Natural Gas Market Insights from RBAC's 24Q3base Release

How Confident Are You?

As we head into the 2024/25 winter season, the natural gas market appears to be staring down the barrel of yet another mild winter and loose Supply/Demand (SnD) balances. The El Niño of yesteryear is now replaced by a La Niña and although that could bode well for a more “normal” winter season, the current expectations aren’t playing out that way. Bears are still in control, with prices peaking about a month ago around $3.00/MMBtu before heading down a double black diamond slope to the low $2.20/MMBtu range. For bulls, it seems way too early to be slaughtering prices as it’s only October and there are way too many degrees of freedom between now and the end of March 2025 – i.e., end of winter. It’s like Dirty Harry (the Bears) asking the punk, “Do you feel lucky?” or maybe just a little less harsh, “how confident are you?”

EIA recently published their Short-Term Energy Outlook report, on October 8, and maybe there is some degree of confidence in limited downside risk to prices. If one believes in EIA’s underlying supply/demand perspectives, prices might be expected to bottom between $1.50 and $2.00/MMBtu between now and end of 2025. Conversely, the upper bound for prices could hit $4.00/MMBtu in short order and possibly $9.00/MMBtu by December 2025. This lower and upper bound represents EIA’s 95% confidence interval (CI). A wide price range that infers prices will remain within that band with only a “marginal” chance that prices will actualize outside of it.

It might seem that a lot of things would have to swing the bull’s way for such higher prices to actualize. If there is a cold winter. If LNG export capacity ramps and runs consistently. If producers don’t undo production curtailments, at least not quickly. If we have another sweltering summer in 2025 and gas burns hold near record levels. If, if, if, if…

On the flip side, as noted in RBAC’s recent article, “New Trader on The Block”, if producers have become more price responsive (supply elasticity), then one would expect that another price leg lower, very well could lead to either further production curtailments or at least certainly maintaining current curtailments.

But what happens if producers maintain or increase curtailments (pardon the oxymoron)? What if these curtailments are in place and a sustainable polar vortex hits, freezing up wells, storage facilities and infrastructure? All while LNG export demand and take-or-pay type contractual obligations keep terminal utilization rates high, with more capacity coming online. Such scenarios can definitely cause price spikes. These may be “tail risks” but they aren’t zero risk events. The bulls would definitely feel lucky then. With roles reversed, one can almost hear them saying, “Go ahead, make my day.”

Likely, a more plausible scenario would be that prices appreciate, due to whatever real or perceived tightening of Supply/Demand balances, and producers start to undo curtailments. Depending on the unwinding rate and magnitude, prices would likely moderate at a level well under the $9.00/MMBtu level. And that’s exactly what the NYMEX futures prices, as well as the STEO price forecast, anticipate.

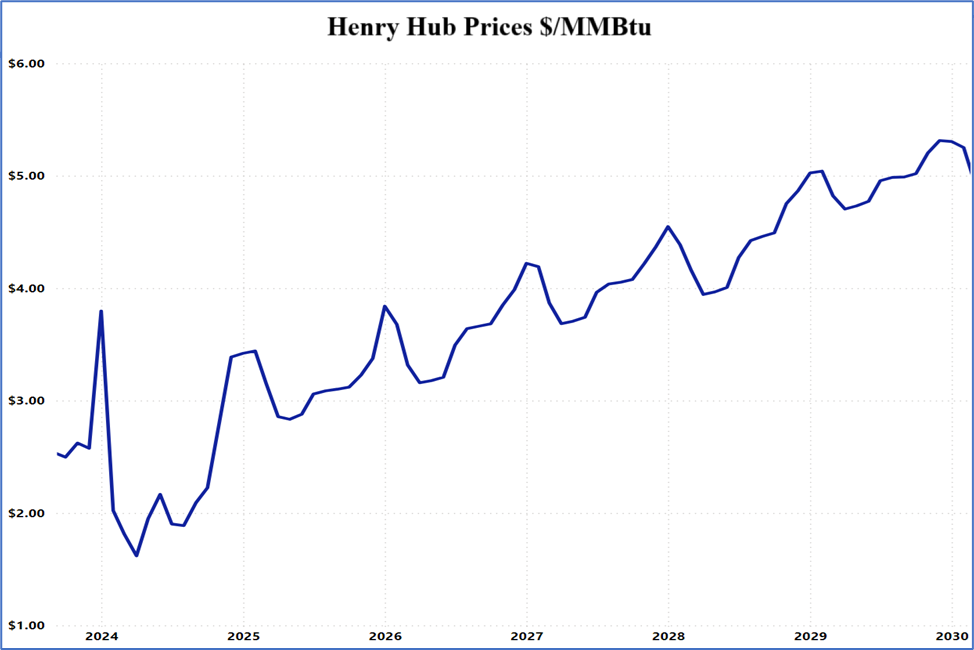

RBAC has just put the wraps on its 24Q3base release, and the base case assessment is similar to EIA’s STEO and NYMEX futures at least through 2025. Prices are expected to firm over the next 14 months as more LNG export capacity comes online and gas-fired power generation remains strong during summer months. Granted, how the 2024/25 winter season plays outs, frosty or mild, will definitely impact near term prices – the current perspective is to the downside as winter looks mild to start.

The 24Q3base forecasts prices to breach $3.00/MMBtu during the Dec – Feb heart of winter before receding toward $2.80/MMBtu in the spring, shoulder season of 2025. Continued strong gas-fired power generation demand coupled with consistent high LNG export terminal utilization, pushes prices back over $3.00/MMBtu. The supply/demand balances tighten heading into the 2025/26 winter as more LNG export capacity comes online. This puts the $4.00/MMBtu price level within reach for the 2025/26 winter while supporting prices above the $3.00/MMBtu price level.

There are a lot of possibilities, questions, and opportunities likely to present themselves over the 2024/25 winter season. Heck, the talk just a few months ago was how quiet of a hurricane season the US was seeing. Boy, did that change in a heartbeat – just ask anyone living on the west coast of Florida, the answer is a resounding, “yes and please, no more!”

So yes, there are still way too many degrees of freedom to call winter a dud and indeed, as we write this in late November, winter storms have descended on many northern states.

A few days after 24Q3 outlook was finished Americans voted, and with results in, there will likely be major ramifications for the energy industry, most particularly on fossil fuels and exports. Likewise, geopolitical events can significantly change global supply, demand, and flow dynamics. Lest we forget, these variables are also related, so the outcomes of the former can/will impact the latter.

Risks abound and the 95% CI is quite wide. But this only drives home the point that combining rigorous analytics and simulating a multitude of scenarios is an ideal approach to formulating one’s market perspective. This “outcomes distribution” helps market participants more clearly identify risk, trading/hedging opportunities, and make more optimal decisions.

RBAC offers both domestic (GPCM®) and global (G2M2®) simulation systems to tackle such complex analytics and is here to help you in this endeavor. Our simulation systems allow users an easy, highly capable set of analytical tools to run multiple scenarios and develop their market perspective and probability distributions. Please reach out to us to discuss how we can assist you.

RBAC, Inc. has been the leading provider of market fundamental analysis tools used by the energy industry and related government agencies for over two decades. The GPCM® Market Simulator for North American Gas and LNG™ is the most widely used natural gas market modeling system in North America. RBAC’s G2M2® Market Simulator for Global Gas and LNG™ has been instrumental in understanding evolving global gas and LNG dynamics and is vital in fully understanding the interrelationship between the North American and global gas markets.