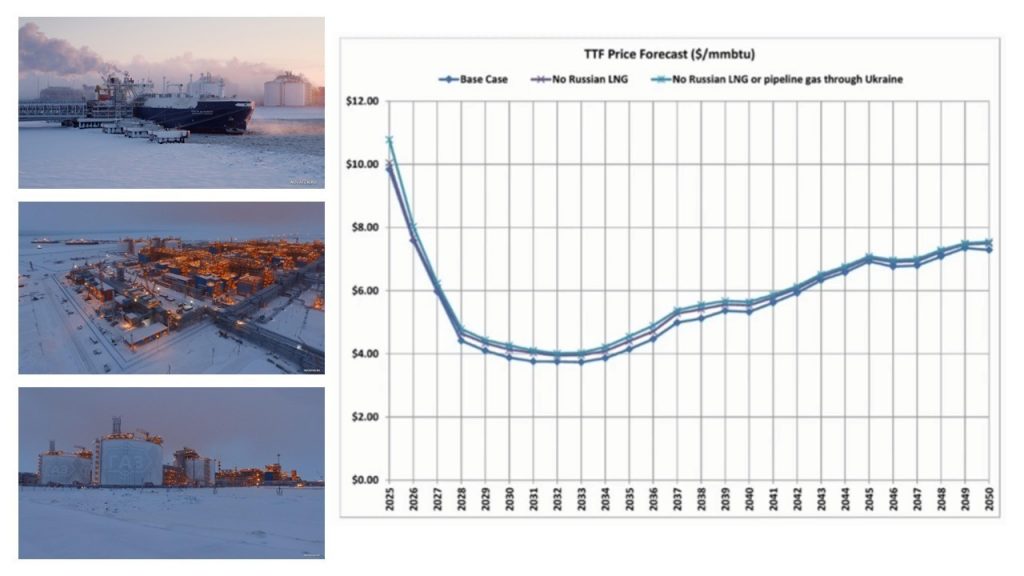

While pipeline gas exports to Europe have plummeted—especially after the Russia-Ukraine conflict escalated—LNG flows from Russia to Europe have persisted. Using RBAC’s modeling tools, Dr. Brooks shared projections indicating that while Russian pipeline flows via Ukraine are likely to decline further after 2024, the effect on European prices may be more muted than expected. Europe’s demand response and diversification have insulated it to some degree from further Russian supply disruptions.

Scenario Modeling: What If Russian Supply Disappears?

RBAC simulated three scenarios using the G2M2 global gas market model: a baseline, a scenario excluding Russian LNG to Europe, and a scenario also removing all Russian pipeline gas through Ukraine. While each scenario saw rising prices, the differences between them narrowed over time. This suggests that Europe’s declining demand, conservation efforts, and expanding alternative sources are mitigating factors.

Russia’s Search for New Markets

With Europe becoming a less reliable buyer, Russia is seeking new destinations for its gas. China appears as the primary candidate, given its proximity and massive demand, though it already produces a significant share of its own gas. Negotiations over the proposed Power of Siberia 2 pipeline—sourced from the Yamal region—highlight China’s strengthened bargaining position. Other markets like India are geographically distant, and Central Asia already has sufficient domestic supply.

Navigating the Arctic: Northern Sea Route and Logistics

One of Russia’s strategic ambitions is year-round navigation of the Northern Sea Route. This could double LNG shipments to Asia by offering a direct Eastward path from Yamal. However, without complete year-round access, Russia has relied on complex transshipment via Europe or offshore hubs like Murmansk and Kamchatka. Novatek has invested in reloading infrastructure to improve efficiency and reduce reliance on expensive Arc7 tankers for long-haul delivery.

Challenges Facing Arctic LNG 2

Novatek’s Arctic LNG 2 project—slated for a 20 MTPA capacity—faces major headwinds due to sanctions. Many international partners have withdrawn under force majeure clauses, placing the project’s full operation in jeopardy. Without access to foreign technologies and markets, the project might operate below capacity, compounding the difficulty posed by its remote Arctic location.

Global Competition and Russian Constraints

As Russia eyes LNG expansion, it faces rising competition. The U.S. is poised to dramatically grow LNG exports, and Qatar plans to expand from 77 to 126 MTPA. African nations like Mozambique and Tanzania are also advancing LNG projects, well-positioned to supply India and Southeast Asia. These competing sources offer lower costs and fewer geopolitical risks.

Contractual Realities and Market Implications

Dr. Brooks emphasized the importance of long-term contracts. In RBAC’s simulations, contracted LNG flows remain stable even when market economics suggest otherwise. Without new offtake agreements, Russian LNG volumes may stagnate. The expansion of LNG exports requires not just production capability but also the certainty of destination markets secured through contracts.

The Role of Modeling in Energy Decision-Making

RBAC’s modeling tools, including G2M2, help stakeholders simulate outcomes based on policy shifts, infrastructure investments, and market behavior. Governments, investors, and academics rely on such models to support sustainable, data-driven decisions. As geopolitical pressures increase and new markets emerge, modeling becomes critical to navigating risk and opportunity.

Finale: The Path Ahead for Russian LNG

Despite vast gas reserves and engineering innovation, Russia’s LNG ambitions face logistical, contractual, and geopolitical hurdles. While it may find modest success in redirecting flows to Asia, especially if the Northern Sea Route becomes navigable year-round, true global competitiveness depends on access to technology, partners, and stable markets. RBAC’s tools aim to illuminate these complexities, supporting better decisions in a world of evolving energy dynamics.

Find out more about our market simulation tools by clicking here and sign up for a free demonstration of their capabilities.

RBAC is the market-leading supplier of global and regional gas and LNG market simulation systems used by the energy industry and related government agencies for over two decades. The GPCM® Market Simulator for North American Gas and LNG™ is the most widely used natural gas market simulation system in North America. RBAC’s G2M2® Market Simulator for Global Gas and LNG™ has been instrumental in understanding evolving global gas and LNG market dynamics and is vital to fully grasp and leverage the interrelationship between the North American and global gas markets.