Cook Inlet Gas Production May Not Meet Demand

In a recent report by Enstar Natural Gas for the regulatory commission of Alaska, it was revealed that the energy-rich state may soon be faced with an energy crisis of its own. “Cook Inlet gas cannot fully meet demand forecast beyond 2026 with current proved reserves or beyond early/mid 2030s assuming incremental local supply development”.

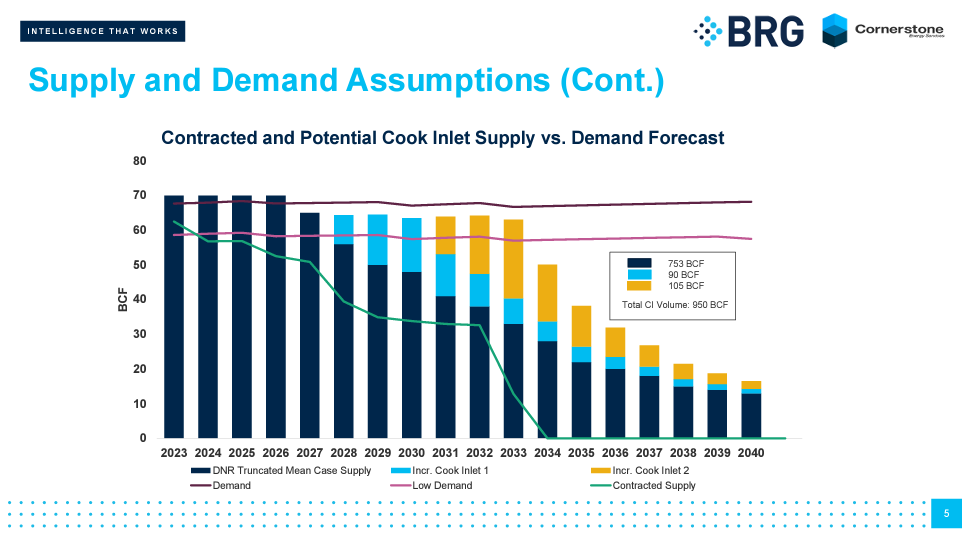

The graph below shows forecasts for electricity demand and gas production from the Cook Inlet forecasts until 2040. If demand remains as expected (70 bcf) it will exceed supply in 2027, if demand is lower than expected (60 bcf) it may not exceed supply until 2034.

The Cook Inlet alone will not be able to support Alaska’s energy needs much longer. Action must be taken to ensure energy availability. What options does Alaska have?

Alaska’s Options

The top options being considered for the future are:

- Further development of the Cook Inlet’s remaining supply resource

- New pipeline(s) accessing North Slope gas (with or without LNG export)

- LNG import projects (both floating and onshore)

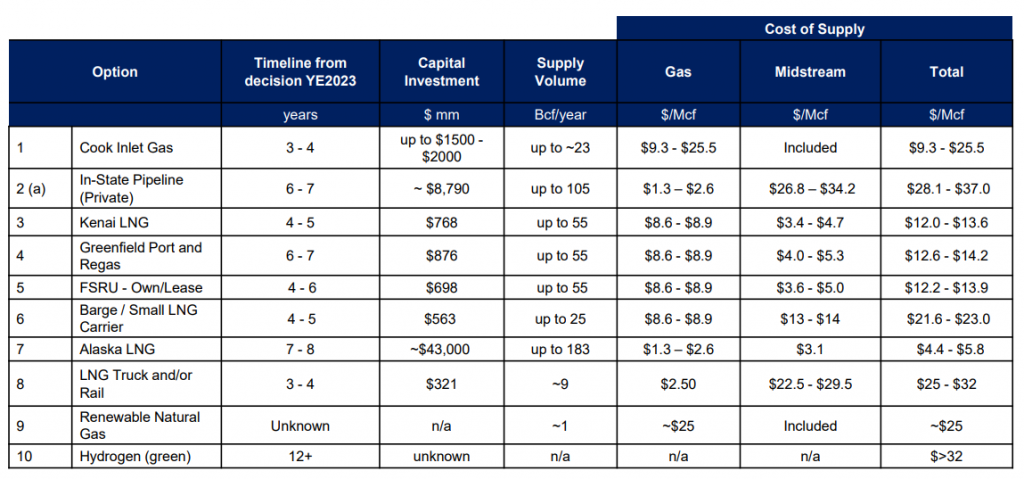

The table below details the construction, cost, and production estimates of each source of these options and other options under consideration.

The supply from the Cook Inlet will last another 3 to 4 years providing up to ~23 bcf/year. The Kenai LNG and FSRUs will take 4 to 6 years to come online and provide up to 55 bcf/year. The Alaska LNG project would take the longest of all options to be operational at 7 to 8 years (not in time to meet the forecasted demand) but it would have the largest increase in supply of all available options at up to 183 bcf/year. BRG estimates that the Alaska LNG Project would require the largest capital investment at $43 billion but would result in energy that would be less than half the cost of other sources being considered.

The Alaska LNG project would include construction of a treatment plant in North Alaska, a pipeline running across the state, and a new liquefaction facility being built in Nikiski. (See map below on next page). The treatment plant is expected to have an average daily capacity of 3.5 bcf per day with a maximum of 3.9 bcf, the pipeline would have a capacity of 3.3 bcf, and the facility would process, store, and transport 20 mtpa. While this project would potentially be of great benefit to the state, it would not be completed in time to meet the forecasted demand.

Another concept is to import LNG to fill the gap in supply. Three options have been considered: 1) repurpose the existing Kenai LNG facility which was used to export LNG to Japan in the past, 2) build an entirely new LNG import facility, or 3) contract for a floating LNG storage and regasification unit (FSRU). The delivered cost for gas would be in the range $12 to $14 / mmbtu for all three of these concepts.

Sourcing LNG for such an import terminal would be an interesting problem. One might think that sourcing it from prolific US Gulf Coast LNG would be a good idea. However, there are legal issues to consider.

Due to the Jones Act which requires that ships transporting goods between American ports must be built in America, have flags signaling it as an American vessel, and a majority American crew, the LNG would have to come from a foreign entity. This is because no currently operating LNG carriers are registered under the U.S flag and no carriers have been built in the U.S since before 1980.

Alaska could ask for a waiver to the Jones Act to import U.S. LNG, but it is only in extremely rare circumstances that such a waiver is granted. This situation is similar to when Sempra Energy in 2005 requested to transport gas from Alaska to California, however they were not able overcome the resistance from maritime groups protected by the act and thus were not granted a waiver.

It is more likely that the LNG would be sourced from BC in Canada. LNG Canada is a major facility scheduled to begin operating in 2025. Woodfibre and Cedar are smaller projects which might have LNG availability for Alaska. Because of its shorter distance, overall cost might be less than the $12 to $14 / mmbtu displayed in the table.

What will the price of energy be for the citizens?

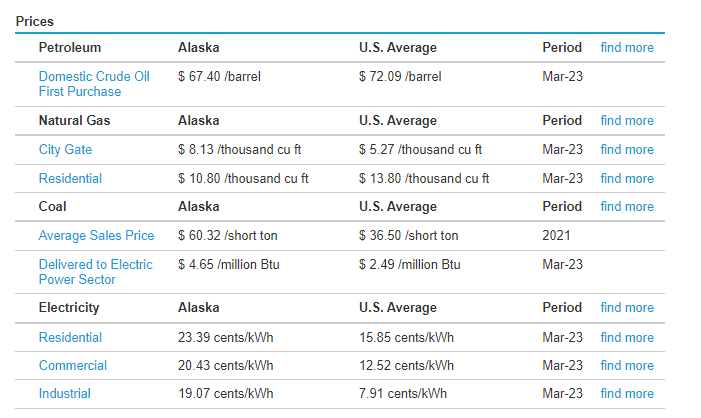

In short, Alaskans will see their utility bills increase. This is in addition to other price increases already taking place in the cities of Aniak and Anchorage. Even before these coming increases, energy in Alaska is already more expensive compared to the average for the rest of the U.S. For example, the cost of electricity of industrial use is 19.07 cents/kWh in Alaska while the the average in the country is only 7.91 cents/kWh, which is 59% lower of a price.

Due to the uncertainty of future markets, the planning process has taken some time to get concrete, long-term solutions proposed. Until one is decided upon, Alaskans may see their utility bills increase as importing LNG is needed until local production sources come online. “By some estimates, electricity rates in parts of Southcentral could go up by as much as 30%.”

The future for Alaskan energy is uncertain, surrounded by unknowns and hesitation. RBAC’s market simulation tools can evaluate all the scenarios above to find viable solutions for Alaska’s energy security that could avoid supply shortfalls at reasonable prices for both investors and consumers.

If you would like to know more, contact us here