In the energy world, few decisions are small.

An asset acquisition. A pipeline expansion. A long-term LNG contract. Even a hedging strategy or a power generation asset planning decision can lock in costs—or opportunity—for years to come.

With the weight of these choices, topflight executives count on advanced methods to guide billion-dollar strategies.

“If you think about the forecasting process and how incredibly important that is … from a boardroom perspective all of those things have to look at what we think the future demand is in the business.” – Alan Armstrong, CEO Williams

What if the core issue isn’t a bad forecasting process, but not knowing that better forecasting exists?

1. The Essential Nature of Energy Forecasting

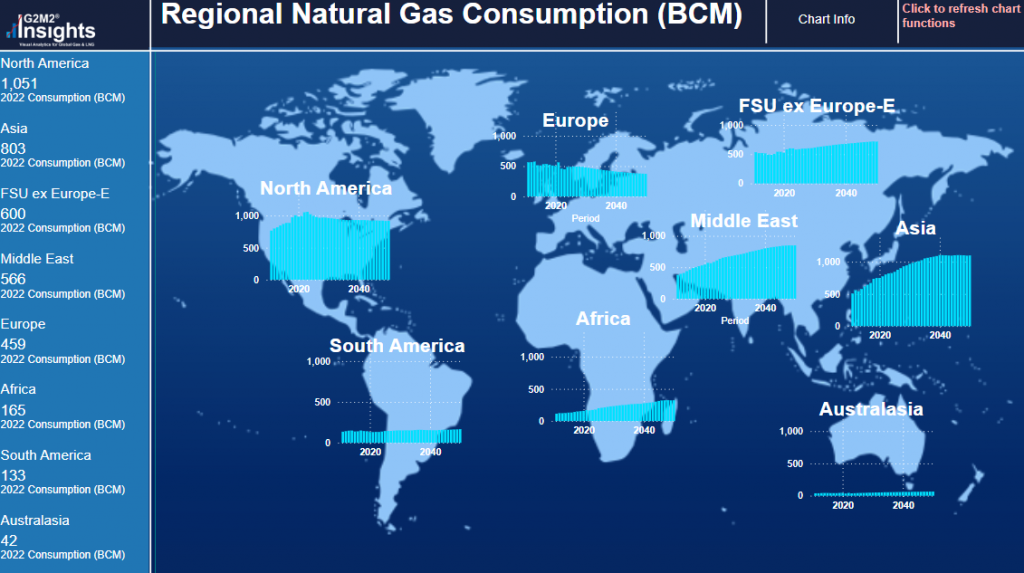

The world’s energy system is undergoing a fundamental shift. Volatility is up, policy is in flux, and competition is fully global. Natural gas, in particular, sits at the crossroads of geopolitics, decarbonization, and energy security. Its infrastructure is capital-intensive but long-lived. However, the ROI takes time with such variables, uncertainty is impacting natural gas markets. Its demand patterns, more and more, are influenced by power markets, seasonal swings, industrial shifts, and both global players and shifts in their respective government’s energy policies.

Given all that, how do you make sound long-term decisions?

As Mr. Armstrong, of Williams, also pointed out in March 2024:

“Natural gas demand is not just growing—it’s accelerating. If we don’t plan for that with the right data, we risk being left behind.”

And he’s not alone. Senior leaders across the energy sector have begun emphasizing the importance of long-range visibility, especially for infrastructure development and cross-border gas trade.

Patrick Pouyanne, CEO of TotalEnergies, has made long-range investing in LNG a part of his legacy, and he knows something of the long game, pointing out:

“If you look at the history of the evolution of the U.S. gas price, the spikes are more linked to the lack of infrastructure than the lack of resources.”

But while awareness may be rising, many companies are still flying half-blind.

2. What Forecasting Looked Like Before Advanced Modeling

If your long-term forecasts are based off a mix of spreadsheets, various market intelligence and gut instinct, then you might be missing the boat in several areas:

- Limited scope: Lack of spatial or temporal granularity. If you have a single number for U.S. gas demand in 2030—you need clarity on where, why, or how it interacts with infrastructure.

- Static assumptions: Gas markets respond dynamically to price, supply, demand, and shipping constraints.

- No sensitivity testing: Legacy tools rarely allow users to test “what-if” conditions in a systematic way—new energy policy, weather, and competition from renewables or other energy sources, geopolitical events.

Just consider some energy companies which have done well, and others have not, and been bought out. So, we can ask the question, which had a better forward look? And which had misplaced confidence and missed opportunities.

3. Why Modeling Matters More Than Ever

The case for better modeling is quite practical considering the modern energy environment is defined by three words: uncertainty, interdependence, and scale.

Uncertainty

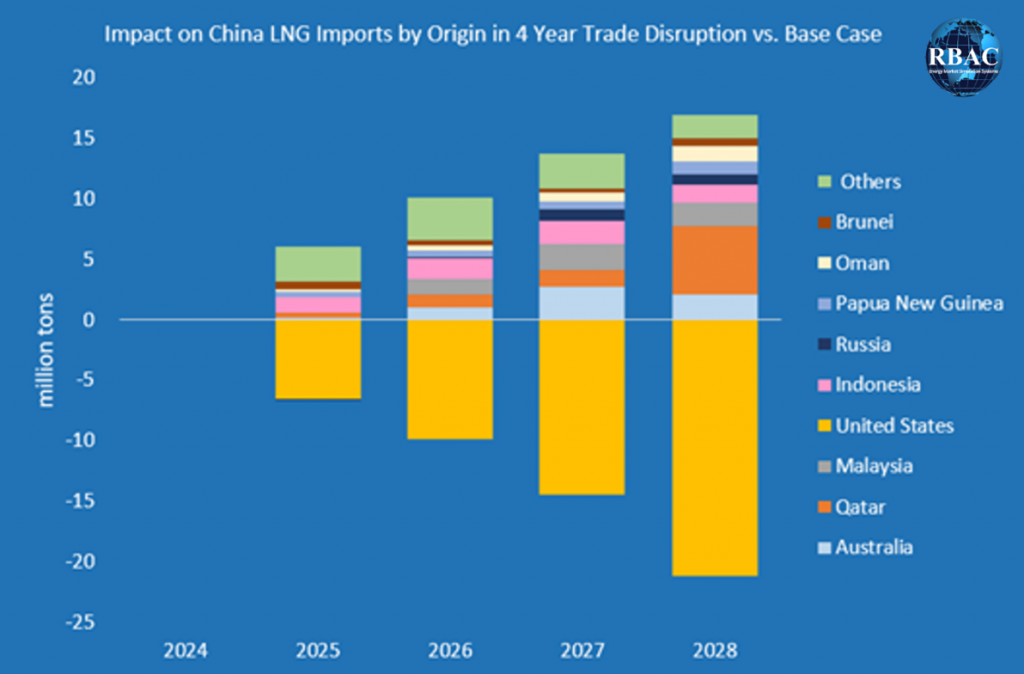

The price of gas through 2030 could be shaped by climate policy, Chinese demand, a return of Russian gas after the war in Ukraine, or ramping up of U.S. or Qatar LNG exports. It could also be shaped by macroeconomic cycles or pipeline constraints. Without tools to explore this uncertainty, planners are guessing.

“Gas market fundamentals have improved over the past year, but for now, we are still seeing significant tightness due to rising demand and muted growth in LNG capacity. Heightened geopolitical uncertainty adds to the risks,” Keisuke Sadamori, Director of Energy Markets and Security, IEA in January 2025.

Interdependence

Gas no longer exists in isolation, if it ever did (coal-to-gas switching and vice-versa is well known). From LNG exports to power markets shared by renewables, from steam reformation of natural gas to hydrogen, ammonia, and various industrial inputs—everything is connected. Changes in solar capacity, costs, and net metering policies in California and throughout the country could affect gas burn. An LNG terminal delay in the Gulf could reshape global flows. Modeling allows us to see the web.

“High natural gas prices encourage more coal generation. This, combined with relaxed emission regulations for some coal-fired plants, could drive generation up by 6% in 2025.“ https://county17.com/2025/05/08/coal-fired-electrical-generation-to-increase-amid-heightened-natural-gas-prices/

Scale

The investments being made today—billions in LNG, CCS, new infrastructure—require a level of conviction and foresight that spreadsheets and even the keenest of oracles (of Omaha or elsewhere) cannot provide. Energy producers, marketers, traders, their investors, executives, and government policy makers all want to know:

What will likely happen under any given conditions, and how will that affect prices, supply, demand, and flows.

They need answers with confidence and clarity. This is where simulation and optimization models come in.

4. What Advanced Energy Models Actually Do

It’s not just sophistication, it’s structure.

- Network representation: They represent pipelines, storages, terminals, flows, and capacity constraints in a real-world map.

- Time granularity: Models run on monthly timelines across years or decades.

- Price-responsive behavior: Supply and demand adjust based on price signals, creating feedback loops that simulate real market behavior.

- Scenario capability: Users can create multiple cases: What if China continues to send US LNG cargoes to Europe? What if Europe resumes importing Russian pipeline gas, in full or in part? and compare results across cases.

- Optimization: You can use these models to optimize your activities, such as flows, contract utilization, or pricing; in other words, to find efficient market outcomes.

- Transparency: Results can be explained, inputs are transparent, the process can be understood.

Most importantly, these models are built on decades of industry and modelling expertise. The software is important, yes, but the knowledge embedded in the system is just as critical.

Key quote: “Optimization techniques have been used by scientists for centuries, … Originally designed for military logistics, these techniques have spread widely into other areas of business including project planning, materials sourcing, transportation planning, and financial analysis. … By combining simulation methods which allow analysts to model a variety of scenarios, including both likely and unlikely events, with state-of-the-art optimization technology, we believe that they will be able to develop more robust strategies for investment in an uncertain world.” https://rbac.com/simulation-and-optimization-overview/

5. The New Generation of Tools

A different kind of modeling approach has taken root—one that marries robust economic logic with physical infrastructure and real-world production, price, demand and supply data. These tools:

- Simulate pipeline-by-pipeline flows.

- Reflect market power dynamics and capacity constraints.

- Link global LNG trade with regional supply and demand.

- Enable power and gas sector price, supply and demand iteration for realistic outcomes.

- Allow users to test different infrastructure builds, tariffs, and policies.

They’ve been used by global LNG developers, utilities, investors, regulators, and even think tanks. But surprisingly, many professionals in the sector still don’t know they exist—or assume such tools are too complex or inaccessible.

They are not.

6. What Users Say

Here’s what we’ve heard from professionals who began using advanced energy market simulation tools, such as GPCM® Market Simulator for North American Gas and LNG™:

7. Simulation Isn’t Optional Anymore—It’s the Cost of Entry

As the market moves faster and decisions grow costlier, companies that rely on simplistic methods are at a disadvantage. Modeling isn’t about predicting the future perfectly. It’s about understanding possibilities—and being prepared for them.

Simulation enables:

- Foresight: Knowing how markets might evolve under multiple conditions.

- Risk Management: Identifying exposure to tariffs, policy shifts, or infrastructure delays.

- Communication: Explaining decisions to boards, investors, regulators, or customers with clarity.

- Optimization: Not just surviving market change—but thriving through it.

In a world of rapid change, simulation becomes the planning language of the serious.

8. Want to Go Deeper?

If this article sparked your curiosity—or if you’re wondering how simulation and optimization actually work in the gas and LNG world—start here:

GPCM® Market Simulator for North American Gas and LNG™ for Regional Gas

G2M2® Market Simulator for Global Gas and LNG™ for Global Gas

Gas4Power® for better understanding of Gas and Power Markets

Simulation and Optimization Overview to understand more about Optimization and Simulation and how they relate to markets

Final Word

Simulation and optimization are not “nice to have” anymore—they are foundational to better energy decisions—whether its investments, trading, even policy planning.

If your current forecasting method can’t handle the complexity of the market, test a variety of scenarios, or simulate new infrastructure or policy impacts, it’s time to rethink your toolkit.

As they say:

Understanding the problem is the first step.

Seeing a better path is the second.

Choosing to walk it—that’s where real growth and leadership shines bright.