by G2M2 Team and Jane Li, Zion Energy Consulting

Market Disruption

Recent events in the Russia-Ukraine conflict have sent shock waves through the global gas market.

E.U. countries are currently scrambling to piece together a plan to reduce their dependence on Russian gas by two-thirds by the end of 2022, which is a tall order even when stretching assumptions.

TTF prices have been trading at a premium versus JKM, and the spread between Asia and Europe in February and March of this year was more negative than ever. The forward curves have reflected deeper concerns of European buyers beyond this winter season’s gas supplies.

Overall, Europe scrambling to reduce its dependence on Russian gas has been tightening the global LNG market. Doubling LNG deliveries to Europe in March and April compared to January and February of this year to is only a preview of what is coming for future winter seasons. And it is impossible to predict how and when this Russia-Ukraine conflict will end.

Lasting impact on the global market

This event resulted in fundamental shifts in the global gas market, and it is critical to recognize the medium to long-term impacts it is going to have. The need for additional LNG to Europe has boosted new LNG liquefaction projects, particularly in North America, although uncertainties in demand and energy transition policies may curb investors’ appetite and the pace of the project.

The call for more LNG imports to Europe has resulted in a direct push for additional LNG liquefaction capacities from key exporting markets. As Europe tries to buy more LNG to reduce its dependence on Russian gas, U.S. LNG has responded with boosted send-outs from February, with additional capacity expansions swiftly underway.

However, for the fundamental balance of supply and demand in the market, it still looks like a tight period for LNG trade for now and the near future with much higher prices and volatility. It takes more than high prices to boost stake holder’s confidence in a final investment decision due to uncertainties of long-term demand and the possibility of an accelerated energy transition away from gas, exacerbated by limited investment financing options and a short ramp up for new projects.

On the demand side, the high price of LNG is also incentivizing European countries to accelerate their progress on decarbonization, pushing harder on finding alternatives, including hydrogen and renewables, in the medium and long term. On the other hand, the high price of LNG also raises concerns about affordability for emerging markets like India and Pakistan which could reverse their commitments to move away from coal. This demand destruction for price-sensitive countries puts an additional burden on global energy transition progress.

This article focuses on the lasting impacts on LNG contracting from two specific angles: global LNG contracting levels by key importers and future trends of LNG contract behavior.

Changing dynamics of LNG contracting

The current geopolitical drama has posed a challenge to LNG buyers and their bargaining power in Europe and Asia during the next round of LNG contracting. This has led to a revival of interest in long-term contracts and a move away from spot markets to avoid price volatility, as well as a focus more on energy security and diversification.

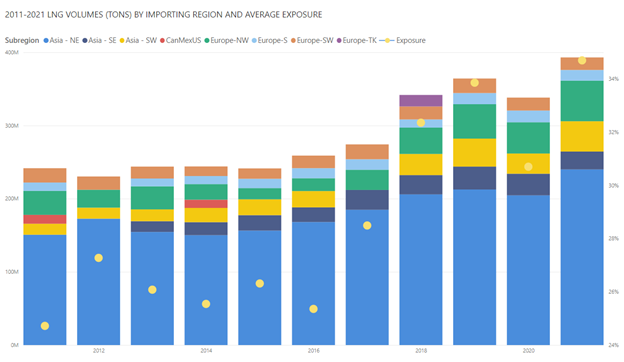

Figure 1 shows the global LNG import volume by region over time since 2011 based on the G2M2® Market Simulator for Global Gas and LNG™. In addition to the total volume, the percent exposure to spot volume increased over time, particularly in 2017-2019, when the market was optimistic about the increased liquidity. In 2020, the market was interrupted by Covid-19 resulting in lower trade volumes of LNG, yet the trade volumes rebounded in 2021. The average exposure to spot increased from about 25% back in 2011, rising more quickly from 2016 to 2021 to about 35%. If there were no additional contracts made for the rest of this year, and with expected volume increases in the LNG market, the percentage of spot in total trade would reach over 40% by the end of 2022. The events in Ukraine have generated concerns over supply security around the globe. This should incentivize buyers to opt for long-term contracts, even if costs are higher than they might have been comfortable with before the conflict began.

Figure 1 LNG import volume by importing region and percent exposure to spot by year

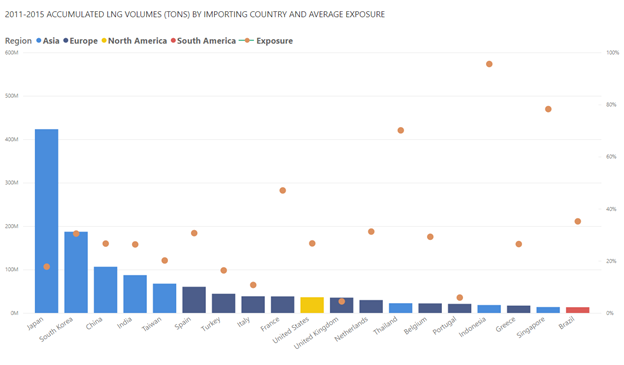

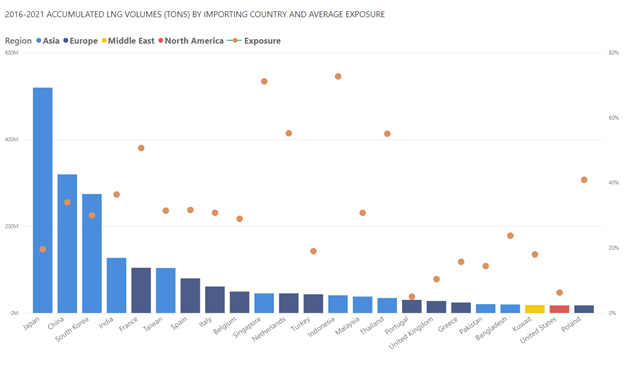

Figure 2 looks at individual countries’ exposure to spot volume and LNG trade. Note that the top LNG importers have increased their reliance on the spot market in the past five years (2021-2016) compared to the prior five years (2011-2015). For European LNG importers, there has been additional volume and countries participating in LNG trade over the past five years and exposure to spot volume is relatively high based on their existing contracts. For example, France and the Netherlands both have over 40% exposure in the spot market for LNG trade.

Figure 2 looks at individual countries’ exposure to spot volume and LNG trade. Note that the top LNG importers have increased their reliance on the spot market in the past five years (2021-2016) compared to the prior five years (2011-2015). For European LNG importers, there has been additional volume and countries participating in LNG trade over the past five years and exposure to spot volume is relatively high based on their existing contracts. For example, France and the Netherlands both have over 40% exposure in the spot market for LNG trade.

Figure 2 Accumulated LNG volume by importing country for 2011-2015

Figure 3 Accumulated LNG volume by importing country for 2016-2021

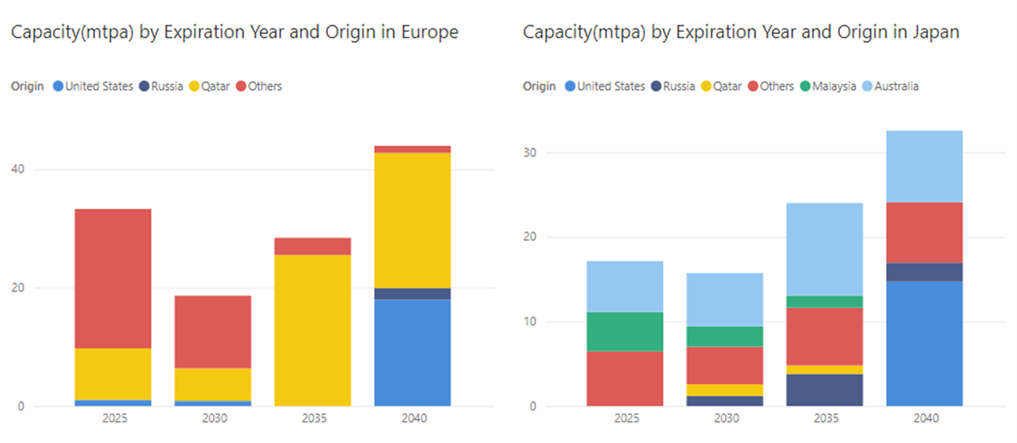

With increased concerns about energy security, it is expected that LNG buyers will focus on strategizing for their next round of LNG contract negotiation activities over the coming years. Figures 3 and 4 show the contract volume expiring by year for both Japan and Europe, which presents a total of around 45 million tons of contracts expiring by 2025. This demonstrates graphically the urgent need for the buyers to renegotiate and/or extend their existing contracts.

Figure 4 LNG contract capacity by expiration year for Europe and Japan (MPTA)

Impact on LNG Contract trends

With a large amount of LNG contract negotiation and renegotiation going on, what insights on LNG contracting trends can we observe and what we can expect in the future? For example, what is the impact on the length of the contract?

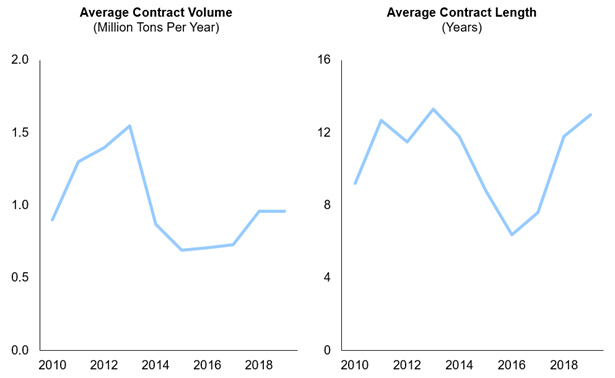

Figure 5 Average volume and length of New LNG Contracts (Source: ADI Analytics)

Looking at Figure 5 we can ascertain newer buyers have caused the average contract length to rise from 6.4 years in 2016 to 13 years in 2019, after the average length declined from 2013 to 2016 as shown in Figure 1.

The average contract volume is also shifting. It declined from 2013 to 2015 and increased from 2015 to 2018 before levelling off in 2019. Even after increasing, the average contract volume is 0.96 million tons per year (MTPA) which is substantially less than the 1.55 MTPA of 2013.

The duration of LNG contracts is largely driven by market sentiment. When the market is tight, LNG buyers tend to sign long-term contracts to lock in the price. When the market is oversupplied, buyers are not willing to commit to long-term contracts. Overall and resultantly, we see that LNG buyers desiring to achieve some balance in their portfolio among long-term, mid-term and short-term contracts.

Trends in Delivery Type

The delivery type, also known as shipping term, is a key component of an LNG contract. All LNG SPAs are required to specify the Incoterm (International Commercial Term), namely FOB or DES. The trend going forward regarding which is preferred depends on the capability of the buyers.

Mature LNG market players prefer to sign FOB contracts since they have LNG vessels and know LNG operations very well. LNG carriers are one of the most valuable assets for LNG portfolio players to extract extrinsic value to maximize their profits. Newer players need to purchase DES given their limited capability and restricted capital. Interestingly, the last five years have witnessed many Chinese LNG importers change from DES preferred buyers to FOB buyers.

Moreover, and in recent years, some LNG project developers have started to charter their own LNG ships to support their LNG project developments. (Mozambique LNG, Cheniere LNG, et al).

Trends in Destination Restrictions

In addition to designating the delivery point, historically, many long-term LNG SPAs contained destination restriction clauses. Such provisions restricted the buyer from reselling the LNG outside of a designated geographic market (usually, the buyer’s home market). For example, some European LNG portfolio players did not allow cargoes to divert to England or other countries, or they required a margin sharing mechanism to be agreed upon in the SPA to allow such diversions.

However, such restrictions have become less common and, as further discussed below, the European Commission has said that such provisions are not permitted in contracts for the sale of LNG to European buyers. More recently, the Japan Fair Trade Commission has indicated that it is ‘highly likely’ that destination restriction clauses are anti-competitive and that such clauses should not be included in new LNG contracts.

New LNG Contracts in Europe and Japan

Destination flexibility is increasingly important due to the uncertainty of LNG demand from their domestic markets (due to regulatory reform, e.g., Japan’s “Gas System Reform”) and multiple regasification locations from the purchaser sides for DES customers. From LNG buyers’ perspective, they would certainly like to have as much destination flexibility as possible. The destination flexibility not only helps LNG players manage their domestic demand uncertainties, but also can help them take advantage high prices in other locations, which is what we have recently seen in the scores of cargoes diverted to Europe, and where LNG players even went back to their suppliers to renegotiate the diversion to capture the high premium prices of gas in Europe.

New LNG project developers in the U.S. and Australia have been quite neutral, and they normally do not include any destination restrictions for any market share reasons, though there might be some language in SPAs restricting LNG destinations due to regulatory reasons. For example, US LNG cannot go to the countries sanctioned by the US Government.

Aside from destination flexibility, sometimes buyers have special requirements from LNG sources. For example, two years ago, Chinese customers did not want US LNG due to the high tariff, and they addressed clearly which party needed to pay the tariff if LNG came into China from the U.S. Other buyers might want US LNG as a way for their governments to decrease their trade deficit with the US.

The Arrangement of Diversion

The arrangement of diversion depends on negotiations and market conditions. Each LNG SPA is very customer specific. But diversion is normally allowed if they can agree on the profit/cost-sharing mechanism and other relevant diversion clauses.

On top of destination flexibility, LNG buyers have pushed hard for other flexibilities such as greater quantity tolerance and more flexible delivery schedules across seasons to manage various risks. Given intense competition among LNG supply projects still awaiting FID, we can expect more flexibility in LNG contracts.

Looking Ahead

With the events in Europe creating tumultuous impacts on the LNG market, players are changing the way they source their LNG. We see changing trends in contracting and buyer behavior and sellers responding. Though the effects on contracting have been great and will continue to be, there are other factors that will need attention. In subsequent articles we will focus on the ramifications of 2022’s power shift on gas demand itself, taking into consideration accelerated decarbonization efforts, challenges in Europe and potential demand destruction for emerging markets.