How Spain Uses Natural Gas

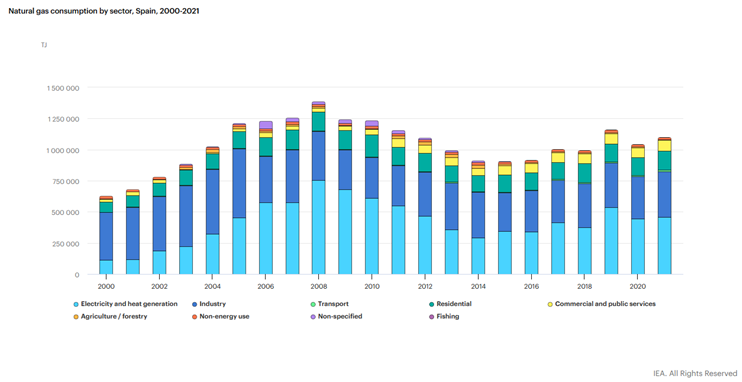

Europe is one of the most important markets in terms of natural gas and is home to some of the largest consumers of the fuel in the world. Despite domestic demand falling slightly in recent years, Spain remains both one of the top consumers and importers in the region. Spain primarily uses natural gas for electricity, heating, and for use in industries such as refining, chemistry, pharmaceuticals, and textiles.

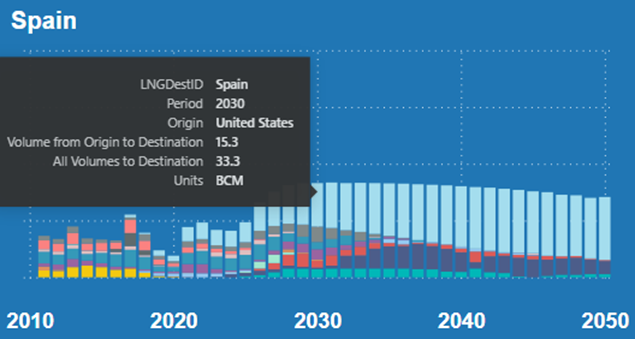

The natural gas market in Spain is expected to remain strong and even grow in the face of declining domestic demand within the country and Europe’s trend towards a fast-tracked energy transition. Spain is positioning itself as a key re-exporter of gas to the rest of Europe and abroad.

Spain’s Existing Imports

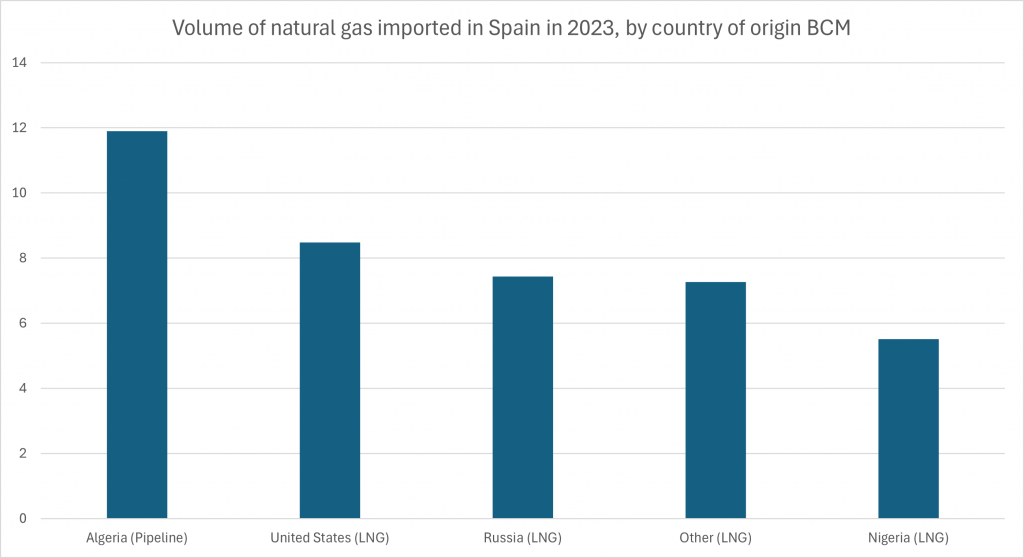

As it does not have gas reserves of its own, Spain is reliant on pipeline and LNG imports. It currently has links for natural gas from Algeria via the Maghreb-Europe Gas (MEG) Pipeline and the Medgaz pipeline. However, the MEG pipeline has not been in use since 2021 as the operation contract was not renewed due to a breakdown in diplomatic relations between Algeria and Morocco, a transit country for gas to Spain from Algeria using MEG. In 2023, Spain imported 11.9 bcm worth of gas from Algeria via Medgaz.

While Algeria is a large supplier of pipeline gas, Spain also imports a sizeable amount of LNG from the United States and Russia totaling 8.48 bcm and 7.44 bcm respectively in 2023. As Spain has no gas reserves of their own and thus cannot produce gas, they are inherently reliant on imports. It is expected to see a significant increase in the amount of LNG imports beginning in 2026.

Gas for Re-Export

Spain consumes most of the gas it imports domestically, what remains is re-exported to neighboring countries. Both Portugal and France are frequent recipients of pipeline deliveries from Spain with Morocco now able to receive gas via a flow reversal on MEG. Outside of pipeline exports, Spain is the reigning leader of LNG re-exports of non-producers of natural gas across the globe. According to Enagas, the owner and operator of Spain’s gas grid, “In 2023, Spain led the world’s non-producers in LNG re-exports with [2.26 bcm].” Italy is the primary recipient of Spanish LNG, but even far away countries and territories such as Puerto Rico have received LNG cargoes.

Spain’s Presence in Africa

We previously covered how Italy is looking to further connect Africa and Europe and the overall potential for natural gas within Africa. This could be said to be true of Spain as well.

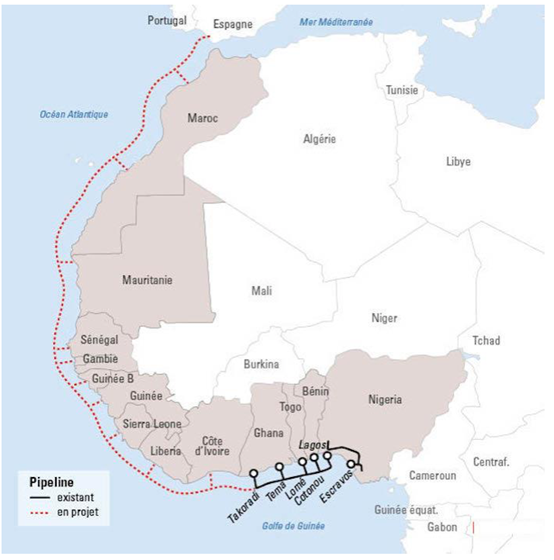

One project currently gaining traction is the Nigeria-Morocco Gas Pipeline. It is an incredibly ambitious project that would be an extension of the already existing and active West African Gas Pipeline (WAGP) which connects Nigeria, Benin, Togo, and Ghana. This expansion would connect countries already apart of WAGP and Ghana, Cote d’Ivoire, Liberia, Sierra Leone, Guinea, Guinea-Bissau, The Gambia, Senegal, Mauritania, Western Sahara, finally ending in Morocco with the option for a connection with Spain.

This pipeline would have a 30 bcm/yr capacity with a length of 5,660 km, which would make it the second longest pipeline in the world if completed. However, “If completed,” is a big “if” as this project not only requires collaboration of several countries, but also comes with a $25 billion price tag and an estimated total construction time of 25 years. The entire pipeline system being completed is likely a pipe dream, but smaller sections of it being completed are much more likely and would help provide reliable and affordable natural gas to western Africa.

The Energy Transition

Even with all of this projected growth for natural gas in Spain, it just like all other member states of the European Union, are expected to decrease the utilization of fossil fuels in the coming years. In line with initiatives set forth by the EU, Spain is currently targeting for renewable energy to make up 81% of power generation within the country by 2030. Spain’s renewable energy portfolio is largely made up of wind, hydro, and solar with investments being made into biogas and hydrogen. However, renewables (especially solar and wind) are intermittent energy sources. They are also called VRE or variable renewable energy, denoting that they are not dispatchable or firm power sources: solar farms don’t produce power at night, and wind farms don’t produce power on a calm day. The undertaking of transitioning from fossil fuels is enormous and would take a massive amount of time and capital and it certainly won’t happen overnight. Because of this, natural gas and LNG will continue to serve as a cleaner and more affordable alternative to fuels such as coal and oil, hence why it is often referred to as a bridge fuel. “No matter where you stand on climate change and the energy transition, statistics have shown over many decades that natural gas not only reduces emissions when replacing coal, but is an abundant, accessible, inexpensive (at least before the crisis) and a high-density energy source that can bridge the gap as we transition to a lower carbon future while maintaining energy security.”

Developments in Africa will be interesting to watch and how they potentially interact with the European market through the Italian and Spanish gateways. It will take an enormous amount of capital and collaboration to make enormous projects such as the Nigeria-Morocco Gas Pipeline a reality, but all parties involved seem committed to ensuring that energy is affordable, reliable, and readily available for all.

For this grand undertaking, it is imperative that market analysts and policy makers have the tools and knowledge necessary to explore all options towards meeting these enormous goals. RBAC’s G2M2® Market Simulator for Global Gas and LNG™ can be used to assess the viability and effects that any project or changes in policy would have on supply, demand, prices, and gas flows. It is with tools like G2M2 that both industry and government can find the best ways to achieve energy security for themselves and others, both in supply and production, through robust market analysis and better strategic decisions.

RBAC, Inc. is a leader in building market fundamental analysis tools used by the energy industry and related government agencies for over two decades. The G2M2® Global Gas Marketing Modeling System™ is designed for developing scenarios for the converging global gas market. It is a complete system of interrelated models for forecasting natural gas and LNG production, transportation, storage, and deliveries across the global gas markets. For more information visit our website at http://www.rbac.com.

[1] Distribution of industrial natural gas consumption in Spain in 2022, by sector (statista.com)

[3] New west-east route keeps Europe hooked on Russian gas | Reuters

[4] Spanish LNG imports, reloads dip in December – LNG Prime

[5] Italy: A Major Gateway Between Europe and Africa – RBAC Inc.

[6] Africa: The Natural Gas Sleeping Giant – RBAC Inc.

[7] Nigeria-Morocco Gas Pipeline – Global Energy Monitor (gem.wiki)

[8] West African Gas Pipeline – Global Energy Monitor (gem.wiki)

[9] Spain raises bet on green hydrogen, biogas in draft plan | Reuters

[10] Ibid

[11] The Next Energy Crisis No One Is Talking About – RBAC Inc.