Southeast Asia’s Gas Consumption

After East Asia, Southeast Asia is seen as another engine of global economic growth due to the gradual shift of industrial production to the area from more developed regions. Southeast Asian economic growth will be fueled by a substantial increase in energy consumption, so RBAC’s Global team has focused on this market, which includes Thailand, Malaysia, Singapore, Indonesia, Vietnam, Myanmar, and Philippines, to find future growth characteristics and trends for natural gas.

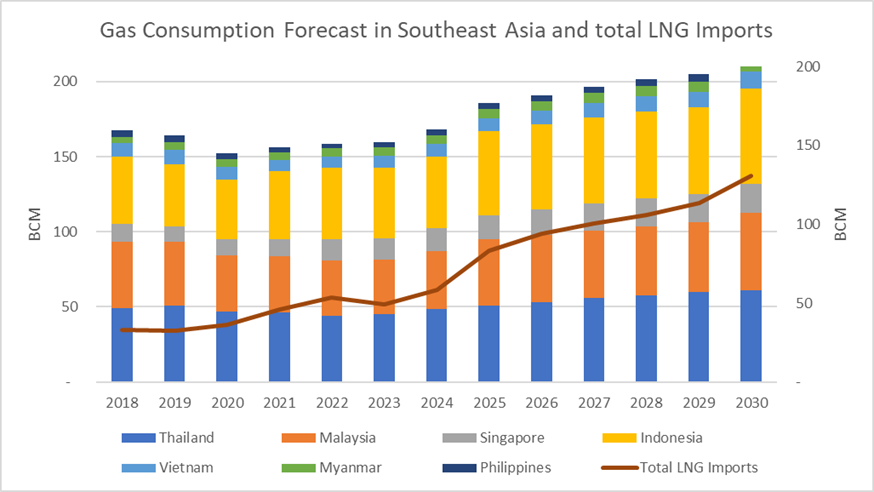

Currently, natural gas in Southeast Asia is mostly used for industry and power generation—residential and commercial use is limited because of underdeveloped infrastructure and a lower demand for heating due to the relatively hot climate. In the current scenario, it is predicted that from 2022 to 2030, the total natural gas consumption of the seven countries will increase by 37%, up to around 60 BCM of growth in consumption and 78 BCM of growth in LNG imports, with an average annual growth rate of 4% and 12% respectively. With the decrease in domestic production, LNG is the main source in meeting the incremental demand. However, the experience of most of Southeast Asian countries in international LNG trade is not yet mature. Compared to China and South Korea, Japan has a higher level of trade participation and motivation to penetrate the Southeast Asian market and has invested in several gas-to-power projects.

Key takeaways:

- Domestic gas consumption and LNG demand in Southeast Asia will increase in the next decade.

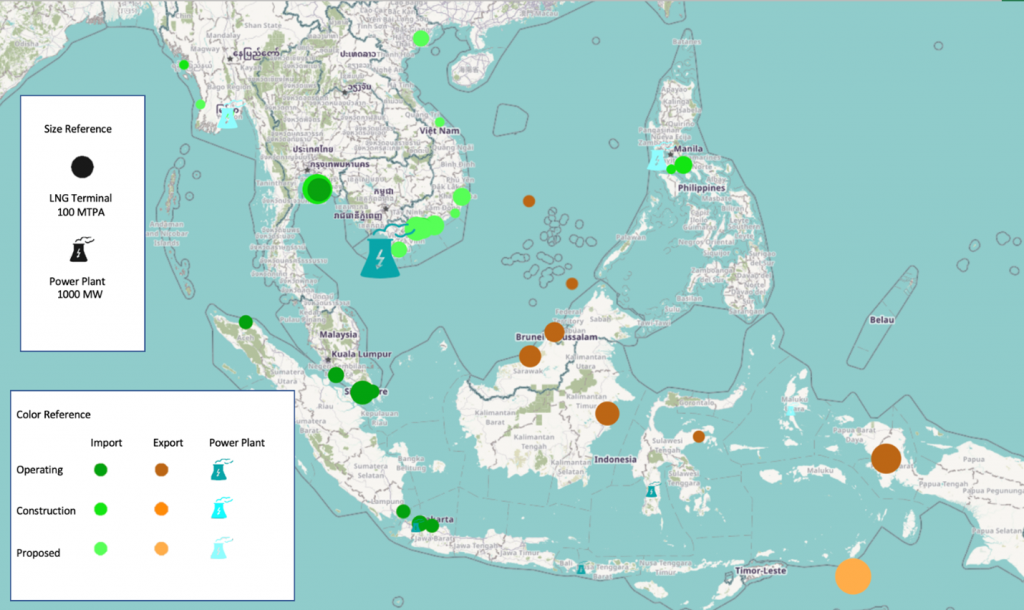

- Different countries share individual dynamics in energy transition. Indonesia and Malaysia will reduce their natural gas exports and may undergo a transition from being natural gas-exporting countries to importers. Other natural gas-importing countries will decrease their reliance on pipeline gas from neighboring countries and opt for LNG.

- Japan can participate in the midstream and downstream segments of the natural gas market in Southeast Asia.

Thailand

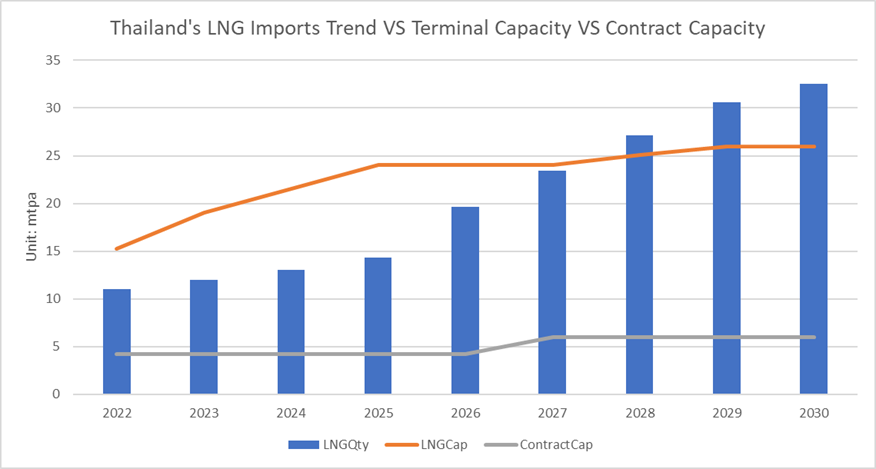

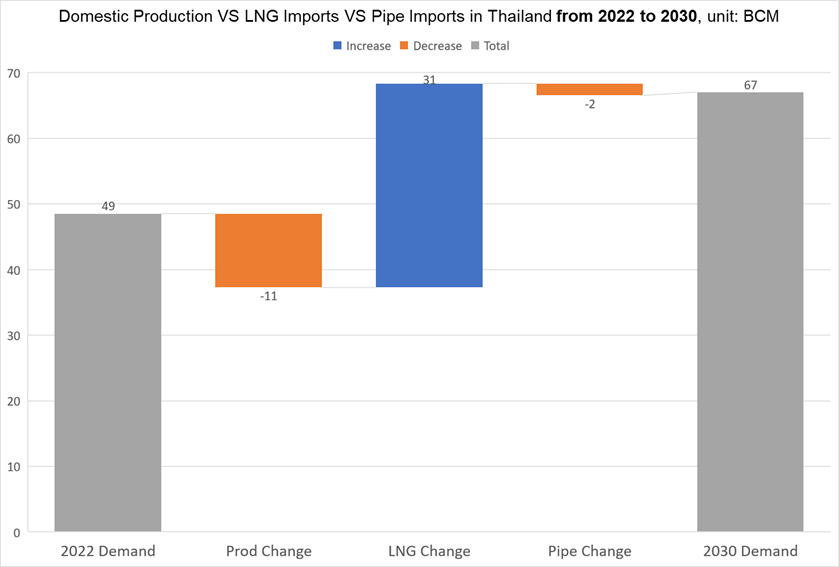

In recent years, natural gas consumption in Thailand has remained stable. However, LNG imports increased by 21% in 2022 compared to 2021, reaching 11 BCM and accounting for 25% of total consumption. According to G2M2, Thailand’s local natural gas production is gradually decreasing. Due to the uncertainty of gas imports from Myanmar, Thailand will be importing more LNG in the future to balance the decrease in production.

As shown in Figure 3, the required amount of LNG will exceed the current regasification capacity by the end of 2030, indicating that if the current situation persists, purchasing LNG in the future may be directly from the spot market, which will increase the risk of potential high prices or shortages.

Singapore

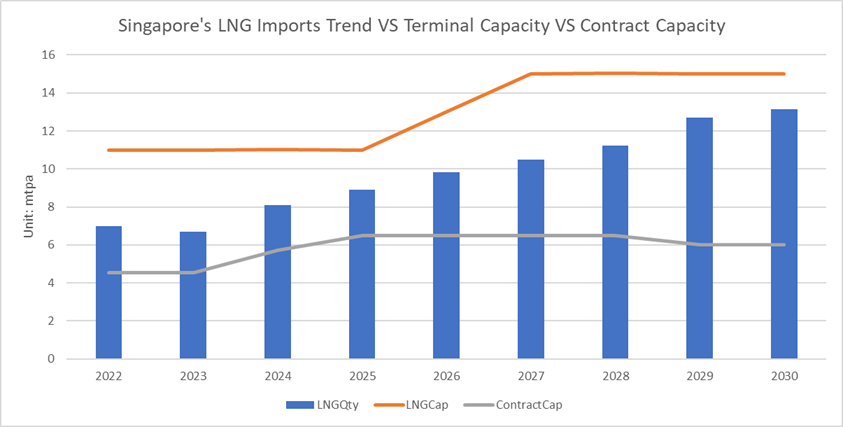

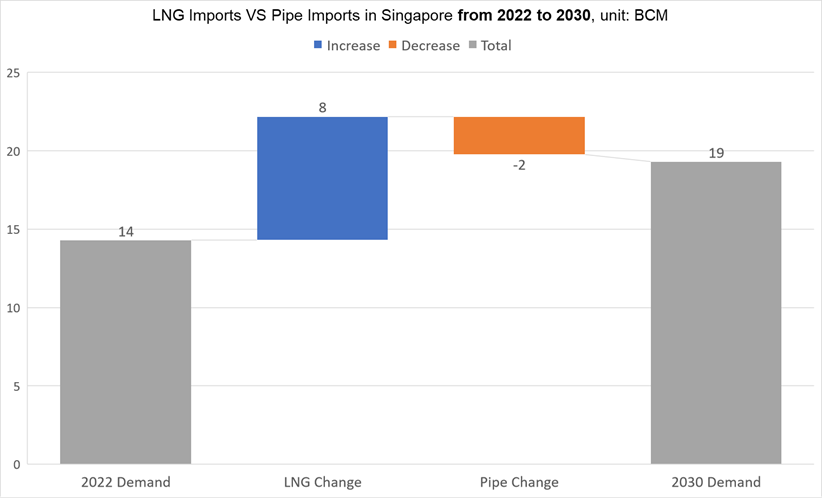

Natural gas is Singapore’s main source of electricity generation, and it will maintain a relatively stable growth over the next decade. Similar to Thailand, Singapore will gradually reduce its reliance on pipeline gas from Malaysia and Indonesia and increase LNG imports. When several of their pipeline gas import contracts expire in 2024, Singapore plans to move towards utilizing LNG to meet all of its natural gas demand.1 In order for this to be possible, Singapore will need to expand its LNG import capacity. According to G2M2, LNG will account for the vast majority of total consumption by 2030. However, according to GIIGNL 2022, the current total amount of LNG contracted by Singaporean companies will be covering about 6 mtpa out of the expected 2030 LNG demand of 13 mtpa, as demonstrated in Figure 5.

Malaysia and Indonesia

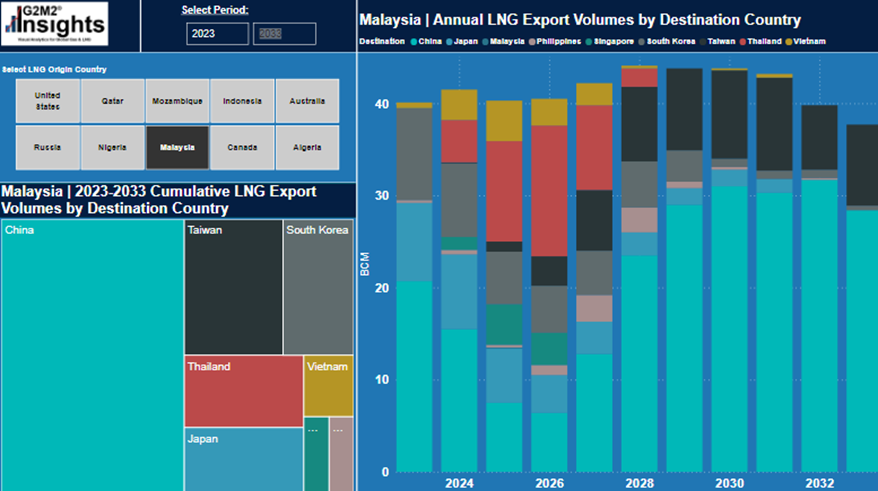

Increasing domestic natural gas consumption combined with inability to replace or expand reserves is expected to limit exporting potential for Malaysia and Indonesia. According to G2M2’s latest base case release, Malaysia will maintain a stable level of exports with slight growth peaking at approximately 44 bcm in 2028 and then declining, while Indonesia will gradually reduce its LNG and pipeline gas exports over time.

Vietnam

Vietnam’s natural gas demand, along with demand from other energy sources, is expected to rise due to its strong 6-7% yearly growth in GDP.

However, it has been increasingly difficult for Vietnam’s domestic gas fields to support this growing gas demand. As a result, Vietnam started importing LNG for the first time in 20232 and has plans to build more regasification terminals. Recognizing its needs to hedge the price risk of LNG imports, Vietnam has been seeking LNG contracts, although there have been no public announcements yet on any deals signed

Myanmar

Myanmar’s natural gas demand is projected to continue increasing, primarily driven by the power generation sector, as shown in Figure 1. Despite having a significant amount of gas fields, Myanmar’s production is far from sufficient to meet the growing demand, especially considering that two-thirds of the gas has been exported to Thailand and China in the past decade. It is estimated that Myanmar’s domestic gas production is expected to decline from 14 BCM in 2025 to 8.4 BCM in 2040.

To address this, Myanmar is transitioning to becoming an LNG importer. According to GIIGNL, Myanmar started importing LNG in 2020. Even though this was a small amount, it is highly possible for imports to increase in the future due to Myanmar’s increasing demand and diminishing reserves. Yet after a coup d’etat overthrew the Burmese government in February 2021, many companies were forced to withdraw, reduce, or postpone investments.3 For example, Thailand’s PTTEP postponed a $2M project this February. Those withdrawals are causing diminishing revenue, which in turn slows progress in gas development.

Philippines

Despite a small increase recently, natural gas growth in the Philippines is below the average level of Southeast Asia. One reason is that the Philippines is actively undergoing an energy transition, while on the other hand, they are running out of gas. The Malampaya gas field is expected to stop producing gas completely within 4 years. In response, the Philippine government is actively searching for new gas fields: in July 2023, President Ferdinand Marcos Jr. extended the Malampaya gas field contract, SC 38, for 15 years, prompting exploration for more gas reserves nearby. The Malampaya field currently supplies 20% of the island of Luzon’s power, Luzon is the most populous island in the Philippines with a population of over 64 million. This contract extension will add at least $600 million in investments towards drilling two new wells and construction of subsea facilities.4 There is an estimated additional 210 bcf of gas near the existing Malampaya field that, if developed, would be a new source of natural gas that would take the place of the declining Malampaya field.

According to G2M2, if domestic production declines, the Philippines will shift from being a natural gas exporter to an importer, which may create a window of opportunity for growth in the local natural gas trade. Much like Vietnam, the Philippines also began importing LNG for the first time in 2023.5

Opportunities for the Global Market

As discussed above, almost every Southeast Asian nation is experiencing the shift from LNG exporter to LNG importer. It is apparent that this change will provide many opportunities to other players.

One such player is Japan, who has been purchasing excessive quantities of LNG from ASEAN countries. When the nations turn to importing LNG, Japan has the potential to re-sell LNG back to Southeast Asia, earning a sizable profit. Japan is leveraging its geological proximity to take lead in this emerging market. Currently, Japan has LNG purchase contracts that exceed its expected domestic consumption.

Furthermore, in recent years, Japan has actively expanded its presence in various Southeast Asian countries, constructing power plants and LNG receiving terminals in countries like Vietnam. This suggests that Japan may plan to resell the excess natural gas to other countries, including Southeast Asian nations.

However, Japan isn’t the only player who’s making significant moves. LNG exporters around the world are all reaching out to sell LNG to this region. For instance, Singapore has arguably the widest network of LNG suppliers from virtually every single continent. Among them is top global exporter Australia, from which they received over 5 BCM in 2021.

China is also actively cooperating with Southeast Asian countries and participating in international LNG trade. For example, Zhejiang Hangjiaxin will purchase up to 500,000 tons of LNG from Singapore’s Pavilion Energy starting from 2023. Xin Ao Holdings has recently signed a long-term LNG purchase and sale agreement with Cheniere Energy for approximately 1.8 million tons, marking their second long-term LNG agreement. In theory, if China actively cooperates with Southeast Asian countries, it can also establish its own industry chain and profit from it, similar to Japan.

China, Japan, and South Korea, as major LNG buyers in the international market, have established good cooperative relationships with many sellers in Southeast Asian countries. With their close geographical proximity, trade between East Asia and Southeast Asia is much more convenient and has lower transportation costs compared to trade with the Americas and the Middle East.

Clearly, the competition for Southeast Asian markets is tense, but it seems like Japan will be the most influential player in the near future, due to its investments in various ASEAN terminals. Yet considering the volatility of the gas market and various countries’ (e.g. Qatar, Angola, and US) ambitions in cooperating with Southeast Asia, it is still an unknown who will be able to retain this leading position for decades to come.

Author:

Jiaxin Yang, Global Gas Market Analyst

Richard Yiu, Analyst Intern

RBAC, Inc. is the market leading supplier of global and regional gas and LNG market simulation systems. The G2M2® Market Simulator for Global Gas and LNG™ is designed for developing scenarios for the converging global gas market. It is a complete system of interrelated models for forecasting natural gas and LNG production, transportation, storage, and deliveries across global gas markets.

[1] International – U.S. Energy Information Administration (EIA)

[2] U.S. Energy Information Administration – EIA – Independent Statistics and Analysis

[3] Myanmar’s natural gas income in jeopardy as foreign firms exit – Nikkei Asia

[4] PH still open to exploration of untapped gas fields | Philippine News Agency (pna.gov.ph)

[5] Ibid.