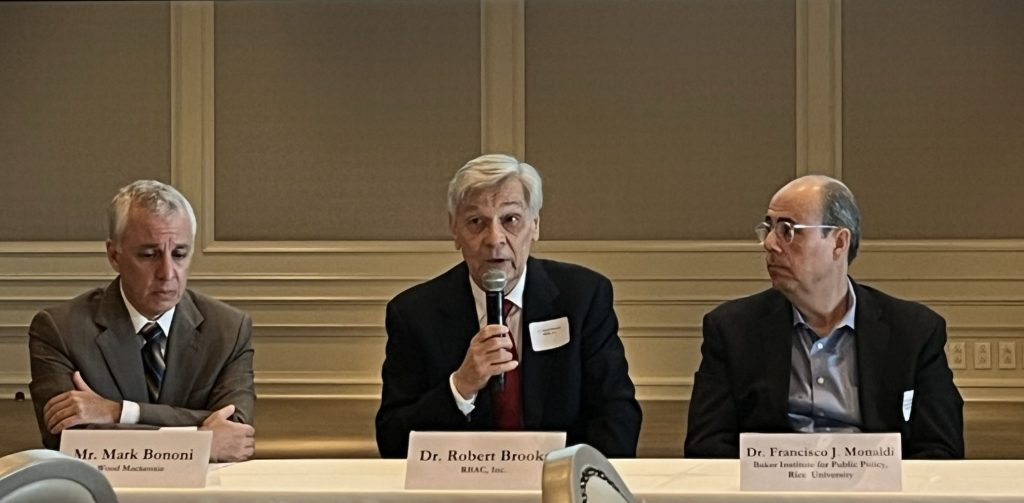

At a recent OGJ-hosted energy breakfast—part of their ongoing industry dialogue series—experts, including Dr. Robert Brooks of RBAC, gathered for a timely and candid exchange on the evolving challenges and opportunities in global LNG.

Moderated by Conglin Xu, the panel covered wide-ranging topics, from U.S. LNG export reliability and Argentina’s Vaca Muerta potential to the risks and regulatory hurdles facing Mexico’s LNG infrastructure.

The Q&A steered the discussion toward urgent themes such as the rising energy demands of AI and data centers, the reentry potential of Russian LNG, and the future of LNG construction in the face of labor shortages and tariffs.

Notably, Dr. Brooks gave insights on China’s gas strategy, Europe’s long-term LNG hesitation, and the geopolitical balancing act surrounding floating regas units. We’ll dive into Dr. Brooks’ key takeaways and more highlights from this dialogue in the sections that follow.

A Global LNG Reality Check

Dr. Robert Brooks of RBAC Inc. brought a data-driven perspective to the panel based on recent outlooks from GPCM and G2M2 market simulators and RBAC’s North American and Global teams, enlightening on LNG trade flows, geopolitical risks, and market dynamics:

- On China’s Role in U.S. LNG Exports:

Dr. Brooks pointed out that despite the spotlight on China, the volume of U.S. LNG actually reaching Chinese ports remains relatively small. With the ongoing trade tensions, many cargoes originally destined for China are being redirected—contributing to downward pressure on global LNG prices in the short term. - China’s Self-Sufficient Gas Strategy:

Dr. Brooks highlighted that over 60% of China’s gas demand is met by domestic production, supplemented by significant pipeline imports from Central Asia and Russia. In addition, China has aggressively built LNG import infrastructure with more than 30 terminals operational or under development, giving it maximum flexibility. In Brooks’ view, this strategic oversupply means China isn’t dependent on U.S. LNG—a vital factor needed to be kept in mind in Western policy debates. - Forecasts and U.S. Price Implications:

On the domestic side, Dr. Brooks noted that rising internal demand from both LNG exports and power generation (including AI/data centers) is already visible in forward curves. The result: U.S. natural gas prices are expected to rise, potentially affecting contract negotiations worldwide. - Russian LNG and the Northern Sea Route:

When the discussion turned to Russia, Dr. Brooks pointed to the Arctic LNG expansion. He explained that though thoughts that global warming might change the picture, the Northern Sea Route remains closed most of the year, with only about four months of viable passage. Even with creative workarounds—like cargo reloading facilities on both ends of the route—the logistical and cost challenges make Russian LNG growth unlikely in the near term, especially under continued sanctions. - Europe’s Reluctance for Long-Term LNG Contracts:

Dr. Brooks observed that Europe’s leaders may be caught between efforts toward ideological goals and energy security, the former of which is making them hesitant to sign 20-year LNG contracts. Instead, Europe is opting for floating storage and regasification units (FSRUs)—a hedge that provides short-term import capacity without long-term fossil fuel commitment. Brooks said this reflects Europe’s energy uncertainty more than its resolve.

“I think the answer is that they don’t have to. They don’t have to do long term contracts right now because there’s plenty of LNG available and going to be available over the next many years, because of all these projects that are being built…But the other thing is the Europeans still are maintaining this ideal of getting rid of fossil fuels… I don’t think that they feel like they need 20-year contracts for LNG if in fact the demand is not going to be there in in the last seven or eight years of that contract.”

Tailwinds, Tariffs, and Tensions

Alex Munton from Rapidan Energy Group offered insight into both sides of the coin regarding U.S. LNG, the momentum behind a new wave infrastructure and the associated risks:

- Commercial Optimism vs. Policy Uncertainty:

Munton described today’s market as powered by “strong tailwinds”—industry enthusiasm and deregulation—but challenged by major “headwinds” like shifting tariffs, rising costs, and global supply chain constraints. - Tariffs and Cost Risk:

He warned that steel and equipment tariffs, especially tied to U.S.–China trade tensions, are creating serious cost volatility. One major project has already reserved $500 million just to cover tariff-related uncertainty. - U.S.–China Disconnect:

While the U.S. is set to remain the world’s top LNG supplier and China its largest importer, recent geopolitical decoupling between the two nations due to tariffs has created instability which in turn has greatly altered the entire global energy ecosystem. - AI and Energy Collision:

Munton noted the rapid rise of electricity demand in the U.S.—fueled by AI and data centers—as a growing source of domestic gas demand. He cautioned that this could lead to policy clashes, including potential export restrictions if supply would need to be rerouted to meet this new wave of demand.

“The potential demand growth on the data center side is pretty significant… U.S. electricity demand was essentially flatlining for about two decades. You know, minimal amounts of annual growth, less than 1%. And in the in the last couple of years, that’s you know where it’s running at like 2 to 3%.”

Real-World Constraints on U.S. LNG Growth

Mark Bononi from Wood Mackenzie, brought a practical lens to the discussion—reminding attendees that optimism must be balanced with on-the-ground realities.

- Regulatory Pause Wasn’t the Only Barrier:

While lifting the Biden export pause revived project momentum, Bononi emphasized that structural constraints remain—including inflation, interest rates, labor shortages, and tighter contractor availability. - Cost of Capital and Labor Pain:

The earlier wave of LNG buildout occurred under near-zero interest rates and looser labor markets. Today, high costs and tight skilled labor pools complicate project timelines and economics.

“When we step back before November last year that the industry in the US was kind of hamstrung by the Biden pause and that was a regulatory issue. Still the demand is still fundamentals… Obviously tariffs are on people’s minds that increase the cost and again you have the underlying fundamental cost increase of inflation and everything else. And then also labor shortages, which is another issue. Cost of capital has increased higher interest rates.”

- Stick-Built vs. Modular Construction:

He explained how labor shortages may shift project design preferences toward modular construction, which can reduce onsite labor needs—but come with tariff exposure when equipment is imported. - Automation Is a Longer Game:

Bononi sees automation as a long-term cost-reduction strategy, but current projects are more likely to adjust construction methods before fully automating. - On Europe and Long-Term LNG Contracts:

He echoed concerns about Europe’s unwillingness to commit to long-term LNG deals, noting the mismatch between climate ambitions and immediate energy needs.

Argentina’s Promise, Mexico’s Uncertainty

Dr. Francisco Monaldi from Rice University’s Baker Institute brought valuable geopolitical and economic depth, focusing on Latin America’s role in the LNG landscape.

- Argentina’s Below-Ground Potential, Above-Ground Risk:

Monaldi described Vaca Muerta as world-class geologically—comparable to the Permian Basin—but burdened by Argentina’s chronic macroeconomic instability, contract insecurity, and political risk.

“If Argentina’s Vaca Muerta was in the U.S., it could be, you know Permian Basin or even better. However, of course, Argentina is a country that has had a lot of off ground risk historically, not only macroeconomic issues, this country with 100 years of macroeconomic instability with a few periods in between. It has had a lot of political risk and regulatory risk. You know, give you an idea in the history of Argentina, there are very few contracts that have gone through their life without possible renegotiation by the government, expropriation, nationalization and the like.”

Both Dr. Monaldi and RBAC agree that the Vaca Muerta formation has incredible potential as a natural gas resources, however actually being able to realize and take advantage of that may prove difficult.

- Policy Progress, but Caution Warranted:

Recent reforms have offered some fiscal stability for infrastructure projects, including a new law aimed at protecting pipelines and terminals. Still, he cautioned that investor hesitation remains, especially for long-cycle export ventures. - Shift to Floating LNG Models:

Argentina is pivoting from large-scale, land-based projects toward modular floating LNG exports (~10 MTPA), which require lower capital and may better fit its investment climate. - Mexico’s Dual-Edged Role:

On Mexico, Monaldi noted that while it serves as a key conduit for U.S. LNG, political tensions and regulatory unpredictability pose risks. Still, shared interests between U.S. producers and Mexican stakeholders (including CFE) could keep cross-border LNG viable, especially with rising Asian demand.

Overall, the event was chock-full of insight into all corners of the global gas market and we at RBAC were happy to be apart of it and spread our perspective on the future of energy. It is with market simulation tools such as GPCM and G2M2 that allow for market participants to get a sense of what could potentially happen in the market under any scenario and make data-driven decisions.

RBAC, Inc. has been the leading provider of market fundamental analysis tools used by the energy industry and related government agencies for over two decades. The GPCM® Market Simulator for North American Gas and LNG™ is the most widely used natural gas market modeling system in North America. RBAC’s G2M2® Market Simulator for Global Gas and LNG™ has been instrumental in understanding evolving global gas and LNG dynamics and is vital in fully understanding the interrelationship between the North American and global gas markets.