Long thought of in a political light, the term “swing states” refers to those states comprised of electorates who show no discernable trend toward any party and thus, could “swing” either Republican or Democrat. It is these states who can make or break a politician’s run for office. Soon the term could take on a whole new meaning. Having emerged from the COVID locked down world, the North American natural gas market has found slack in the energy supply chain. High levels of natural gas in storage and renewable generation have depressed gas demand outlooks, moderated prices and are creating breathing room for households and other end-use consumers alike.

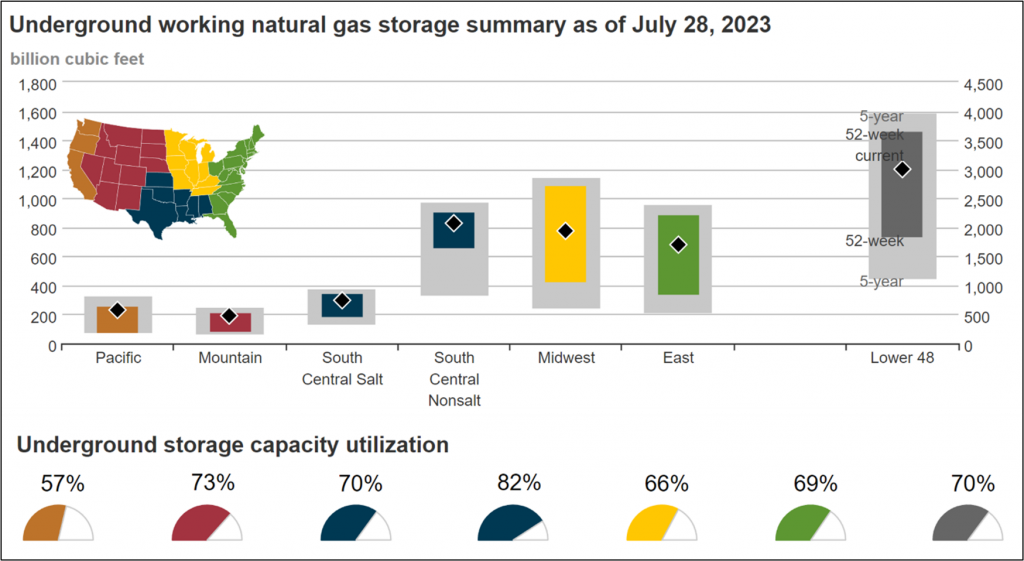

Lower-48 working gas in underground storage is approximately 70% full as of this writing, with certain regions even higher. One of the major producing regions, South Central, and its subcategory, Non-salt storage, each currently sitting at 70% and 82% full respectively, are skewing the overall Lower-48 average higher. Production in this region continues to rise, mostly on the back of associated gas coming from the oil-centric Permian Basin. As such, Henry Hub prices have fallen significantly and this in turn has affected natural gas drilling activity, which could eventually impact production.

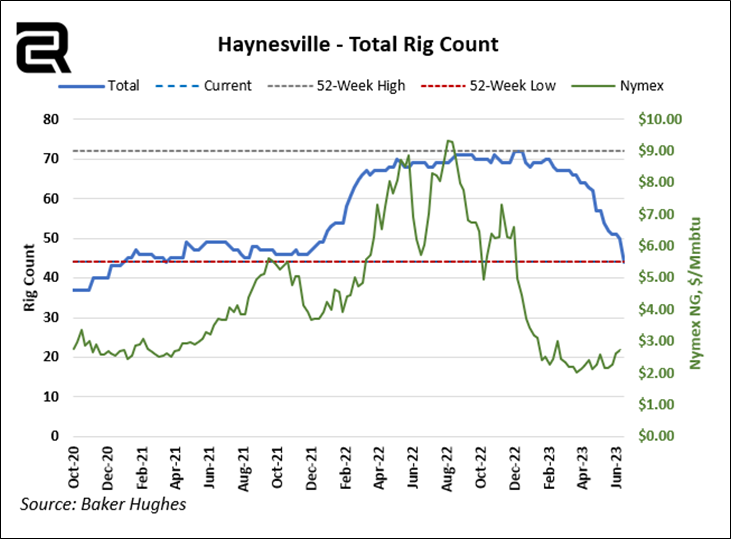

With Henry Hub trading below $3.00/MMBtu and the possibility of remaining there for the balance of 2023, production in some regions has become uneconomical – especially after considering basis differentials. Many producing regions have effectively “swung” down supply to match the level of demand. States like Louisiana with its Haynesville Shale and Oklahoma with the Woodford Shale are taking on this “swing” title. Drilling in these areas is more expensive, requiring a price north of $3.50/MMBtu to be profitable, per recent findings from the Kansas City FED. Their survey goes on to say that in order for drilling activity to substantially increase, a natural gas price level of at least $4.67/MMbtu would be needed. These states have borne the brunt of the natural gas pricing collapse in the last year, one has to look no further than natural gas drilling rig counts. Reported weekly by Baker Hughes, rig counts, particularly those in the Haynesville Shale have fallen off a cliff. Especially when compared to last fall, when the Henry Hub price was above $7.00/MMBtu, it makes perfect sense that producers are drilling less in a price environment below $3.00/MMBtu.

The Haynesville is uniquely situated near the Gulf Coast, long known as an industrial powerhouse. Demand in this region has grown by leaps and bounds recently due to the operations of LNG Export Facilities such as Calcasieu Pass, Cameron LNG, and Sabine Pass. LNG Exports account for 13-15% of domestic demand and new facilities like Venture Global’s Plaquemines LNG and Golden Pass LNG are slated to begin operations in 2024. In the most recent 23Q2base Release these facilities represent an additional 5 Bcf/d of demand, taking LNG exports’ percentage of domestic demand to nearly 20%.

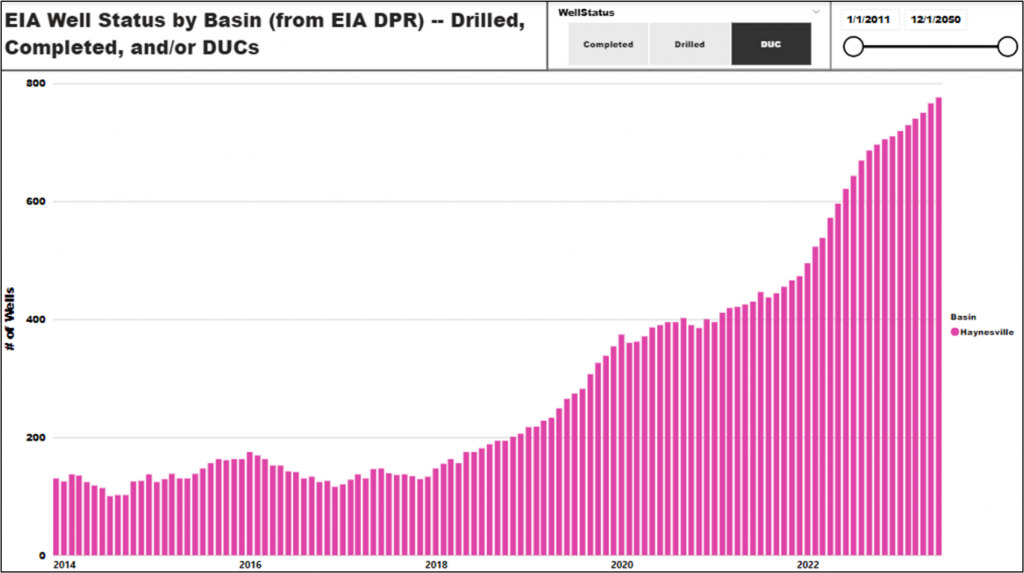

Focusing on drilling activity is only part of the picture. While drilling rigs in the region are falling, DUC counts are higher. Drilled but Un-Completed (DUC) wells are considered to be a spigot; a quick way to bring additional gas to market. It seems these Haynesville Shale operators have foreseen this demand growth and plan on utilizing DUCs to supply it when the price is right.

While there has been a similar decrease in drilling rig activity in the Oklahoma Shales, DUCs have not increased, likely an effect of Oklahoma’s location vs. Louisiana’s. It will likely take a longer period of elevated prices before we see drilling activity return to Oklahoma. But in this “swing state” world, this can easily happen.

The North American natural gas market is constantly changing and with growing exposure to global markets, it will experience heightened and more frequent volatility. As such, proper planning is critical using a tool to see how the market will move under various conditions. And the GPCM® Market Simulator for North American Gas and LNG™ is a tool uniquely suited to do just that.

RBAC, Inc. has been the leading provider of market fundamental analysis tools used by the energy industry and related government agencies for over two decades. The GPCM® Market Simulator for North American Gas and LNG™ is the most widely used natural gas market modeling system in North America. RBAC’s G2M2® Market Simulator for Global Gas and LNG™ has been instrumental in understanding evolving global gas and LNG dynamics and is vital in fully understanding the interrelationship between the North American and global gas markets.