The Biden Administration dropped a bombshell last week, announcing a pause to some natural gas export facility approvals and a review of how such projects are evaluated. Future evaluations of LNG Export facilities will “adequately account” for domestic energy costs and greenhouse gas emissions. How this pause impacts future industry developments is yet to be seen. But to understand why this happened, we must look at how we got here.

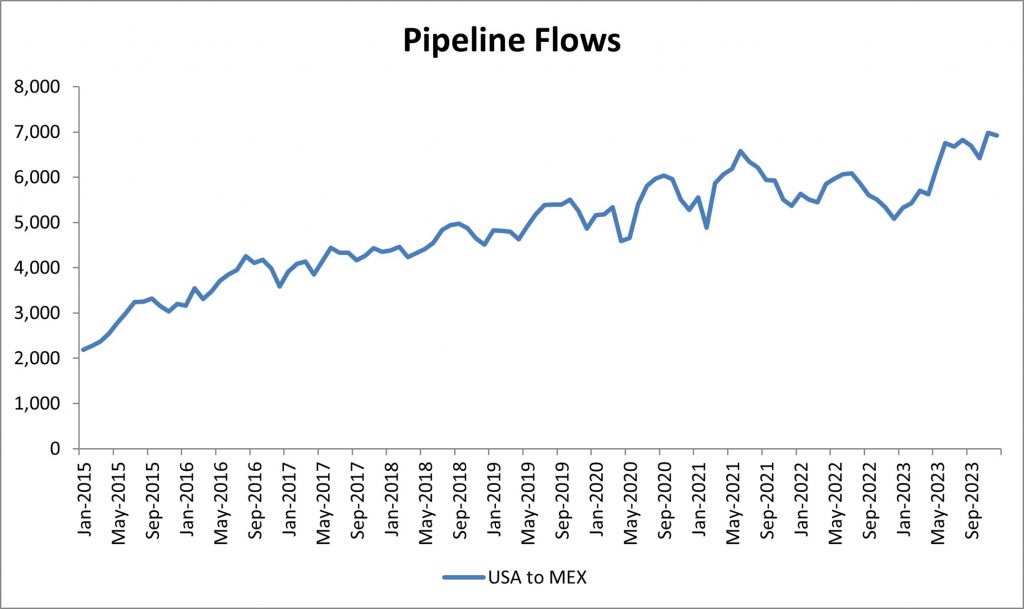

In 2023, the US overtook Qatar as the largest exporter of liquified natural gas (LNG), and with several facilities slated to come online in 2024, the US is poised for another banner year. LNG is only one side of the coin with US pipeline exports on the other. Pipeline flows to and from Canada have been consistent in recent memory, acting as a balancing tool to support fluctuations in demand due to weather. However, exports to Mexico as well as LNG Exports, have skyrocketed in recent history, consistently setting new records and supporting economic growth in other countries.

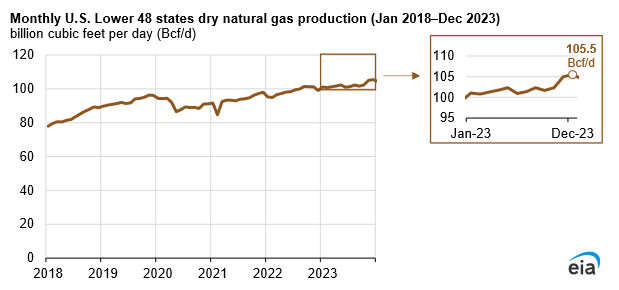

December 2023 set a monthly record for LNG Exports from the US, with 8.6 million tonnes delivered to overseas trading partners, capping off a year which saw a total of 88.9 million tonnes shipped out. This record, which arguably would have been higher had Freeport LNG not experienced a prolonged outage , limiting LNG export capacity until early 2023. These exports have been supported by record North American production that, at times, topped 105 Bcf/d.

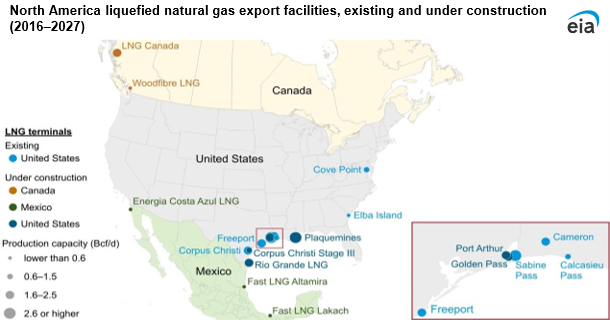

Looking forward to 2024, Golden Pass LNG and Plaquemines LNG facilities are both fully permitted and slated to come into service. Located in the Gulf of Mexico, these facilities are situated close to the Haynesville and other large producing basins like the Eagle Ford and the Permian. In addition to these facilities, Corpus Christi Stage III, Rio Grande and Port Arthur are under construction and are expected to be completed by 2028. However, these are the projects at risk under Biden’s new policy. Stricter standards and higher evidence of need are looming in their future.

Depending on how this policy develops, LNG exports could double by 2028, when some if not all of the facilities above reach completion. This will dramatically impact the North American Natural Gas Market, with ~20% of all production shipped overseas to allies and trade partners – with and without Free Trade Agreements. In our 23Q4base scenario we expect production to increase in line with the additional exports, particularly in the Haynesville Shale. We also expect more high deliverability storage facilities to be built and expanded in the Gulf Region to function as a buffer in the event of a disruption to exports. However, as seen during the cold snap earlier this month, the flow of natural gas to LNG Facilities can be re-directed to local demand, ensuring heating demand is met but also that the lights stay on and the electric grid remains stable. Effectively acting as variable storage, this is one more lever that can be adjusted in an ever-changing market.

In addition to LNG Exports, southbound pipeline flows to Mexico have tripled since 2015, reaching over 6 Bcf/d at times. The lion’s share of these exports is going to electric generation, typically running at 5 Bcf/d but reaching as high as 7 Bcf/d in the summer. This growth is remarkable, considering natural gas is in most circumstances replacing fuel oil. Meaning that not only is Mexico burning a cheaper fuel, but also a cleaner one. And this growth is expected to continue, with the Comision Federal de Electridad (CFE) building an additional 1.1 Bcf/d of gas fired generating capacity over the next 3 years. Not to mention the 3 Mexican LNG Export facilities which could be in operation by 2027. Fast LNG Altamira has already begun operation, while we are optimistic regarding Energia Costa Azul LNG it will require significant infrastructure to support its operation. The RBAC Team is still researching the Fast LNG Lakach facilities and will provide more updates as it develops.

Obviously, exports are an increasingly significant variable in the supply/demand balance equation. And, obviously, policies are another significant variable in this equation. Yet, unlike drilling, production, infrastructure and exports (which are typically known, planned and can be anticipated), policy adjustments can arise almost out of nowhere, wreaking havoc on business decisions, forecasting and risk management.

How the market will adapt to Biden’s new policy is yet to be seen, however, using a tool like GPCM can simulate the impacts of facility closures on supply/demand balances and pricing. We here at RBAC are following this closely and will have more analysis for you soon. You may not always know what is coming, but scenario analysis will help you better understand the risks and have a plan ready for such market events.

RBAC, Inc. has been the leading provider of market fundamental analysis tools used by the energy industry and related government agencies for over two decades. The GPCM® Market Simulator for North American Gas and LNG™ is the most widely used natural gas market modeling system in North America. RBAC’s G2M2® Market Simulator for Global Gas and LNG™ has been instrumental in understanding evolving global gas and LNG dynamics and is vital in fully understanding the interrelationship between the North American and global gas markets.