Argentina has the second largest shale gas reserves in the world; with a new president having to face the dark clouds of rampant inflation and economic chaos, could their natural gas be the silver lining they are looking for?

Argentina’s President-elect, Javier Milei, a free-market economist and libertarian, has a herculean task in front of him—inflation over 100%, poverty rate at 40%, multiple defaults of international loans, projected economic contraction over the next 2 years. In addition to these burdens to overcome, the presidential palace seems to have a revolving door with 3X the number of presidents as the US in 34 less years of nationhood.

Indeed, the cards are stacked against any president. But the “Land of Silver” (Latin argentum), may have a silver lining in its natural gas industry?

Argentina’s Lengthy Natural Gas History

Argentina at one point had a larger GPD per capita than the United States, and their growing economy attracted immigrants from all over the world, especially Italians, Germans, Spaniards and many others. Around that time, they became the first country to found a national oil company in 1922, calling it Yacimientos Petrolíferos Fiscales (YPF) meaning “Fiscal Oilfields” in English.

In these early days, there was not much gas to be spoken of; by the 1940s, natural gas only served 200,000 of 17 million people. That changed when a man inseparable from Argentinian politics emerged, Juan Domingo Perón. He mixed socialism with fascism and his own style of governance. But whatever his legacy, he did see to it to expand the natural gas network, ordering the YPF to capture rather than flare natural gas from oil extraction, creating Gas del Estado (“State Gas”) in 1946 to sell this. The then world’s longest gas pipeline was completed by 1949, expanding availability of gas to over 700,000. Meanwhile YPF increased oil production to 25 million barrels by 1955.

The ebb and flow of politics in Argentina matched somewhat with state control. YPF in the 1990s suffered yearly losses and was privatized. The result was that by 1999, YPF was profitable and had record-breaking oil and associated gas production. Yet, it was re-nationalized again in 2014 by President Cristina Fernández de Kirchner but not before (then named) YPF-Repsol made significant discoveries in the Vaca Muerta Formation.

Vaca Muerta (Sp. dead cow) is the second largest gas shale and fourth largest shale oil reserve in the world, and it is so promising that ExxonMobil said in 2018, when fully operational it could represent, with the USA, 30% of global gas production.

Talked about for years, bets are sure to be placed on it. The lure of an environment where thousands of wells can be explored in a more friendly government regulatory and financial regime is so good that billions are being invested. But changes in strict financial controls will be vital, as Vaca Muerta only attracted the interest of big majors after loosening up its restrictions.

All political parties are interested in this cash cow, which is quite alive despite the name. In 2022, the Néstor Kirchner Gas Pipeline started construction connecting Vaca Muerta with Buenos Aires and was finished in record time. Upon completion, it connected 6 million customers and displaced between $1B to $4B in imports.

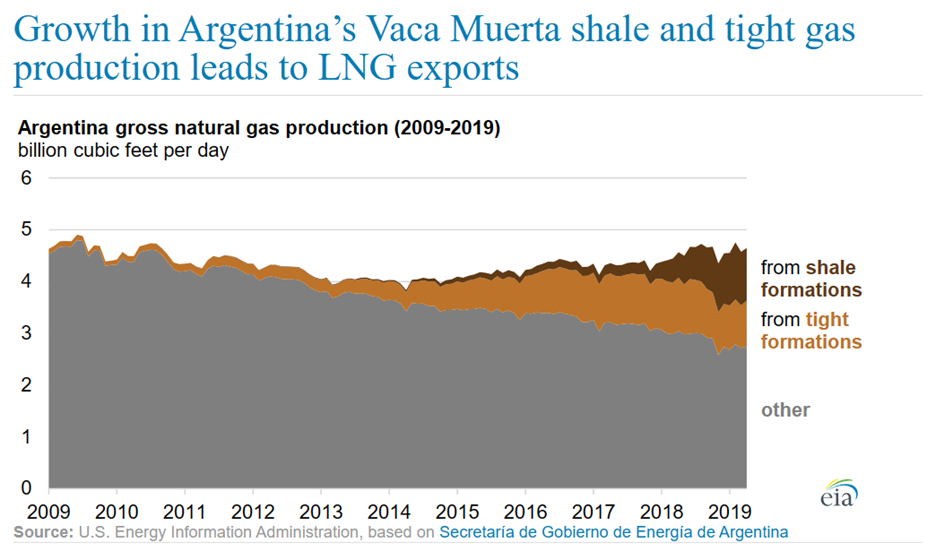

Of course, the famed Vaca Muerta is not the only game in town. With the call again for re-privatization of YPF voiced by President-elect Milei in 2023, along with a host of other state corporations, could this spell a renaissance in oil and gas exploration and production? Any shale revolution does have technical challenges, but the vagaries of politics are much greater. Besides, production is increasing.

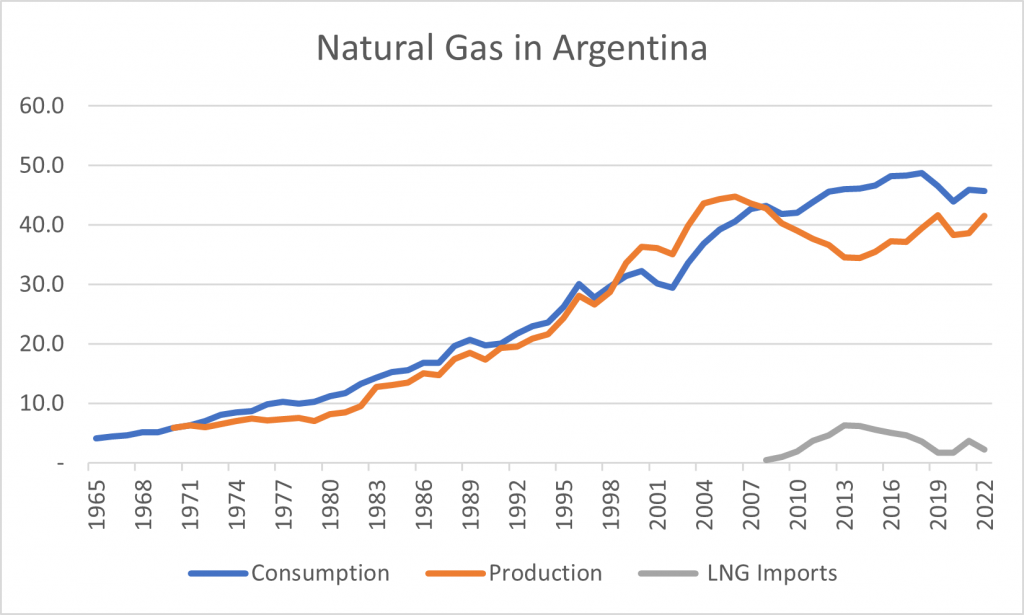

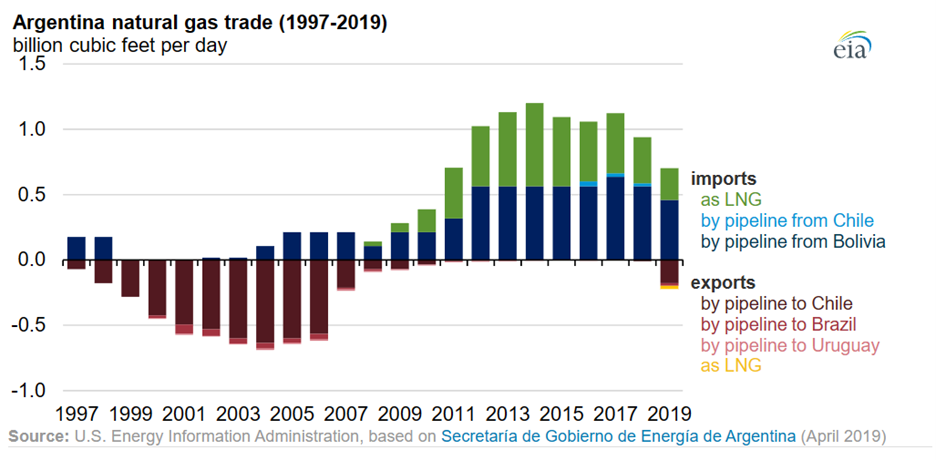

Moreover recent, increased Argentinian production has been displacing LNG, but even with piped gas there appear to be changes on the horizon. For example, Bolivia has been piping gas to Argentina on the Yabog pipeline since 1972, but their fields are on the decline. With a renewed and promising production outlook, Argentina could take advantage of this by upgrading the pipeline to be able to reverse the flow in the future, but then again, neighboring Bolivia also seems to be taking their own domestic revival seriously.

Liquified Natural Gas

And how about LNG? Argentina is well situated for it. Analysts pointed out peak production in summer coincides with high Asian demand in the winter and avoids congestion and costs going through the Panama Canal potentially making their LNG cost competitive with the US Gulf Coast.

But infrastructure takes time and money to build. Successive governments with different approaches have tried to balance their approaches to not only attract investment, but for that to alleviate and even advance the troubled economy, with the Kirchner Pipeline the latest example.

And that is the crux of the matter, isn’t it? Both Argentina’s government and energy industry players must make these policy and investment decisions work for both their futures.

Such vital decisions must be based on, not only local, but regional and global market conditions now and into the future. How these decisions are made and will play out doesn’t require omens or crystal balls, but it does require expert and robust market fundamentals analysis based on a variety of scenarios market players are concerned with using the best tools in market simulation one can get.

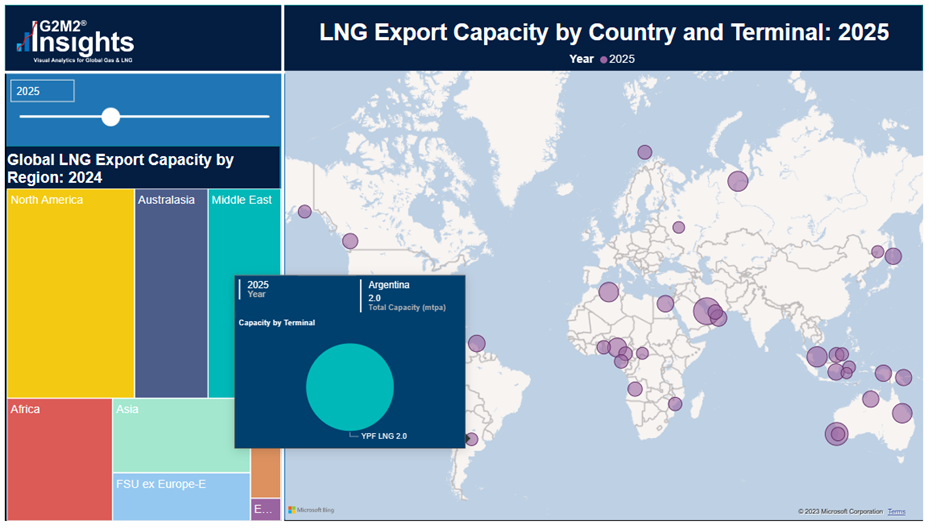

Utilizing RBAC’s G2M2® Market Simulator for Global Gas and LNG™, we can see what could happen in the future, for example with YPG LNG and its planned capacity of 5 mtpa. What we find is that it will be difficult to compete on the basis of cost alone. New capacity will be coming online in 2026, 2027 in the US, Qatar, and parts of Africa. What could YPF do?

One solution could be to establish an entire supply chain such as LNG-to-power. Many countries need more power and LNG can be the fuel to provide that power. Energy companies that can provide the whole supply chain from LNG production, to shipping, to receiving, to power generation could help under-powered countries take their next step toward better economic development. Contracts are the key; contracts trump spot, so therein lies the possibility.

Another option for Argentina might be expansion and better utilization of the South American gas pipeline network. Chile may be a small market, but Brazil is not. G2M2 Market Simulator for Global Gas and LNG empowers analysts to contract and run those scenarios to see if they could work.

And that is how you make better energy decisions.

This is the first part in a series on Argentina and the future of its gas industry. Look out for more utilizing RBAC’s G2M2® Market Simulator for Global Gas and LNG™.

RBAC, Inc. has been the leading provider of market fundamental analysis tools used by the energy industry and related government agencies for over two decades. The GPCM® Market Simulator for North American Gas and LNG™ is the most widely used natural gas market modeling system in North America. RBAC’s G2M2® Market Simulator for Global Gas and LNG™ has been instrumental in understanding evolving global gas and LNG dynamics and is vital in fully understanding the interrelationship between the North American and global gas markets.

[1] Argentina’s Vaca Muerta field: the world’s second-largest shale gas deposit | BBVA /

[2] Argentina’s Presidents (wikimedia.org)

[4] Exploration and Production Snapshots: Argentina | Deloitte US

[6] Argentina’s Vaca Muerta field: the world’s second-largest shale gas deposit | BBVA

[7] Argentina energy mogul bets on shale gas amidst looming presidential election (worldoil.com)

[8] Argentina’s Vaca Muerta shale boom is running out of road | Reuters

[9] Argentina: First segment of President Néstor Kirchner gas pipeline inaugurated — MercoPress

[10] Néstor Kirchner Gas Pipeline – Global Energy Monitor (gem.wiki)

[11] Argentina’s conventional oil and gas attract explorers (ft.com)

[12] What’s Holding Back Argentina’s Shale Revolution? | OilPrice.com

[13] Yabog Gas Pipeline – Global Energy Monitor (gem.wiki)

[14] YPFB finds new gas reservoir — MercoPress

[15] Is Argentina’s Shale Boom Finally Taking Off? | OilPrice.com

[16] Argentina hits milestone on path to gas export bonanza (ft.com)