With tensions escalating higher between Moscow and Kiev, Europeans have been looking for alternative sources of LNG to not only address the current energy crisis in Europe, but also provide some measure of energy security should a conflict between Russia and Ukraine break out.

Using RBAC’s G2M2® Market Simulator for Global Gas and LNG™, we developed a scenario where European imports of Russian gas drop to zero starting in February of 2022. In comparing this scenario to our latest base case we found:

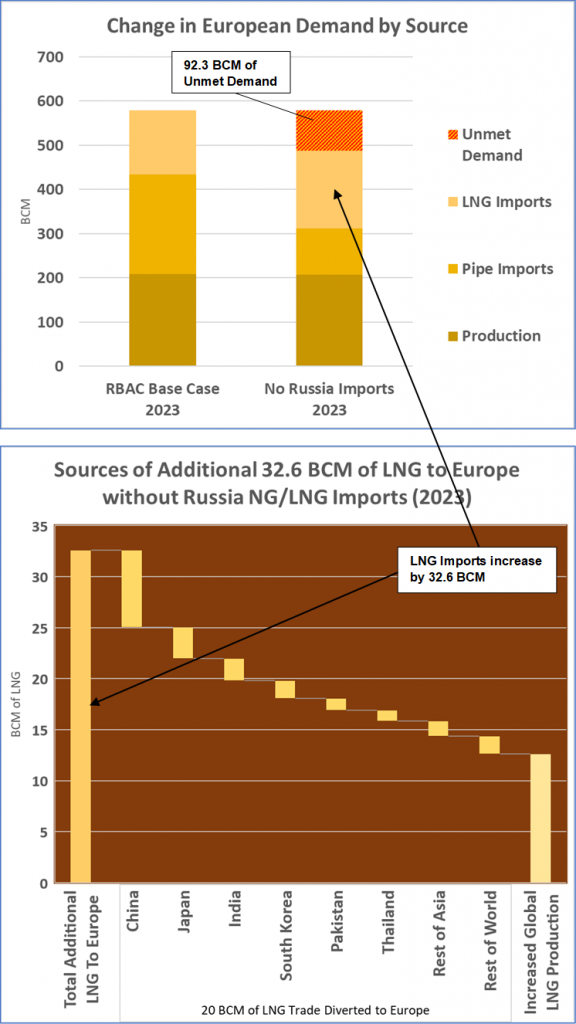

- There is not enough global LNG capacity available to completely offset the loss of Russian pipeline and LNG exports into Europe

- European LNG imports increase by 32.6 BCM, but roughly 92.3 BCM of European demand cannot be met

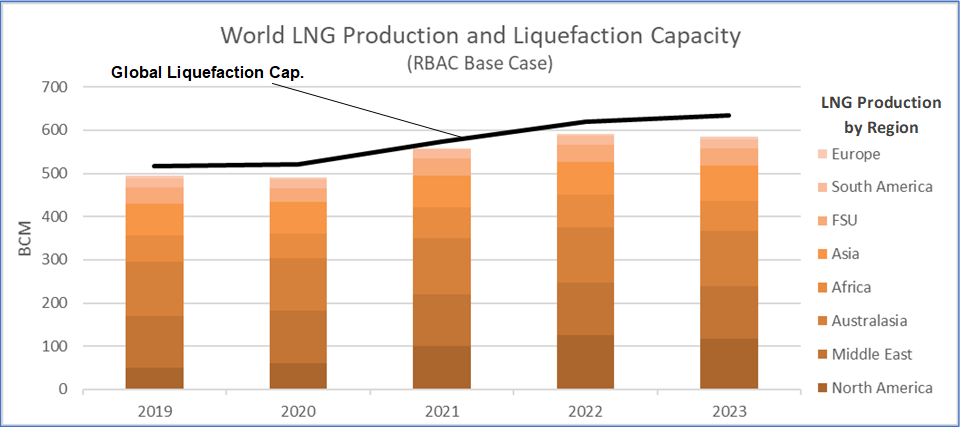

- Of the 32.6 BCM increase in LNG imports, 12.6 BCM comes from increased utilization of liquefaction facilities while 20 BCM comes from diverted LNG trade—primarily exports intended for Asia

We also found that Russian LNG exports drop globally as shipments from Yamal cannot reach countries in Asia during the winter months when the Northern Sea Route is closed; utilization of US LNG export facilities can be increased to offset some of the lost supply; and Middle East and Australia are operating at max capacity in the base case and cannot increase production.

A conflict with Ukraine could prove to be quite costly for Europe in both the higher cost of importing LNG and the loss of natural gas supply for consumers. For Russia, it could mean a significant loss of market for its pipeline gas as well as the inability to ship LNG from Yamal during the winter months to key markets in Europe while the Northern Sea Route to Asia is closed. Even if Russia resumes gas deliveries to fulfill contractual obligations, the Biden Administration has already indicated steep sanctions on the yet to be commissioned Nord Stream 2 pipeline should Russia invade Ukraine. Is it really worth the cost? For more information about this study or how G2M2 could be utilized for your market analysis, contact Ed O’Toole at edward.otoole@rbac.com or James Brooks at james.brooks@rbac.com.