India’s Energy Mix

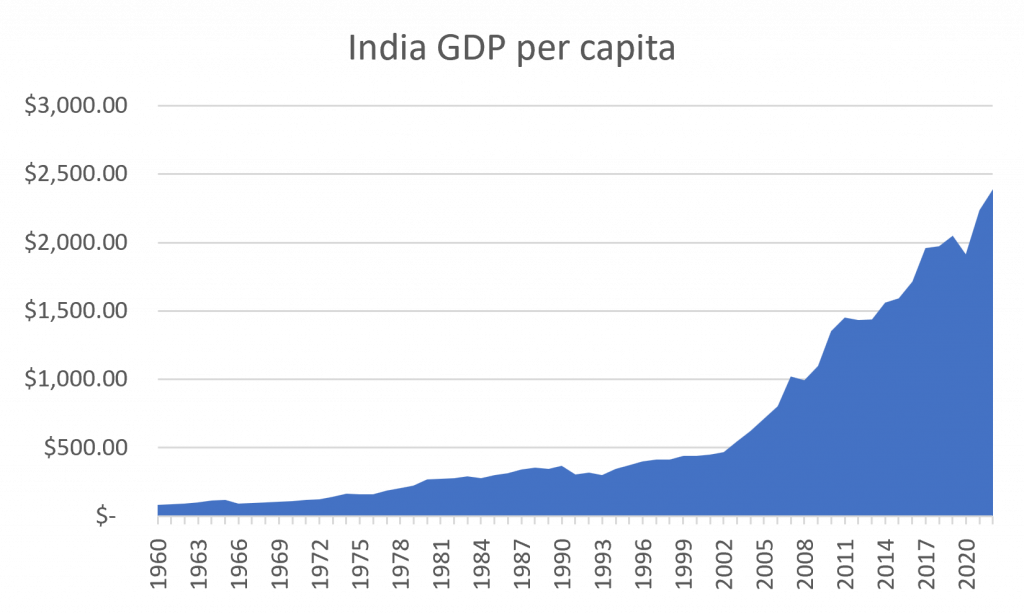

India is now the fifth largest economy by GDP in the world, with the largest GDP growth of any industrialized country currently sitting around 7% per Forbes India. They are also predicted to become the world’s most populous nation this year and within the last 10 years the percentage of households with electricity has risen from ~80% to ~99.6% per data from the World Bank. With such tremendous growth across the boards, India’s demand for energy will only continue to increase with it.

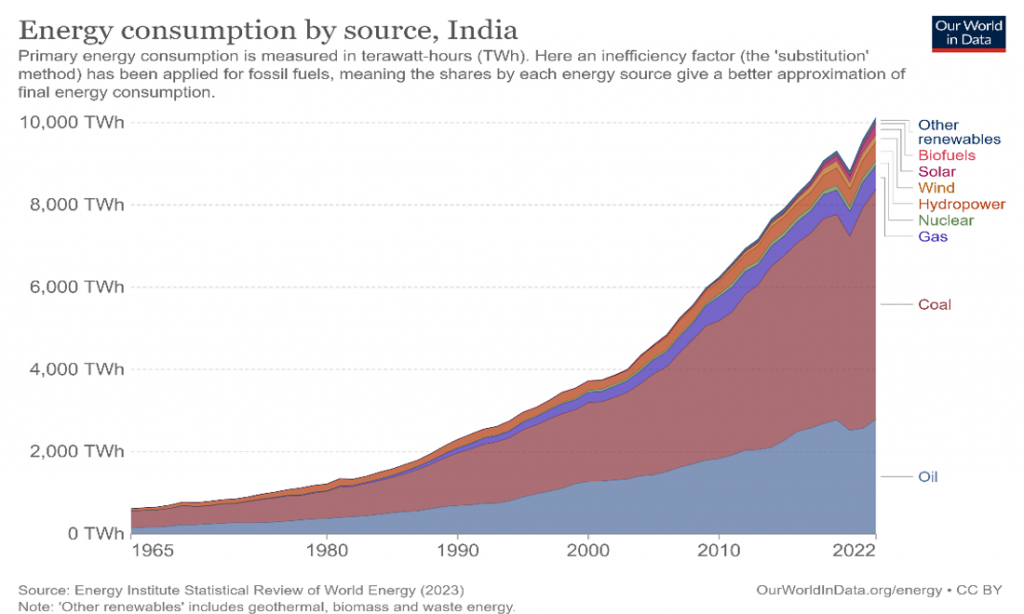

Figure 1, India’s GDP. Source: The World Bank. Figure 2, India’s Energy Consumption. Source: Hannah Ritchie and Max Roser.

But what are India’s plans to ensure their energy supply can keep up with rising demand? They are already making steps towards transitioning away from coal which has been backbone of their energy mix for decades, providing roughly half of India’s energy supply. This is because the country has been experienced several power outages over the last few years due to supply shortages caused by spikes in demand as a result of COVID-19 and heatwaves across the country. These spikes resulted in power plants increasing output dramatically in order to attempt to keep up. The average coal stocks held by utilities for that time of year was the lowest it had been in 9 years. These plants also faced difficulty replenishing these stocks with domestic coal as the railways within the country were not adequately facilitating the transport of coal.

India was even forced to pass emergency coal import and power generation policy changes to, “Up coal imports for the next three years to build up inventories and satisfy demand,” and,” start generation at some idle power plants running on imported coal.” These plants were previously idle and not producing power due to financial stress and high coal prices on the international market,

During this supply crisis and outages, it became evident that new options had to be explored for future sources of energy.

Where Natural Gas Fits In

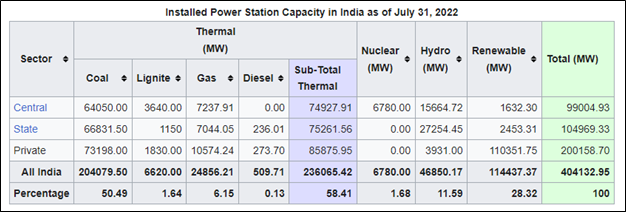

To keep up with rising demand and to avoid potential supply shortages, India is exploring development of other sources of energy, such as natural gas, to meet their needs and partially replace coal. This will be accomplished through LNG imports and investment into domestic production as they look to increase the amount of natural gas in the energy mix from 6.5% to 15% by 2030. India is also considering natural gas due their current goal of being net-zero by 2070, however despite this goal being in place, they are still keeping all options for power generation on the table and is even continuing to invest into two new coal-fired power stations.

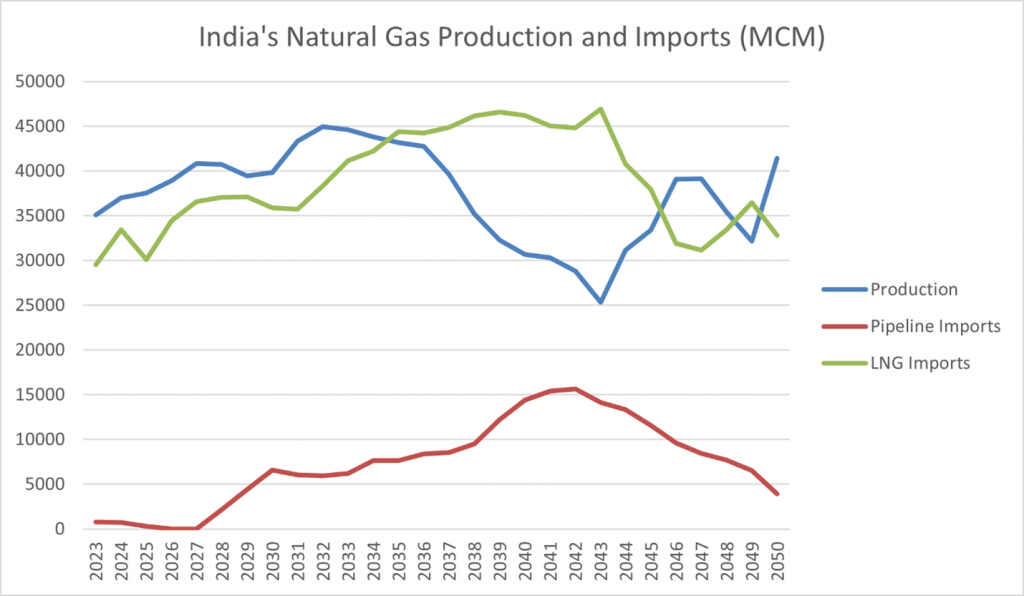

This past year, India produced 33,664 mcm of natural gas and imported 26,647 mcm of LNG, which is a 16.5% decrease compared to the previous year’s imports of 31,906 mmscm. India will likely rely on a mix of domestic production and LNG imports to incorporate natural gas into their energy mix. Anil Jain, chairman of India’s Petroleum & Natural Gas Regulatory Board, recently stated that, “As the demand for natural gas increases in the country, the dynamics will tilt in the favor of imports.”

India’s Natural Gas Reserves

In 2019 it was believed that India had 100 tcf of undiscovered natural gas reserves which would be enough to meet, “Half of the nation’s gas demand till 2050.” If these reserves can proven, then work can be done towards building infrastructure so that India becomes more self-sufficient. Currently as part of a partnership between BP and Reliance Industries, the final of three gas fields is being completed and is commencing production. Each of these fields combined are expected to produce 1 bcf per day once the final field is at peak production. This will make up, “Around one third of India’s current domestic gas production and meet approximately 15% of India’s demand.”

Utilizing our G2M2® Market Simulator for Global Gas and LNG™ , our analysis shows that LNG imports and pipeline imports to India are expected to increase until 2043. At this point both forms of importing are expected to decrease while domestic production begins rapidly increasing and eventually surpasses the amount of LNG being imported in 2046.

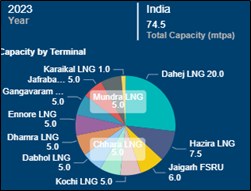

Currently India has the capacity to import 74.5 mtpa of LNG. This capacity is expected to increase to 90.5 mtpa over the next 7 years.

India’s LNG Import Capacity 2023 vs 2050. Source: G2M2 Insights

India’s New LNG Contracts

India has also reached out to the U.S., UAE, and Saudi Arabia to inquire about new 20-year LNG contracts. These long-term contracts, if realized, will assist in protecting them from price surges in the international market and secure a much-needed supply of energy to meet rising demand.

As a result of these discussions, India Oil Corp was able to sign signed preliminary agreements with Abu Dhabi National Oil Corp (Adnoc) and TotalEnergies for a combined 2 mtpa starting in 2026. The agreement with Adnoc is for 1.2 mtpa for 14 years and Total would supply .8 mtpa for 10 years. India had previously had a contract in place with GMTS (Gazprom Marketing and Trading Singapore) to supply 2.5 mtpa for 20 years starting in 2018. However, this contract was cut short due to Russia’s invasion of Ukraine which required India to purchase from the spot market and seek new long-term LNG contracts.

Sri Lanka Partners with India

Sri Lanka may also play a part in these discussions as they are trying to improve economic ties with India, going so far as to connect their electricity grids.

Sri Lanka had been growing quite steadily for years. Like India, increased their industry, brought full electrification to the country by 2017 and had been increasing trade with India and other major economies such as China, the United States. However; they practically hit a wall in 2022 with a financial crisis, leading to an energy shortage, creating widespread unrest and strife; they have started to recover and expect GDP growth to return in 2024.

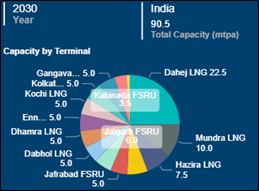

Historically, Sri Lanka has relied on biomass for the majority of its energy; even today upwards of 75% use it for cooking, with oil taking an ever-increasing share until surpassing biomass in 2011; which is also when coal use started to rise significantly. As of 2020, only 36% of total energy comes from biomass, 4% from hydropower, 16% from coal and 43% from oil.

Sri Lanka’s is now quite reliant on coal and oil to meet their energy demand. However, the oil industry has faced several challenges over the last year which greatly affected Sri Lanka’s ability to meet their demand. In March of 2022, they faced several power outages and were quickly becoming bankrupt as the price of oil kept increasing and ended up becoming so later that year. Due to this crisis, it became evident that new solutions must be proposed so that this doesn’t happen again. One of the solutions was integrating natural gas into their energy mix.

In 2019, the Public Utility Commission of Sri Lanka had a goal to further integrate natural gas. “The share of natural gas reaches at least 1/3 of the mix of total fossil fuel consumption by 2030.” They still have a long way to go to meet this goal over the next 7 years, but if they are able to meet it, “Sri Lanka can reap significant economic, social and environmental benefits from using natural gas as a source of energy in power, industrial, transportation, household and commercial sectors.”

They also aspire to be net-zero emitter by 2050 which is another reason for increasing the presence of natural gas and moving away from coal and oil. However, they should still do what is best for the country as a whole towards providing energy for their citizens and not force a transition that results in less energy availability and higher prices. As mentioned in our article from 2022 by our founder and CEO, Dr. Robert Brooks,” Trying to force an abrupt transition is beginning to have very substantial and destabilizing effects on countries…across the globe.”

Sri Lanka is currently in the process of constructing a new LNG import terminal near their capital. This project is a collaboration with New Fortress Energy, a U.S. based company. This terminal will have capacity for 3.7 mtpa and is expected to begin operations later this year. New Fortress will be providing approximately 0.77 MTPA to the Sri Lankan government.

Summary:

With India’s energy consumption currently trending to be, “more than double from today’s levels by 2040,” they will need both local production and LNG imports to meet future demand forecasts. India has enough gas reserves to help meet demand for the next few decades, but it won’t be enough by itself. Because of this, India is also signing long-term LNG contracts and building new infrastructure and expanding current infrastructure to increase import capacity. And with Sri Lanka joining India’s power grid and building an LNG import terminal to increase the presence of natural gas in their energy supply, both of these countries will be ones to watch in the coming years.

G2M2® Market Simulator for Global Gas and LNG™ would allow for forecasts of how new pipeline projects or expansions on existing pipelines and new LNG import terminals would contribute increasing the presence of natural gas in their energy mix. It would also allow for calculations of future prices of domestic gas and importing LNG to determine their energy strategy to avoid supply shortfalls at reasonable prices for both investors and consumers.

If you would like to know more, contact us here.