Vietnam’s Power Crisis

Last year brought particularly persistent blackouts to Vietnam, especially in the North, where the streets were darkened as the country faced a power crisis brought on by shortfalls in power generation and higher demand during intense heatwaves. The country is heavily reliant on coal and hydropower for electricity generation, but the blistering heat and drought greatly impacted the effectiveness of hydroelectric plants. Available hydropower was reduced to merely half the installed capacity (one-fifth in some areas) causing recurring loadshedding as well as unannounced blackouts. The country’s coal-power generation also was under strain, with some capacity offline awaiting repairs, the remaining plants were not enough to meet the demand, and this started to affect industry with rolling blackouts and sudden power outages costing an estimated US $1.4 billion in lost revenue.

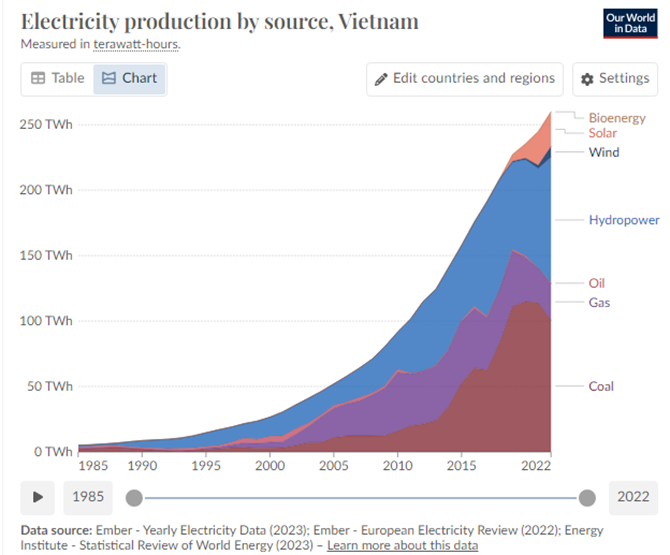

Vietnam’s electricity generation is primarily made up of a near even mix of hydropower and coal, with natural gas, solar, and wind also part of the country’s energy portfolio. However, Vietnam’s Power Development Plan VIII, approved in 2023, details a changing future for its power generation sources. “Longer-term goals include the gradual phase-out of coal, increased reliance on natural gas, specifically LNG, and an expansion of renewable energy capacity from 30.9% of the country’s energy mix in 2030 to 67.5% by 2050.”

The Role of Coal

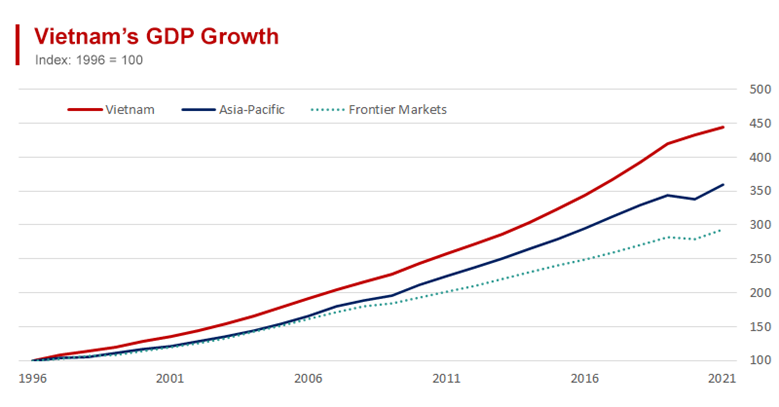

Even with Vietnam planning to move away from coal towards natural gas then eventually to hydropower and renewables such as solar and wind, this shift won’t take place over night. In fact, coal has been integral to the overall economic development of Vietnam and its rapid industrialization which is necessitating higher demand for power.

Vietnam’s current coal-fired generation capacity is about 25 GW, accounting for slightly over one third of its total capacity of 78 GW. Coal imports and domestic production are still increasing compared to what they were in 2023, and overall usage of coal for power generation is expected to increase to 30 GW before it gets phased out. The increases in coal imports, domestic production, and generation capacity to consume this coal, will assist in meeting future power demand as Vietnam further industrializes.

However, in the eyes of some global organizations, Vietnam’s planned transition away from coal is not occurring quickly enough and are investing money to hasten it.

Members of the G7 have offered grants and some low-cost loans to Vietnam to support the reduction in coal usage. But not all has been peaches and cream. According to Reuters, “Vietnam pushed for a large share of grants and cheap funding to smooth its planned costly phase-out of coal-fired power plants and replace them with wind farms and other renewables sources, but donors offered mostly expensive loans at market rates amid chronic delays in the country’s power projects.”

Hydropower and Droughts

Hydropower is currently the largest source of renewable energy within the country. However, in terms of being a reliable source of energy, it may not be the most effective for a country that has a high propensity for droughts.

Over the last two decades, Vietnam has experienced several ‘flash droughts’ across the country. A flash drought can be more impactful to a community than a normal drought as it doesn’t take nearly as long to develop as a traditional drought and is more difficult to predict. Northern Vietnam is the most reliant on hydropower so any droughts occurring can have a profound impact on the local economy. However, droughts of this nature and the more common variations are not unique to this region alone and happen across the country.

The Mekong Delta is one of the most important bodies of water within Vietnam and is home to a variety of industries such as agriculture, fishing, and energy. However, due to droughts in 2019, “The Mekong water levels dropped to their lowest in 100 years,” which is greatly affecting the region. Droughts of this severity are still occurring, with one taking place just last year in 2023.

After several record-high temperature heat waves decimated various rivers and reservoirs, Vietnam experienced power outages and rolling blackouts due to low water levels. “At Thac Ba hydropower plant in Yen Bai province, 160 kilometers (100 miles) north of Hanoi, water in the reservoir is at its lowest level in 20 years, according to state media. At its worst, the water was about 15 to 20 centimeters (6 to 8 inches) below the minimum level needed for the plant to function.”

Solar and the Grid

Southern Vietnam has a solar potential similar to that of Southern California, and the solar industry has seen substantial investments and growth and is producing power as intended, but a large portion of the power generated is not being consumed. This is due to limitations within the underlying grid structure that is simply unable to properly support the boom in solar energy. A supermarket manager in Vietnam’s southern Ninh Thuan province stated that, “I’m losing on average 40 percent of output.” He has to turn off the solar panels he installed on the roof of his store, even during hours in which solar power generation would peak. “Across southern Vietnam and the Central Highlands, authorities are asking small-scale energy producers like Kiet and industrial solar farms alike to limit their operations due to infrastructure limitations.”

While it is true that in some capacity Vietnam is planning to follow along with the energy transition through the phasing out of coal and increasing the presence of renewables in its energy mix, it also intends to utilize LNG as a bridge fuel to take over the role of coal and help, “Secure the national power supply capacity until renewable energy is broadly commercialized at appropriate prices.”

Natural Gas and LNG

Natural gas is primarily used in Vietnam for power generation: between 2015 and 2020, over 75% of consumption was to make electricity. Vietnam also has domestic natural gas production which totaled 8.08 bcm in 2022, an 8.3% increase to the previous year. Vietnam also plans steady growth: “Vietnam’s masterplan” sets domestic natural gas production targets at 5.5 – 15 bcm per year by 2030, and 10 – 15 bcm per year by 2050.

One of the long-awaited projects for achieving this goal recently reached FID when Mitsui & Co committed $740 million to the “Block B Project.” This project would develop the Kim Long, Ac Quy, and Ca Voi gas fields with a potential production capacity of 490 mmcfd along with a pipeline to transport the gas to gas-fired power plant facilities.

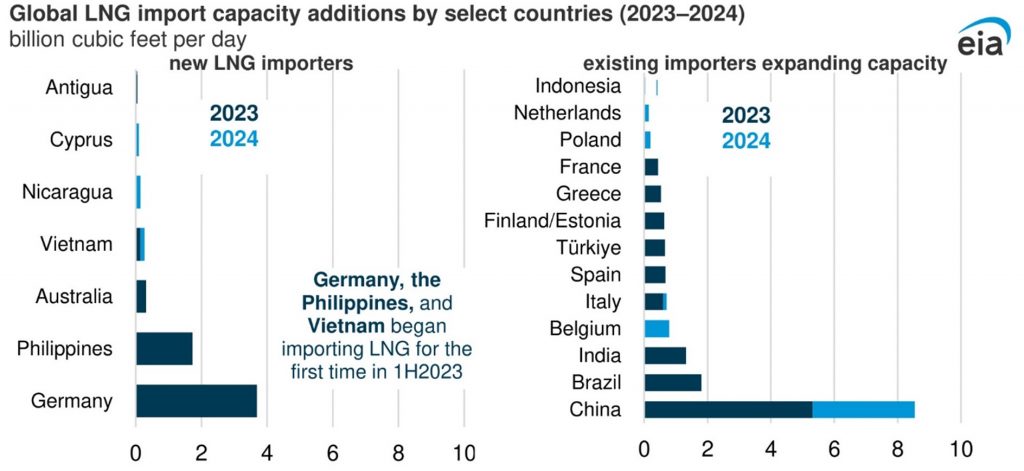

However, this project is not expected to begin production until 2026 causing concern over whether domestic production in the near term would be able to keep pace with rising demand; hence, Vietnam joining the LNG importers club in 2023.

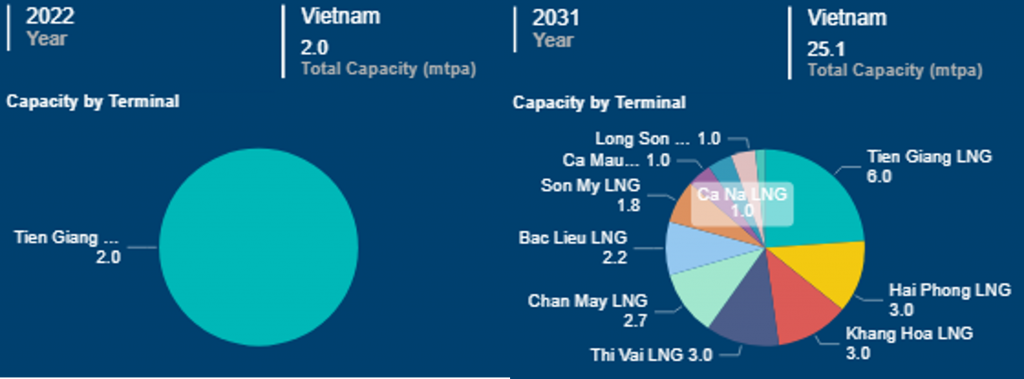

Despite having begun importing LNG only recently, Vietnam has plans to dramatically increase the presence of LNG in its energy mix in the future. Its LNG import capacity was only 2 mtpa in 2022 but is expected to increase over tenfold to 25.1 mtpa by 2031.

Being near several LNG producers, such as Malaysia and notably Australia, could prove to be of great benefit in securing long-term contracts. Australia is already taking note of Vietnam’s investments into gas and has come to an agreement with the Vietnamese Ministry of Industry and Trade to, “Streamline Australia’s exports of coal and liquefied natural gas (LNG) to Vietnam.” This proximity to major exporters coupled with the beefing up of LNG import infrastructure within Vietnam as well as investments into domestic production, highlight the potential for a bright future for gas in Vietnam.

Summary

Vietnam is hungry for power and will need all it can get to further industrialize. The current plan is to slowly continue along the path of transitioning from one energy source to another to lower carbon emissions and to ensure reliable and affordable energy for its people. The road to achieving its energy objectives may be long and expensive, but with careful and realistic planning, these lofty goals just might come to fruition.

Our goal at RBAC is to help both industry and government achieve greater certainty their energy decisions are the best possible, and with all available information and understanding on the impacts of these decisions. The G2M2® Market Simulator for Global Gas and LNG™ can be used to know the possible short-, medium- and long-term effects of any decision on natural gas and LNG related projects and better understand the global gas and LNG market as a whole. All of this is in effort to help the world make better energy decisions.

RBAC, Inc. has been the leading provider of market fundamental analysis tools used by the energy industry and related government agencies for over two decades. The GPCM® Market Simulator for North American Gas and LNG™ is the most widely used natural gas market modeling system in North America. RBAC’s G2M2® Market Simulator for Global Gas and LNG™ has been instrumental in understanding evolving global gas and LNG dynamics and is vital in fully understanding the interrelationship between the North American and global gas markets.

[1] Northern Vietnam’s widespread power outages explained – VnExpress International

[2] Heatwave lays bare Vietnam’s structural electricity woes | Reuters

[3] Power crisis cost Vietnam $1.4 bn: World Bank, Energy News, ET EnergyWorld (indiatimes.com)

[4] Vietnam Approves Power Development Plan for Cleaner Fuels | White & Case LLP (whitecase.com)

[5] Vietnam sees coal imports peaking at 85mn t in 2035 | Latest Market News (argusmedia.com)

[6] Vietnam boosts coal imports as it promises investors no more power cuts | Reuters

[7] G7 offers costly loans, few grants to help Vietnam cut coal – documents | Reuters

[9] Northern Vietnam Plunged Into Darkness as Power Crisis Prompts Investor Concerns | AsiaPacific

[10] Drought of the Sinking Delta | Parametric Press

[11] After renewables frenzy, Vietnam’s solar energy goes to waste | Energy | Al Jazeera

[12] Considerations For Vietnam To Convert Coal-Fired Plants To LNG Power Plants – Lexology

[13] Vietnam Energy Statistics 2020 (vepg.vn)

[15] Ibid

[16] Mitsui & Co eyes 2026 production date for $740 million Vietnamese natural gas project (worldoil.com)