H.R.5376 or The Inflation Reduction Act of 2022 seems to be all anyone can talk about these days. This broad-ranging legislation touches everything from healthcare to the IRS budget and even climate change. Proponents of the bill having said it will reduce healthcare costs, fund low-carbon energy projects and close tax loopholes. Opponents have opined it won’t reduce inflation and has increased costs to energy producers, increased royalty costs and additional fees on methane emissions. So, is it the death knell for the fossil fuel industry?

Whatever your view on the bill overall, digging in a bit, you will find there are some surprising take-a-ways that the oil and gas industry can find solace in. Senator Joe Manchin negotiated for the re-opening of federal lands and offshore waters as well as incentives towards carbon capture solutions. There was also a concession by the Biden Administration to streamline the Mountain Valley Pipeline approval process as well as speed permitting for future oil and gas projects, which would be a boon to Joe Manchin’s constituents and the entire Appalachian region. Which seems great, right?

But can Mountain Valley Pipeline reduce inflation? And why is this particular pipeline important?

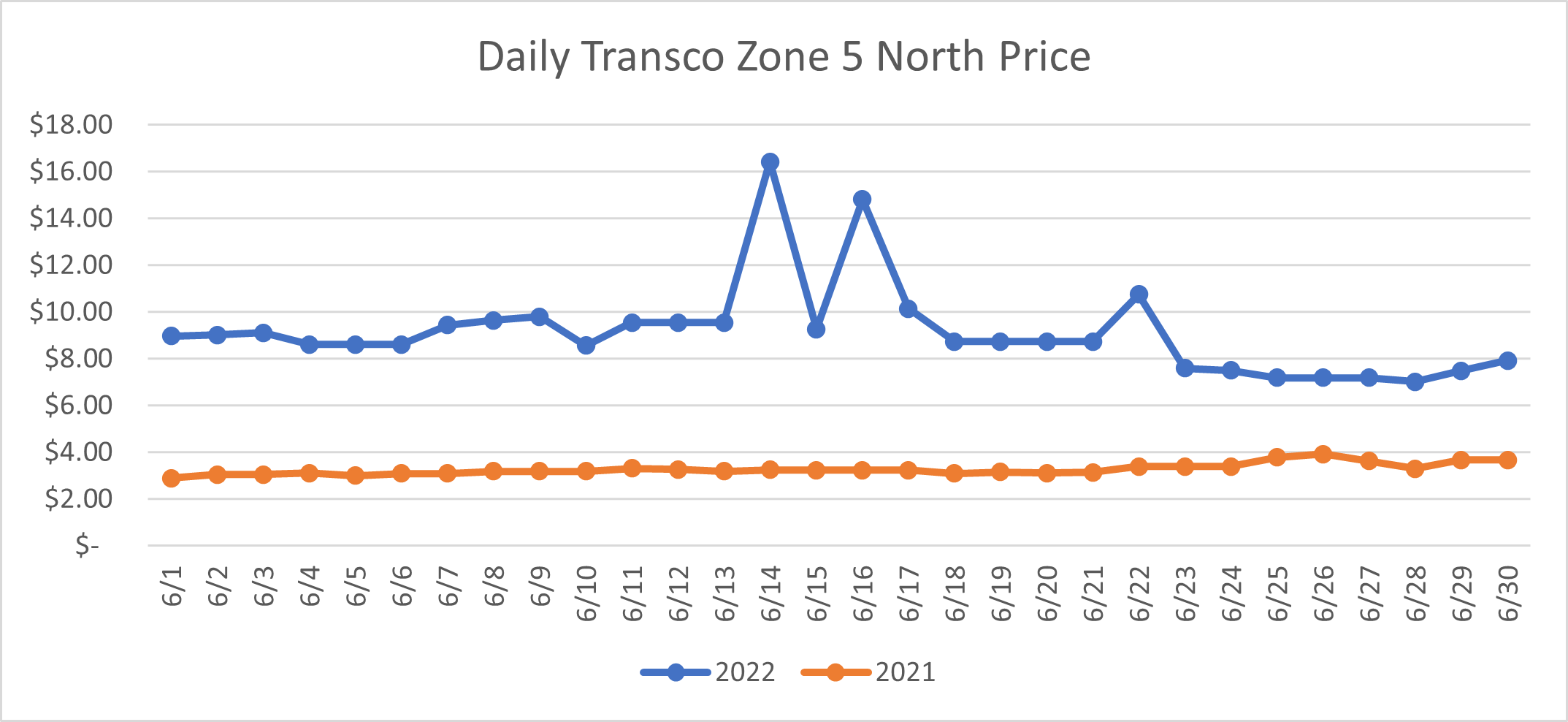

The Mountain Valley Pipeline is a 303-mile pipeline which extends from the heart of the Marcellus and Utica Shales in northern West Virginia to southern Virginia. Southern Virginia has traditionally depended on imports from Texas and Louisiana for their natural gas needs, which before, had never been an issue. However, with the advent of LNG (Liquified Natural Gas) Exports, southern Virginia is now competing with LNG tankers for molecules of natural gas. Transco Zone 5 North (Transco Z5 N), the natural gas market of southern Virginia, where Mountain Valley would deliver into has experienced a drastic increase in price and volatility when comparing daily prices per dekatherm (Dth) from June 2021 to June 2022. Quantified below, daily prices increased 182% in June 2022 when compared to June 2021. That is nearly 3 times as much for the commodity portion of local utility bills. Is 2022 an aberration or omen?

While there are macro-economic factors beyond our control at play, this is significant for another reason. The average cost per Dth at Transco Z5 N was $9.15 in June of 2022. In contrast-Columbia-Appalachia natural gas prices, supply gas that would feed Mountain Valley Pipeline, averaged $6.91. Meaning that consumers in southern Virginia are paying a premium of 33% because a 4-mile section of pipeline has been held up in court.

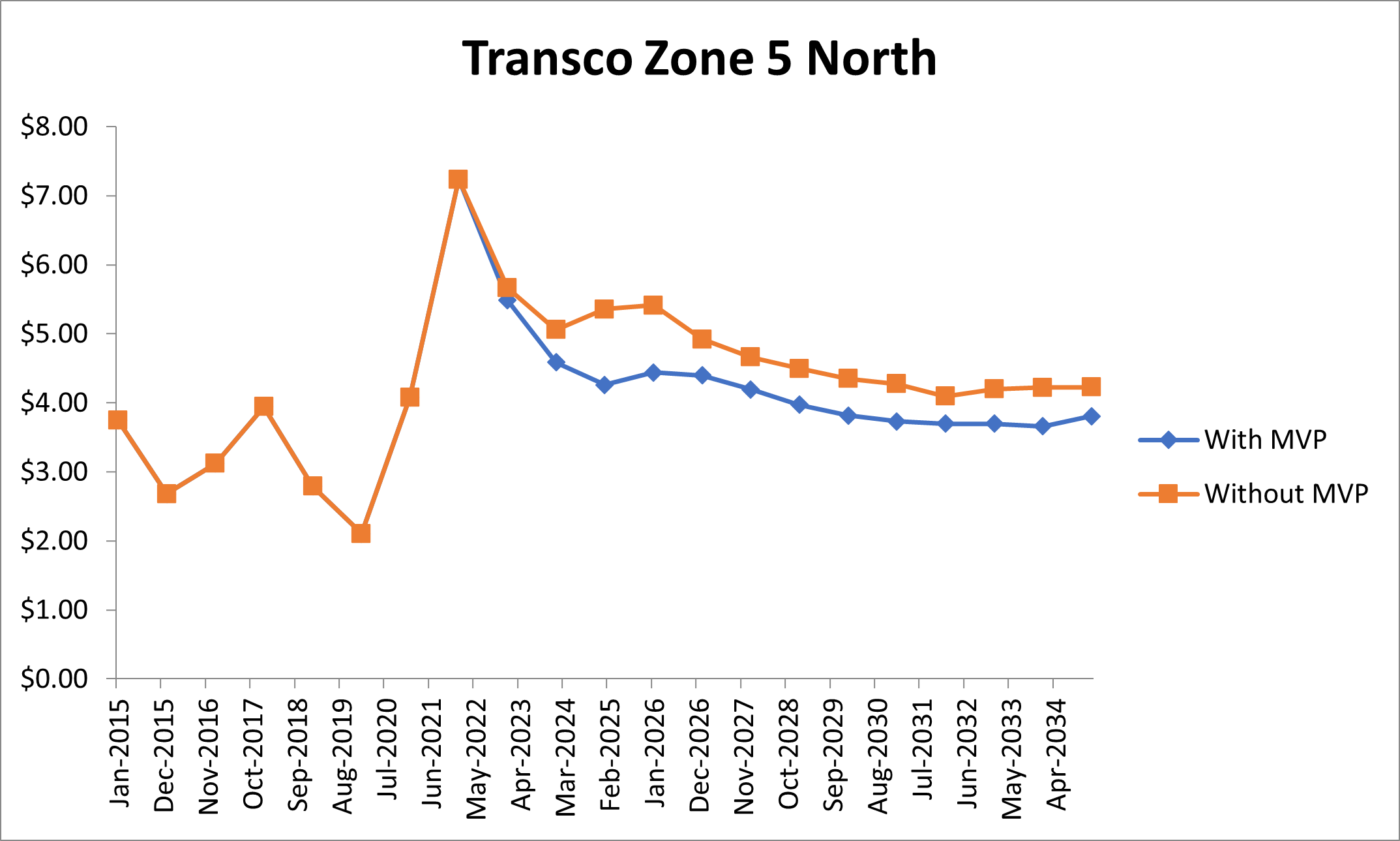

Using RBAC’s GPCM® Market Simulator for North American Gas & LNG™ software, we ran scenario forecasts on future Transco Z5 North pricing with and without the Mountain Valley Pipeline (MVP). The graph below reinforces the fact that without MVP, consumers in the region will continue to pay a premium for their energy.

This concession for MVP approval streamlining is nowhere near written in stone and will be addressed in additional legislation later this year. If it comes to fruition, it could drastically impact domestic energy pricing in the mid and long-terms. IF, a very big if.

But Senator, as the old adage goes, “don’t count your chickens before they hatch.”

Right now, we’re in the midst of an inflationary spiral. By inflationary spiral I am referencing the sequence of events that are impacted by the dramatic increase in energy prices we are currently experiencing. When the cost of energy increases, so in turn do the costs of products and services which depend upon that energy, i.e., electric generation, steel manufacturing and other energy-intensive manufacturing processes. This cascades into workers requiring higher wages to buy the same amount of goods as before. But that is not the end of the story, higher wages are another input into the production costs of materials, goods and services, thus creating a vicious cycle of rising costs of energy, goods and services, and wages—all spiraling out of control.

This concession is an important step in shortening the inflationary spiral we are experiencing and could impact our country and the world to an extent unrealized by the bill’s original expectations.

Fostering an environment where energy infrastructure is prioritized would allow cheap, environmentally friendly energy to be transported to regions in need. That’s especially vital in tough times when millions of Americans are struggling and every penny counts (in case some are unaware, natural gas is currently trading back over $9/MMBtu, and that’s a lot of pennies). So yes, Mountain Valley Pipeline could reduce inflation.

And Transco Zone 5 North is not the only region to be affected by the approval of MVP, nor the only region currently affected by infrastructure constraints, just the only one explicitly mentioned by Joe Manchin. Consumers in New York and New England would also benefit from a streamlining of the permitting and construction requirements. Yet, recent experience suggests this will be no small feat. One only needs to think back to the demise of the Atlantic Coast Pipeline, even after spending billions and getting so close to completion. One thing has proven certain, overcoming opposition to such infrastructure will be a challenge. Yet, if Senator Manchin can pass this upcoming legislation, he will be helping millions of Americans around the country, not just in his small corner of West Virginia. But don’t count your chickens just yet Senator Manchin.