A Historical Review of Tariffs on China-U.S. LNG Trade

As the new Trump administration takes office, discussions around LNG tariffs have resurfaced due to China’s imposition of additional tariffs on U.S. LNG during his previous presidential tenure. Examining the market changes during the previous tariff period may offer valuable insights into the current situation.

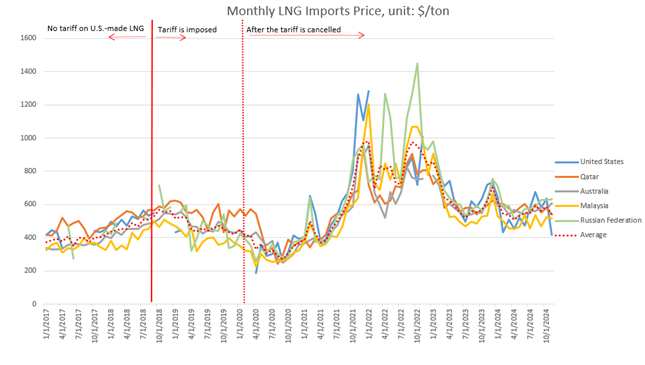

In September 2018, a 10% tariff was imposed on LNG imports, which was subsequently raised to 25% in May 2019. By March 2020, the tariffs were lifted. Following the imposition of tariffs, LNG import prices in China saw a slight increase but avoided a panic-driven spike. After the tariffs were removed, prices gradually declined over the subsequent year.

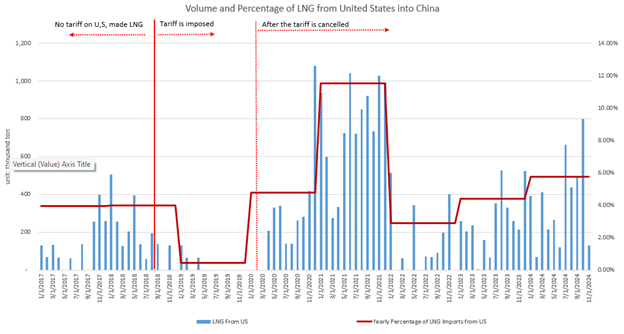

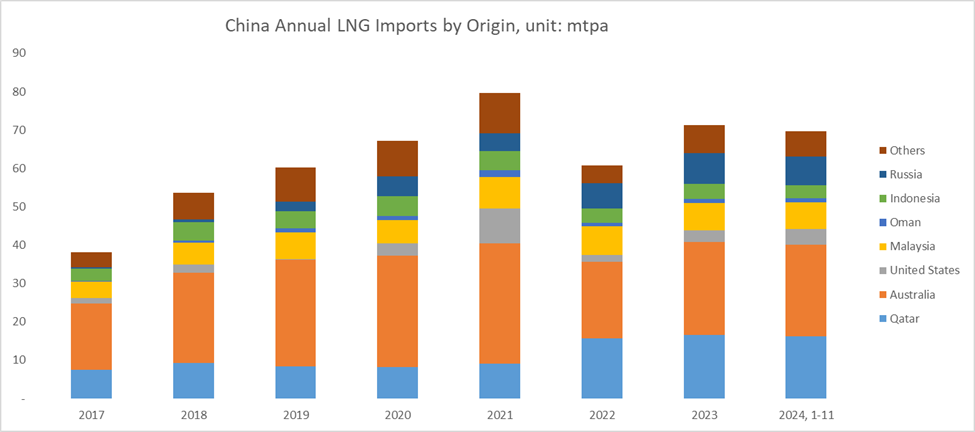

In terms of LNG import volumes, U.S. LNG exports to China were significantly impacted by the introduction and removal of tariffs. In 2021, U.S. LNG accounted for a record-high share of China’s imports, exceeding 10% for the first time. However, due to the Russia-Ukraine war, much of U.S. LNG was redirected to Europe. Alongside China’s increasingly diversified LNG import portfolio in recent years, U.S. LNG now represents only a small portion of China’s LNG imports, accounting for approximately 6%.

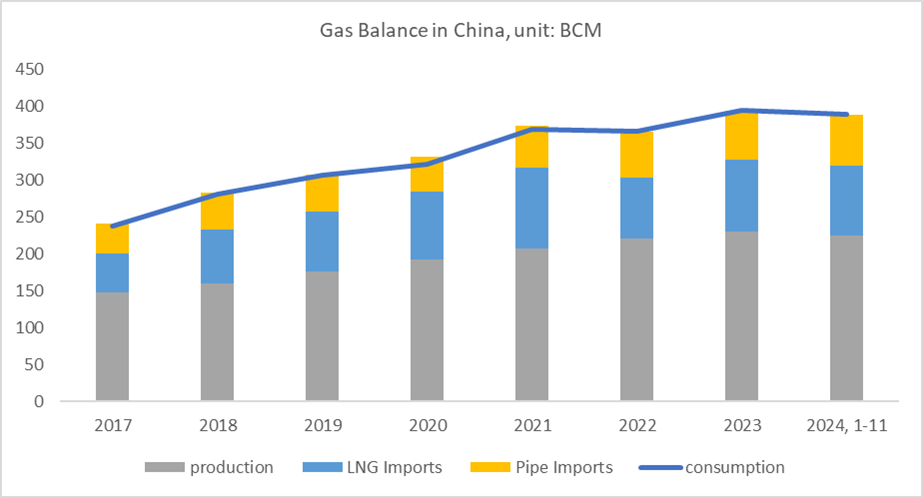

This time, the situation differs from 2018 in several ways: the total volume of LNG imports into China has significantly increased, and the sources have become more diversified. On the other hand, the Power of Siberia pipeline is operational and running near full capacity. Imposing tariffs will certainly impact China-U.S. LNG trade; however, it is unlikely that China’s natural gas market will be significantly affected. So, this begs the question, what is the current state of China’s domestic gas market?

China Gas Consumption Exceeds 400 BCM and LNG Imports Stays Number 1 in 2024

China’s domestic natural gas consumption has been growing over the past decade, with the exception of a less than 1% decrease in 2022. In the past two years, it has returned to a growth trend of over 5% annually. In 2024, natural gas consumption is expected to exceed 400 billion cubic meters for the first time.

Although LNG imports decreased in 2022 due to a decline in domestic demand, causing China to lose its position as the world’s largest LNG importer that year, it regained the top spot in 2023, surpassing Japan once again. In 2024, LNG imports are expected to continue growing steadily, maintaining China’s position as the largest importer and potentially approaching the historic peak reached in 2021.

With LNG demand from Europe on track to decline in the coming decades, Asia and more specifically China will be a market that energy industry players around the globe will keep a watchful eye on.

To see how the market in this region of the world will continue to evolve, RBAC’s G2M2® Market Simulator for Global Gas and LNG™ is an invaluable tool for forecasting the global gas and LNG market. It allows energy professionals, executives, analysts, and policy makers to run any number of scenarios accounting for different actions they could take and what market variables would be affected. G2M2 is sure to assist in achieving energy security goals and increased knowledge in the potential of the future market before making final investment decisions, all through robust market analysis.

Look out for Part 2 of this analysis powered by G2M2 Market Simulator for Global Gas and LNG, with various tariff scenarios run should there be a Trade War 2.0 with China.

Would you like more information about RBAC’s market simulation tools? Contact us for questions or to set up a demonstration.

RBAC, Inc. has been the leading provider of market fundamental analysis tools used by the energy industry and related government agencies for over two decades. The GPCM® Market Simulator for North American Gas and LNG™ is the most widely used natural gas market modeling system in North America. RBAC’s G2M2® Market Simulator for Global Gas and LNG™ has been instrumental in understanding evolving global gas and LNG dynamics and is vital in fully understanding the interrelationship between the North American and global gas markets.