Africa’s Potential

Africa is a land full of promise, blessed with abundant resources and huge untapped potential in human capital. And when it comes to natural gas, its gas reserves in 2021 were estimated at 625.6 tcf which is nearly equivalent to that of the United States.1 If Africa can properly develop their natural resources, they will be able to strengthen their position in the global energy supply chain and provide affordable energy not just for their people but to the entire world. We are seeing glimpses of this already.

According to the Gas Exporting Countries Forum, the demand for energy in Africa is expected to increase by 82% by 2050 and natural gas will account for 30% of their energy mix.2

What countries are currently paving the way for increased natural gas production and what will be the state of the industry in Africa a few decades hence?

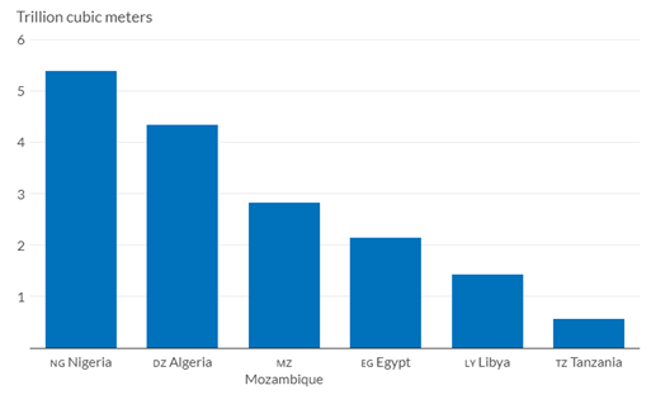

Africa's Natural Gas Reserves

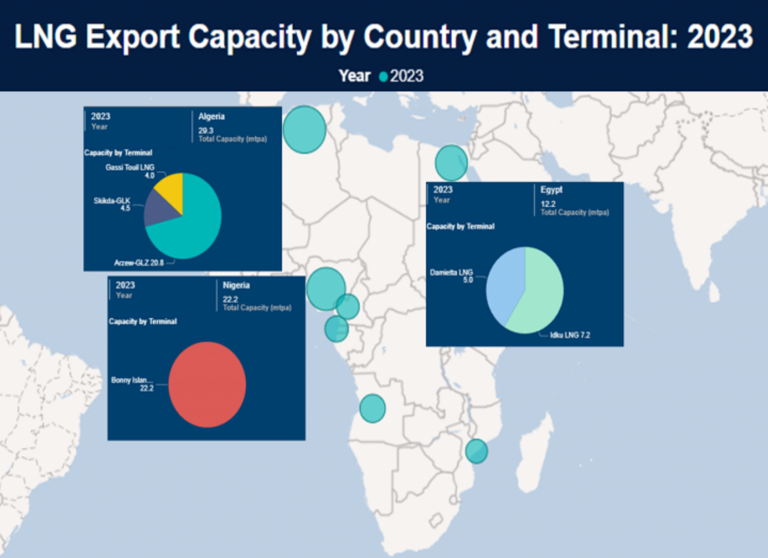

Algeria, Nigeria, and Egypt currently lead the pack in LNG exports having the highest export capacity on the continent. Algeria’s export capacity is 29.3 mtpa, Nigeria’s is 22.2 mtpa, and Egypt’s is 12.2 mtpa.

According to a report from the African Energy Chamber, “Algeria, Egypt, and Nigeria are expected to drive the majority of the natural gas supply with an average of 80% of the total African gas coming from these three countries.”6

Africa’s Current LNG Projects

There are several big projects in progress or awaiting FID. These include Coral North FLNG, Rovuma LNG, Mozambique LNG, and Tanzania LNG in Southeast Africa. These projects will be instrumental in significantly increasing Africa’s LNG export capacity over the next decade.

Coral North FLNG

This proposed project would be a duplicate of the Coral South FLNG currently in operation. The north facility is expected to commence operations in 2027 and will be providing a capacity of 3.5 mtpa alongside the 3.5 mtpa already in place at Coral South. 7

Rovuma LNG

Rovuma LNG was initially going to be a two-train project with 7.6 mtpa capacity per train combining for 15.2 mtpa. However, the design was recently changed to use small modular units. It has become a twelve-train project with 1.5 mtpa capacity per train but a higher total capacity of 18 mtpa. These smaller trains are becoming more popular for new LNG project proposals. It helps mitigate risk for stakeholders who don’t have to commit to large projects from the beginning but can instead commit to additions to the project as demand changes over time.8

Mozambique LNG

This project was proposed to take advantage of the approximately 65 tcf of natural gas that was found of the northern coast of Mozambique in 2010. The project reached FID in 2019 but stalled due to concerns of security and stability within the area. However, TotalEnergies recently announced that they were in the process of restarting construction.9 The project was originally going to be delivering its first cargo in 2024 and was going have the capacity to export 43 mtpa.10

Tanzania LNG

While the three projects described above are all located within Mozambique, this last project is to be sited just north of Mozambique in Tanzania. The project was initially proposed in 2016 and would provide 10 mtpa worth of capacity, but negotiations have been slow. However, recently Equinor, Shell, and Exxon reached an agreement with the Tanzanian Government on a regulatory framework and how the LNG produced at this facility will be shared. The acting director of Tanzania’s Petroleum Upstream Regulatory Authority, Charles Sangweni, stated “We are happy it is a big step towards the implementation of the project although we have a lot to do. If everything goes well as planned, I am confident that the final investment decision will be reached in 2025.”11

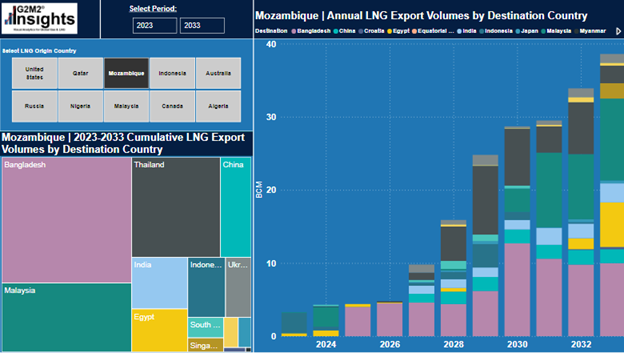

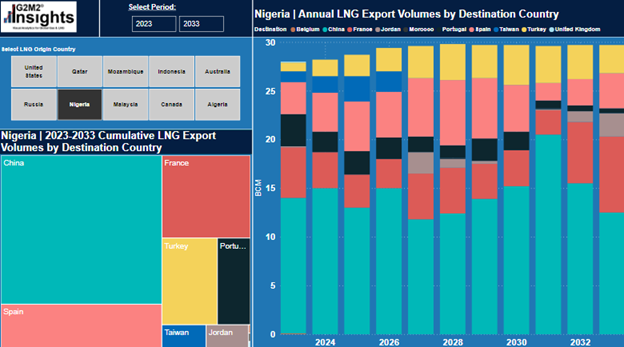

Where does Africa’s LNG Flow?

The top African LNG exporters over the next 10 years are forecast to be Mozambique, Algeria, and Nigeria. Because of history and geography, each of these countries are expected to supply its LNG to a different set of destination countries. RBAC’s outlook shows that the top three destinations for Mozambique LNG over the next ten years will be Bangladesh (66.8 bcm), Malaysia (36.7 bcm), and Thailand (36.3 bcm).12

Nigeria’s top three LNG destinations will be China (158.8 bcm), Spain (49.0 bcm), and France (48.5 bcm).

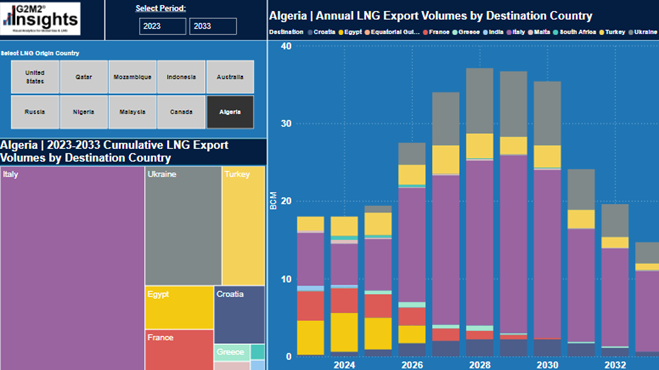

Algeria’s top three LNG destinations will be Italy (155.8 bcm), Turkey (26.7 bcm), and Egypt (15.7 bcm).

Ukraine was also going to be an importer of Algerian LNG, had their planned LNG import terminal begun operation. The terminal was going to consist of both an FSRU and a land-based facility combining for 7.3 mtpa. This project would have helped Ukraine move away from being reliant on imports of Russian gas; however, the project was never able to get off the ground. It was supposed to start construction in 2012 and be in operation by 2018.13 However, the project was delayed for years due to a lack of sufficient investment. Interest was renewed again in 2017 when Frontera Resources signed a new agreement with Naftogaz to resume construction, but there have been no new updates on the project since.14 The graph below shows what Algeria’s cumulative LNG exports would have been if Ukraine does come online by 2025.

How Natural Gas will Shape Africa’s Future

Although the African continent has grown, with a GDP 4.5 times larger than that of 20 years ago, it still has much progress to make. This includes high levels of extreme poverty in the very countries which are expected to supply large volumes of LNG to the world over the next several decades—Nigeria (11.9%), Tanzania (4.5%) and Mozambique (3.5%).15

While the development of natural gas resources within the continent won’t immediately fix these issues, it will contribute to eventually solving them. The secretary general of the East Mediterranean Gas Forum stated at a recent energy conference that, “Africa needs to have better living standards and at the same time several African countries during the last few years have discovered a lot of gas and they need to develop this gas to have better lives for their people and also for industrialization.”16

This can be accomplished through the construction of domestic infrastructure such as pipelines, gas-fired power plants, and liquefied petroleum gas (LPG) supply chains to meet the needs of their people. In addition, LNG export projects can help to secure sources of revenue which can be used to address economic challenges that have stifled development in the past. Even the transportation sector in Africa would benefit from increased investment into natural gas. Vehicles that use compressed natural gas (CNG) have been steadily increasing in number over the last few years primarily in Nigeria, Egypt, Tanzania, and Kenya.17

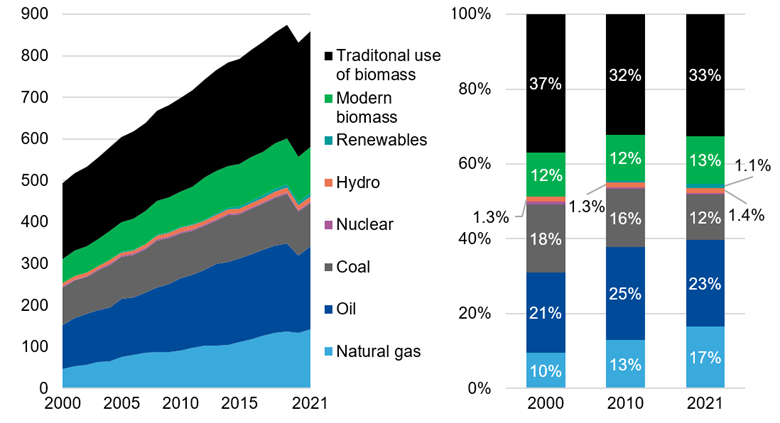

Natural gas has been steadily increasing its presence in Africa’s energy mix over the last twenty years. It will likely continue its growth as Africa becomes more industrialized and the availability of reliable electricity becomes more common.

In 2021, only about half of the population of Sub-Saharan Africa had access to electricity.18 Natural gas will likely continue to increase its presence in Africa’s energy mix as Africa becomes more industrialized, and the availability of reliable electricity becomes more common and accessible to residents of the continent. The capital saved by investing in and utilizing their domestic resources will help spur economic growth for the future.

Some wish for Africa to move away from further integration of fossil fuels into their economies and instead look towards renewable energy such as solar power. However, energy leaders in Africa are of a different view, such as African Development Bank President Akinwumi Adesina who said, “Africa must have natural gas to complement its renewable energy.”19 Many other leaders agree that to meet the energy needs of a growing and industrializing Africa, natural gas will be needed to provide reliable and affordable energy as well as better energy access for all.20 Mr. Adesina further stated recently at the Africa Climate Summit 2023, “We must make sure we achieve universal energy access, optimising and maximising the potential that Africa has, including natural gas, which is a great part of the energy mix.”21

As Africa further develops its gas resources for both domestic use and for export, RBAC’s G2M2® Market Simulator for Global Gas and LNG™ can be used to help countries both within and outside of Africa to better navigate global market, and enable investors, executives and other leaders to make better investment decisions and thus a better energy future for this vast continent and its peoples.

RBAC, Inc. has been the leading provider of market fundamental analysis tools used by the energy industry and related government agencies for over two decades. The GPCM® Market Simulator for North American Gas and LNG™ is the most widely used natural gas market modeling system in North America. RBAC’s G2M2® Market Simulator for Global Gas and LNG™ has been instrumental in understanding evolving global gas and LNG dynamics and is vital in fully understanding the interrelationship between the North American and global gas markets.

[1] U.S. Energy Information Administration – EIA – Independent Statistics and Analysis

[2] Expert Commentary – The role of natural gas in powering Africa’s future (gecf.org)

[3] The Nigerian government claims to have 33% of all of Africa’s gas reserves | Business Insider Africa

[4] Exxon And Chevron Close To Signing Gas Exploration Deals In Algeria | OilPrice.com

[5] Algeria’s Sonatrach signs natural gas contracts with TotalEnergies (thenationalnews.com)

[8] Exxon Eyes Staggered, But Larger, Rovuma LNG Scheme | Energy Intelligence

[9] TotalEnergies prepares for Mozambique LNG restart | Reuters

[10] About the Mozambique Liquefied Natural Gas Project | TotalEnergies-led Mozambique LNG Project

[11] Equinor, Shell and Exxon agree LNG project with Tanzania | Reuters

[12] G2M2 Insights Visual Analytics for Global Gas & LNG – RBAC Inc.

[13] Ukraine Starts to Import Gas from Europe, Cuts Imports from Russia – Jamestown

[14] Frontera Signs MoU with Ukraine’s Naftogaz for Upstream, LNG Cooperation | Rigzone

[15] Africa: share of global poverty by country 2022 | Statista

[16] Africa must use its gas reserves to drive the economy, industry officials say | Reuters

[17] Natural gas-fueled vehicles are popping up across Africa (the-star.co.ke)

[18] Access to electricity (% of population) – Sub-Saharan Africa | Data (worldbank.org)

[19] Africa deserves right to use natural gas reserves – AfDB chief | Reuters