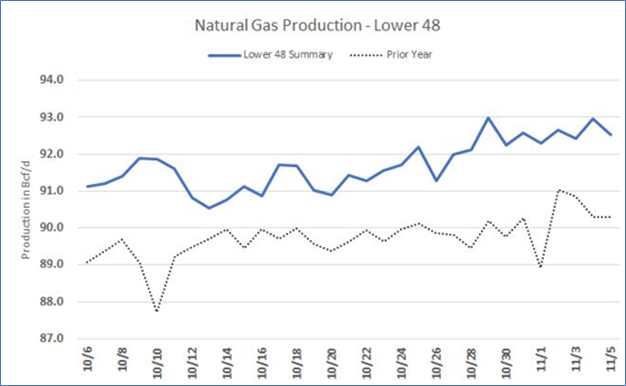

For independent natural gas producers, the saying “When opportunity knocks, answer the door.” has never been truer. Despite a high natural gas price environment, there have been limited production increases from major publicly held companies. Even with natural gas prices in excess of $5.00/MMBtu, US dry gas production has averaged about 92 Bcf/d over the past few months, well below the pre-pandemic peak of 97 Bcf/d. At $5.00/MMBtu, most shale gas plays are economic, yet production hasn’t ramped up. Why?

Source: Criterion

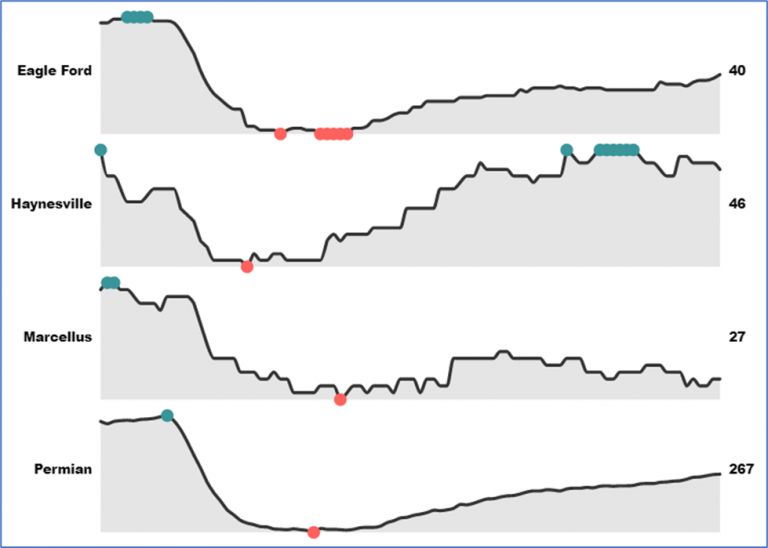

The easy answer would be to blame this supply doldrum on a green energy agenda pushed by investors. However, a deeper look reveals myriad complexities affecting the market. Many companies hedged production through 2022. For example, EQT, a large Appalachian producer, hedged their production before this Henry Hub runup and is currently looking at $5 billion in missed revenue. Six other Marcellus producers account for another $7.5 Billion in lost revenue, totaling over $12 Billion just in that basin. Adding to Marcellus producers’ woes is a lack of takeaway capacity to premium priced markets. Speaking on CNBC’s “The Exchange” EQT’s CEO, Toby Rice, has gone as far to say “This is self inflicted problem”; indicating that shale producers could increase flow 20% given adequate infrastructure.

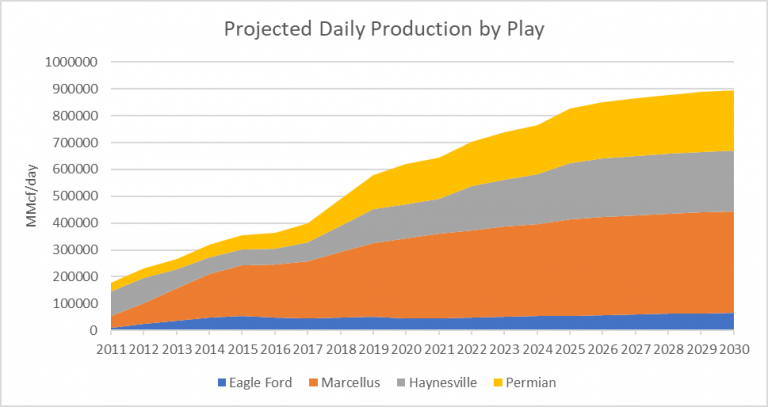

Mountain Valley Pipeline (MVP), a 2 Bcf/d project designed to ship gas 304 miles from northern West Virginia into southern Virginia, could alleviate bottlenecks in Appalachian production. However, following the cancellation of the PennEast Pipeline construction in September, citizen and environmental groups are pushing back against MVP with renewed vigor, and it’s possible that the same issues that doomed the PennEast project could scuttle the MVP project. With low incentive to drill and limited take-a-way capacity, many large publicly traded Marcellus producers are choosing to hold production levels steady, focusing on free cash flow and ESG improvement. Highlighting the need for sound mid- to long-term forecasting and market analysis similar to RBAC’s GPCM® Market Simulator for North American Gas and LNG™. Our 21Q3base release incorporates the latest supply, demand, infrastructure, and tariff data to drive decisions so you can sleep at night.

Source: Baker Hughes, RBAC

In Texas, particularly the Permian Basin, significant rig growth increases are being seen as small independents are reworking and bringing on production at a frenzied pace. In July 2021, the Midland sub-Basin accounted for 107 drilling rigs and 28 fracking crews alone, making up 22% of all active rigs in the US. Perhaps the most prolific basin in the US, the Permian accounts for about 30% of crude oil and 14% of natural gas. Unconstrained by shareholders and board members, these producers are maximizing their operational flexibility to take advantage of the pricing environment. At the same time, these companies are developing ESG goals of their own. Many companies are reducing flaring and venting, while others are recycling their frac fluid with the goal of being self-sustainable by mid-2022.

Source: GPCM

All of this puts independent producers in an advantageous spot. Lower 48 natural gas production has not returned to pre-Covid levels, despite LNG and pipeline exports hitting record highs, pushing Henry Hub pricing to levels it has not seen since 2014. With significant barriers to production gains in other regions, paired with reasonable, well thought out ESG agendas, it appears that Texas independent producers are answering opportunity’s knock.

These complex and changing market conditions demonstrate the need for a powerful analytical tool, driving strategies and decisions that allow businesses to prosper. RBAC’s GPCM® Market Simulator for North American Gas and LNG™ is designed to allow users to do just that, conducting a wide array of scenario analysis; altering supply, demand or infrastructure assumptions to quickly and easily execute simulations. RBAC’s 21Q3 base database and forecast is a snapshot in time that serves as a starting point. It provides users with an up-to-date database of supply, demand, infrastructure, tariffs, and cost components. Developed and released quarterly, the outlooks allow users to better simulate and identify risk, leading to more optimal risk management, hedging, and decision-making for when the opportunity knocks.

For additional information please contact James Brooks at (281) 506-0588 ext. 126 or click here to contact.